sitox

Introduction

Apart from sending geopolitical shock waves across the globe, when Russian troops advanced into Ukraine back in February 2022, this saddening event also brought about a game-changer for fertilizer producers in the United States, such as CVR Partners (NYSE:UAN). After recently seeing further geopolitical boosts, investors have the opportunity to buy now, as another big rally could be coming as seen earlier in the year when they reached a 52-week high of $179.74. Everyone would like a peaceful end to the loss of life but realistically, it seems the ramifications are only growing stronger as the war rages past the six-month mark and the resulting impacts for Europe mount as their gas crisis intensifies.

Background

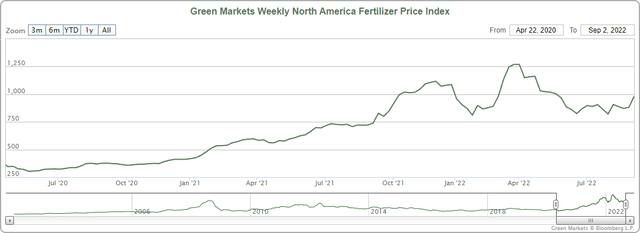

Despite softening early in 2022 after a strong rally during 2021, fertilizer prices subsequently rallied upwards of 30%+ during March and April following the Russia-Ukraine war because the two countries were responsible for 28% of fertilizer exports. Apart from obviously pulling supply out of the market directly in the short-term as sanctions hit the former and war ravishes the latter, the resulting flow on impacts via the gas market offer far more important medium to long-term implications that create a game-changer for producers in the United States.

Since their production is located in the United States, they have cheaper access to gas unlike their fertilizer peers in Europe who are now battling higher gas prices, which is an important feedstock for the production of their ammonia and urea-based fertilizers. In fact, the gas situation in Europe continues to grow so dire that 70%+ of European fertilizer production is already curtailed, thereby benefitting producers in other continents.

Whilst many people across the Atlantic are likely hoping this will be a one-off short-term bump in the road, the medium to long-term outlook is not particularly supportive given their reliance upon Russian gas. Several months ago, the International Energy Agency warned that they should brace for Russian gas flows to completely cease, which sadly appears to have been apt with supply via the Nord Stream 1 pipeline recently being halted for a yet-to-be-known length of time, further compounding issues from earlier supply losses from Russia. This provides another geopolitical boost for those in the United States and similar to these earlier instances, Gazprom (OTCPK:OGZPY) claims this is due to maintenance but is widely thought to actually be retaliation for the sanctions Europe imposed in support of Ukraine.

In theory, Russia may restore their gas supplies at any moment, although realistically, their actions thus far into 2022 indicate that this would be fleeting and thus creates the scary possibility that Europe could run out of gas during the coming winter or more likely, forcing further supply rationing and thus hindering fertilizer production. It will likely take Europe many years, if not even the remainder of this decade to completely transition their gas supplies from sources outside of Russia, whilst still securing enough supply to provide cheap feedstock for chemical and fertilizer production.

This creates very strong medium to long-term fundamentals for those in the United States and thus reduces the downside risk of prices returning back to their suppressed levels during 2020. To this point, the latest news of fertilizer production curtailments appears to be lifting prices once again, as the graph included below displays.

Green Markets via Bloomberg Data.

Even though there have been concerns of demand destruction for fertilizer, I remain skeptical that these will be sufficiently large to derail this outlook since food supply is the number one priority for every human because regardless of prices or economic conditions, everyone needs to eat and crop yields suffer without fertilizers. Admittedly, no one can perfectly ascertain the direction of any commodity given their inherent volatility but given this very strong outlook for fertilizer producers in the United States, it seems that 2021 now represents a suitable middle-of-the-road basis point that is neither too bearish nor too bullish, at least in my eyes.

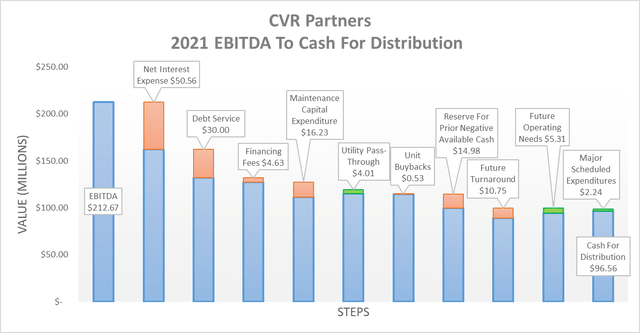

On the surface, their annual distributions of $9.89 per unit attributable to 2021 may seem relatively disappointing given their most recent massive quarterly distribution of $10.05 per unit. Although upon digging deeper, thankfully there is still plenty of scope for higher distributions in the future for the same prevailing operating conditions. After examining how management determined their 2021 cash for distribution, as per their fourth quarter of 2021 results announcement, it reveals several large items that weighed down their 2021 distributions that will no longer be relevant going forwards.

Once 2021 ended, it saw them post an EBITDA of $212.67m, which resulted in cash for distribution of $96.56m after the various adjustments observed above, and whilst many of these were run-of-the-mill and thus would be repeated once again, this is not the case for others. The first item is their net interest expense, which was $50.56m during 2021 but after repaying debt, it should not exceed $33.69m as their remaining $550m of debt carries a 6.125% interest rate, thereby making a difference of $16.87m. By extension, the $30m outflow incurred for debt service and further $4.63m outflow for financing fees can also be removed as they are related to repaying this debt, which is now ceased since they have reached their debt target. Meanwhile, they have recovered from the severe downturn of 2020 and as a result, they will not need to repeat the $14.98m outflow from 2021 that was allocated to rebuilding their reserve for prior negative available cash, and thus, this can also be added back onto their cash for distribution.

When these variables have been aggregated, it lifts their cash for distribution to $163.04m and thus would see annual distributions of $15.42 per unit given their latest outstanding unit count of 10,570,000. Apart from representing a sizeable improvement versus their annual distributions of $9.89 per unit attributable to 2021, it should make for a suitable basis point going forwards to frame investment decisions. If interested in further details regarding their cash flow performance or financial position, please refer to my previous article, which carries a deeper analysis of these topics, whereas the focus of this analysis centers on their current valuation.

Discounted Cash Flow Valuations

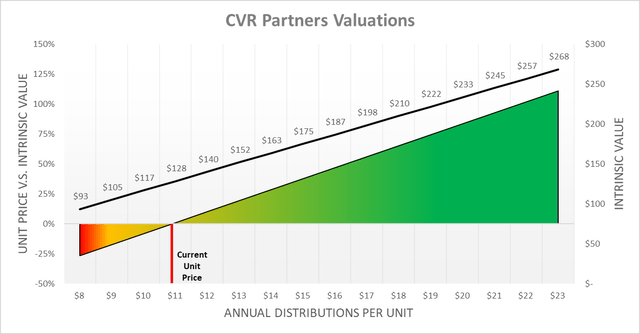

Even though their distributions vary each quarter, they obviously form the center of their investment proposition, especially given their income-focused Master Limited Partnership structure. This means that their intrinsic value is heavily dependent upon the future income they can provide their unitholders and thus can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their distribution payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

Whilst valuations can be approached in numerous ways, selecting the right one is particularly tricky when the partnership in question takes a variable approach to their distributions and operates in a volatile industry that can see its financial performance swing violently at times. In these situations, I prefer to view their intrinsic value for various average distributions to help assess whether the odds are stacked in favor of the investor, or not. Going forwards as a basis point, we already know that their operating conditions from 2021 should give rise to annual distributions of $15.42 per unit and thus it seems reasonable to provide a range of bearish to bullish scenarios in either direction. These range from a low of $8 per unit to a high of $23 per unit, thereby representing seven $1 per unit increments either way from the $15 to $16 per unit basis point.

Despite their units enjoying a very strong rally during the past twelve months, their current unit price was still towards the bottom end of this range and aligns with a scenario whereby their annual distributions only average circa $11 per unit, which is notably below the $15 to $16 per unit basis point. If looking at this basis point, it produces an intrinsic value of between $175 to $187 and even if opting for the lesser of these two, it remains almost a very impressive 38% higher than their current unit price of $127.20. This means that their current unit price is not reflecting the softer operating conditions of 2021, which as a reminder, I feel represents a suitable middle-of-the-road scenario, let alone these booming operating conditions of 2022. Apart from creating prospects to generate very significant alpha as their units appear undervalued, it also reduces downside risks as it does not require a particularly bullish future from this point forwards.

Since operating conditions remain far stronger than those during 2021 and their medium to long-term fundamentals keep receiving further geopolitical boosts as Russia reduces their gas supplies, it would not be surprising to see their unit price overshoot this intrinsic value in the short-term and thus rally towards $200+ during the coming months. By providing a variety of results, readers can cross-reference their own views with these valuations as they may vary from my own.

Valuation Inputs

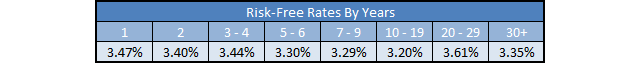

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 1.26 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on September 02, 2022, as the table included below displays.

Author

Conclusion

Whilst 2021 was still already a strong year historically speaking, the events of 2022 from Eastern Europe represent a game-changer that I suspect will persist for many years to come. Following the further geopolitical boosts they see at the expense of their European peers as Russia plays hardball with gas exports, it makes another big rally quite likely in the short-term, at least in my eyes. Even if their unit price does not reach this point in the short-term, it still appears to not even be pricing their softer 2021 operating conditions with such a scenario seeing an intrinsic value almost 38% higher than their current unit price. This stacks the odds very favorable for investors who have prospects to generate very significant alpha whilst also reducing downside risk, and thus, given this very desirable investment opportunity, it should not be surprising that I believe maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from CVR Partners’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment