Ilia Yefimovich/Getty Images News

This article will not provide an exhaustive review or company fundamentals for RADA Electronic Industries Ltd. (NASDAQ:RADA), as the company is set to be completely absorbed by Leonardo DRS, Inc. (DRS) in a reverse-merger in the last quarter of 2022. Please refer to previous Seeking Alpha articles for a more in-depth overview of RADA, here and here. This article will be focused solely on what actions, if any, investors might be motivated to take prior to the completion of the DRS + RADA reverse-merger.

Investment Summary

Leonardo DRS, the U.S. arm of the European defense industrial giant, Leonardo, will be going public late 2022 on U.S. exchanges through a reverse-merger with RADA. RADA shareholders will receive 19.5% of the combined company ownership. This article believes there is arbitrage upside of 33% in the short-term prior to the official closing of the deal. Looking forward, we also believe there is value in the long term for investors willing to hold to the tune of ~124% as a base case, taking only recent and current revenue-generating programs into account. Further upside can be realized with highly visible upcoming revenue-generating programs. The primary risks are a weaker balance sheet post-merger and potential slow-down in U.S. military spending.

RADA and Leonardo DRS Combined Company

Leonardo DRS operates four business segments after divesting non-core assets: advanced sensing, network computing, force protection, and electric power & propulsion. The RADA acquisition strengthens the advanced sensing and force protection segments by providing vertically integrated advanced radar-sensing capabilities to holistic system solutions. The force protection unit supports several high-profile, high-priority U.S. Army modernization programs: M-SHORAD, GBAD, and Bradley brigade upgrades. Finally, while not associated to RADA, the DRS electric power and propulsion unit is a huge moat for the company in dealing with its U.S. Navy customers on nuclear-powered submarines. These last points are made to underscore that the combined company’s earnings power is quite visible into the medium-term and de-risks investor capital with company strategy aligned directly to U.S. budget priorities.

DRS previously tried to go public on its own in 2021 at about $3B valuation. However, DRS has provided a recent 10-K and has been filing quarterly reports with the SEC in anticipation of its public status, allowing investors to determine what the combined DRS + RADA company would look like. We will go through that here.

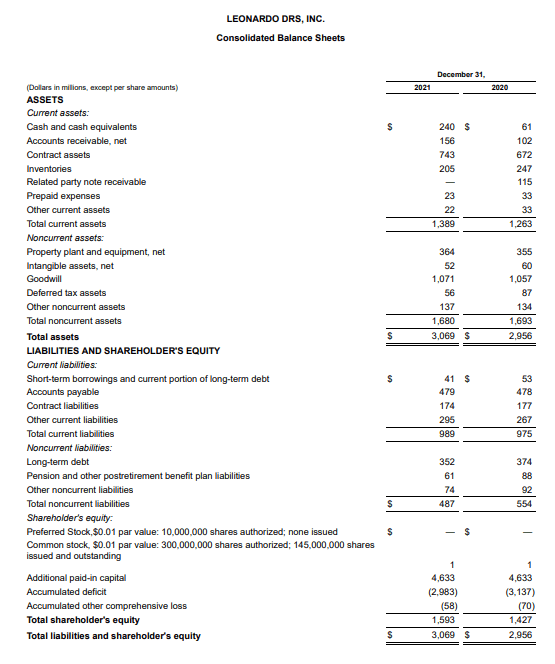

First, we go through the balance sheet, shown below from the 2021 10-K. Taking some key line items from the balance sheet in consolidation with RADA’s latest 20-F, we get:

- Cash and cash equivalents: $319 M

- Inventory: $254 M

- Property plant and equipment, net: $395 M

- Accounts receivable: $190 M

- Total assets, net of goodwill: $2196 M

- Total assets attributable to RADA shareholders: $428 M

Recall that RADA shareholders will own 19.5% of the combined company, which we use to determine the portion attributable to RADA shareholders. With RADA’s current market cap of $484 M, the assets might seem alluring at first, particularly since RADA only has liabilities of $48 M. However, with DRS liabilities of $1476 M, total equity attributable to RADA shareholders falls to: $131 M. This represents a downside risk of 73% based on combined company equity. The balance sheet, namely DRS liabilities, is the primary risk factor in this merger. However, DRS is cashflow positive at $175 M, comfortably covering its interest-bearing debt and mitigating this risk somewhat.

DRS 10-K Balance Sheet (DRS 10-K)

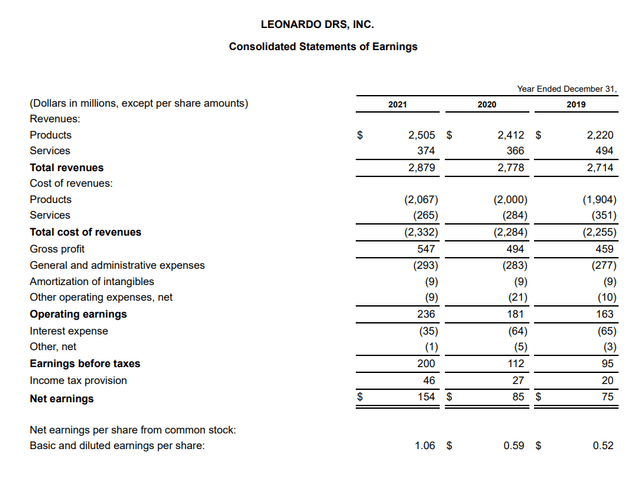

Moving on to the income statement, DRS has pre-tax income of $200 M in 2021 while RADA brought in $20 M, for a combined company earnings power of $220 M, or $43 M attributable to RADA shareholders.

DRS 10-K Income Statement (DRS 10-K)

Short-Term Arbitrage

From the previous section, the combined company pre-tax income attributable to RADA shareholders comes in at $43 M. This earnings power is expected to grow with a ramp-up of U.S. Army modernization efforts, as well as DRS monopoly on submarine electric power and propulsion capabilities, leading to the lucrative contract for upgrades to the Columbia class nuclear-powered submarines.

Ignoring any increased earnings power, the $43 M of pre-tax income is extremely close to the coveted Warren Buffett “10x pre-tax income” rule, given that the current price for the RADA business is $484 M. However, assigning a 10x valuation to DRS + RADA would be a woeful undervaluation when compared to peers of similar size.

According to the 2021 DRS 10-K, they brought in $2505 M in sales and operating income of $236 M. The table below compares DRS operating income margins to similarly sized peers.

| KTOS | HII | AVAV | DRS | DRS + RADA | |

| Sales | $811 M | $9524 M | $395 M | $2505 M | $2622 M |

| EBIT | $29.70 M | $668 M | $50.28 M | $236 M | $256 M |

| EBIT Margin | 3.66% | 7.00% | 12.73% | 9.40% | 9.80% |

Source: 2021 10-K for respective companies.

The purpose of the peer comparison in EBIT is to illustrate that it is not unimaginable to give DRS + RADA a multiple of 15x P/E valuation, in line with Huntington Ingalls (HII) and remarkably lower than Kratos Defense & Security Solutions (KTOS) and AeroVironment (AVAV). This relative multiple is also conservative considering that DRS + RADA is expected to grow at >15% EBITDA, in-line with its much higher-multiple peers of Kratos and AeroVironment, while also remaining consistently profitable.

Thus, while RADA’s current price-tag of $484 M provides a decent baseline to the “10x pre-tax” rule, there is a clear dissonance from RADA’s current price and the market caps of peers. Assigning only a 15x P/E multiple, equivalent to that of HII, leads to a market cap of $645 M. In other words, a 33% upside.

This leads us to conclude that there should be a short-term arbitrage at play as the broader investor base digests the combined company post official merger.

Long-Term Expectations

Longer term, DRS is focused on key strategies aligned with the U.S. Army and U.S. Navy. Through 2026, DRS + RADA have either locked in or are widely expected to be shoe-ins for high-priority budget items pertaining to M-SHORAD, Bradley, and GBAD upgrades for the U.S. Army and Columbia class nuclear-powered submarine upgrades for the U.S. Navy. Beyond that, DRS even has alignment with the U.S. Space Force Space Development Agency Tranche-1 missile defense tracking layer, a massive budget priority for the U.S. military.

With high revenue visibility, this gives us some comfort in being able to prescribe a Return on Capital for DRS + RADA and compound five years out. We compute DRS + RADA Return on Capital as:

Return on Capital = Total EBIT / (Total Equity + Total Debt)

DRS:

- EBIT: $236 M

- Total Equity: $1593 M

- Total Debt: $352 M

RADA:

- EBIT: $20 M

- Total Equity: $156 M

- Total Debt: $0 M

Return on Capital = 12 %

Using the DRS + RADA pre-tax income attributable to RADA shareholders determined previously at $43 M and compounding for five years out, we arrive at a market cap of: $1070 M, or an upside of 124% from the current price of RADA’s business. Once again, we stress much of these earnings will come from DRS + RADA having a virtual monopoly on highly-visible programs from the U.S. Army and U.S. Navy with no re-competes on contracts. Any other wins that the company turns its focus to – of which they have singled out the U.S. Space Force SDA Tracking Layer program – will be further upside.

Conclusion

The reverse-merger deal has upset the RADA shareholder base, who believe RADA’s agile, small-company growth prematurely slams on the brakes upon absorption into DRS. We share the same sentiment. However, we do not believe the current price of RADA reflects either the short-term or long-term value that the DRS + RADA combined company should command.

Unlike with the majority of other smaller defense companies, this belief is not supported by a “hope” for budgeted line items in the Department of Defense budget materials. The current earnings power and expected growth for DRS + RADA is rooted in highly-visible, high-priority existing budget items and programs across both the U.S. Army and U.S. Navy.

While the balance sheet leaves room for improvement to de-risk U.S. continuing resolutions and budget delays, and remains a risk for conservative investors, we believe the sell-off due to both global markets headwinds and negative investor sentiment to the merger deal provides an opportunity. We believe there is a short-term arbitrage upside of 33% and a longer-term 5-yr upside of 124% based solely only on existing budget items and programs.

We conclude this article with a Buy rating for investors who seek exposure to the defense industry with a smaller, consistently profitable organization directly aligned to high-priority U.S. military strategies. This article is intended to provide an idea for investors to pursue their own due diligence, and should not be construed as financial advice.

Be the first to comment