LilliDay

Everyone is watching the Fed as the FOMC convenes at the Sept. 20-21 FOMC meeting that will undoubtedly result in at least a 75 basis point hike in the Fed Funds Rate. Meanwhile, some market participants expect a full percentage point hike. The latest consumer price index data came in hot as a pistol, with the inflation barometer posting an 8.3% gain and core inflation up 6.3% on a year-over-year basis. The producer price index rose 8.1%, less than expected but still at a sky-high reading. The data-sensitive central bank has all the ammo it needs to push the short-term Fed Funds Rate 75 points high to the 3.00% to 3.25% level on Sept. 21. Moreover, many of the Fed’s economists remain hawkish, forecasting the rate at the 4% level by the end of this year.

Meanwhile, quantitative tightening doubled in September as the central bank reduces its swollen balance sheet, pushing rates higher further out along the yield curve. There’s no doubt that the US Fed is serious about driving inflation to its 2% target rate. Based on the questionable last core CPI reading, inflation was running at over triple that level.

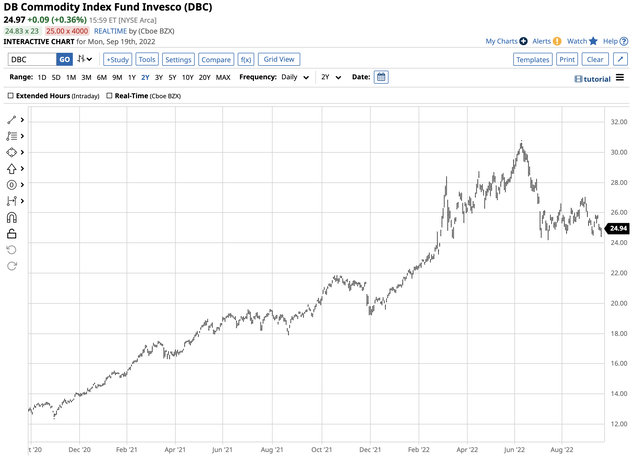

Higher rates have weighed on commodity prices, which have declined significantly from the highs of earlier this year. However, bullish trends in the raw materials sector since the 2020 pandemic-inspired lows remain intact. If the Fed fails, or makes another tragic economic blunder, buying commodities on a scale-down basis over the coming hawkish months could be the optimal approach to the highly interest rate-sensitive sector. The Invesco DB Commodity Index Tracking Fund (NYSEARCA:DBC) is a diversified raw material price index weighted towards energy commodities.

A “transitory” error in 2021

Throughout most of 2021, the US Fed and Biden administration told markets that inflation was a “transitory” event caused by pandemic-inspired supply chain bottlenecks. As the consumer and producer price indices continued to rise, reaching the highest levels in over four decades, they had an epiphany. Artificially low interest rates via a zero percent Fed Funds Rate, quantitative easing pushing rates lower along the yield curve, and unprecedented government stimulus programs in response to the worldwide COVID-19 crisis planted inflationary seeds in 2020 that bloomed in 2021 and began to grow and spread like wildfire.

The Fed’s 2% inflation target moved further and further away from reality, causing the central bank to experience a sudden wake-up call and address rising prices. The Fed Funds Rate remained at zero percent until March 2022, allowing inflation to rise. While the pandemic was an excuse in 2021, in 2022 the blame turned to Russia as it invaded Ukraine, causing supply-side economic issues that exacerbated and turbocharged rising inflationary pressures.

On Wednesday, Sept. 21, the Fed will increase the Fed Funds Rate to at least the 3.00% to 3.25% level, with some market participants expecting an even more dramatic move considering the latest CPI and PPI data. Rate hikes are impacting the demand side of the economy. Still, despite the rate hikes, the supply-side issues caused by the first major European War since WW II remain a clear and present inflationary danger in the food and energy sectors.

The bottom line is the Fed and administration were asleep at the wheel when inflation began rising and continued its ascent in 2021. In September 2022, the central bank now considers inflation as economic public enemy number one and has committed to obliterate the condition and push inflation back to 2% with a tight monetary policy agenda. “Transitory” or temporary inflation in 2021 was a significant miscalculation by the Fed’s economists.

2022 is a year of “transition“

Economic textbooks define a recession as two consecutive quarterly GDP declines. In Q1 and Q2 2021, the US economy experienced two successive economic contractions.

After 2021’s “transitory” misstep, the Fed and Biden administration declared that the economic data that signal a recession is nothing more than a post-pandemic economic “transition.” The Fed seems willing to risk a recession to battle inflation. The administration has called its latest legislative initiative an “Inflation Reduction Act,” claiming it makes a “historic down payment on deficit reduction to fight inflation, invest in domestic energy production and manufacturing, and reduce carbon emissions by roughly 40% by 2030.” Topline estimates expect a $300-plus billion total deficit reduction.

Meanwhile, fighting inflation and a recession requires mutually exclusive economic tools. While austerity and higher rates are the prescriptions for inflation reduction, a recessionary environment requires stimulus. Stagflation, or inflation and economic contraction, is one of the most challenging conditions for the central bank and administration. In September 2022, both are counting on a “transition” and not a recession.

Another t-word miscalculation will likely cause economic travails in 2023. The markets will be watching GDP data for Q3 and Q4 2022 to see if stagflation is the next financial crisis that grips the economy.

Commodity prices correct as interest rates rise

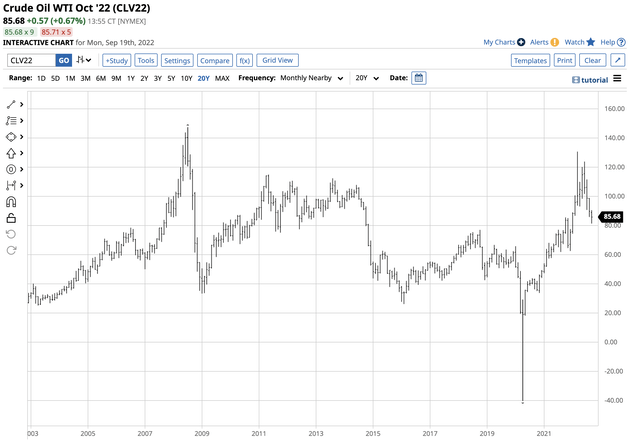

Crude oil has been at the center of the stage in 2022 as the war and inflationary pressures pushed the price to the highest level in 14 years.

Long-term NYMEX Crude Oil Futures Chart (Barchart)

The chart highlights that NYMEX crude oil futures rose to the highest price since 2008 at $130.50 per barrel in March 2022. Rising interest rates, a strong US dollar, and an unprecedented series of US Strategic Petroleum Reserve sales pushed crude oil to below $90 over the past weeks. The US SPR was at the 434.1-million-barrel level as of the week ending on Sept. 9, 2022, the lowest level since 1984. The Biden administration has said that while it could extend the releases past the October 2022 deadline, it also plans to repurchase crude oil to fill the emptying reserves if and when the price falls below the $80 per barrel level.

Meanwhile, food prices remain high as the war in Ukraine has impacted supplies from Europe’s breadbasket in Ukraine and Russia. The fertile soils in the region and critical logistical export hub at the Black Sea ports have been a war zone throughout the 2022 crop year. Russia and Ukraine are leading wheat and corn exporting countries. While corn is a food source, it’s also an ingredient in ethanol, and soybeans are an input in biodiesel fuel. The line between food and fuel has blurred as the world addresses climate change. Moreover, as Russia is a critical fertilizer supplier, shortages have increased production costs, and availabilities have declined.

As of Sept. 19, nearby soybean futures were at the $14.50 per bushel level, the highest price since 2014, and corn at above $6.75 per bushel is at the highest level since 2013. CBOT wheat futures at above $8.30 per bushel were trading at prices not seen since 2012. Central bank monetary policy that can influence the economy’s demand side has little impact on the supply side issues created by the geopolitical landscape.

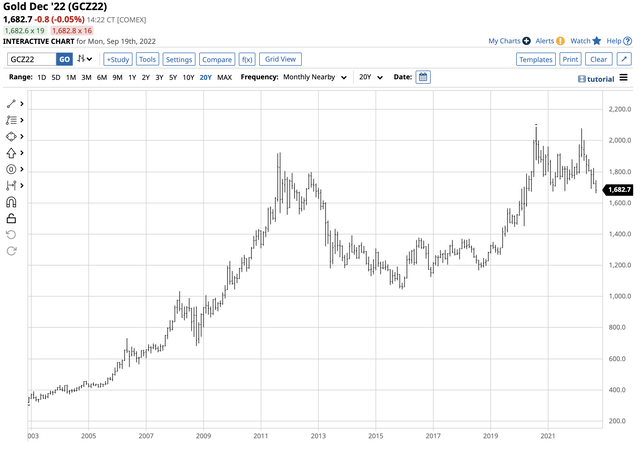

Meanwhile, many other commodities have corrected on the back of monetary policy initiatives that have lifted the US dollar and interest rates. Gold has historically been an inflation barometer.

COMEX Gold Futures Chart (Barchart)

The chart shows that gold futures fell below short and medium-term technical support last week, reaching $1661.90 per ounce, the lowest level since April 2020, as the strong US currency and rising interest rates have pushed the precious metal’s price lower. Copper has declined from over $5 per pound in March 2022 to the $3.50 level on Sept. 19. Other raw material prices have declined over the past weeks and months as rising interest rates increase the cost of carrying inventories. Moreover, the US dollar remains the pricing mechanism for most commodities, and a strong dollar tends to be a bearish factor. Since interest rate differentials drive currency values, rising rates have been bullish for the US dollar, creating a potent bearish combination of increased interest rates and a bullish trend in the US currency. The third reason for the latest commodity selloff has been the weakness in the US stock market and the rising fear of a risk-off period, impacting markets across all asset classes.

Another error could light a bullish fuse

Policies to battle inflation slow economic growth at a time when recessionary pressures are rising. The Fed and US administration have picked sides in the battle, choosing to address inflation and downplay economic contraction.

After making a grave mistake in 2021, they’re overcompensating in 2022, running the risk of making the same miscalculation with their hopes that GDP declines are a “transition” they made when they called inflation “transitory.” The bottom line is that data is objective, and its interpretation is subjective. In late 2021 and 2022, the Fed and US administration did an about-face, starting an all-out war against inflation. If US GDP continues to decline, they may need to curb their enthusiasm for interest rate hikes to stimulate an ailing economy. Another round of stimulus to address a deepening recession could light a bullish fuse under the commodity asset class over the coming months and in 2023.

If history is a guide, the tools that stabilized conditions in the aftermath of the 2008 global financial crisis lifted commodity prices to multi-year and, in some cases, all-time highs in 2011 and 2012. Bull markets rarely move in straight lines, and corrections can be brutal. If prices follow a similar schedule following the 2020 pandemic, raw material markets could peak in 2023 and 2024, making the current price weakness a golden buying opportunity. A decision to address the increasing potential for a recession could relight the bullish commodity fuse.

DBC on a scale-down basis

The Invesco DB Commodity Index Tracking Fund is a diversified commodity product, holding a portfolio weighted to energy.

Top Holdings of the DBC ETF Product (Barchart)

The chart shows that DBC has around 50% exposure to energy, but it owns other leading commodity assets, providing exposure to the overall raw material asset class. At just below $25 per share, DBC had over $3.48 billion in assets under management. The ETF trades an average of more than 3.767 shares daily and charges a 0.87% management fee.

Chart of the DBC ETF Product (Barchart)

DBC corrected from $30.64 per share in early June 2022 to below the $25 level. If the recessionary pressures continue to rise and the Fed and administration must eat another slice of humble pie that stops the ascent to interest rates, commodity prices could come roaring back. Moreover, the ongoing war in Ukraine threatens higher energy and food prices as the US SPR releases could end next month.

It’s impossible to pick bottoms during market corrections, but if the price action from 2008 through 2012 is a guide, raw materials could peak in 2023 and 2024. I favor a long position in DBC, leaving plenty of room to add on further declines. I believe calling a recession a “transition” will be the same mistake as calling inflation “transitory.”

Be the first to comment