FOTOKITA/iStock via Getty Images

Dawn of the Living Debt

We’ve all heard meme-favorite names like GameStop (GME), AMC (AMC), and pandemic darlings like Peloton (PTON) and Shopify (SHOP). With barely enough cash to stay afloat, cover their interest expenses, and make a profit, zombie companies like these popular names are in debt. Typically relying on loans and external sources of investment to stay afloat, many zombies took advantage of low rates during COVID, rolled over obligations, and took advantage of government assistance that boosts liquidity. With inflation at 40-year highs and a volatile market, these zombies on borrowed money and time after a low-rate environment are feeling the wrath of falling profits.

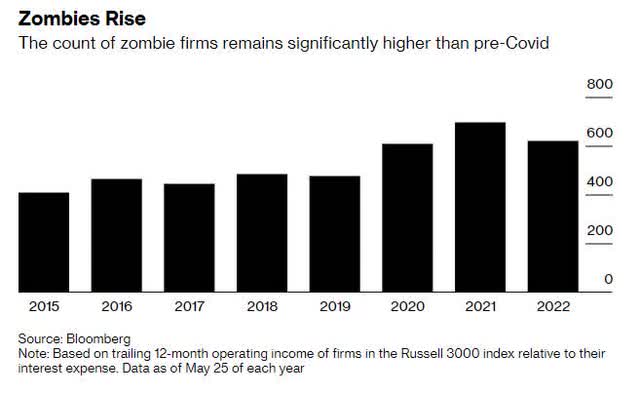

Zombie Companies Rise (Bloomberg)

The number of zombies rose in 2021, and many tech companies that experienced tailwinds and expansion amid fiscal and monetary policies and from a newly established remote environment have halted. Borrowing is no longer cheap. Where the Fed boosted liquidity during the pandemic, vaccine distribution and re-openings have given way to business as usual, and rate hikes and inflation are producing more zombies. As Dreyfus and Mellon Chief Economist Vincent Reinhart said,

“You worry that the mechanism of financial fragility generally, zombie firms, in particular, are an accelerant to what the Fed does,” Reinhart said. “As rates rise, it pushes more of those firms into distress and amplifies the tightening by the Fed of financial conditions and credit availability.”

The companies that borrowed significantly during the pandemic have too much debt on their balance sheets and not enough business activity to keep them strong – alive and well. The month of October is nearly over as Halloween approaches. October tends to be a feared month in the markets because of its “October effect,” as its historically riddled with drastic market declines that include:

-

The Panic of 1907, aka Bankers’ Panic

-

Black Tuesday

-

Wall Street Crash of 1929

-

Black Monday 1987

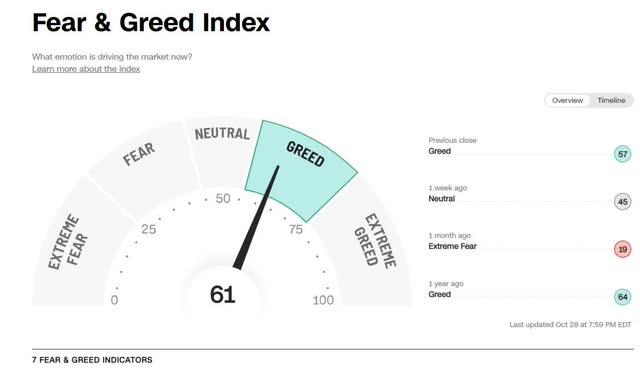

The good news is that the biggest shock this month involves a GDP report that the markets received well. The economy grew by 2.6%, prompting talks of the Fed not being as aggressive and offering a soft landing, which could mean a turnaround. The markets ended the week up, and investor sentiment has gone from extreme fear to greed within less than a month. In fact, the Dow is on track for its best month since 1976.

Fear & Greed Index (CNN Fear & Greed Index)

While tech stocks may continue to experience some downside, I believe now is a good time to consider zombie tech stocks for potential buy opportunities. The Fed meets next week. Earnings have been better than expected. And the two technology companies I’m focusing on are software and internet services-based, which tend to be exposed to fewer macroeconomic headwinds. As I wrote in a recent article titled Rally Monkey: Tech Stocks With Strong Upward Revisions,

“Technology requires parts that are becoming more costly as we see pricing parity no more… software (and cloud-based) requires fewer people and moving parts to profit. What better opportunity than software and cloud-based stocks to limit some of the geopolitical risks involved with supply chain constraints, (AND) potential inventory build-up?”

As such, my first zombie stock is Bill.com.

1. Bill.com Holdings, Inc. (BILL)

-

Market Capitalization: $14.21B

-

Quant Rating: Hold

-

Quant Sector Ranking (as of 10/28): 174 out of 647

-

Quant Industry Ranking (as of 10/28): 44 out of 206

My first zombie stock is Bill.com Holdings, Inc., a cloud-based software company automating processes for small and midsize businesses to improve back offices. With the changing digital landscape, businesses automate accounts payable and accounts receivable transactions while digitally managing expense and cash flow reports. Bill.com connects its customers with suppliers, accounting firms, and financial institutions using software-as-a-service (SaaS) and spend management products. With robust organic growth and strategic partnerships that include the acquisitions of Divvy and Invoice2go, Bill.com has managed to stay alive!

Valuation and Momentum

Bill.com stock has declined 42% year-to-date. Despite shares being highly overvalued and trading at 381.03x forward earnings and 21.24 times trailing sales, the momentum for BILL is very bullish. Although growth for Bill.com and the economy is projected to slow in 2023, and valuations are stretched, some prudence is necessary when investing in this stock. But investors continue to pay higher prices for shares. With strong momentum, BILL’s quarterly price performance outperforms its sector peers on the heels of impressive earnings.

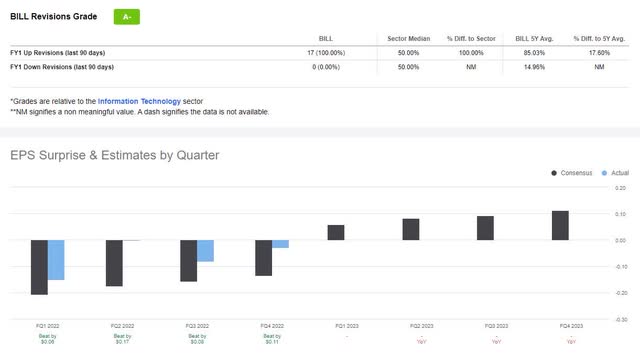

Growth and Profitability

Bill.com released Q4 2022 results on Aug. 18, which showcased an EPS of -$0.03 that beat by $0.11 and revenue of $200.22M that beat by $17.12M, more than 155% YoY. Strong third-party verification (TPV) has driven Bill.com’s customer funds to increase by $99M since Q3. Not only are businesses using Bill.com’s solutions to automate their financial operations and better manage their cash flows, BILL’s operating cash flow growth is a 1,094% difference to the sector, and its balance sheet showcases cash and cash equivalents, and short-term investments were 2.7B. Driven by strong third-party verification (TPV), Bill.com’s customer funds increased by $99M since Q3.

Bill.com EPS & Revisions Grade (Seeking Alpha Premium)

Although the company’s expenses have increased faster than revenue over the last few years, and margins were -35.4% FY2022 following sudden increases in depreciation and SG&A expenses, these declines are likely a result of acquisitions. While the inflationary environment has resulted in some changes in spending patterns, as CFO John Rettig said,

“One of the benefits that we have of the very large customer base and our scale is that we do have a lot of visibility into spend patterns and activities and repeat behaviors. The repeat transaction rates continued to be very, very high. So that visibility is helpful as we pin down our assumptions…we’re assuming that some of the softness or moderation, as we call that in the last couple of months, continues throughout the year given the external environment.”

Although the macro environment is changing, BILL continues to show significant growth potential, supported by its vast and diversified customer base and subscription revenue growth. As Khaveen Investments writes:

“Bill.com shows significant growth potential organically supported by customer additions, transaction, and subscription revenue growth as well as with its acquisitions of Divvy and Invoice2go. Taking into account our estimated revenue synergies with Divvy and Invoice2go, we rate Bill.com as a Buy.”

Although Seeking Alpha’s quant rating system currently ranks the stock as a Hold, this is one to watch going forward, as it could be a zombie that comes back to life, along with the next stock.

2. WIX.com Ltd. (WIX)

-

Market Capitalization: $4.74B

-

Quant Rating: Hold

-

Quant Sector Ranking (as of 10/28): 211 out of 647

-

Quant Industry Ranking (as of 10/28): 7 out of 28

WIX.com, together with its subsidiaries, is a leading global software-as-a-service (SaaS) platform that allows businesses and individuals to manage and grow their online presence. Headquartered in Tel Aviv, Israel, this cloud-based platform allows anyone to create a website, offering features to connect, automate and grow business. Riding high during the pandemic, when tech companies like Wix were in hyper-growth, and its revenue grew nearly 30% in 2020 and 2021, post-pandemic momentum has slowed. With its smart drag-and-drop editor capabilities, Wix offers a web infrastructure for growth. While this stock lacks profitability, its strong partnerships are paving the way for a bright outlook and potential upside.

Wix Growth and Profitability

Nothing screams a rise from the dead than analyst upward revisions, especially from the likes of Oppenheimer. Oppenheimer upgraded Wix after activist Starboard Value, an American hedge fund company amassed a 9% stake in the cloud-based company to improve its operations, giving competitor GoDaddy (GDDY) a run for its money.

“Investors are generally constructive on Wix’s more balanced approach, but view activist involvement as a positive catalyst to potentially accelerate efforts to streamline operations, and hold management accountable to staying the course (equally important)... We believe a combination of these initiatives could deliver meaningful shareholder value,” writes Oppenheimer analyst Ken Wong.

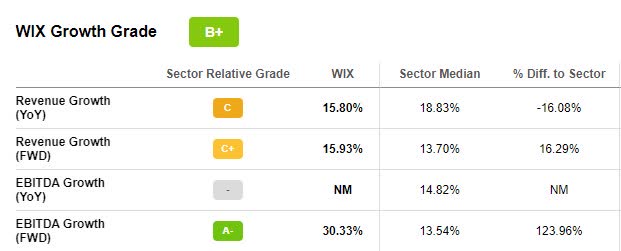

Post-pandemic revenue booking has slowed, with Q1 up 12% and Q2 +9%. Despite mixed Q2 earnings results, EPS of -$0.14 beat by $0.22, and revenue of $345.2M beat by $894.06K. Also, in the face of macro headwinds and continued market volatility, along with a projected economic slowdown, Q3 revenue is expected to grow 7% to 8% YoY and 8% to 10% for the full year.

WIX Growth Grade (Seeking Alpha Premium)

The growth of e-commerce has allowed Wix to shift gears and focus on vertical commerce applications to help drive growth. And where e-commerce experienced greater demand amid COVID-19 and is seeing a slowdown, the reality is that commerce continues to migrate online, providing an increased need for internet services and infrastructure. People are trying to build their own businesses, which require a platform and subscriptions like Wix, which offers diversified business solutions. Wix CEO Avishai Abrahami said,

“Wix is very horizontal, right? We have a lot of different things that we do as commerce and, of course, products like booking events, traveler scheduling. And those are less affected. And we can see that — I think this diversification of what we offer also gives us stability in the long term.”

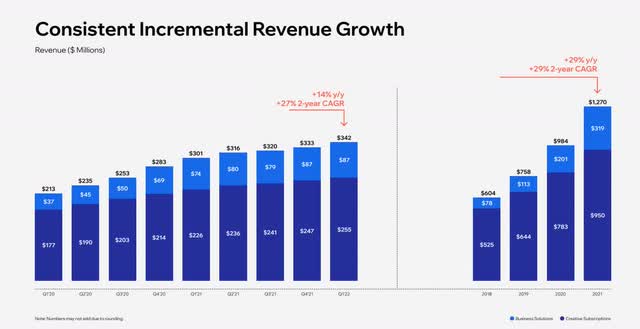

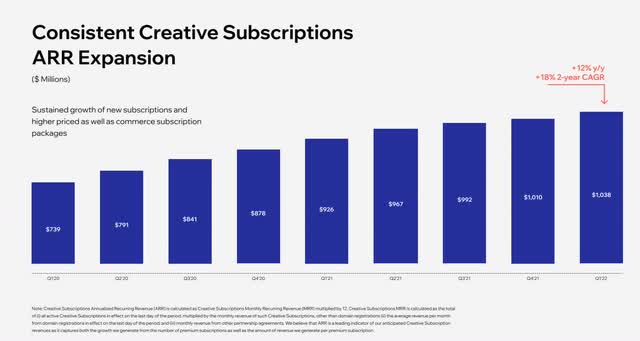

Wix’s Self Creators business generates over $1 billion in annualized revenue, making it more profitable than some of its biggest competitors. In addition to strong bookings growth, partners and transactions revenue, and consistent and incremental ARR expansion, Wix is projecting a three-year revenue CAGR of 17% to 19%.

WIX Revenue Growth (Wix Q1 Investor Presentation)

WIX ARR Expansion Chart (Wix Q1 2022 Investor Presentation)

Total non-GAAP gross margins for Q2 were 62%, and Wix expected free cash flow to be approximately 2%-3% of revenue, which includes a cost reduction plan. Additionally, Wix authorized a $300M share repurchase program. Lior Shemesh, Wix CFO, said,

“We remain confident in our ability to generate free cash flow as laid out in our three-year plan, enabling us to continue to invest in our strategic initiatives while also returning capital to shareholders. We have built a healthy balance sheet and believe that our current stock price represents an attractive valuation for a repurchase… This new program further demonstrates our ongoing commitment to managing dilution as part of our capital allocation priorities and increasing shareholder value.”

Where Wix has lagged in profitability, it is seeing a turnaround on the heels of Starboard Value. As Seeking Alpha Marketplace author Michael Wiggins De Oliveira wrote:

“Wix.com: Path to Profitability Is Now Serious…Wix will undoubtedly assure Starboard that it’s serious about its plan to improve profitability. And I’m confident that Starboard would retort that they, too, are serious, given that their position is bigger than the whole C-suit combined.

Presently, the stock trades for approximately 20x free cash flows. A figure that I believe is very reasonable, particularly if Wix can indeed get closer to 30% on a Rule of 40.”

Although Wix does not come at the ideal valuation, it’s taking measures to position itself for greater profitability and less debt by cutting expenses and user acquisition marketing and improving margins through business partnerships. Let us dive into Wix’s valuation and momentum grades.

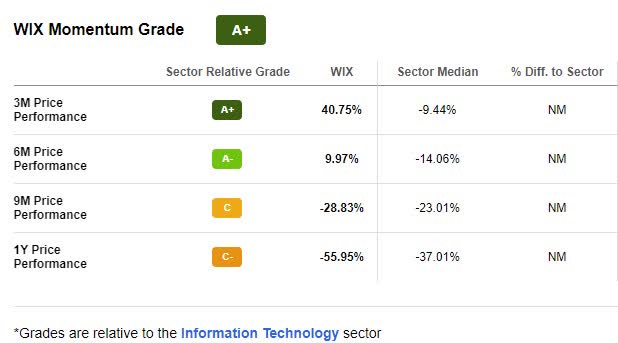

WIX Stock Valuation and Momentum

Like Bill.com, WIX requires some prudence when buying the stock at its current price. But its momentum is very attractive. With an overall D+ valuation grade, forward EV/Sales of 3.20x compared to the sector 2.63x, and forward Price/Sales of 3.5x versus the sector 2.52, Wix comes at a relative premium.

WIX Momentum Grade (Seeking Alpha Premium)

Although Wix has experienced a 46% YTD price decline and -55% over the last year, momentum is strongly bullish. With a higher trading volume trending, many analysts call the stock overbought, which is driving its share price higher.

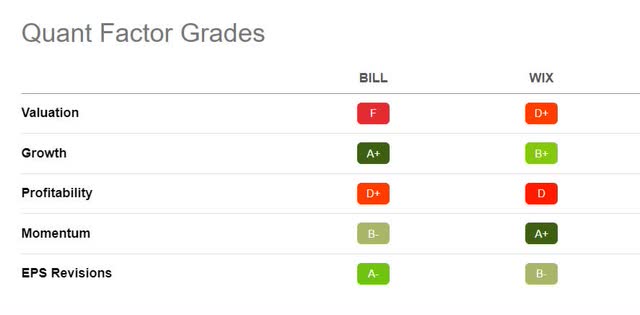

As you can see from the momentum grades above, Wix outperforms its sector median peers quarterly. Although both of my stock picks are beaten-down techs that will have to overcome factors that include slowing in e-commerce, purchases, and FX headwinds, they’re taking steps to reduce costs and strategically position themselves for growth. Both stocks are textbook zombies, and a look at their Quant Ratings and Factor Grades showcases that they’re lacking profits while also maintaining solid momentum and growth grades. And analysts still have positive outlooks for these stocks!

Quant Factor Grades (Seeking Alpha Premium)

The quant ratings offer powerful cues that help investors examine stocks’ shared traits of value, growth, profitability, rising earnings revisions, and momentum. Both stocks have yet to earn a profit, but their collective metrics indicate these zombies may see the light of day in the future.

Treat Yourself This Halloween

Zombie stocks are risky investments but can come with high reward potential. Investors considering these stocks should be aware of the risk and the absence of well-rounded investment fundamentals. The catalyst for appreciation is usually aligned with hyper-revenue growth. Although zombies tend to be drowning in debt, many offer unique and innovative products and services and can be disruptors, offering substantial upside; with risk comes potential reward. Also, who doesn’t love the tech sector?

Many zombie stocks offer strong growth stories. And in today’s day and age, where tech is involved in everyday life, investing in the sector offers diversification. And as technology makes the world go round, why not consider cloud-based and software stocks void of many supply chain constraints and external macro factors affecting other tech industries? The demand for digital services may prove fruitful for investors considering BILL and WIX for a portfolio. Treat yourself to zombie tech stocks this Halloween, and perhaps you’ll find value in creating Stock Screens to suit your specific investment objectives. Notably, If the risk of Zombie stocks is too high, perhaps looking at our Top Software stocks with Quant Strong Buy recommendations might be a better avenue for stocks possessing all-around stronger fundamentals.

Be the first to comment