nantonov

Here at the Lab, Danone (OTCQX:DANOY) was one of our first investments backed by a compelling sum-of-the-part valuation and later on supported by activists’ involvement. Over the years, we have cleared our position and consequently, we lowered our rating to neutral. It was a good move and since then Danone has been penalized by the market.

Source: Mare Evidence Lab’s previous publication

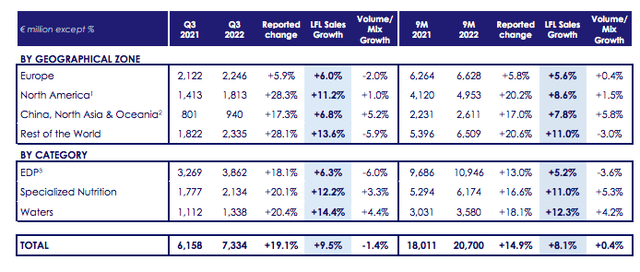

During the Q3 reporting season, the Swiss giant Nestlé (OTCPK:NSRGY) opened the ball and posted a turnover increase of more than 9% and an operating profit margin of 17%. Nestlé’s product positioning (very present on coffee and animal food) allows the company to be less exposed to the shelf price. However, Danone which usually lags behind its Swiss competitors was able to accelerate the like-for-like growth, posting a plus 9.5% (and an increase of 19.1% on a reported basis). As usual, there is not a full disclosure of Danone Q3 numbers, but only a press release with divisional highlights and geographical performances.

Danone GEO/segment sales development

Source: Danone Q3 press release

Cross-checking analyst estimates, the company sales were above the VARA consensus of more than 6%; however, volume/mix still declined more than expected. EDP Russia negatively contributed to the performance. Indeed, if we are excluding Russia, volume declined by only 20 basis points. Here at the Lab, we recently analyzed Danone’s Russian exit, providing an estimated write-off of approximately €1 billion (we will have full visibility on the FY results). Last time, we were forecasting an increase in top-line sales of 8% mainly “driven by only a price increase and a negative volume growth for the Q3 account”, we believe that with this Q3 revenue results and the negative sentiment on Danone shares, it will positively influence its stock price development.

Mare Evidence Lab’s key takeaways:

- CEO confirmed Danone’s guidance, so we are not providing any material changes in our internal estimates;

- In Q3, we note that consumer elasticities have not played out. There are lower purchase frequencies but in absolute value, Danone is navigating very well in this inflationary pressure environment;

- Currently, we are still forecasting a plus 8% in Q4 sales; however, we decide to implement minor changes in our 2023 accounts, forecasting a lower volume mix based on SKU rationalization and disputes with hypermarkets;

- So far, there was no change in consumer behavior;

- As already mentioned last time, under new leadership, we believe that the French food giant will experience a positive momentum with new managers and a clear focus on the cost side;

Conclusion and Valuation

In the current macroeconomic environment, growing volumes is not easy; however, the French company is growing volumes where it is critical to do so (for instance in China). Danone has a market-leading position in many countries and follows its CMD, a business model that’s very sustainable. With the new management in place and once the portfolio transformation is completed, we believe Danone’s stock price might unlock its real value. Concerning the valuation, we know that Danone is trading at a discount compared to its closest peers and versus its historical average, but we believe this is justified. Valuing the business with a 16x P/E on our 2023 numbers, we end up with a €54 stock price, assigning a neutral rating.

Be the first to comment