MicroStockHub/iStock via Getty Images

Introduction

After struggling for half a decade, CVR Partners (NYSE:UAN) saw a game-changer from Eastern Europe during early 2022 as Russia invaded Ukraine, thereby seeing prospects for their strong operating conditions of 2021 to persist well into the future, as my previous article highlighted. Since publication, it seems that their units have been caught in the recent broad market sell-off that has left their unit price down by around one-third but thankfully, this actually provides an opportunity to double down with their fundamentals up.

Executive Summary & Ratings

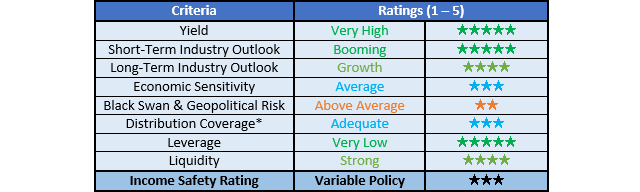

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

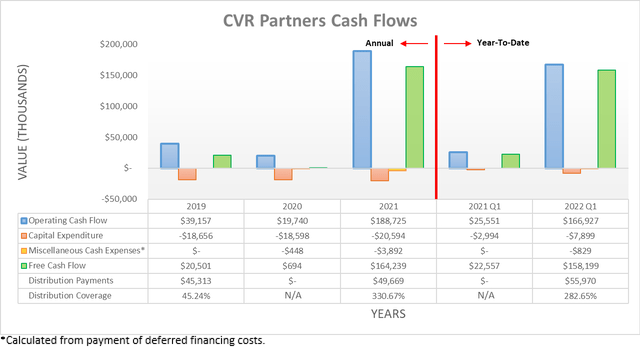

When conducting the previous analysis, their operating cash flow of $68.5m during the fourth quarter of 2021 seemed very impressive at the time but after their results for the first quarter of 2022, the former now pales in comparison to their latter result of $166.9m, which is so high that describing it as “very impressive” no longer does it justice. Apart from being many-magnitudes higher year-on-year versus their previous result of $25.6m during the first quarter of 2021, it also almost matches their full-year result of $188.7m during 2021 that at the time, was already a record. Whilst this massive result was aided by a sizeable $40m working capital draw, even if removed, their underlying operating cash flow of $126.9m still easily surpasses anything they have ever seen in the past.

Following this unbelievable strong financial performance, unitholders may have felt disappointed to only receive a quarterly distribution of $2.26 per unit, which represents a decrease of 56.87% versus their previous quarterly distribution of $5.24 per unit attributable to the fourth quarter of 2021. When reviewing their available cash for distribution reconciliation, their variable distribution policy utilizes a methodology of matching cash inflows with cash outflows, which therefore saw their result being weighed down significantly by a $65m debt repayment, as per their first quarter of 2022 results announcement. If not for this cash outflow, their available cash for distribution would have been $88.8m instead of $23.8m and as a result, seen a new record quarterly distribution attributable to the first quarter of 2022 of $8.40 per unit, given their latest outstanding unit count of 10,570,000. It should also be mentioned that they also conducted $12.4m of unit buybacks, which diverted the equivalence of a further $1.17 per unit of cash away from their quarterly distribution to help slightly boost their future distributions.

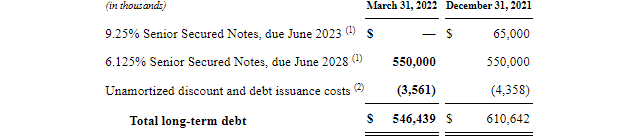

Thankfully, this backward step was expected within my previous article, as management had flagged this debt repayment was forthcoming during their fourth quarter of 2021 conference call. Very excitingly, this was also only temporary and the final hurdle because as subsequently discussed, they have finished deleveraging and thus this means no more debt repayments, thereby unlocking their full distribution potential that stands to see higher distributions even if operating conditions soften back to their levels during 2021.

Throughout 2021 their available cash for distribution of $96.6m was weighed down by $30m for debt repayments and a further $50.6m for interest expenses, as per their fourth quarter of 2021 results announcement. If not for the former, their available cash for distribution would have automatically jumped significantly higher to $126.6m. To make matters even better, given their remaining debt is $550m with a 6.125% interest rate, as subsequently discussed, this should see their interest expense dropping to only $33.7m and thus save a further $16.9m going forwards on an annual basis. When combined, this means that even if operating conditions soften back to their levels during 2021, their available cash for distribution should still be $143.5m and thus a very impressive 48.55% higher, which on their latest outstanding unit count translates into quarterly distributions of $3.39 per unit and thus a very high yield of almost 14% on the current unit price. Obviously, if their booming operating conditions thus far into 2022 persist, this would grow much higher and likely surpass a massive 20%+ distribution yield.

Whilst already positive and shows that their fundamentals have improved throughout the first quarter of 2022, given the rapidly different geopolitical situation, seeing operating conditions return to their 20221 levels seems unlikely within the foreseeable future. After fertilizer prices retracted lower in the early days of 2022, they rallied upwards of 30%+ during March and April following the Russian invasion of Ukraine with both countries once being major fertilizer and food exporters, thereby sending shock waves across the globe and offering a game-changer for producers in the United States.

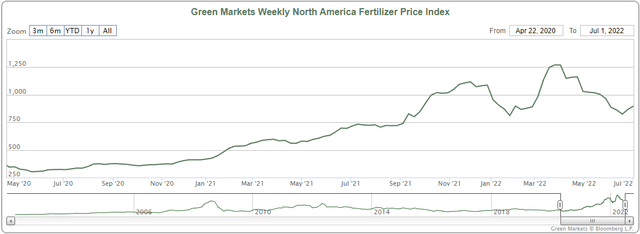

Unlike fertilizer producers in Europe who are now battling higher gas prices, which is an important feedstock for the production of their ammonia and urea-based fertilizers, as a producer in the United States, they have cheaper access to gas and thus a competitive advantage, as was discussed within my previously linked article. Throughout the subsequent months after publication, fertilizer prices have once again retraced lower but still remain well above their levels during 2021, as the graph included below displays.

Green Markets via Bloomberg Data

The recent sell-off in fertilizer prices is not the first time, nor will it be the last time but even more importantly, the fundamentals have improved and thus have reduced the downside risk of prices returning back to their levels during 2021, let alone plunging even further back to their suppressed levels during 2020. The supply of gas in Europe was already tight but recently, Russia reduced its gas exports even further, likely in retaliation to sanctions in support of Ukraine. This now sees the International Energy Agency warning that they should brace for their gas flows to completely cease and thus creates the scary possibility that Europe could run out of gas during the coming Winter or more likely, force them to ration supply. Whilst it remains to be seen how any potential rations would be applied, it seems reasonable to expect residential power and heating would likely be higher priorities than industrial usage, which creates a very scary outlook for their fertilizer producers who may have to scale back or even halt their production.

Even though there have been concerns of demand destruction for fertilizers at these record prices, I personally suspect this will only be minor as food supply is the number one priority for every human because regardless of the price or economic conditions, we all have to eat and without fertilizers, crop yields suffer. Despite this situation remaining anything but desirable from a humanitarian point of view, objectively speaking, this sees a fundamental improvement for them as United States fertilizer producers. Whether these geopolitical issues in Europe drive fertilizer prices to new heights remains uncertain but if nothing else, they further help reduce the downside risk and given their very high double-digit distribution yield, further gains are not necessary for unitholders to enjoy very desirable returns.

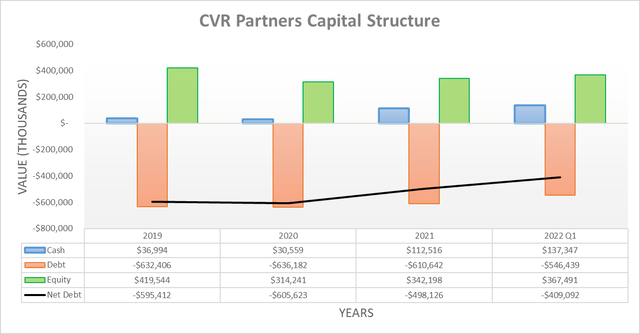

Even though their variable distribution policy effectively aims to match their cash inflows to their cash outflows, as they utilize an accrual-based approach, it means that their working capital draw was still retained and thus saw their cash balance increase during the first quarter of 2022 to land at $137.4m versus $112.5m at the end of 2021. When combined with their debt repayment, this saw their net debt pushed down to $409.1m and thus a very impressive 17.87% lower during just this one quarter and excitingly, once again confirms they have finished deleveraging with their debt target reached, as per the commentary from management included below.

“As Dane mentioned, we completed our targeted debt pay down by retiring the remaining $65 million of the 2023 Senior Notes in February. Our total debt now stands at $550 million and with an interest rate of 6.125%, we are comfortable with our debt level and interest cost through a full market cycle.”

– CVR Partners Q1 2022 Conference Call.

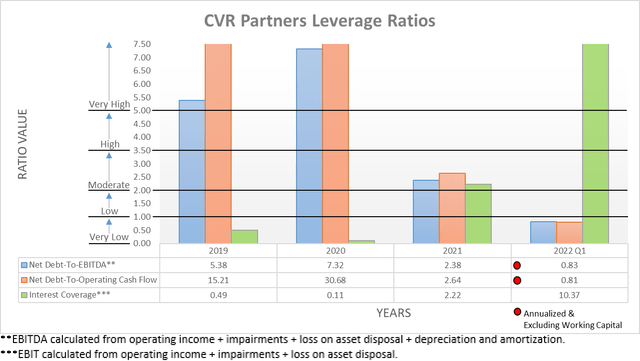

The combination of insanely strong financial performance and materially lower net debt made dramatically lower leverage inevitable, which now sees their respective net debt-to-EBITDA and net debt-to-operating cash flow at 0.83 and 0.81 versus their previous respective results of 2.38 and 2.64 at the end of 2021. These both now sit beneath the threshold of 1.00 for the very low territory but when looking ahead, they will continue fluctuating with their financial performance that is driven by inherently volatile commodity prices. Whilst not necessarily ideal, it remains par for the course when it comes to those operating with commodities, regardless of whether we are talking about oil, copper or in this instance, fertilizers.

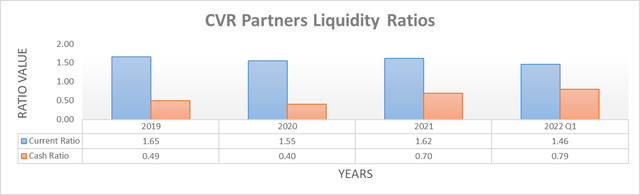

Quite unsurprisingly, their strong liquidity persisted during the first quarter of 2022 with their current ratio seeing a minor fluctuation to 1.46 versus its previous result of 1.62 at the end of 2021, meanwhile their cash ratio increased to 0.79 from 0.70, on the back of their higher cash balance. Whilst not necessarily required, they still retain another $35m of availability under their credit facility, thereby providing an emergency backstop. Now they have repaid their expensive 9.25% senior notes, their nearest debt maturity is not until 2028 and thus allows plenty of time to focus upon rewarding their unitholders, as the table included below displays.

CVR Partners Q1 2022 10-Q

Conclusion

Even though their unit price is down by one-third during the past couple of months, it seems that their fundamentals are actually up with their deleveraging finished, thereby unlocking their full distribution potential. Meanwhile, Russia continues to play hardball with Europe by further restricting gas supply and thus creates the very scary prospects of forced gas rations come Wintertime. Since they are a United States fertilizer producer, they stand to benefit at the expense of their European peers, which if nothing else, reduces the downside risk of operating conditions plunging back to their suppressed levels during 2020. Following the recent board market sell-off, it seems that their unit price dropping is not necessarily driven by fundamentals and by extension, provides an opportunity for investors to double down and thus I believe that upgrading to a strong buy rating is now appropriate given the prospects for a very high 14%+ distribution yield.

Notes: Unless specified otherwise, all figures in this article were taken from CVR Partners’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment