roberthyrons/iStock via Getty Images

Thesis

As inflation sparks and reaches a 40-year maximum, the service sector has found itself in a huge amount of trouble. Businesses are facing a labor shortage and material prices increase. That forces companies to increase their prices with no margin growth.

Restaurants are feeling even more pressure, as it’s getting harder for them to raise their prices since their customers are really sensitive to these kinds of changes.

Darden Restaurants, Inc. (NYSE:DRI), however, has used its position to increase its net profit margin in FY2022, confirming that its strategy is working.

Restaurants and inflation

Restaurants are not feeling comfortable in this macroeconomic environment and use different ways to fight rising costs. According to a Simon-Kucher study, casual-dining menu prices rose 9% YoY back in May, while expenses soared to 11.7% compared to last year.

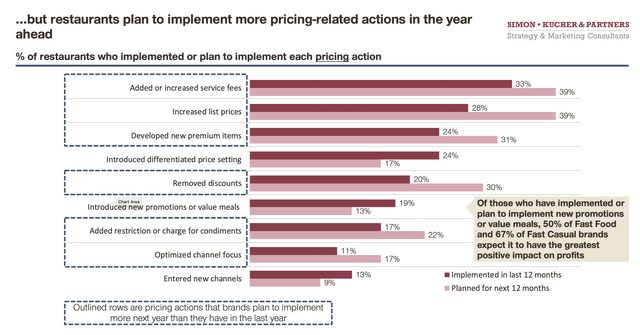

There are different ways for companies to fight these costs: simply pass the inflation on to the consumer, adjust portion sizes, remove discounts, etc. Service fees adjustments and list-price increases look like the most preferred options for brands, with 33% and 28%, respectively, of 50 restaurants implementing this pricing action.

However, it is hard to increase the prices and fees at an inflation rate without pressure on the margin. That’s why other actions are also required.

Darden Restaurants’ position

Darden Restaurants is the largest full-service restaurant company, with $9.63 billion in revenue. The company manages a chain of full-service dining 1,800 locations in North America. Darden has more than 180,000 employees and serves about 380 million guests a year. There are 8 restaurant chains for different occasions and budgets. A centralization of units allows for an increase in overall efficiency and gives more flexibility to the brand.

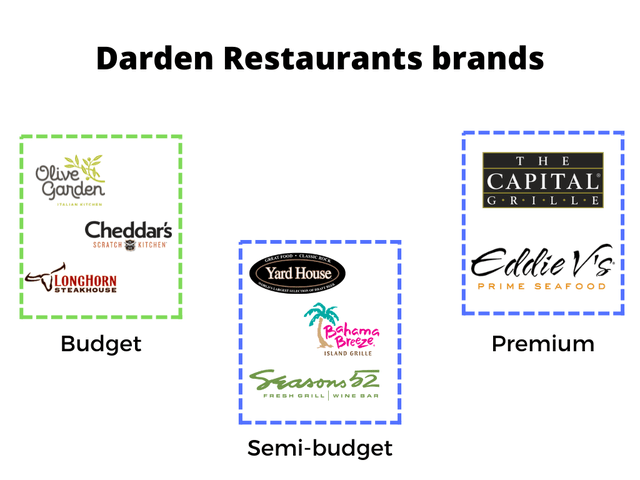

There are eight different brands under Darden’s roof: Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, Bahama Breeze, and Eddie V’s. This kind of diversification will help Darden Restaurants take a differentiated approach to price increases by managing restaurants in different price categories.

by author (based on average check)

The company pursues a strategy of raising prices below the inflation rate while maintaining sales growth. The chain didn’t pass on all inflation to consumers, especially in areas where it does not see continued pressure in the long term. Darden is betting that this will highlight the value proposition for guests and support the restaurant’s attendance relative to competitors, especially when compared to privately owned restaurants or smaller chains that are experiencing double-digit inflation.

Strategy is working

Thanks to the big brands, diversified revenue, scale, and strategy Darden Restaurants was able to increase the net profit margin to 9.9% in the fourth fiscal quarter.

In the Q4 of 2022 ending May 31, revenue rose 14.2% YoY to $2.6 billion, fueled by 33 new openings for the year and same-restaurant sales growth.

The management proposes a 5% price increase scenario with 6% inflation for FY2023. The pricing policy will maintain the flow of guests, while the prices of home-cooked products and the prices of competitors will rise faster than those at Darden. The company will be raising prices closer to inflationary levels in premium segments, where guests are less sensitive to it.

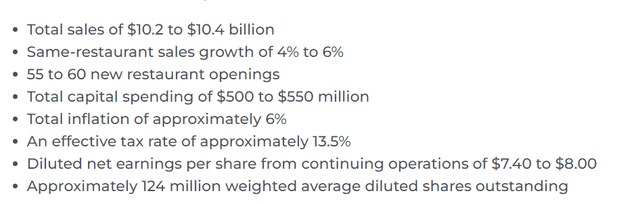

Fiscal 2023 outlook (Darden Restaurants)

“By adhering to our strategy, and pricing below inflation, we ended the year with significantly better margins than pre-COVID,” said CFO Raj Vennam.

Conclusion

Absolutely everyone in the service sector suffers from inflation, especially restaurant chains. Pricing pressure is forcing companies to raise prices, which as a result hurts margins and long-term prospects as they face lower consumer spending.

Darden Restaurants is in another position, though. Its scale and the strategy they chose were the main factors for its amazing Q4 performance. Although a slowdown in economic activity may adversely affect the attendance of restaurants, and, as a result, the performance of Darden, the company will still feel better than competitors in this economic environment.

Thus, I rate Darden Restaurants as a Buy.

Be the first to comment