gorodenkoff/iStock via Getty Images

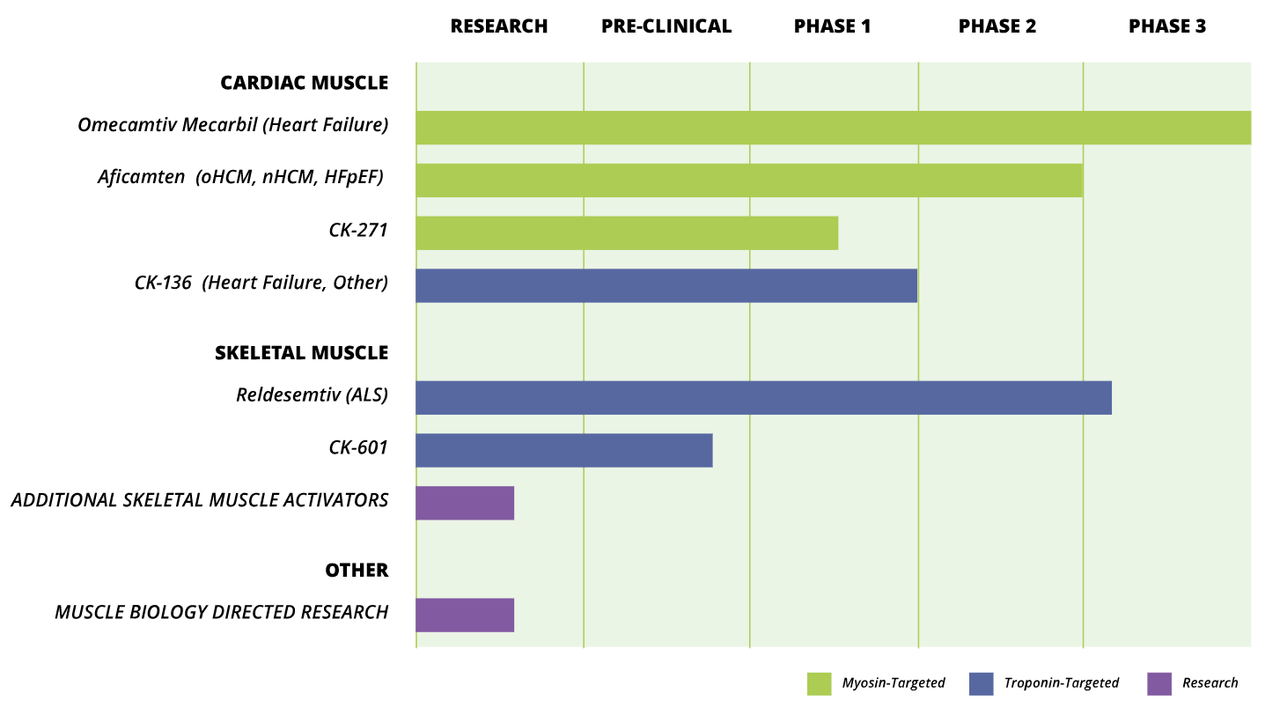

Based in San Francisco, California, Cytokinetics (NASDAQ:CYTK) is a biopharmaceutical company that is in the process of developing muscle activators and muscle inhibitors. These drugs have the potential to impact the pharmaceutical industry in multiple segments, from muscular to cardiovascular. The company has three different treatments in the development and trial stages. Omecamtiv Mecarbil is one of the company’s more promising drugs, gaining fast-track approval from the FDA to treat cardiac failure. Reldesemtiv is an FTSA in development by the company that has undergone clinical trials to test its viability as a treatment for ALS. Aficamten is a small molecule myosin inhibitor designed to treat hypertrophic cardiomyopathy.

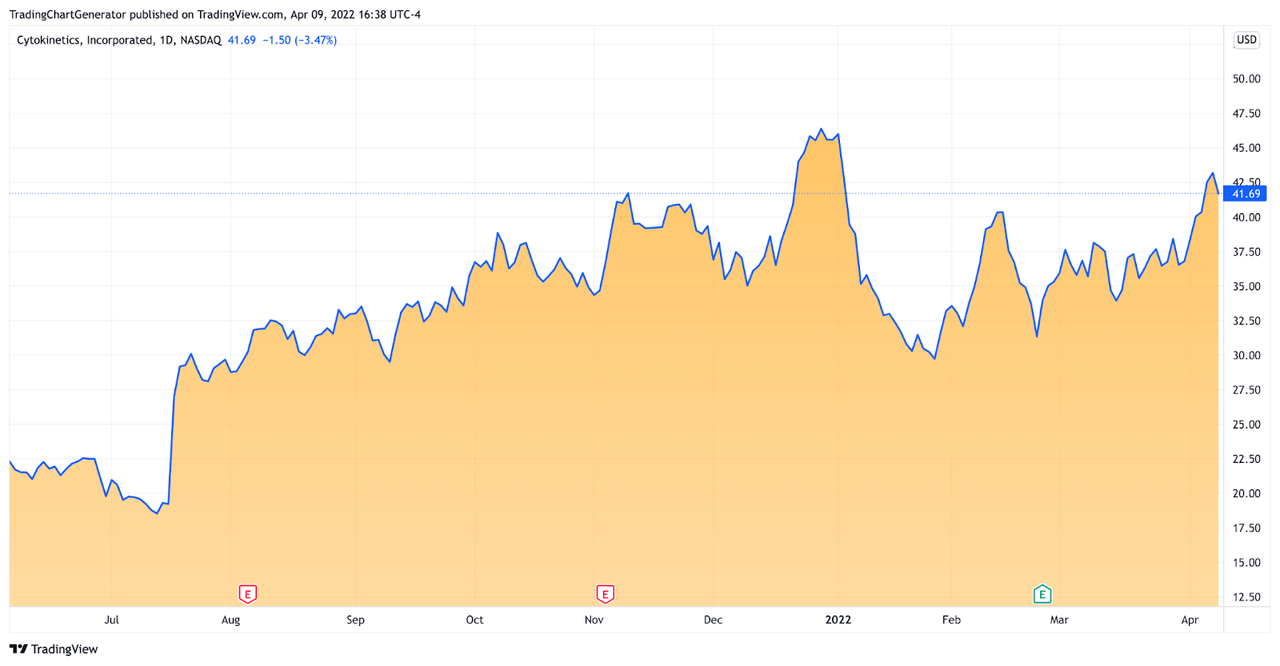

TradingView

In this article, I will show that despite not having a viable product on the market to date, the progress that the company has made is significant enough to warrant investment. The global cardiovascular drug market is expected to see steady growth up into 2026, and the ALS drug market is expected to see substantial growth as well. Cytokinetics has done an excellent job utilizing its research and development platform to form collaborative partnerships with other medical research companies and drug manufacturers. These partnerships have helped them acquire the funding needed to continue their R&D without incurring substantial debt. Using this formula, the company has managed to generate gross profits for four consecutive years. If they are able to bring their drugs from development to the market, it could skyrocket the company’s value. For that reason, I believe investors should pursue this stock with a bullish investment strategy.

Multiple Market Driving Potential

There have been a number of advancements in the medical field over the last ten years. Those advancements have given us new insights and changed the way we look at and treat disease. Cytokinetics focuses on the mechanics of muscle biology, utilizing its research and development platform to aid in developing drugs that combat muscular disease and illness. Because the heart is the most important muscle in the body, this extends the company’s market to cardiovascular drugs as well.

One of the most deadly diseases associated with muscle function loss is Lou Gehrig’s Disease or ALS. This disease affects the intermuscular nervous system, slowly reducing muscle functionality. To this day, there is no cure – symptoms can only be managed. Cytokinetics is working on the development of a drug called Reldesemtiv, which is a fast skeletal muscle troponin activator that has undergone clinical trials for ALS treatment. The ALS treatment market is projected to reach $885.5 million by 2026. This growth is at a CAGR of 5.8%. There are only a few approved treatment options for ALS, so the market potential is big for Reldesemtiv.

The global cardiovascular market is one of the more robust markets in the biopharmaceutical industry. This is because several medications deal with the vascular system and not the actual muscle itself, which is what Cytokinetics focuses on. Omecamtiv Mecarbil is a medication in company development that treats chronic heart failure in combination with reduced ejection fraction treatment. The market is projected to grow to $63.9 billion by 2026 at a CAGR of 3.8%. Cytokinetics’ heart failure and other cardiac muscle treatments fall under the “other” segment when analyzing the market in-depth, and only account for about 8% of the market total.

Collaboration Is Key

One of the key factors that has led to Cytokinetics’ survival on the market is the company’s ability to forge key collaborations and funding contracts with both other medical research and development labs and drug manufacturers. A particularly noteworthy example of this is the aforementioned Omecamtiv Mecarbil. Cytokinetics had a partnership with Amgen (AMGN) in the development of this drug. The companies had worked together collaboratively on other treatments and decided to expand the partnership to the research and development of this new cardiac failure treatment in 2013. In 2020, however, Amgen decided to terminate the collaboration.

In 2021, Royalty Pharma formed its own partnership with Cytokinetics for $450 million which included both drugs Omecamtiv Mecarbil and Aficamten. These strategic partnerships and collaborations have allowed the company to continue its research and development track without taking on too much excess debt and while improving company revenue.

Cytokinetics

Financial Overview

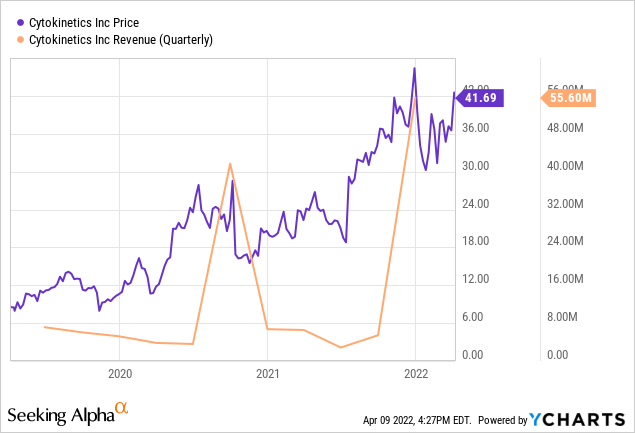

Company revenue has improved dramatically in the last four years. In 2018 the company posted revenues of $31.5 million. In 2019 the revenue suffered a slight dip, closing the year with just $26.8 million. The company started turning its negative around in 2020, increasing revenues to $55.8 million. In 2021 the company capitalized on its forward momentum generating a four year high of $70.4 million in revenue. Because the company has no technical products on the market, all of its revenues count as gross profits.

YCharts

Despite the healthy-looking profit and revenue numbers, the company has operated at a loss since 2018. The net income column shows that in 2018 the company operated at a loss of $106 million. In 2019 that number snowballed even further downhill, with the company seeing a loss of $121 million. In 2020 the slide continued, with the company posting a loss of $127 million. 2021 offered an even more pessimistic loss of $215.3 million in net income. However, this is not uncommon with biopharmaceutical companies involved in research and development. Company valuations are based on the market the drugs in development fall into. In addition, they are based on the trial results, which are indications of how close the treatments are to gaining FDA approval. Since Cytokinetics just recently had one of its drugs (Reldesemtiv) fast-tracked by the FDA, there is optimism that reflects in the valuation. This makes the negative net income string more palatable for potential investors.

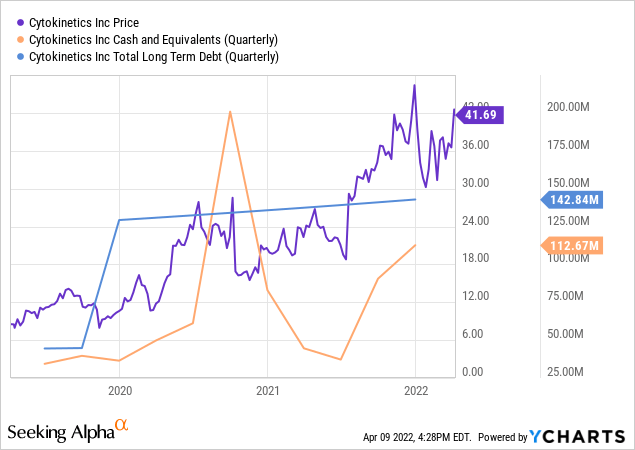

The company has done a good job in terms of increasing its cash holdings and assets. By increasing these metrics, they safeguard themselves against any setbacks in their trials that could result in delays, offsetting the potential impact. In 2018 the company held $42 million in cash. In 2019 that number decreased slightly to $36.4 million. In 2020 the number took a positive jump forward to $82.9 million. By the end of 2021, Cytokinetics had increased its cash holdings to a robust $112.6 million. The company’s total assets have enjoyed a very steady 4-year rise. In 2021, the company held $211 million in total assets. In 2019 that number rose to $289.8 million. 2020 saw yet another jump to $533.8 million. The meteoric rise in asset totals continued through 2021 when the company finished the year with over $841 million in assets.

YCharts

While the company has done a good job operating without depleting its cash flows and without taking on excess debt, it did not leave them immune from debt completely. In 2018 the company held just $39 million in long-term debt. Since then, the debt totals have steadily risen. In 2019 the long-term debt stood at $129 million, a massive increase from the previous year. In 2020 the debt totals rose again, modestly, to $135 million. 2021 followed the same trend, ending the year with $142.8 million in long-term debts.

Risks

While this is not surprising while operating at a loss, it could be a long-term concern. If the company is not able to bring a product to the market quickly, those debts could continue to swell, which could have an impact on company valuation in the future. However, with almost every R&D-centered biopharmaceutical company, there are always risks. The question is how certain you can be that the risks outweigh the rewards. In the case of Cytokinetics, I believe that the long-term debt risk is a minor obstacle in the face of overwhelming potential.

Conclusion

Cytokinetics is an intriguing option for those looking to invest in the biopharmaceutical industry. Their area of research and development is vastly untapped, and the applications for their drugs give them a wide pipeline for distribution should they gain FDA approval. Disease rates across the world are rising. Cardiovascular disease is one of the fastest-growing ailments in humankind and thus has a robust market. Other markets that the company’s treatments target, such as the ALS markets, are markets with little hope and virtually no breakthrough technologies that can counteract the devastation of the disease. This makes them highly lucrative for any company capable of getting a novel treatment option through FDA approval. Given that the FDA granted a fast-track designation for Reldesemtiv, I believe that Cytokinetics is closer than ever to developing a breakthrough in that market. For those reasons, I am willing to overlook the risks and list Cytokinetics as a buy. I believe investors should pursue this stock with a bullish investment strategy.

Be the first to comment