LPETTET

CVS Health (NYSE:CVS) has been in our family portfolio for over four years. With a relentless focus on owning slices of enduring enterprises bought at value prices, CVS continues to present as a reasonably-priced stock of an adequately-managed company.

I had initially covered CVS on Seeking Alpha in an Editor’s Pick article in January of 2018.

In this updated primary ticker research report, I put the company and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation, and downside risk.

The resulting investment thesis:

Although room exists for improvement in returns on equity and capital, plus share price performance against its industry, sector, and market, CVS Health’s emerging one-stop neighborhood health care model and attractively-priced stock offer a compelling buy-and-hold argument.

My current overall rating: Buy.

Unless noted, all data presented is sourced from Seeking Alpha and YCharts as of the intraday market on July 19, 2022, and intended for illustration only.

Value Proposition: One Stop Health Care Store

CVS is a dividend-paying large-cap stock in the health care sector’s services industry.

CVS Health Corporation provides health services in the United States through three segments: Health Care Benefits, Pharmacy Services, and Retail/LTC, including its walk-in medical clinics. Recently, the company announced closures of unprofitable stores, the movement of retail merchandise online, and entered the burgeoning home kidney care industry. CVS was founded in 1963 and is headquartered in Woonsocket, Rhode Island, USA.

My value proposition elevator pitch for CVS Health:

One stop health care store for insurance, primary care, and prescriptions.

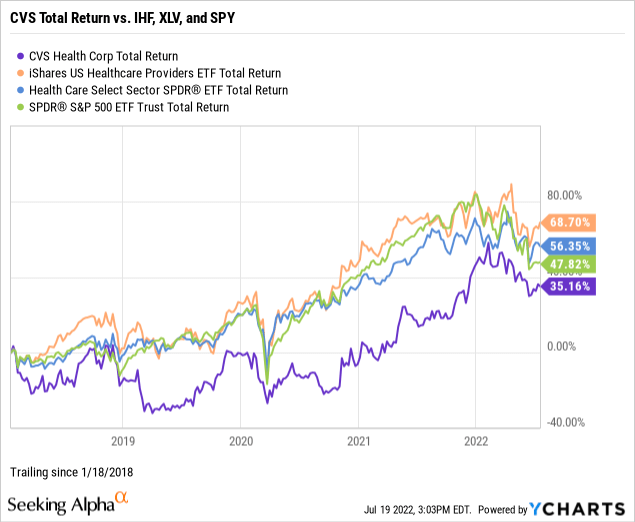

The chart below illustrates the stock’s performance against the iShares U.S. Healthcare Providers ETF (NYSE:IHF), the Health Care Select Sector SPDR ETF (NYSE:XLV), and the SPDR S&P 500 Trust ETF (NYSE:SPY) since adding the shares to our family portfolio on January 18, 2018.

Ultimately, investing in individual common stocks should aim to beat the benchmark indices over time. However, CVS has underperformed the total return of its industry, sector, and market since my initial report and simultaneous purchase for our family portfolio.

My value proposition rating for CVS: Bullish.

Shareholder Yields: Doubling the 10-Year

As part of my due diligence, I average the total shareholder yields on earnings, free cash flow, and dividends to measure how a targeted stock compares to the prevailing yield on the 10-year Treasury benchmark note. In other words, what is the equity bond rate of the common shares?

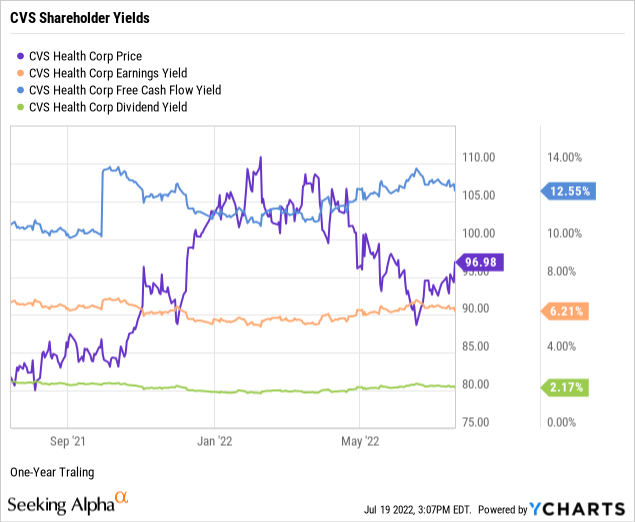

Target an earnings yield greater than 6 percent or the equivalent P/E multiple below 17 times. CVS is above the floor at 6.21%, as demonstrated in the below chart.

Target a free cash flow yield or FCFY of 7 percent and higher or the equivalent of fewer than 15 times the inverted price-to-free cash flow multiple. At 12.55%, CVS far exceeds the FCFY threshold.

Whether or not a yield-oriented investor, consider dividend-paying stocks for compensation in the short term while waiting for capital gains to compound over time. For example, CVS offers a dividend yield of 2.17% with a conservative 23.86% payout ratio, well below the recommended 60% payout ceiling, thus indicating a safe, well-covered dividend with room for annual raises.

Disciplined value investors are wary of high dividend yields unless calculated on a cost basis. For example, CVS was yielding 3.14% on our family portfolio’s adjusted cost basis of $70.13 per share, or 97 basis points above the forward yield. Yet another reminder that quality value investing delivers over time.

Next, take the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 3.01% on the 10-year Treasury benchmark note. The average shareholder yield for CVS was 6.98%, or 7.30% using the stock’s dividend yield on our cost. Arguably, equities are deemed riskier than U.S. bonds. However, securities that reward shareholders at higher yields than the government benchmark, such as CVS, favor owning the stock instead of the bond.

Remember that earnings and free cash flow yields are inverse valuation multiples, suggesting that CVS is trading at a discount. I’ll further explore valuation later in this report.

My shareholder yields rating for CVS: Bullish.

Fundamentals: Sector-Beating Returns

Let’s explore the fundamentals of CVS Health, uncovering the performance strength of the company’s senior management.

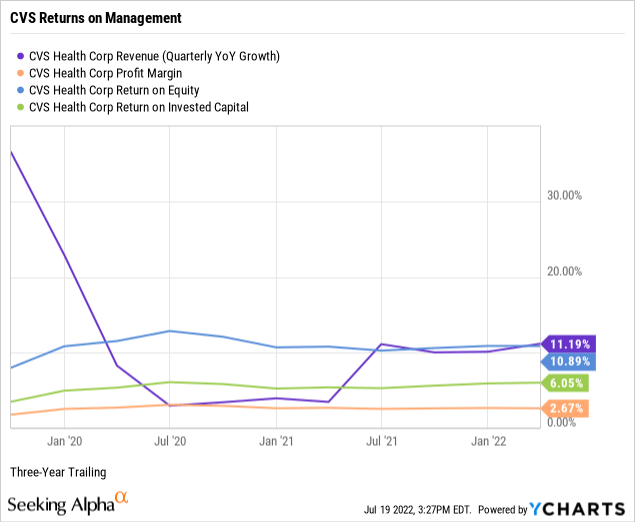

When analyzing a business, stay biased toward established growth instead of biased executive guidance or sell-side analyst projections. For example, per the below chart, CVS Health had three-year revenue growth of 11.19%, almost double the 5.83% median growth for the health care sector.

Chart note: The early 2020 falloff in growth was likely a result of the Covid-19 impact on storefront traffic. Management has since announced moving many retail items exclusively online.

CVS Health had a trailing three-year pre-tax net profit margin of 2.67%, exceeding the sector’s negative median net margin of -1.86%. Remember to screen for profitable companies to avoid unnecessary speculation. CVS’s low single-digit margin is typical of a predominant retail pharmacy business model.

Return on equity or ROE reveals how much profit a company generates from shareholder investment in the stock. Target an ROE of 15 percent or higher to discover shareholder-friendly management. Despite missing the threshold, CVS Health’s trailing three-year returns on equity of 10.89% were trouncing the negative median ROE of -35.87% for the sector.

Target a return on invested capital or ROIC above 12%. At 6.05%, CVS Health was underperforming the threshold but exceeding the sector’s negative median ROIC of -19.74%, indicating that CVS’s senior executives are capable capital allocators. Return on invested capital measures how well a company invests its resources to generate excess returns.

ROIC needs to exceed the weighted average cost of capital or WACC by a comfortable margin, demonstrating management’s ability to outperform its capital costs. CVS had a trailing WACC of 5.09% (Source: GuruFocus). Despite the narrow spread between ROIC and WACC, the solid growth, positive net profit margins, and sector-beating returns on equity and capital indicate superior management performance at CVS Health.

My fundamentals rating for CVS: Bullish.

Valuation: Discounted to Sales and Cash Flow

The common sense investor can rely on just four valuation multiples encompassing the vertical of sales, earnings, and cash flow, plus a contrarian view of market sentiment to estimate the intrinsic value of a targeted quality enterprise’s stock price.

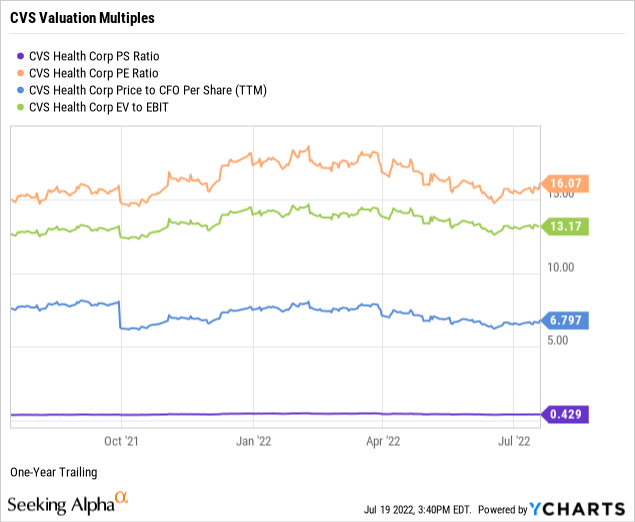

The price-to-sales ratio or P/S measures the stock price relative to revenues. Target fewer than 2.0 times and at 0.43, CVS was trading well below the ceiling. Comparatively, CVS’s trailing P/S ratio was well below the 4.66 times for the health care sector and also lower than the more attractive 2.35 times sales for the S&P 500. Thus, the weighted industry and market sentiment suggests an undervalued stock relative to CVS Health’s top line.

Although often a hit or miss multiple, target price-to-trailing earnings or P/E multiples fewer than 17 times or below the target stock’s sector averages. CVS had a price-to-earnings multiple of 16.07 times against a sector P/E of 27.14, indicating investor sentiment discounts the stock price relative to earnings per share. CVS also traded at a discount to the S&P 500’s recent overall P/E of 20.57 times. (Source of S&P 500 P/E: Barron’s).

Target single-digit price-to-operating cash flow multiples for the best value. At 6.80 times, CVS was trading below the ceiling and about one-third the sector’s median of 18.81, indicating the market deeply discounts the stock price relative to current cash flows.

Enterprise value to operating earnings or EV/EBIT measures whether a stock is overbought, a bearish signal, or oversold, a bullish signal, by the market. Target an EV/EBIT of fewer than 15 times. Against the broader sector median of 20.40 times, CVS was trading at just 13.17 enterprise value to operating earnings signaling the stock was underbought by the market.

Weighting the preferred valuation multiples suggests the market discounts CVS Health’s stock price to sales, earnings, cash flow, and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this report, risks and potential catalysts notwithstanding, I would call CVS a value-priced stock of a diversified quality operator within the health care industry.

My valuation rating for CVS: Bullish.

Downside Risks: Less Volatile Narrow Moat

When assessing the downside risks of a company and its common shares, focus on five metrics that, in my experience as a long-time individual investor and market observer, often predict the potential risk/reward of the investment. Hence, assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below average and low-risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none.

Morningstar assigns CVS Health a narrow moat rating.

CVS Health earns a narrow economic moat rating from us. As a top-tier medical insurer, pharmacy benefit manager, and pharmacy retailer, we believe CVS possesses enough scale-related cost advantages to generate economic profits for the long run. Even after the late 2018 Aetna merger, which cut into returns on invested capital, including goodwill, somewhat, we estimate that CVS’ ROICs should remain above its capital costs throughout our explicit 10-year forecast period. CVS generates profits almost equally among its three major segments, and we see the medical insurance and PBM assets as generally stronger than the retail store chain.

– Julie Utterback, CFA, Senior Equity Analyst, December 23, 2021

A favorite of the legendary value investor Benjamin Graham, long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. Generally, at least one-and-a-half times current assets to long-term debt is ideal. Notably, as reported on its March 2022 quarterly financial statements, CVS Health’s long-term debt coverage of 1.18 was below the threshold.

Nonetheless, in theory, the company could pay off its longer-term debt obligations using its liquid assets such as cash and equivalents, short-term investments, accounts receivables, and inventory.

Current liabilities coverage or current ratio measures the short-term liquidity of the balance sheet. Target higher than 1.00, although CVS Health’s short-term debt coverage was 0.88. Thus, its balance sheet provides insufficient liquid assets to pay down 100% of its current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes. Notably, short-term inventory financing at retail-dependent enterprises often results in sub-1.00 current ratios.

For longer term investing, use a five-year beta trend line and screen for stocks lower than 1.25 or no more than 125% volatility in the market. CVS’s 60-month trailing beta was 0.76. However, its shorter-term 24-month beta was 0.99. Either way, with price volatility less than the S&P 500 standard of 1.00, CVS presents as a stable core holding across market cycles.

The short interest percentage of the float for CVS was 1.09%, well under a conservative investor’s 5-10% ceiling. So perhaps the near-sighted bears view the stock as a safe staple in the health care services industry with its balanced earnings streams and predictable cash flows.

Despite its lower debt coverages, typical of a predominant retailer, CVS Health is a fundamentally sound, narrow moat company with an appealing risk profile.

My downside risk rating for CVS: Below Average.

Embracing Emerging Health Care Verticals

Catalysts confirming or contradicting my overall bullish investment thesis on CVS Health and its common shares include, but are not limited to:

- Confirmation: The complete assimilation of its 2018 Aetna health insurer and third-party benefits acquisition into its pharmacy, Minute Clinics, and pharmacy benefits manager segments provides a diversified health care services model beyond the traditional pharmacy retail storefront.

- Contradiction: Its health insurance, home health, and Minute Clinics transformations become susceptible to a universal, single payer insurance model, while Amazon (NASDAQ:AMZN) and other industry disruptions threaten its pharmacy market share.

Nevertheless, CVS has a history of embracing and integrating emerging health care verticals and should successfully navigate and scale its diversified and strategic one-stop model.

Be the first to comment