tunart/E+ via Getty Images

Thesis

The Daily 7-10 Year Treasury Bear 3X Shares (NYSEARCA:TYO) is an inverse ETF tracking the ICE U.S. Treasury 7-10 Year Bond Index. As per its literature:

The ICE U.S. Treasury 7-10 Year Bond Index (IDCOT7TR) is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years. Eligible securities must be fixed rate, denominated in U.S. dollars, and have $300 million or more of outstanding face value, excluding amounts held by the Federal Reserve. Securities excluded from the Index are inflation-linked securities, Treasury bills, cash management bills, any government agency debt issued with or without a government guarantee and zero-coupon issues that have been stripped from coupon-paying bonds.

The vehicle aims to provide a daily return equivalent to -300% of the return for the benchmark for a single day. The vehicle has a duration of 7.95 years:

Duration (Fund Fact Sheet)

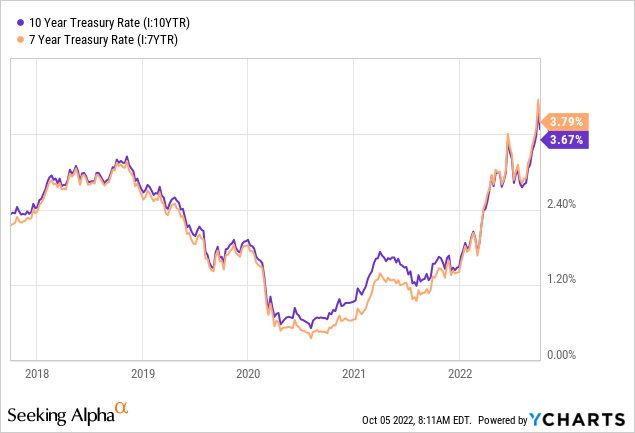

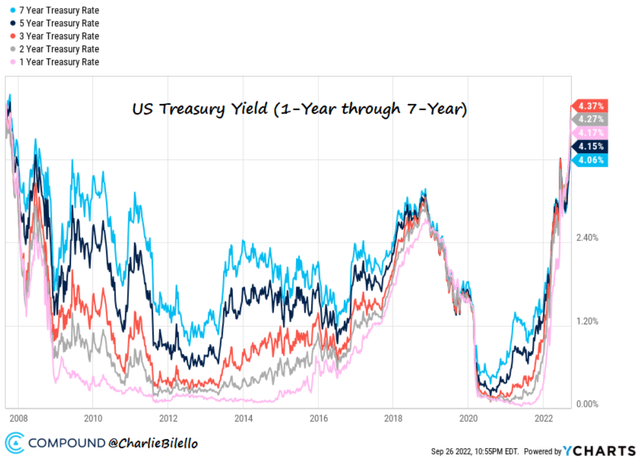

Given that the basis (i.e. spread between the 7 year and 10 year treasuries) between the two points in the curve is under 20 bps historically, a retail investor should think about TYO in the context of taking a view on 10 year Treasuries:

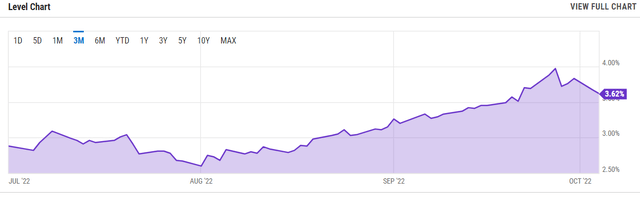

As yields move up, bond prices move down. This year has been a historic year in term of bond drawdowns given the massive spike in yields:

As 10-year yields have moved up, TYO has gained, being up more than 48% year to date. This is around 3x of the performance of the unleveraged ETF (TBX). In the “Performance” section below we go into detail regarding the bond mechanics that have generated this move. It boils down to duration and the fact that for every 100 bps of rate increases we should expect TBX to move by 8% and TYO to move by 24%.

Market View

The bear market in the S&P 500 (SPY) continues unabated, even though we are in the midst of another bear market rally. Weaker than expected US ISM Manufacturing (50.9 vs. 52.0 expected) and the U-turn in UK fiscal policy have triggered the latest rally, in a classic example of bad news is good news.

The rates market has been driven by profit taking and a short sighted view that we might have seen peak rates because the economy is “breaking”. 10-year yields have moved down by almost 40 bps in the past week:

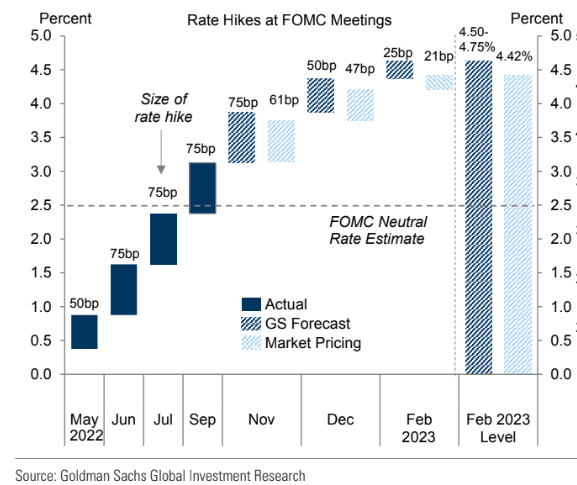

Yet investment bank analysts still have Fed funds exceeding 4.5% by year’s end:

Rates Prediction (Goldman Sachs)

Nothing goes up in a straight line, and that is the case for yields as well. We saw the same price action in August, when the bond carnage took a month off with yields tightening. The story was similar – market participants were expecting the Fed to somehow pivot based on peak inflation.

We think this time is different, and the Fed has been crystal clear about its messaging, where they need to see inflation come down significantly and within a well-established trend in order to normalize the curve. We are very far from that. The Fed is going to front-load all of their hikes because they are behind and then wait and see how the data comes in. Monetary policy has a notorious lag to its impact being felt in the economy, so even the massive hikes in the past months are not going to have an immediate effect.

Performance

The fund is up over 48% year to date:

YTD Total Return (Seeking Alpha)

We can see the leverage factor kicking in, with the unleveraged vehicle (TBX) being up “only” 15%.

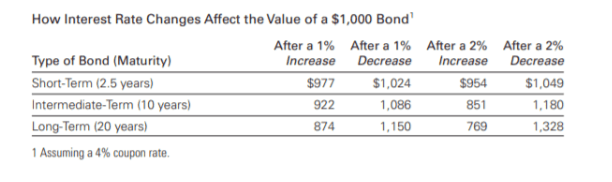

Let us marry up the fund’s performance with the yield move. Firstly let us see how bonds react to interest rate changes:

Bond Sensitivity (Vanguard)

We can see from the above table that intermediate term bond funds lose about 8% for every 100 bps increase in rates. 10-year yields started the year at 1.63% and are now at 3.67%, which translates into 204 bps of increases. Per our trusty table that equates to a bond loss of roughly -16%. That is almost spot on with the performance of the unleveraged fund TBX, which is a little bit over 15%. Multiply that by 3x and we get TYO’s performance.

Holdings

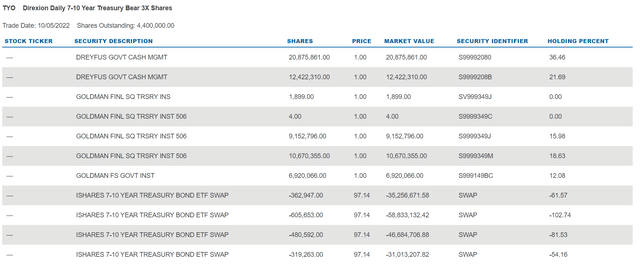

The following are the ETF’s holdings:

We can see that the majority of the funds are parked in money market accounts, while the actual fund returns are achieved via swaps. A swap is a bilateral agreement between two parties that can allow for any type of return to be structured within the contract. The fund thus achieves its goals via derivatives.

Conclusion

The Daily 7-10 Year Treasury Bear 3X Shares (TYO) is an inverse ETF tracking the ICE U.S. Treasury 7-10 Year Bond Index. The vehicle aims to provide a daily return equivalent to -300% of the benchmark for a single day. The best way for a retail investor to frame TYO is in the context of a leveraged take on 10-year Treasuries’ yields. When yields rise by 100 bps the pricing for this fund goes up by roughly 24% given its duration profile. Being long TYO has been a very profitable trade year to date, with the fund up above 48%. Decomposing that return we can see that 10-year yields have moved up by roughly 200 bps, which translates into a 2 x 24%, or 48% return for this leveraged vehicle. With 10-year yields down almost 40 bps on the week, driven by profit taking and talk about another “Fed pivot”, we feel the current 3.67% level is unsustainable. We are of the opinion that the Fed is crystal clear regarding its desire to front load rate hikes and use 2023 to go to neutral, and similarly to Goldman Sachs, we see 10-year yields above 4% by year end. That view translates into a 15% plus return for TYO for the remainder of the year.

Be the first to comment