piranka

Summary

I recommend a BUY rating on Cyxtera Technologies (NASDAQ:CYXT). CYXT has excellent infrastructure and is well-known in the global market. As long as investors can stomach the short-term share price volatility caused by its debt profit, I believe CYXT will be rewarding if it meets my expectations for growth and profitability.

Company overview

I think the current price of CYXT shares is below the company’s true value. CYXT’s infrastructure is top-notch, and the company is well-known in international trade. All of these factors are more than enough to convince any potential investor to put their faith, resources, and money into the company.

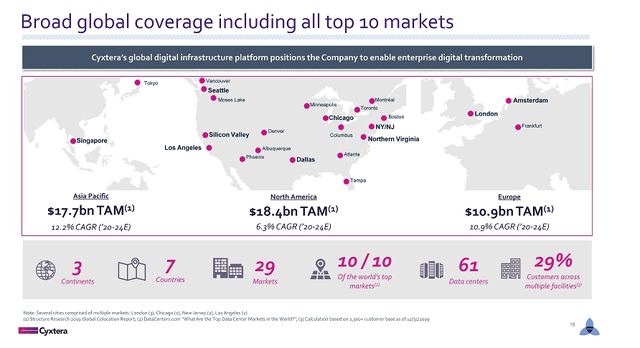

Broad geographical reach and ecosystem

CYXT’s mark is all over the globe. Their major markets are in North America, Europe, and Asia. Because of the geographic impact they have made, they are able to deliver solutions to enterprises, service providers, and government agencies anywhere they want to be. These consumers want to be near population centers, customers, employees, and service providers. They need the right minds to support their growth with deployments in multiple data centers across several markets, and CYXT is the best bet for them. CYXT is in a position to meet the expanding requirements of its strong customer base because of its 245 MW total power capacity and 40.7 MW of available expansion capacity that is balanced across CYXT’s platform.

It is very important to note that their data centers are purposely positioned and located in large metropolitan markets globally that are close in proximity to core business and financial hubs, major groups of connectivity and a broad range of data center customers, including various global enterprises and leading hyperscale cloud providers. This geographic reach enables them to meet all of their customers’ needs, which includes meeting these customers where they want to be and also supporting their growth with deployments in multiple data centers across various markets. In the long run, all of these have placed CYXT in a position where it will continue to grow and create an edge for them over new entrants into the market and regional players.

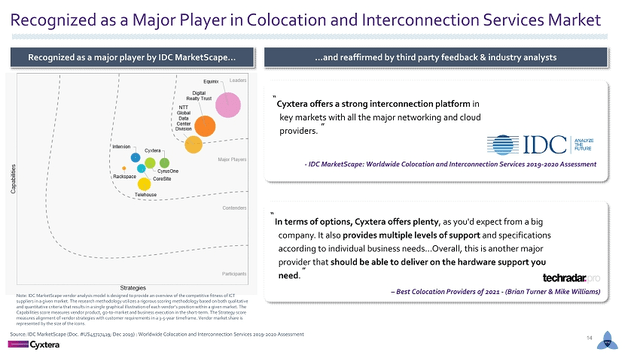

Almost all of CYXT’s data centers have low-latency connections to key public cloud zones and access to 40,000 physical and virtual cross-connects on their carrier-neutral colocation and interconnection platform. Because of how reliable its interconnection platform is, CYXT is able to attract corporations, media and content creators, service providers, and other entities that would rather access CYXT’s different networks in one place.

Top-notch facilities

CYXT’s portfolio includes high-quality Tier III data center facilities. The Tier III data center facility is synchronously sustainable with redundant components as a key differentiator, with redundant distribution paths to serve the critical environment. These centers are all always on board because the redundant infrastructure allows them to maintain their equipment or replace it without necessarily shutting down the whole facility. The preventive maintenance program ensures that all infrastructure is always in good condition and will meet and even exceed the industry standards. All of these ensure that customers receive availability, as they have been available 99.999% of the time over the past years.

Customers can easily connect to other businesses and partners, as well as a wide variety of network service providers, public cloud service providers, and other service providers, thanks to the interconnection solutions that form the backbone of a global platform of data centers that serves as an ecosystem. CYST’s mission is to streamline the process by which customers consume, deploy, access, and manage solutions for their IT infrastructure. Their cutting-edge, software-defined, API-driven solutions make all of this possible.

Diversified customer base reduces revenue risk

CYXT has a customer base of over 2,300 that is hugely diversified. Their customer base mainly consists of large enterprises and government entities. A large percentage of their customer base consists of cloud, information technology, and network service providers, creating a harmonious ecosystem with the corporate customers that contribute to the remainder of CYXT’s revenue. As of 2021, Lumen (LUMN) accounts for approximately 11% of their annual revenue, and their top 20 customers apart from Lumen contribute approximately 25% of the total revenue. They also have long-term relationships with their top 20 customers that have spanned over 14 years.

S-1

Cloud-like agility and intelligent automation combined with a seasoned team of executives are key competitive advantages

The goal is to deliver solutions that will enable customers to fully utilize their ability to compete in the present day digital economy. CYXT makes sure of this by giving customers the financial and operational flexibility of the cloud along with the performance and security of enterprise-grade infrastructure.

IoT sensors have been used to share real-time temperature and humidity data as well as provide customers with tools for automating recurring tasks. This shows that they are really big on incorporating automation into every aspect of the business.

A good team is very necessary in any business’s life, and CYXT has a senior management team. This alone shows a strong balance in the data center industry and related technology and telecommunications industries. I strongly believe that with this, CYXT is going to continue to be a strong force in the industry to reckon with.

Valuation

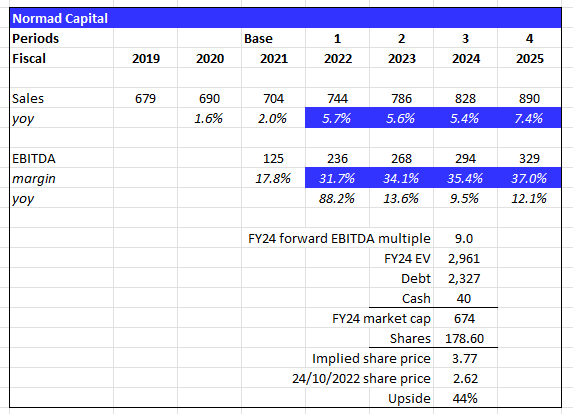

At the current stock price of $2.62 and 178.6 million shares, the market cap is ~$470 million. I believe the current valuation does not reflect the fair value and provides an alright entry point. That said, investors need to be prepared for extreme volatility given the debt level of CYXT. I want to highlight that my model did not factor in valuation re-rating upwards to its historical average. Any positive change in multiples would have a major impact on equity value. Hence, returns could be better than what I expect.

My estimates are largely in line with consensus, which revolves around management’ guidance. I believe CYXT will make $890 million in sales and $329 million in EBITDA in FY25. This will be driven by organic sales growth and margin expansion through growing utilization, giving it a market cap of $674 million and a stock price of $3.77 in FY24, assuming it trades at 8x in FY24.

Assumptions:

- Sales: to follow consensus estimates until FY25 as CYXT continues to gain market share

- EBITDA: to follow consensus estimates until FY25 as CYXT continues to ramp up utilization in existing centers, which carry high incremental margin

- Valuation: I assume no change in valuation and that it should continue to be valued using the current forward EBITDA multiple of 8x in FY24.

Normad Capital

Risk

Ever-changing technological landscape

As the days pass, the industry is also evolving. New trends come into being, technology also rapidly changes, customers have new requirements, and, of course, there is the industry standard. CYXT’s power and cooling systems are hard and costly to upgrade, and they might not be able to efficiently upgrade these systems to meet these new demands without breaking the bank.

Barriers to entry

The industry does not have competitors due to barriers holding back new entrants. CYXT will always be under the threat of new entrants from well-capitalized businesses in the adjacent market.

High debt level

CYXT has incurred over $2 billion in debt on its balance sheet. Additional pressure is put on the equity value when there is fluctuation in operating results. Also, the present rising rate environment is not exactly healthy for CYXT.

Conclusion

CYXT’s current share price does not reflect its fair value. There are a number of things that will determine whether or not a business will continue to thrive and dominate the industry in which it is in. One of the important things is to have a team of great intellects that are committed to seeing the business move forward. CYXT likely has that. Also, there is a place for having a huge customer base. Customers from different arms of the industry, and, of course, CYXT has this and even more. CYXT has great infrastructure in place, and they are also recognized in the global market. To name a few, all of these reasons are more than enough for any investor to put their time, trust, and money into the business in my opinion.

Be the first to comment