bfk92

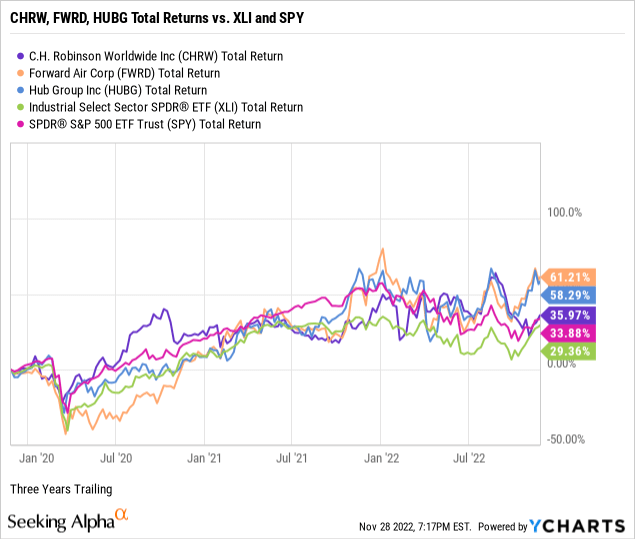

Air freight and logistics stocks, C.H. Robinson Worldwide (CHRW), Forward Air (FWRD), and Hub Group (HUBG) have each outperformed the industrials sector and the broader market during the past three years, leading up to and including the endemic bear market.

Although all three companies also possess high-quality business models, the current inflationary cycle, a pending rail strike, and fears of a global recession could directly or indirectly affect the air freight and logistics sub-industry. Therefore, in this compare, contrast, and confirm article, I will uncover which stocks are potential buy-and-holds for interested quality value investors.

By focusing investment research on the fact-based current wealth of publicly-traded companies and the present value of their representative shares instead of unreliable predictive analysis and speculative growth, the individual stock holdings of my Marketplace service, Quality + Value Strategies’ model portfolios have collectively outperformed the broader market since 2009.

In this multiple ticker research report, I put the select three air freight and logistics companies and their common shares through my proprietary, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation multiples, and downside risk.

The resulting investment thesis:

Despite the current hyper-inflationary economic cycle combined with lurking fears of a rail strike and global recession, CHRW, FWRD, and HUBG are collectively outperforming the industrials sector and the broader market, plus their respective fundamentals and valuations suggest the bear trapping will continue.

Unless noted, all data presented is sourced from Seeking Alpha Premium as of the market close on November 28, 2022; and intended for illustration only.

High-Quality Growth Bound Business Models

CHRW is a mid-cap, and FWRD and HUBG are small-caps in the industrials sector’s air freight and logistics industry.

C.H. Robinson Worldwide, Inc. and its subsidiaries provide freight transportation services and logistics solutions to companies in various industries worldwide. The company operates in two segments, North American Surface Transportation and Global Forwarding.

Forward Air Corporation and its subsidiaries operate as an asset-light freight and logistics company in the United States and Canada. It operates in two segments, Expedited Freight and Intermodal.

Hub Group, Inc. offers transportation and logistics management services in North America. The company’s transportation services include intermodal, truckload, less-than-truckload, flatbed, temperature-controlled, and dedicated and regional trucking, as well as final mile, railcar, small parcel, and international transportation.

All three companies have long-established operating histories, each based in the United States of America.

My collective value proposition elevator pitch for these select air freight and logistics enterprises:

Whether operating air, ground, or intermodal delivery and logistics, CHRW, FWRD, and HUBG each present high-quality business models within an enduring global growth industry.

The chart below illustrates each stock’s performance against the Industrial Select Sector SPDR Fund ETF (XLI) and the SPDR S&P 500 ETF Trust (SPY) for the prior three years. Each select stock has outperformed the total returns of the sector and the broader market during the timeframe up to and including the current bear market.

Equity Bond Rates Outperforming the 10-Year

Let’s uncover the equity bond rate of the common shares of these select air freight and logistics companies.

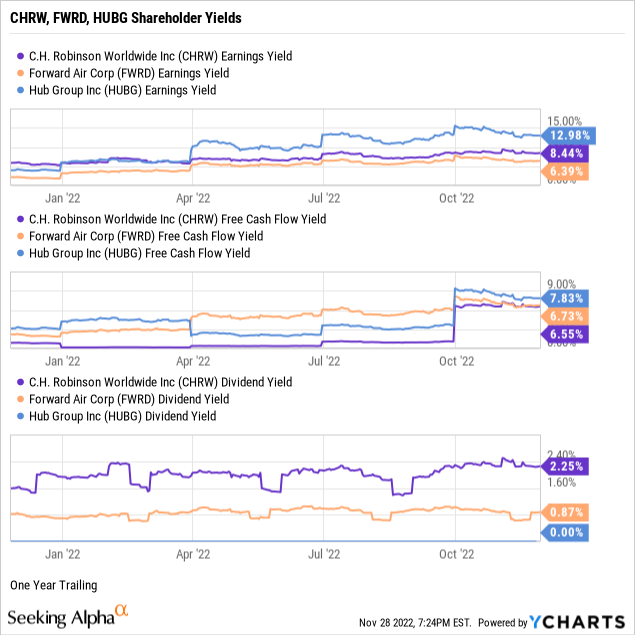

Per the chart below, CHRW was trading with an earnings yield of 8.44%, FWRD was at 6.39%, and HUBG’s earnings yield was 12.98%. CHRW’s free cash flow yield was at 6.55%, FWRD’s was at 6.73%, and HUBG’s free cash flow yield was at 7.83%.

Remember that earnings and free cash flow yields are inverse valuation multiples, suggesting that all three stocks trade at a discount. I’ll further explore valuation later in this report.

Two companies pay a dividend: CHRW had a forward yield of 2.25%, supported by a manageable 26.70% payout ratio, and FWRD was yielding 0.87% with a 13.40% payout. Both payout ratios indicate safe, well-covered dividends with room for annual raises.

Next, I take the average of the three shareholder yields to measure how the stocks compare to the prevailing yield of 3.69% on the 10-Year Treasury benchmark note. For example, the average result for CHRW was 5.75%, FWRD averaged 4.66%, and HUBG, despite no dividend, had an average shareholder yield of 6.94%. Securities such as these three select air freight and logistics tickers, which reward shareholders with yields above the government benchmark, argue for owning the stocks instead of the bond.

Shareholder-Friendly Returns on Management

Next, I’ll explore the fundamentals of each select air freight and logistics company uncovering the performance strength of the respective senior management teams.

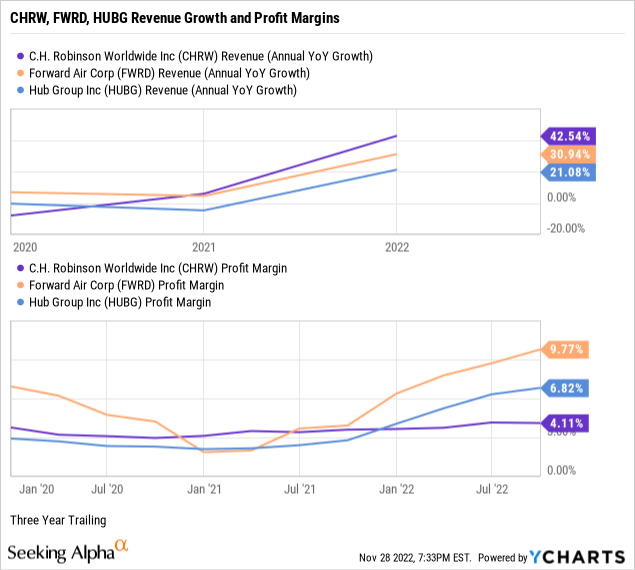

Per the chart below, each company had positive, double-digit three-year annualized revenue growth: C.H. Robinson Worldwide grew at 42.54%, Forward Air at 30.94%, and Hub Group at 21.08%. As a result, each enterprise exceeded the 16.79% median growth for the industrials sector.

Except for C.H. Robinson, underperforming at 4.11%, each company had a trailing three-year pre-tax net profit margin that topped or met the sector’s median net margin of 6.74%. Forward Air was 9.77%, and Hub Group’s net margin was 6.82%.

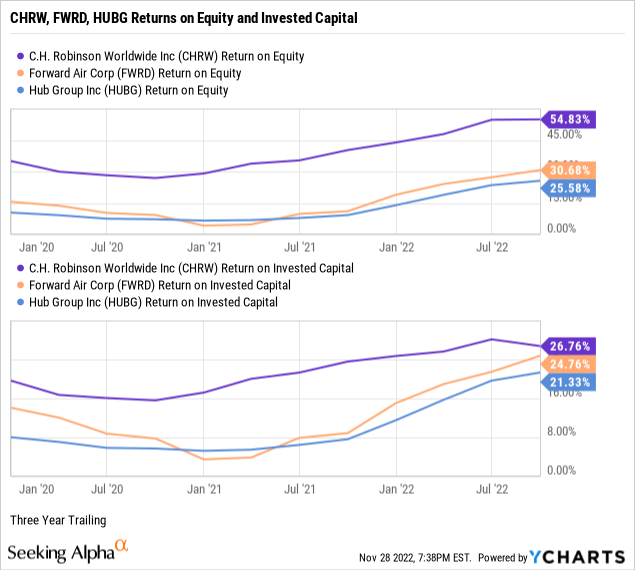

In further showcasing their collective shareholder-friendly management, all three select air freight and logistics companies were producing trailing three-year returns on equity or ROE exceeding the sector’s median ROE of 14.15%. As illustrated in the chart below, C.H. Robinson Worldwide led the group with a return on equity of 54.83%, Forward Air returned 30.68%, and Hub Group’s ROE was 25.58%.

All three select companies far outperformed in return on invested capital or ROIC, at least tripling the sector’s median ROIC of 6.81%, indicating that each enterprise’s senior executives are outstanding capital allocators.

In addition, the respective management teams are doubling their trailing weighted average cost of capital or WACC: CHRW at 7.65%, FWRD at 9.11%, and HUBG at 7.95%, confirming a collective ability to outperform capital costs. (Source of WACC: GuruFocus).

The double-digit revenue growth, positive and sector-beating net profit margins (except CHRW), and attractive returns on equity and capital indicate quality management performance at these select air freight and logistics enterprises.

Below Fair Value Stock Prices

I rely on just four valuation multiples to estimate the intrinsic value of a targeted quality enterprise’s stock price.

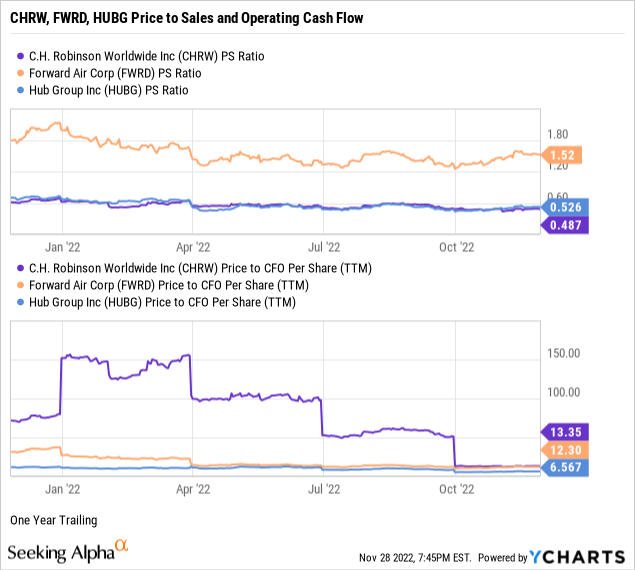

As demonstrated in the chart below, CHRW was trading at a trailing price-to-sales ratio or P/S of 0.49 times, FWRD was at 1.52, and HUBG traded at 0.53 times, each below or in line with the 1.36 median P/S for the industrials sector and at a discount to 2.32 times for the S&P 500. (Source of S&P 500 P/S: Charles Schwab & Co.) Thus, the weighted industry plus market sentiment suggests reasonably-priced stocks relative to each company’s top line.

Compared to the sector’s median of 16.58 times, CHRW’s price-to-operating cash flow multiple was 13.35, FWRD was at 12.30%, and HUBG was trading at 6.57 times, indicating that the market prices the stocks below fair value relative to current cash flows.

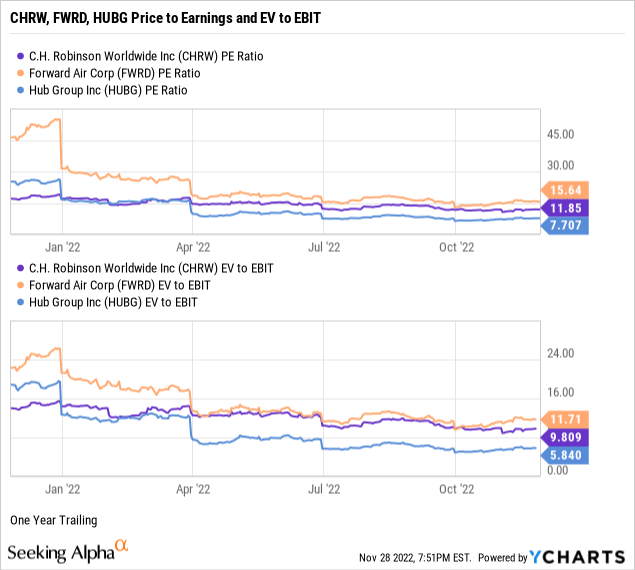

Per the chart below, and against a sector median price-to-trailing earnings or P/E of 19.87 times, CHRW had a P/E multiple of 11.85 times, FRWD was at 15.64, and HUBG was trading at 7.77 times, indicating investor sentiment discounts each stock price relative to earnings per share. Further, all three stocks traded at a discount to the S&P 500’s overall P/E of 19.22. (Source of S&P 500 P/E: Barron’s).

In addition, each stock was trading significantly below the broader sector median enterprise value to operating earnings or EV/EBIT of 16.99 times, signaling the select stocks were oversold or underbought by the market.

Weighting my preferred valuation multiples suggests the market assigns a discount to all three select company stock prices relative to sales, cash flow, earnings, and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this report, risks and potential catalysts notwithstanding, I would call CHRW, FWRD, and HUBG, the below fair-value-priced, bear market-beating stocks, representing high-quality business models in the air freight and logistics industry.

Competitive Moats and Solid Debt Coverage

When assessing the downside risks of a company and its common shares, I focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none. For example, Morningstar assigns CHRW a wide moat rating and FWRD and HUBG narrow moat ratings.

Notably, as reported on their most recent respective quarterly financial statements, C.H. Robinson Worldwide at 3.29 times, Forward Air at 2.93, and Hub Group at 4.69 times had long-term debt coverages or current assets to long-term debt that could pay off 100% of their respective leveraged obligations in a crisis using liquid assets, such as cash and equivalents, short-term investments, and accounts receivables.

In a further test of paydown capacities, the short-term debt coverages or current ratios were 1.32 times for CHRW, 1.74 for FWRD, and 1.38 times for HUBG. Thus, each balance sheet provides significant liquid assets to pay down 100% of current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes.

CHRW’s 60-month trailing beta was 0.76, FWRD was 1.15, and HUBG had a trailing 5-year beta of 0.94. Thus, with price volatilities trading below or near the S&P 500 standard of 1.00, each stock presents as a market-average volatility portfolio holding. However, CHRW is arguably the least volatile of the group.

The short interest percentage of the float was an alarming 10.80% for CHRW. Still, a bear paws-off of 2.44% for FWRD and 2.95% short interest for HUBG suggests that near-sighted traders view the latter two stocks as market-leading, narrow-moat air freight and logistics operators with loyal and sustainable customer bases. On the contrary, the market seems most concerned with C.H. Robinson Worldwide’s potential for shrinking gross margins due to global supply chain disruptions affecting the entire industry.

Except for CHRW’s short interest, each of the select air freight and logistics companies and their underlying stocks have competitive economic moats, strong debt coverage, stable price volatility, and favorable market sentiment, suggesting below-average downside risks.

Catalysts and Final Thoughts

Catalysts confirming or contradicting my overall bullish investment thesis on the select air freight and logistics operators, C.H. Robinson Worldwide, Forward Air, Hub Group, and their respective common shares include, but are not limited to:

- Confirmations: Long histories of execution throughout the freight cycle have thwarted a host of competitive threats. The group is well-positioned to weather a downturn in freight volumes and continue to build out capabilities in growth areas. Intermodal shipping enjoys positive long-term trends. Freight delivery operations should enjoy favorable longer-term tailwinds from e-commerce growth.

- Contradictions: A fragmented marketplace and the potential for high capital returns attract increased competition to the space. Negative macroeconomic headwinds may lower profit margins, particularly if truck diesel and jet fuel prices rise further. Transportation costs and customer satisfaction depend heavily on the performance of partner Class I railroads, which have been grappling with labor-related headwinds. Volume and U.S., Asia, and European macroeconomic conditions are vulnerable to global trade and face elevated downside risk from inflation.

(Additional source of catalysts: Morningstar.)

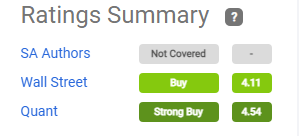

In a review of the most recent consensus rating summaries for the three select stocks on Seeking Alpha and Wall Street, CHRW rated a buy to hold, FWRD a buy to strong buy, and HUBG a buy to strong buy.

CHRW Consensus Rating (Seeking Alpha Premium)

FRWD Consensus Rating (Seeking Alpha Premium) HUBG Consensus Rating (Seeking Alpha Premium)

I am bullish on all three stocks based on high-quality business models with market-beating stocks currently trading at reasonable, if not bargain, prices.

Be the first to comment