magicmine

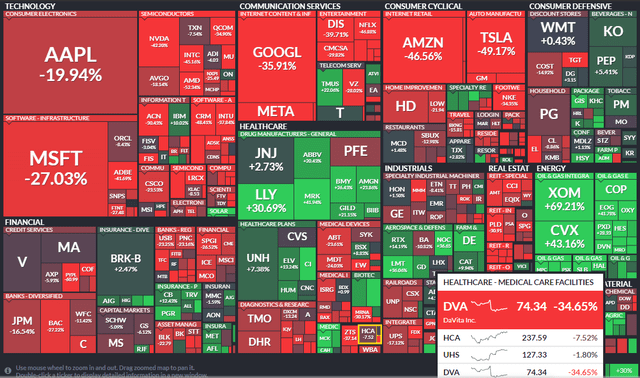

Healthcare continues to work in 2022. There are big year-to-date gains in shares of some of the largest pharmaceutical companies while health insurance providers are mainly green. It’s not all positive, though.

Many more cyclical medical device stocks and even facilities firms have endured losses. One of the worst of the bunch is DaVita Inc. (NYSE:DVA). Are shares a good value now? Let’s check-in.

YTD S&P 500 Performance Heat Map

Finviz

According to Bank of America Global Research and Fidelity, DaVita is a leading dialysis provider in the United States. The company operates over 2,700 outpatient clinics in the US and serves over 200,000 patients. DaVita also operates in countries outside of the US. It also provides outpatient, hospital inpatient, and home-based hemodialysis services; owns clinical laboratories that provide routine laboratory tests for dialysis and other physician-prescribed laboratory tests for End-Stage Renal Disease patients; and management and administrative services to outpatient dialysis centers.

The Colorado-based $6.7 billion market cap Health Care Providers & Supplies industry company within the Health Care sector trades at a low 10.9 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. The company missed on Q3 earnings estimates back in late October and slashed its guidance as Covid-19 and labor market pressures dinged profits. Along with a negative SCOTUS ruling earlier this year, macro headwinds persist.

Still, with decent earnings growth still seen through 2024, there appears to be a valuation case, though some of its peers are more levered to expected volume improvements in the industry. There are also risks with regulatory and legislative changes around treating kidney diseases. Upside potential stems from improved volumes, better sales from its commercial customers, positive reimbursement trends, and a quicker shift to Medicare Advantage. Cost pressure could weigh on the company and other risks come from rate pressures.

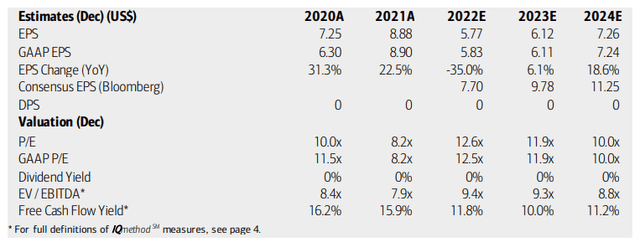

On valuation, analysts at BofA see earnings falling sharply this year but then rebounding in 2023 and 2024. The Bloomberg consensus forecast is must more upbeat compared to BofA’s outlook. Using forward numbers, the valuation case continues to look compelling despite the firm not paying a dividend. Free cash flow is very strong.

DVA: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

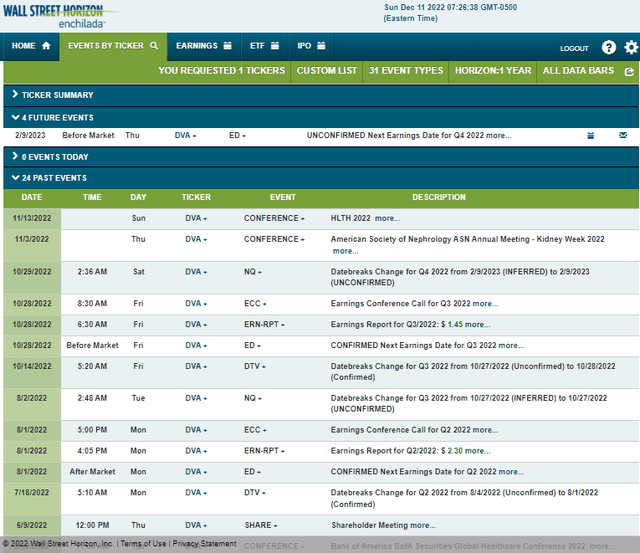

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 9 BMO. The calendar is light aside from that event.

Corporate Event Calendar

Wall Street Horizon

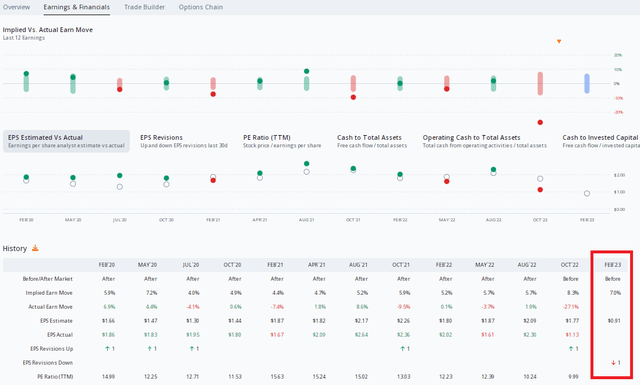

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.91 which would be a steep drop from $2.02 of per-share profits earned in the same quarter a year ago. Since the late October earnings release, there has been one analyst EPS downgrade of the stock. With implied volatility of 33%, the at-the-money straddle prices in a 7% earnings-related stock price move in February after a massive downward move following Q3 results.

DVA: A Big YoY Earnings Drop Expected

ORATS

The Technical Take

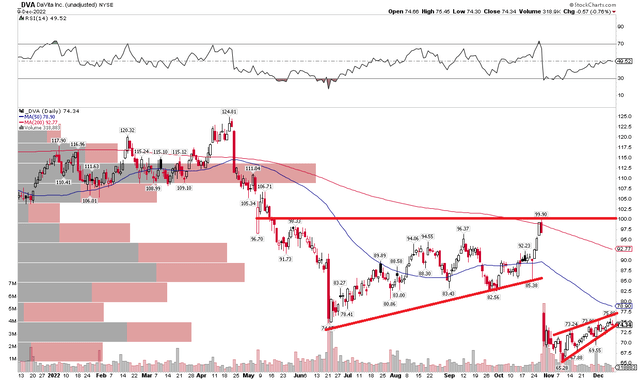

I had a hold on DVA back in September, but should have paid closer attention to the technicals. The stock indeed struggled in the mid to upper $90s and at its falling 200-day moving average. Following a 27% plunge post-earnings in late October, the stock has merely consolidated in a bearish rising wedge pattern of late. Notice in the chart below that the stock is struggling at its June low near $75 on this small rally. Moreover, I would not be surprised to see some pressure near the falling 50-day moving average. Overall, the technical picture continues to look weak.

DVA: Bearish Rising Wedge After Failing Breaking Support

Stockcharts.com

The Bottom Line

I am keeping my hold recommendation given a still decent valuation case, but the DVA chart remains in favor of the bears.

Be the first to comment