imaginima

Thesis

Demographic trends are perceived by many analysts to play a significant role in economic growth and, consequently, stock market returns over time. The housing sector’s performance is also affected by changes in population growth. In this analysis, I explore the demographic factor as it relates to the growth prospects of the homebuilding industry, proposing D.R. Horton, Inc. (NYSE:DHI) as an attractive choice for investors to exploit the favorable trends over the mid-term.

Short-term Fear and Bad memories Rule Over Homebuilder Stocks

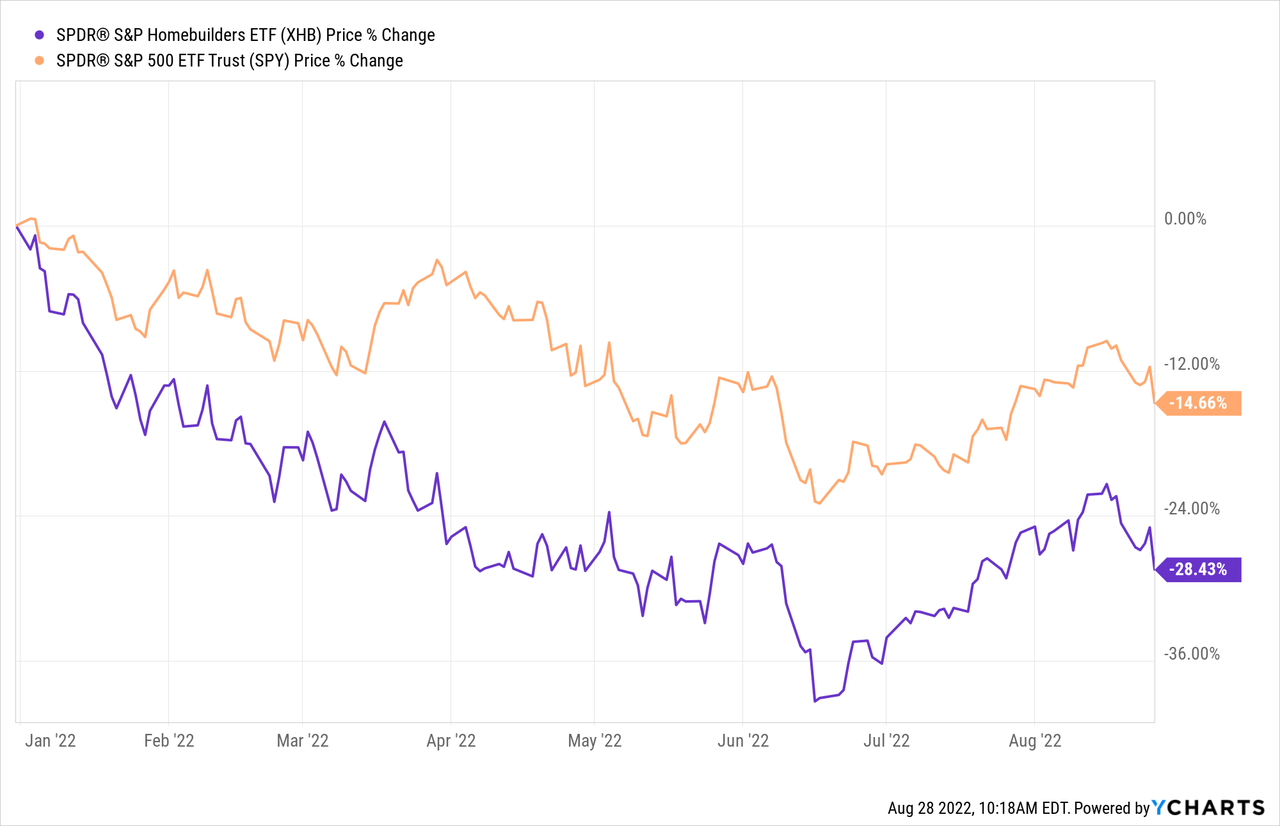

Spreading fear of an upcoming recession, combined with increasing borrowing costs (interest rate hikes) and input-cost inflation (building materials’ prices increase) have led to the homebuilders’ industry marking significant losses since the beginning of the year. Despite very modest valuations across the industry, Homebuilders have seen a -28% decline YTD compared to the S&P 500’s -15%.

Even though the industry has recorded some growth over the past few years – +65% 5-year price return for the (XHB) – the 2008 housing bubble and the subsequent crash still haunt investors’ memories, making them hesitant to commit to stocks in the industry. As a result, today, especially since the recent major market pullback, almost every stock in the industry trades at a significant discount.

Demographics: Exploring the Demographics Catalyst for Homebuilders & Equities

While more hurdles might appear in the short term and recent performance is indicative of a deteriorating investors’ sentiment, over the next decade a major catalyst is going to drive industry performance higher.

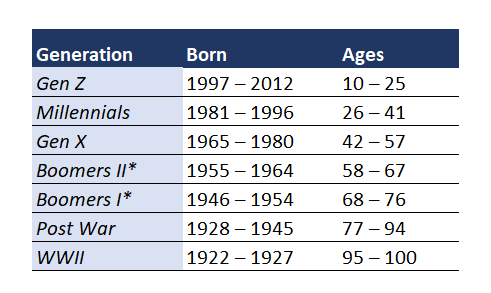

As population growth changes over time, some generations are significantly larger than others. When a large generation enter its prime years of productivity (28 – 50), economic growth and stock market returns have historically exhibited significant uptrends.

beresfordresearch.com

Millennials are one of the largest generations in recent memory and the good news is that they are now entering their prime productivity and home-buying years. As millennials enter the 30-50 year range, they are expected to reach peak productivity in 2029.

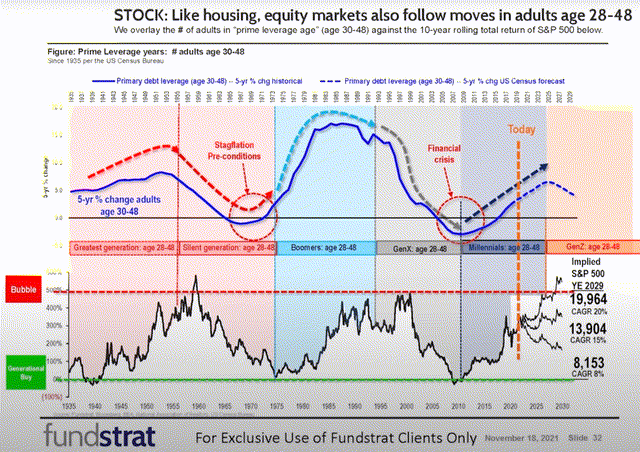

As shown in the chart below, provided by Fundstrat, equity market performance over the mid-term is correlated to the size of the population group between the ages of 28-48. In fact, the period when two other large generations (WWII generation and Boomers) reached their prime productivity years coincided with very strong growth in the stock market. Depending on other macroeconomic factors, the compounded annual growth from 2022 until 2029 should lay between 8% to 20%.

Every market cycle is a demographics cycle. Especially when it comes to industries revolving around the housing market. Returns in the homebuilding sector are likely to surpass those of the broader market, due to its discretionary nature (strong performance in periods of economic growth). Moreover, a generation moving toward its peak productivity years translates into greater homebuying activity.

Homebuilders are therefore very likely to provide market beating performance over the mid-term. Given the very low valuation levels across the industry, downside potential becomes limited, offering a rare asymmetrical return-risk opportunity.

In the long scheme of things, short-term market movements become rather irrelevant, except for the entry opportunities they may provide as stock prices retreat.

It is also important to remember that U.S Households are arguably one of the most sequential owners of equity investments, either through retirement programs or brokerage accounts. People between the ages of 30 and 50 years, are likely to invest since they earn more. In that sense, a large demographic between these ages applies upward pressure to equities. According to U.S news, in 2019, around 53% of American families held investments in the stock market, a sharp increase from the 32% who owned equities in 1989.

Why D.R. Horton Specifically?

Within the homebuilders’ industry analysts and investors could identify a number of well positioned companies. So what really makes D.R. Horton a great candidate for capitalizing on the demographics catalyst?

Financial performance: D.R. Horton has grown its revenue at 22.7% and 18.50% CAGRs over the last 10 and 5 years respectively. Operating income has also increased significantly, at 10 and 5-year annualized rates of 42.3% and 36.0%, outpacing both sector and industry growth rates. Profitability is also strong, with a 30% gross margin in 2021, when most companies in the industry aim for 22-25%.

Size and Competitive Strengths: DHI is the largest homebuilder in the United States with a $25B market cap and $27.7B in revenue (2021 fiscal year). The company also maintains the largest market share in its 5 largest markets, including Houston, DFW, Atlanta, Phoenix and Austin.

Geographical positioning: D.R Horton operates in some of the fastest growing real estate markets in the United States, including Texas, Florida, Arizona and others. Population growth and domestic migration trends are particularly beneficial in these parts of the country.

Diverse Product offerings: DHI maintains a diverse catalog that includes entry-level, move-up and luxury houses. As most of the company’s revenue is derived from lower-priced homes, the company should be more resilient in the case of a recession or a real estate market slowdown.

Dividend Growth: While the current yield of 0.95% is not impressive, DHI is a good dividend growth choice for long-term investors. Dividends have grown at an 11.03% CAGR over the last 5-years and the payout ratio remains low.

Valuation: Adding to the Upside Potential

The risk-return outlook for exploiting the demographics catalyst within the homebuilders’ industry, improves further if they consider the attractiveness of DHI’s current valuation. While exhibiting strong growth and substantial profitability, the stock trades close to liquidation value, which is not only absurd, but also a downside-limiting factor.

Currently, DHI is trading at a FWD 4.3x P/E, a 0.75x P/S, and a 1.3x P/B. Compared to both market and sector averages the stock appears very inexpensive. Even compared to the company’s historical 5-year P/E multiples, currently, DHI is sitting at a lower multiple compared to 2020 levels. That is after posting record earnings in 2021, and while analysts expect another year of net income growth in 2022. Both P/S and P/B ratios also stand at or near 5-year lows as well.

Risks to the Thesis

As with any other investment proposition, especially during uncertain times, several risks should be taken into consideration. A short list of factors that could negatively affect the thesis is offered below.

Mounting inflationary pressures: In the scenario where inflation fails to subside, margin contraction for homebuilders should be anticipated. Higher materials’ prices, labor and transportation costs will reduce operating margins.

Significant interest rates increases: Despite the recent interest rate hikes by the Fed, rates remain, at the moment in relatively normal levels in a historical sense. Currently, the 30-year fixed mortgage rate stands around 5%. Further increases are likely to affect house affordability and lead to consumers postponing house purchases.

U.S economy enters a major recession: Spending on new houses is discretionary and the demand elastic. In the case that consumer income decreases significantly, unemployment rises and sentiments deteriorates further, house purchases could decrease significantly affecting sales growth and profitability.

Final Thoughts

Even though the demographic catalyst might be unreliable for predicting short-term market performance, and is therefore not useful for short-term oriented investors and traders, over the mid-term it projects asymmetrical upside potential. The homebuilder sector and D.R. Horton are in my view the best vehicles to exploit the overarching growth trend that is set to affect performance in the next decade.

Be the first to comment