Olemedia

Cypress Development Corp. (OTCQX:CYDVF) is one of many companies currently trying to develop an alternative method of lithium extraction. Although the company is based in Canada, its focus is on developing a Direct Lithium Extraction (“DLE”) process that works on its 100%-owned lithium bearing claystone deposit, located in the Clayton Valley of Nevada. So far, the company has had many successes and been able to reach several milestones on its development path, but the effectiveness of its DLE tech has yet to be proven in the field. This article will discuss the importance of DLE to Cypress, the inherent risks of developing a new process, and the potential impact on the company’s stock price.

Company Backgrounder

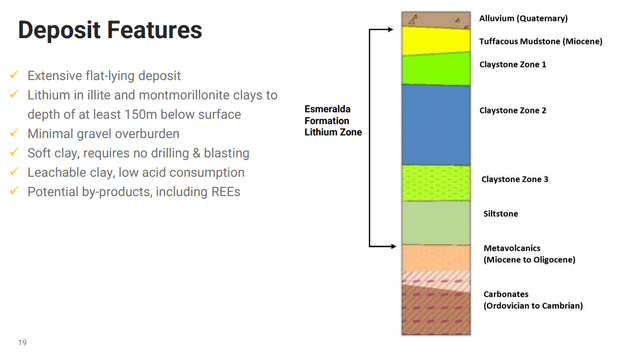

Cypress is a pre-production miner that has been working on the development of its Clayton Valley Lithium Project since 2015. Exploration work done at the site has enabled the company to identify a Reserve of 1.28Mt LCE (Probable) as well as a Resource of 6.3Mt (Indicated). It plans to extract the reserve at a rate of 27.4ktpa over a span of 40 years. Also, given the sizable additional resource that Cypress has been able to identify, one can easily imagine the company expanding production at some point in the future.

Cypress compares itself to both brine and hard rock projects given that its clay extraction process has elements of both. But given the soft clay’s properties, the absence of drilling or blasting, a very minimal overburden, and the planned use of DLE, a comparison to brine instead of hard rock is probably more appropriate.

In that context, the project’s grade, which comes in at 1,129 Li ppm, is very respectable. It compares very favorably to other DLE projects of which I have previously written. E3 Lithium Limited (OTCQX:EEMMF), a Canadian pre-production lithium miner, is planning to extract brine grading at only 75 mg/L from the Leduc Aquifer in Alberta while Standard Lithium Ltd. (SLI) plans to extract lithium from brine in the Smackover formation grading at 400 mg/L in Arkansas. Lake Resources (OTCQB:LLKKF), a well-known pre-production miner operating in Argentina, has teamed up with the Gates Foundation-backed Lilac Solutions in order to extract brine from the Salars of the Lithium Triangle using DLE technology. And its resource grades at only 289 mg/L.

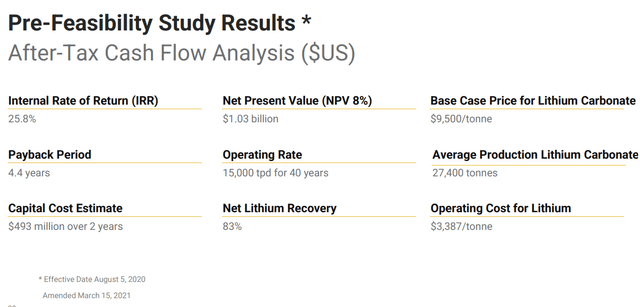

Given all of this, it’ll probably come as no surprise that Cypress’ NPV came in north of a billion dollars. In fact, a Pre-Feasibility Study (“PFS”) completed in August of 2020 and amended in March of 2021 lists the company’s NPV8% as $1.03 billion and its IRR as 25.8%. However, one has to bear in mind that lithium prices were then trading at much lower levels than what they trade at today. The spot price of carbonate recently rose above $75k/t, a far cry from the $9,500/tonne price assumption used in the PFS. Granted, inflation has probably also pushed up the $3,387/tonne operating cost assumption, but it’s probably a safe bet to assume that the NPV would be much higher were it to be recalculated today.

On the operational side, Cypress is progressing nicely. It’s currently running a pilot plant located about 100 miles from the Clayton Valley Project, where it’s testing its DLE process. So far, the tests have met with great success as the company reported producing 99.94% battery-grade lithium carbonate extracted from Clayton Valley claystone. The company, which had about C$34 million of cash on its balance sheet at the end of Q2, has announced plans to complete on-site lithium carbonate production and release a Feasibility Study but no timeframe has yet been provided.

Reason For the Hold Rating

In comparing Cypress’ $106 million Enterprise Value to the previously mentioned $1.03 billion NPV, we see that its stock is trading at deeply discounted levels; a valuation well below many other post-PFS junior lithium miners. The valuation looks even cheaper when we consider that Cypress’ barely 10% EV/NPV value is based on a $9,500/tonne carbonate price assumption baked into the NPV. The question then becomes, why?

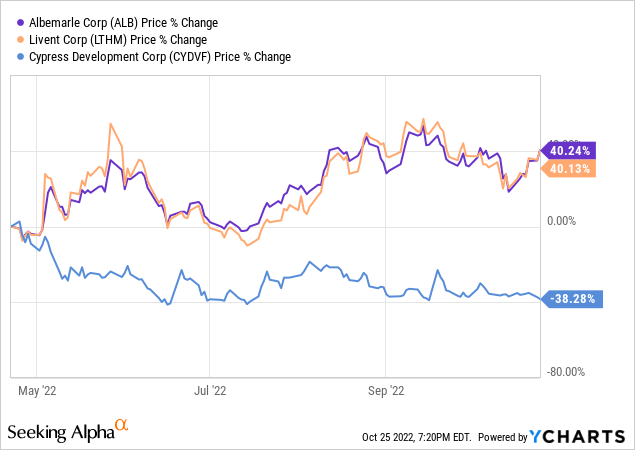

A price-action pattern that I have noticed on other DLE plays seems to also be occurring for Cypress as well. After rising to the ~$1.60/share range in April on some news, the stock has since fallen back and remained rangebound for most of the last six months. That’s in spite of positive DLE extraction results from Cypress and the bull market in carbonate that pushed many other lithium stocks much higher. Below is a comparison of Cypress with Livent Corporation (LTHM) and Albemarle Corporation (ALB).

It appears that the market is waiting for proof-of-concept of Cypress’ DLE process. The company has had a lot of success at its offsite pilot plant, but the method still needs to be proven on-site and under real-world conditions. It’s also highly likely that the shares will continue to trade in a narrow range and at a deep discount to NPV until those conditions are satisfied.

This is not a bad thing, but potential investors should be cognizant of this added event risk. An inability to deploy its DLE process in the field would probably see the stock take a substantial hit. But by the same token, it’s also highly likely that if Cypress eventually releases positive field test results, the stock price will immediately rocket higher and reward shareholders who stuck by the company.

I gave the company a Hold rating because I invest in lithium miners to gain exposure to price changes in the underlying commodity. And as long as Cypress’ DLE process remains unproven, the value of its reserve and resource will not be reflected in its share price. But I plan to keep a close eye on the company and hope that it’s successful in moving the process from the pilot plant to the mine site. By staying out of the stock, I’ll forgo the immediate gap-up in price if the company is successful, but I would probably buy the stock anyway given that I don’t think the market completely understands the value of a fully-functional DLE process.

Takeaway

Cypress Development has had many successes and been able to reach several milestones on its development path, but the effectiveness of its DLE tech has yet to be proven in the field. The added event risk is also preventing the company’s share price from reflecting the value of its lithium resource. This uncertainty will continue to overhang the stock until the company can fully deploy its DLE process and begin on-site production.

Be the first to comment