Justin Paget

Daqo New Energy’s (NYSE:DQ) stock price is up 33% YTD. Because of supply and demand imbalances in the polysilicon market, polysilicon prices increased in 2022. Compared with 3Q 2021, DQ reported stronger financial results in the third quarter of 2022. However, despite a higher average selling price, the company’s 3Q 2022 financial results were not as strong as in 2Q 2022. Because the company’s production and sales volumes in 3Q 2022 were significantly lower than in the second quarter. The company expects its 4Q 2022 polysilicon production volumes to be between 30000 MT to 32000 MT. Also, Daqo ended the third quarter with a very low polysilicon inventory level. Moreover, polysilicon prices in 4Q 2022 are lower than in 3Q 2022. Thus, I expect the company’s fourth-quarter results not to be as strong as the two previous quarters. However, it doesn’t mean that the market condition is not attractive for Daqo New Energy.

The demand for polysilicon is increasing and solar PV installations around the world are expected to grow significantly. On 3 November 2022, Daqo announced that two of its subsidiaries, Xinjiang Daqo and Inner Mongolia Daqo, will provide a solar manufacturing company in China with a total amount of 57,600 MT high-purity mono-grade polysilicon from October 2022 to December 2027. Also, On 21 November 2022, Daqo announced that its subsidiary, Xinjiang Daqo, will provide a leading solar manufacturing company in China with a total amount of 148,800 MT polysilicon from January 2023 to December 2027. According to the recent developments and agreements, the polysilicon and solar PV market outlook, and the company’s position in the polysilicon market, Daqo believes that its ADR price is seriously undervalued. Thus, after a huge share repurchase program in the third quarter, DQ recently announced a $700 million share repurchase program, effective from 7 November 7 2022 to 31 December 2023. The stock is a buy.

Quarterly results

In its 3Q 2022 financial results, DQ reported revenues of $1218 million, compared with 3Q 2021 revenues of $586 million and 2Q 2022 revenues of $1244 million. The company’s gross profit increased from $435 million in 3Q 2021 to $947 million in 2Q 2022 and $979 million in 3Q 2022. DQ’s gross margin increased from 74.3% in 3Q 2021 to 76.1% in 2Q 2022 and 80.2% in 3Q 2022. The company reported net income attributable to shareholders of $323 million in 3Q 2022, compared with $628 million in 2Q 2022 and $292 million in 3Q 2021. Its adjusted net income increased from $295 million in 3Q 2021 to $630 million in 2Q 2022, and then, decreased to $590 million in 3Q 2022. DQ reported EBITDA of $720 million in 3Q 2022, compared with $955 million in 2Q 2022 and $442 million in 3Q 2021. The EBITDA margin of Daqo New Energy increased from 75.4% in 3Q 2021 to 76.8% in 2Q 2022, and then, decreased to 59.0% in 3Q 2022. The company’s polysilicon sales volume increased from 21183 MT in 3Q 2021 to 37545 MT in 2Q 2022 and decreased to 33126 MT in 3Q 2022. The company’s polysilicon total production cost increased from $6.84/kg in 3Q 2021 to $7.26/kg in 2Q 2022 and decreased to $6.82/kg in 3Q 2022.

“We ended the quarter with a very strong balance sheet, as our cash position combined with bank note receivables, which are redeemable for cash, reached $4.6 billion at the end of Q3, and we had no financial debt or bank loans,” the CEO commented. “In June, our board of directors authorized the company to repurchase up to US$120 million worth of its issued shares on the open market. We have completed the share repurchase program and spent $119.9 million to repurchase approximately 1.88 million ADRs. We will consider another share repurchase program when Xinjiang Daqo determines its dividend plan for the fiscal year 2022, as we believe that our current ADR price is seriously undervalued and not reflective of our position as a technology and cost leader with strong profitability and operating cash flow,” he continued.

The market outlook

According to Future Market Insights, the polysilicon market size in 2022 is estimated to be $8.5 billion and is expected to reach $11.8 billion in 2028, with a CAGR of 5.8%. Currently, about 52% of the global silicon market relates to polysilicon sales. Due to the increasing number of solar PV installations across the world (as a result of the increasing adoption of renewable energy sources), the demand outlook for polysilicon is strong. With a market share of 62%, China currently has the dominant market share in the polysilicon market. The sale of polysilicon in China is expected to rise as the Chinese government’s investments in the solar industry increase.

In 2021, the global polysilicon shipments were 560 kilotons. With a CAGR of 6%, the global polysilicon shipments are expected to reach 804 kilotons by 2027. It is worth noting that supply chain disruptions due to COVID-19 lockdowns around the world, especially China’s zero COVID-19 policy, hindered market growth. Due to the shortage of raw material supplies, the semiconductor manufacturing capacity decreased significantly. On the other hand, as a result of the rising adoption of solar power during the pandemic, the demand for polysilicon increased. Due to supply and demand imbalances, polysilicon prices increased.

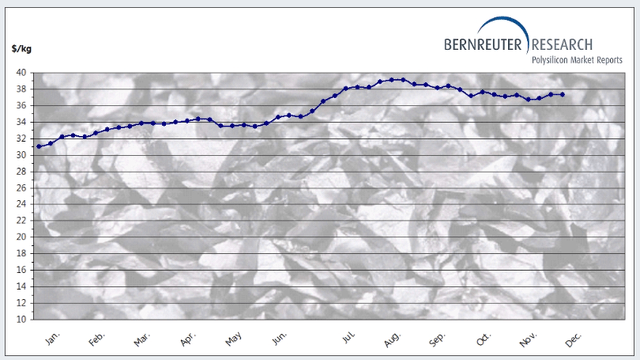

According to Figure 1, the global polysilicon spot price was about $37 per kg on November 2022, compared with around $39.0 per kg in August 2022, and about $31 per kg at the beginning of the year. The number of COVID-19 cases in China hiked in the past few weeks, meaning that we cannot expect the Chinese government to ease restrictions completely soon. Thus, the production capacity of polysilicon companies in China will remain limited and the supply and demand imbalances will remain high. As a result, I don’t expect polysilicon prices to decrease in December. Polysilicon prices in 4Q 2022 will be higher than in 1Q 2022 and 2Q 2022; however, lower than in 3Q 2022. DQ expects its polysilicon production to be between 30000 MT to 32000 MT in the fourth quarter of the year. It is worth noting that the company ended the third quarter with a very low polysilicon inventory level.

Based on the company’s guidance, and the polysilicon market condition, I expect the company’s revenues in the fourth quarter of 2022 to be $1095 million. “We believe we will continue to greatly benefit from this long-term trend as one of the most competitive low-cost and high-quality polysilicon providers in the world,” the CEO said.

Figure 1 – Polysilicon prices

www.bernreuter.com

The performance outlook

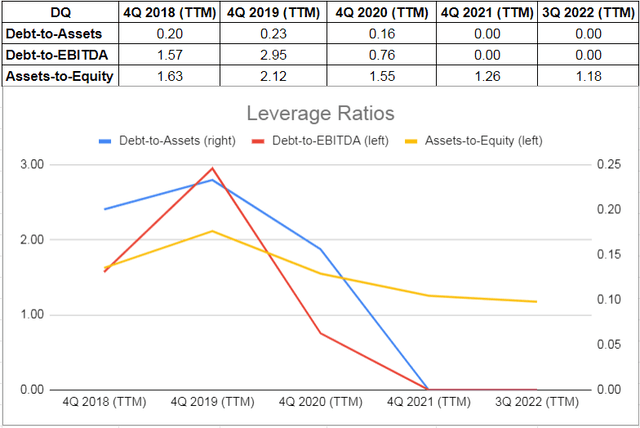

The debt-to-assets ratio is one of the significant calculations that measure the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. The company’s debt-to-asset ratio increased from 0.20 in 2018 to 0.23. However, due to hiked polysilicon prices and increased demand for solar PV, DQ’s debt-to-asset ratio dropped to 0.16 in 2020. Due to the favorable market condition in the past two years, the company ended 2021 and 3Q 2022, with no financial debt or bank loans, causing its debt-to-asset ratio to be zero at the end of 2021 and at the end of 3Q 2022. Also, DQ’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) plunged from 2.95 at the end of 2090 to 0.76 at the end of 2020 and to zero in 2021 and 3Q 2022. Due to better performance as a result of better market condition, DQ’s asset-to-equity ratio decreased from 2.12 at the end of 2019 to 1.51 at the end of 2020, 1.26 at the end of 2021, and 1.18 on 30 September 2022. The decreasing assets-to-equity ratio during the past years indicates that the company has been using lower debt to finance its assets. Due to its recent developments and plans, and the promising market outlook for the polysilicon market, DQ’s leverage ratios will improve in the upcoming quarters (see Figure 2).

Figure 2 – DQ’s leverage ratios

Author (based on SA data)

Summary

Due to higher-than-expected polysilicon prices in the third quarter of 2022, Daqo New Energy polysilicon sales volume reached 33,126 MT in 3Q 2022. Due to the increased energy prices and environmental regulations, the demand outlook for solar PV installations around the world is strong. On the other hand, due to the supply chain challenges, the supply of polysilicon is limited, meaning that polysilicon process will remain high. Thus, Daqo New Energy can make huge profit. Also, relying on its improved leverage ratios, the company can easily finance its development programs. The stock is a buy.

Be the first to comment