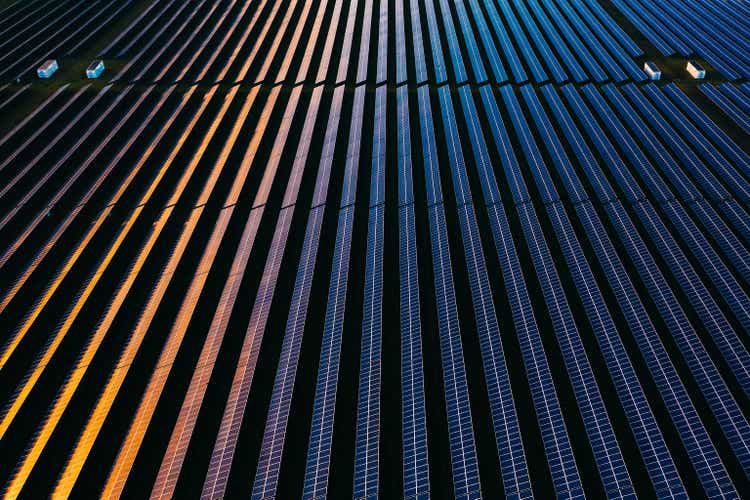

Justin Paget

The solar industry is booming yet again, as energy prices are soaring through the roof. The household demand for solar panels is increasing rapidly, while people are trying to counter their energy bills. As a result, investors are trying to rush in, but few investments are still worthwhile. Daqo New Energy (NYSE:DQ) leads the pack by a mile in terms of profit margins and cash on hand.

Demand In Europe Is Picking Up The Pace

Recently, a news outlet in my home country (Belgium) broadcasted a news story on television, which gave me the incentive to write this article. In Belgium, the demand for solar panels is currently extremely high, due to the energy prices. Solar panels are getting more and more attractive, for the reason that they are getting paid off a lot faster than normally. But there are not enough solar panel installers available to place the solar panels on the roof, which is causing lead-times till the summer period (8 months+). Although there are some bottlenecks, the high energy prices make the green energy transition speed up. The realization of the benefits of solar energy will boost the whole industry going forward.

America Has No Solar “power”

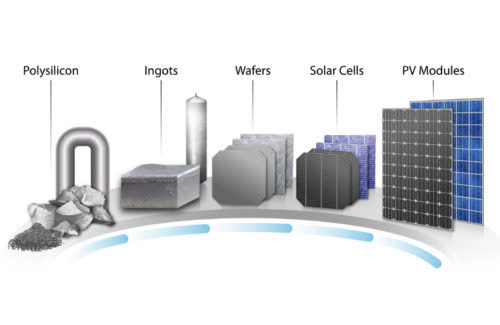

America lost the trade war with China badly in the solar industry, decisions made 10 years ago are still boycotting businesses today. The supply chain of solar panels has a lot of stages and the production capacity of these is influential towards the profit margins a business can make. China has been able to undercut the costs to produce solar panels due to low energy costs and alleged forced labor, therefore the U.S. implemented import taxes on solar cells.

Stages of creating solar panels (Al Hicks/NREL)

This is where it all went wrong… China took the same action and placed import tariffs on polysilicon manufactured in the U.S. As a result, REC Silicon (OTCPK:RNWEF) had to abort their polysilicon production along with Hemlock, which resulted in an EBITDA loss in 2021, while polysilicon prices are standing at an all-time high.

REC Silicon mentioned in their 2021 annual report that:

Impacts of Chinese tariffs on polysilicon manufactured in the United States, uncertain market conditions, and reduced demand for the Company’s solar grade polysilicon resulted in the shutdown of the FBR polysilicon plant in Moses Lake, Washington during 2019.

China does not need the U.S. to be profitable in the solar industry, on the other hand the U.S. needs China if they want to transition to green energy. Solar panels have a high global demand, even more China is the country that wants to grow their green energy and solar exposure the most. If the U.S. does not want solar products from China, then China will sell it domestically or elsewhere (Europe, Asia…).

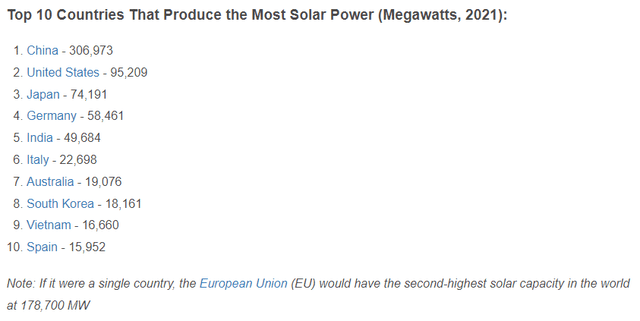

The U.S. killed their own polysilicon production and solar energy transition. All of this, resulted into U.S. lagging in solar power produced yearly. But focused on solar power produced per capita, the U.S. is still doing better than China.

worldpopulationreview

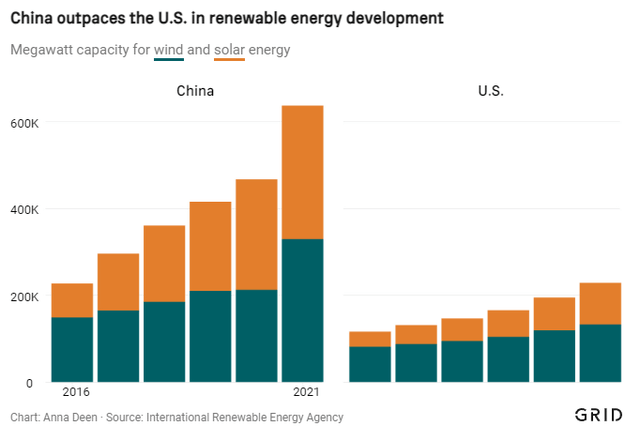

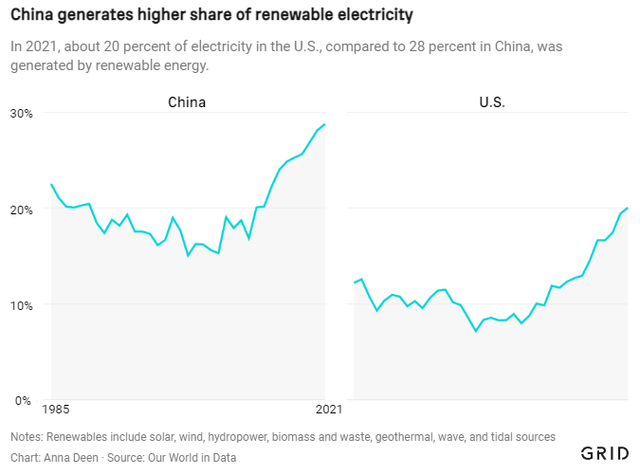

Nonetheless, China is expanding at a much faster pace than the U.S. In 2021, 28% of electricity generated was by renewable energy, while the U.S. was at 20%. The U.S. also lags behind other developed countries in Europe.

GRID

GRID

Some debate that China is making solar panels with cheap electricity from coal-fired power plants, which is not good for the environment. Nonetheless, the International Energy Agency reports otherwise:

The IEA reports that even the most carbon-intensive solar panels make up for all their manufacturing-related emissions in less than a year by generating carbon-free electricity, but Parr still wants to see production move to places that have access to cleaner electricity grids.

Polysilicon Scarcity Drives Up Profit Margins

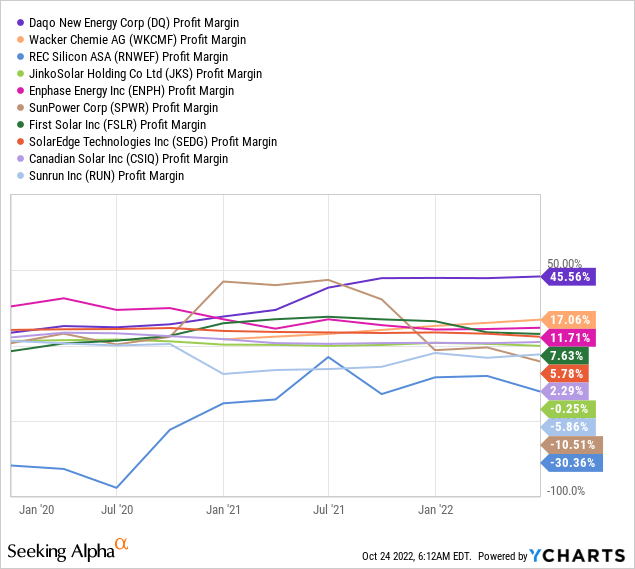

We already know that the demand is there for solar panels. Unfortunately, bottlenecks in the supply chain cause only some to benefit from it. The two highest margin businesses are Daqo New Energy and Wacker Chemie (OTC:WKCMF), who both manufacture polysilicon (first stage in the supply chain). The reason for this is mainly because the wafer capacity is expanding more rapidly than the polysilicon capacity. Polysilicon makers have the price power to push higher silicon metal costs down the supply chain. Further, wafer companies are actively looking for polysilicon, therefore taking polysilicon deals at a higher purchasing price to get what they need. Since companies, governments and households are buying solar panels anyway, in a never seen before demand, wafer companies can also pass along the price downstream to the next stage of the supply chain.

For that reason Enphase (ENPH) mentioned this risk in their SEC filing:

If we or our contract manufacturers are unable to obtain raw materials in a timely manner or if the price of raw materials increases significantly, production time and product costs could increase, which may adversely affect our business.

Enphase can do little about the pricing power upstream, which is also reflected into the profit margins of the other solar panel makers. Although solar panel makers struggle to make any money, Enphase is separating itself from the rest through high quality products and increasing their ‘share of wallet‘ per home. In the next few years, normal supply and demand should be in place as enough polysilicon capacity is available. However, American panel makers might struggle a while longer by the strong grip of China’s upstream supply chain.

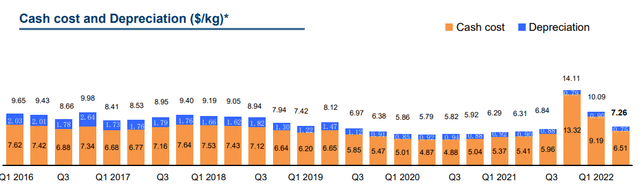

Daqo New Energy’s margins are topping the charts due to a very efficient cost structure. In Q4 2021 and Q1 2022, silicon metal costs spiked but have now decreased again significant. The future of Daqo’s cash cost looks even brighter as the new Inner Mongolia facility comes online. The company plans to manufacture their own silicon metal to gain even more efficiency in the cash cost for manufacturing polysilicon.

Seeking Alpha DQ Q2 Presentation

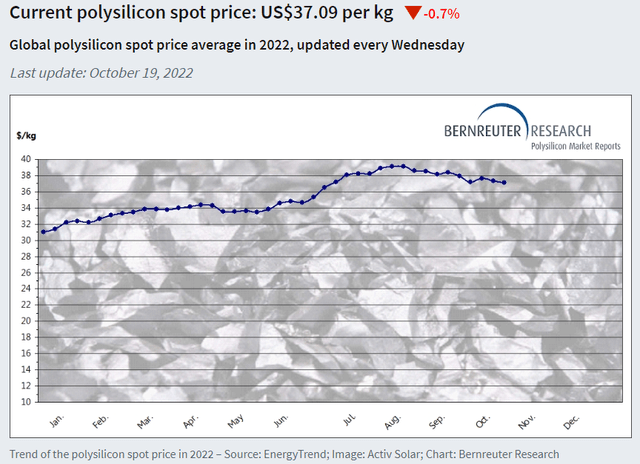

There has been a lot of debate around decreasing polysilicon prices, but the prices are yet to come down. Sitting at $37 per kg, the polysilicon industry is making a killing.

On the 14th of October, the company announced a 5-year polysilicon deal with Shuangliang Silicon Materials to supply their fast growing solar wafer business. Xinjiang Daqo and Inner Mongolia Daqo will provide Shuangliang with a total amount of 150,300 MT high-purity mono-grade polysilicon from 2022 to 2027. Currently, this is more than the production volume in the full year of 2022.

On the 18th of October, the company announced another 5-year polysilicon deal with a solar manufacturing company for a total supply of 46,200 MT from 2023 to 2027.

On the 25th of October, Daqo announced a third deal for a 6-year polysilicon supply agreement with a leading solar manufacturing company. Xinjiang Daqo and Inner Mongolia Daqo will provide the company with a total amount of 432,000 MT high-purity mono-grade polysilicon from 2023 to 2028. This is more than 3 times the annual production in 2022, so a huge contract.

All 3 deals will have flexible sale prices of polysilicon in the contract, which will be negotiated monthly based on the market. These deals further fuel the thesis that downstream capacity is expanding rapidly and will support the current polysilicon capacity. Plus, this gives a green light to investors that the management has made a good decision to invest heavily in capacity growth. In the next 2 years, the polysilicon capacity of Daqo is expected to grow 50% annually.

Bernreuter Research

Cheap Valuation

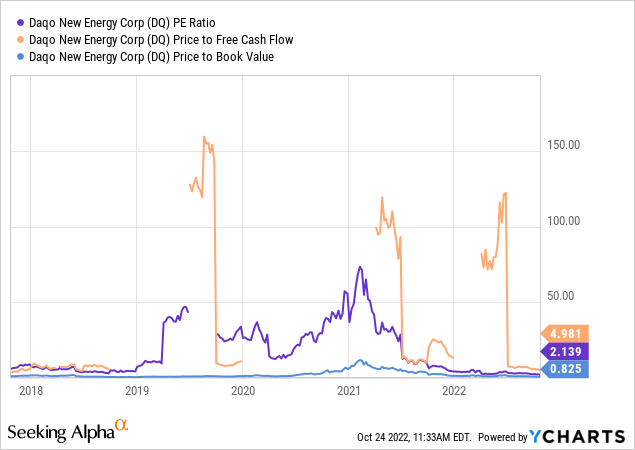

Daqo New Energy trades at a very low multiple of 2x earnings, 5x free cash flow and 0.8x book value. The company has started a $120 million buyback program, which accounts for 3.6% of the current market cap. In 2023, shareholders could expect more value through dividends and share buybacks as Xinjiang Daqo’s (Daqo’s subsidiary) income has skyrocketed and is obligated to pay out a percentage of its income in dividends to the parent company.

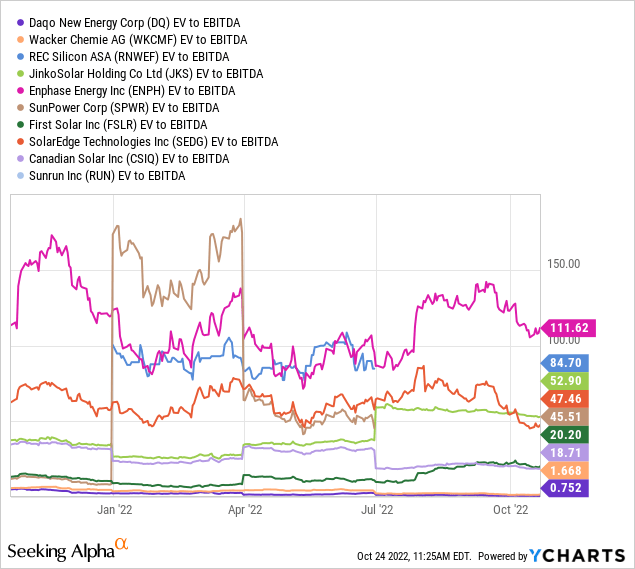

Furthermore, Daqo New Energy is trading the cheapest in terms of EV to EBITDA compared to other peers; like JinkoSolar (JKS), SunPower (SPWR), First Solar (FSLR), SolarEdge Technologies (SEDG), Canadian Solar (CSIQ) and Sunrun (RUN). The slightly profitable American solar panel makers seem extremely expensive and do not show great signs of a well-balanced risk reward proposition. On the other side, Daqo New Energy shows signs of high pessimism and price levels with not much room to go lower.

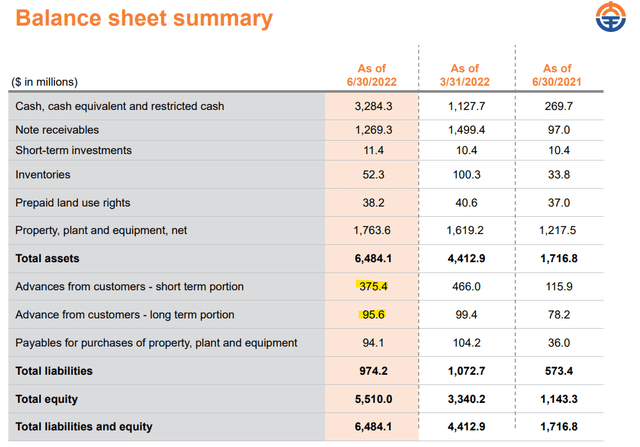

Fortress Balance Sheet

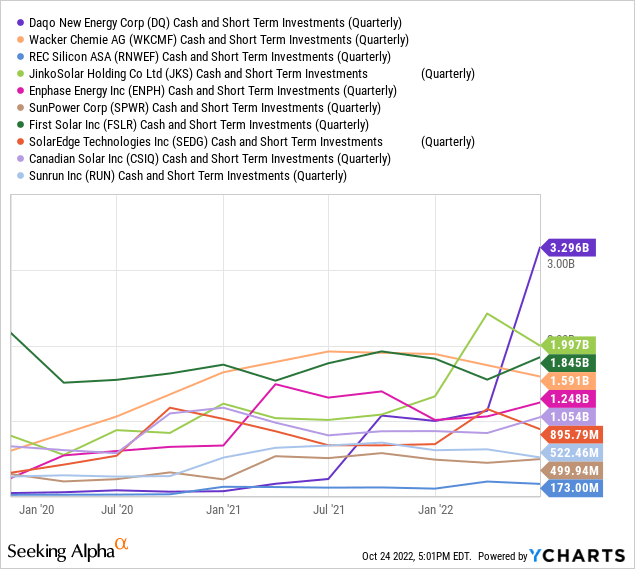

The stabilization of high polysilicon prices gives the company abnormal earnings, which resulted into a fortress balance sheet and almost no debt. Daqo is the cash king in the industry and this will not change in the coming quarters.

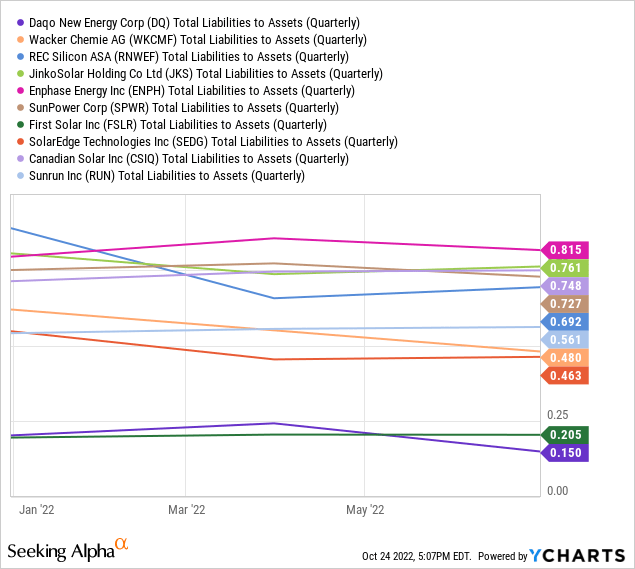

In addition, most panel makers are higher leveraged than the Chinese polysilicon maker. Only First Solar can stand its ground against Daqo with a solid balance sheet.

If we take a deeper dive in the balance sheet, we can see that most of the liabilities are actually unearned revenue. Around $470 million are advances from customers, this is accounted for liabilities till the polysilicon is delivered.

Seeking Alpha DQ Q2 presentation

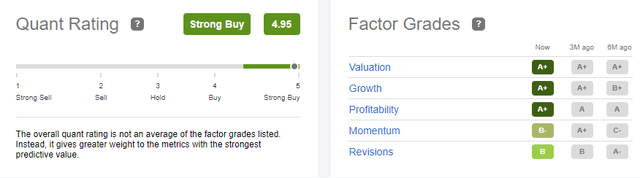

Quant Rating

At this time, Daqo New Energy has a very respectable Quant Rating of 4.95/5. The company has everything a well-performing stock needs. In terms of valuation, growth and profitability the company is outperforming its peers by a great margin. The momentum rating has gone down a bit due to the bad Chinese sentiment. Even in these worse than normal economic times, solar panel demand is still reaching new highs.

Seeking Alpha

Delisting Risk & Xinjiang Forced Labor

Unfortunately, Daqo New Energy has been identified by the SEC under the Holding Foreign Companies Accountable Act. This means the company will be delisted by 2024, if they do not show the right auditing under the rules of the United States. Finally, there has been relieving news that the U.S. and China have started inspecting the auditing papers of the Chinese listed companies on the U.S. exchanges.

On top of that Xinjiang Daqo imports to the U.S. are still banned. The revenue percentage of the United States was pretty low at the time, but can impact future relations with companies that do business in the United States.

The company has opened up their factories to the public for inspection. Although, there is no evidence Xinjiang Daqo has used any type of forced labor, the full Xinjiang region is blocked from imports to the U.S. Besides, the Xinjiang forced labor issue is currently not affecting the demand for the firm’s products. The new Inner Mongolia facility might bring back deals with the United States.

For now, these risks will probably explain the reason why the valuation is so low at the moment. Solving these issues might bring more positive momentum to the stock and give the company a more reasonable valuation.

Personally, I see these risks as an opportunity to build up a position in one of the polysilicon industry leaders. The SEC delisting list carries more than 200 companies (including companies like Baidu), so Daqo is not in this alone.

Final Thoughts

Daqo New Energy’s business is booming. The company is in the right place at the right time and has everything to satisfy customers. Polysilicon deals are flooding in, which secured almost 5 times production capacity of 2022 for the following years. You can expect more deals to come, as wafer companies are scrambling to find polysilicon. However, lower polysilicon prices might be imminent to have a sustainable long term supply chain. Nevertheless, Daqo New Energy is growing its business and is improving the cash cost efficiency to manufacture polysilicon.

China is definitely a risk to consider, but in my opinion the country is not un-investable like many claim it to be. The global solar industry must grow to meet climate change goals and China will be needed as they supply more than 80% of polysilicon in the world. If you are betting on the future of green energy, Daqo New Energy should be in your portfolio. Even a 1% allocation can grow to a big holding overtime.

I will retain my Strong Buy rating on Daqo New Energy. The stock is currently too cheap to ignore given the bullish prospects. The management is doing an awesome job by buying back their cheap shares and I hope to see this continue going forward. Once the China-U.S. auditing problems are resolved for Daqo, the stock could reach new-highs rather soon. A low of $35 seems like the bottom for now, I am actively buying below $50 a share.

Be the first to comment