asbe/iStock via Getty Images

Investment Thesis

I last posted on CVS Health Corporation (NYSE:CVS) for Seeking Alpha almost exactly 1 year ago. I argued that, after a lengthy bull run from November 2020 to May 2021, a cooling off period ought to be expected, particularly as the share price momentum was largely created by pandemic tailwinds in the form of COVID testing revenues.

I was wrong on that count, as CVS shares kept climbing until January this year, when the stock traded at ~$109, an all-time high price for the company. Nevertheless, at the present time, after a bearish few months, the share price is only 9% higher than when I made my bearish call.

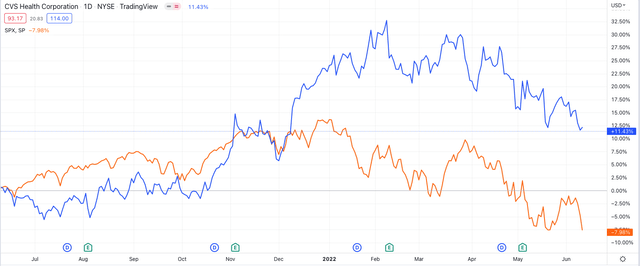

CVS share price performance past 12 months vs S&P 500. (presentation)

Although that is superior to the performance of the S&P 500 over the same period – -7% – and significantly better than a host of blue chip stocks – Apple (AAPL), for example, which is +8%, Microsoft (MSFT), +1.3%, Alphabet (GOOG) (GOOGL) 90+11%, Amazon (AMZN) and Meta (META), respectively -34% and -47% – and shareholders benefit from a CVS dividend yielding a quite reasonable 2.4%, I would still urge investors to consider selling CVS stock and reinvest elsewhere.

There are several pragmatic, non-contrarian reasons why I would take this position. Broadly speaking, I think it’s possible to break down CVS in 3 different ways. The Good, which involves CVS’ strong fundamentals and sheer size. The Bad, which involves headwinds such as shrinking store numbers, falling COVID test revenues, stagnant organic growth, and thin profit margins. And finally, the Ugly, which is the overall outlook for CVS’ 3 core business divisions.

Attempting to modernize in an industry such as healthcare, which is notoriously resistant to change, most notably in the digital sphere, is no easy task. For context, look at the share price performance of arguably CVS 2 biggest rivals in the Retail segment – Walgreens Boots Alliance (WBA) and Rite Aid (RAD). Respectively, these 2 companies’ share prices have fallen by 23% and 73% across the past 12 months.

In the rest of this post, I will attempt to enlarge upon these themes, and explain why, in CVS’ case, the Bad and the Ugly marginally outweigh the Good, which is likely to damage CVS’ share price over the next couple of years and drag it back down into $80 – $85 range again.

I would not necessarily argue that holding CVS shares long-term is a disastrous idea – it is just that an experienced investor with some appetite for risk-mitigation may look 2-3 years ahead, in the context of the headwinds in play for CVS, and prefer to be in a stock or a market that is more obviously future-proofed.

To begin with, however, let’s celebrate all this is positive in relation to CVS Health.

CVS – All That Is Good About This Healthcare Behemoth

“The Good” primarily concerns CVS’ very strong fundamentals. Revenues, for example, have grown from $123bn in 2012, to $291bn in FY21, at a CAGR of 10% per annum. Only Walmart (WMT), with $573bn, Amazon, with $470bn, and Apple, with $366bn, generate higher revenue per annum as public companies.

Admittedly, CVS’ recent revenue growth has been generated by the mega-money acquisition of Aetna Healthcare, as opposed to organically, but we’ll come to that later. Earnings Per Share (“EPS”) in FY21 was $6, for a Price to Earnings (“PE”) ratio of 15.6, which is reasonably low, probably indicating that CVS shares are priced fairly at this time.

CVS has historically had a fundamentally strong business model. According to a CVS investor factsheet, 85% of Americans live within 10 miles of a CVS store, 4.5m consumers visit a CVS store every day, and between them, Caremark, the company’s Pharmacy Benefit Management business, and Aetna, its health insurance division, have >100m members.

CVS is divided into 3 business divisions – its Healthcare Benefits segment, which generated $23.1bn of revenue in Q122 – up 13% year-on-year, and accounting for ~26% of total revenues, its Pharmacy Services Sector – $39.5bn of Q122 revenues, up 9% year-on-year, and accounting for 45% of total revenues, and Retail Services – $25.4bn of revenues in Q122, up 9.2% year-on-year, and accounting for 29% of total revenue.

CVS is guiding for revenues of $305bn – $310bn in FY22 – which represents ~5.3% annual growth at the midpoint, $16.9bn – $17.3bn of operating income, and adjusted EPS of $8.2 – $8.24, for a forward PE ratio of ~11.3x – a sign of overall improvement in operating efficiency.

For good measure, CVS has also increased its dividend – for the first time since 2017 – by 10%, to $0.55 per quarter, and repurchased 19.1m of common stock last quarter. Share count now stands at 1.33bn.

The Bad – Stagnant Retail, Pharmacy/Healthcare Headwinds, Debt

When I plug CVS’ income statement into a discounted cash flow (“DCF’) analysis model, assuming an annual growth rate of 5%, as forecast for FY22, and with overall operating expenses declining from ~95.5%, to 95.3% over time, and using a weighted average cost of capital of ~11% (beta of 1.2, risk free rate of 1.7%, expected market return of 12%, growth rate in perpetuity of 1.5%), I calculate a healthy share price target of ~$128 for CVS stock – and $139 using an EBITDA multiple approach.

Investors may well look at this, the growing dividend, and the share repurchases and believe their money is in the right place being invested in CVS stock, but the above is something of an optimistic scenario when we factor in the rampant inflationary environment, threat of a recession, cost of servicing debt, and the unique headwinds facing each of CVS’ 3 business divisions.

For example, I am assuming a net profit margin of ~3% in FY22 – a little higher than FY21’s ~2.7%, growing to 3.6% by 2025 as CVS pays off its substantial debt pile of ~$50bn with interest payments of ~$2.4bn per annum. If we subtract the interest expense from the free cash flow, and reduce depreciation from 1.7% to just 1%, then the DCF model implies a share price of only $94, so we can see how CVS’ somewhat thin profit margins may undermine its cash flow generation.

In FY22, the Retail division is under threat of shrinking slightly, with management’s forecast for (1) – 1% growth, as a result of falling COVID test revenues. The crucial role that CVS stores have been playing in vaccine administration – ~6m tests administered in Q122 alone, and ~8m vaccines administered – is unlikely to be sustained.

The US government is reluctant to authorize a fall booster vaccine, and with COVID vaccination looking increasingly likely to become a private market from 2023 – a COVID vaccine could even be combined with an influenza vaccine – the bump in revenues that Retail experienced in Q122 is unlikely to be repeated every year.

Although the Retail Pharmacy segment’s share of all Pharmacy scripts increased by 49bps to an impressive 26.7% in Q122, the 10% increase in Pharmacy sales was primarily due to the weakness in the cold and flu season in 2021, and sales of COVID test kits, so again, looking ahead, the outlook beyond 2022 looks a little weaker.

Health Care benefits – i.e., the division created by the $69bn acquisition of Aetna Health – saw its adjusted operating income fall year-on-year in Q122, by 1.7%, and the Medical Benefit Ratio (“MBR”), a key measure of performance, increase to 83.5%, from 83.2%, narrowing profit margins.

Meanwhile, although there was not much wrong with the performance of the Pharmacy Services segment, which saw revenues and net income increase by 8.6%, whilst total claims processed increased by 5.8% to 567m, this segment faces some tough challenges in the years ahead – as, in fact, may the health insurance and Retail sectors – it’s time to consider the Ugly outlook for CVS.

The Ugly – Long Term Outlook Across All 3 Business Segments Is Uncertain – Rivals’ Struggles May Eventually Catch Up With CVS

When a company is as large and as dominant in its markets – especially retail and Pharmacy Benefits – as CVS is, it’s tempting to apply the “too big to fail” tag, but investors may be unwise simply to assume CVS won’t be affected by the severe headwinds that has blown some its key rivals off-course.

Let’s consider retail first – CVS is closing large numbers of its physical stores, as President and CEO Karen Lynch told analysts on the Q122 earnings call:

we are optimizing our retail portfolio that will be comprised of three models: advanced primary care clinics, enhanced health hub locations, and our traditional CVS Pharmacy locations. As of today, we have closed approximately 100 stores out of the 300 planned for this year and the 900 planned by the end of 2024.

Our early experience suggests we are retaining nearly 70% of the prescription volume within our network, demonstrating strong evidence of our value to consumers. Additionally, we retained more than 95% of colleagues and redeployed them to other CVS locations.

Optimizing is a buzzword, but for me it is often interchangeable with “downsizing” and usually has negative connotations. CVS will close 900 physical stores by 2024, and, however you look at it, that is a big number. Meanwhile, 70% of the prescription volume maintained implies 30% of it being lost – another large number – while employees are being redeployed, meaning their wages are still being paid by CVS.

For some sobering news on how rival health store operators are performing, as mentioned above, consider the share price of Walgreens Boots Alliance – down 25% over the past 12 months – and Rite Aid – down 72%.

The wider issue here is that CVS, which built its empire on, and is best recognized via, its physical stores, is now closing down stores, and in their place, hoping that its customers will move online.

It’s a logical assumption to make, but in reality, customers appear to prefer traditional to digital. CVS says it has 44m online customers, but they are unlikely to mimic the spending patterns of the 4.5m daily physical store visitors, whilst digitally disrupting healthcare is proving to be much harder than anticipated. Just ask Berkshire Hathaway (BRK.A) (BRK.B), Amazon (AMZN) and JPMorgan (JPM), whose combined digital healthcare business, Haven, was disbanded after 3 fruitless years. If these 3 giants saw no value in the digitalization of healthcare, does CVS?

CVS built its empire on bricks, but the economics of this business are more uncertain today than ever before because although many customers now prefer “clicks” to “bricks,” they also expect to be able to access healthcare physically too. Most businesses have successfully made the transition from “bricks,” to “clicks,” but it has not worked in healthcare, leaving the likes of CVS stuck between a rock and a hard place. CVS is not quite Blockbuster Video – a business obliterated by online – but nobody has quite been able to create a digital roadmap for success in healthcare.

Medicare Advantage Pricing Wars Threaten Profitability As Aetna Struggles In Other Markets

Now let’s consider healthcare – Aetna has a strong exposure to the lucrative Medicare Advantage sector, where health insurers bid for and administer government backed, flexible insurance plans, keeping whatever money they manage to save in the course of administering the plans as profit.

Behind UnitedHealth (UNH), Humana (HUM), and Anthem (ANTM), Aetna has the next largest share of this market. However, because the model has proven so profitable, the industry has become flooded with new entrants offering cheaper and cheaper plans, which is driving down profitability. Humana shares lost 25% of their value after management cut its new member forecast by 150k in January this year, with its CEO admitting that the company had failed to compete aggressively enough on price. If it can happen to Humana, it could happen to CVS also.

Meanwhile, CVS / Aetna’s attempt to move back into the Affordable Care Act exchange’s market has not proven fruitful, with new member enrollment disappointing. This means that the health insurance business faces challenges on 2 fronts – keeping hold of its Medicare Advantage members each year even as upstarts such as Oscar Health (OSCR), Bright Health Group (BHG), and Alignment Healthcare (ALHC) undercut on price, and finding new markets to operate in.

Once again, as with online, this is not CVS’ “traditional” business. Health insurance is not a cash cow that can be milked ad infinitum, it is a tough, low margin, labor intensive business that can unravel in the wrong hands.

PBM’s To Be Hauled Over The Coals Over Drug Pricing

Finally, when we look at Pharmacy Benefit Managers (PBMs) – the third pillar of CVS’ business – we can observe that the COVID pandemic effectively granted this controversial segment of the healthcare industry a stay of execution through 2020 and 2021.

There has been long-term, bipartisan pressure on PBMs from the U.S. government, with the belief from the outside being that PBMs enable collusion between drug manufacturers and pharmacies to fix drug prices, maintaining them at artificially high prices.

The pandemic ensured that the government’s attention was diverted away from PBM legislation, but now there is a new bill making its way through the Senate, which seeks to allow the Federal Trade Commission (“FTC”) to challenge PBMs over “unfair and deceptive practices that drive up the costs of prescription drugs at the expense of consumers,” and stating that:

PBMs are the middlemen in the prescription drug supply chain, and it’s time for Congress to give the FTC the ability to shine a brighter light on any deceptive and abusive practices.

Of course, CVS’ Caremark business, UnitedHealth’s Optum, and Cigna’s (CI) Express Scripts – the 3 largest PBMs – have faced such challenges before, and there is no easy way to determine drug prices – it is not as if there is a ready made solution waiting in the wings.

Nevertheless, a day of reckoning will eventually arrive when the 3 largest PBMs will need to redesign their business models amid intense external pressure to drive down drug prices, and it could be a costly, slow process.

Conclusion – Uncertainty Around Healthcare Administration In Digital Age Threatens All 3 Pillars of CVS’ Business, & Company Valuation

As I have discussed earlier in this post, fundamentally speaking there is much to like and admire about CVS as a business. It is a giant in its markets – with an almost monopolistic control of the brick and mortar market – capable of delivering revenues >$300bn per annum – only a handful of listed companies can say that.

CVS is also profitable, a dividend payer, and engaged in share buybacks, so there is plenty of encouragement to keep holding the stock – after all, only a few months ago the stock traded at a ~20% premium to its current price.

As I have briefly outlined in this post, however, all 3 of its core business divisions are facing some tricky headwinds at a time when inflation is rampant and recession fears are real, growth after the Aetna acquisition is incremental, rather than buoyant, and there is still $50bn of debt to pay off.

Even in an optimistic scenario, there is not a powerful case to make that the share price will continue to climb in my opinion – in fact it is still priced close to its all-time high, having spent >5 years priced <$85.

CVS is being forced to alter its business models to meet a changing healthcare landscape, but the threats seem to outweigh the opportunities, with the digital healthcare market highly uncertain – the biggest issues being the public do not seem to favor it – the health insurance market trending towards a period of bust after the boom of Medicare Advantage, and PBMs facing renewed claims to drive down drug prices and provide more transparency.

I would not exactly call the current climate a perfect storm for CVS, and I am the only SA writer to give CVS shares a bearish rating since my last note, 1 year ago, so the general consensus seems to be the company is in good health.

Although I broadly agree CVS can overcome most of the hurdles – administrative, digital, price, etc. – placed in front of it, negotiating them may impact profitability and demand wholesale changes, and in that environment, I think it may be asking too much of management to keep growing the share price – my expectation would be for a 10 / 20% downward price correction over the next 12 months.

Be the first to comment