BanksPhotos

I have written a number of articles on CVR Partners (NYSE:UAN) before. I will not repeat the particulars of the partnership in this article, but will refer readers to my previous article for details. In this article, I will describe the reasons why I am very constructive about the fundamentals of the nitrogen fertilizer market and the partnership’s business in the next twelve months.

3Q distribution estimate is between $2 and $6

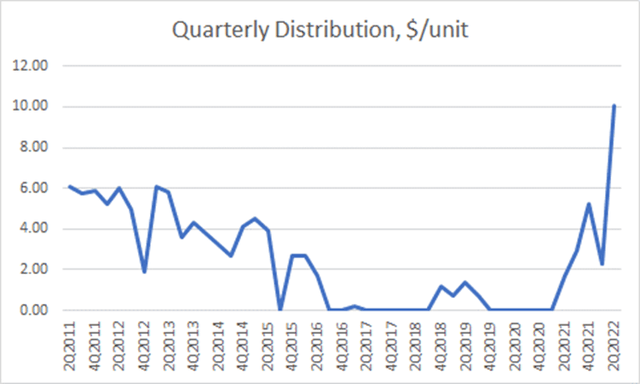

For 2Q, UAN announced a distribution of $10.05 per unit. This distribution is the largest quarterly distribution that UAN has ever made. This is shown in Figure 1.

Figure 1: UAN cash distribution history, adjusted for 10 for 1 reverse split in November 2020. (Company releases)

The distribution was high as a result of high realized prices of its nitrogen fertilizer products. The distribution could have been higher if not for several issues. The utilization at both plants was impacted by unplanned outages, resulting in reduced production. The demand for fertilizers were held back as a result of a strong fall ammonia application, a late spring planting due to weather, a reduced corn acreage of 89.9 million acres this year compared to 92.7 million acres in 2021, and a reduced application rate in some marginal acres. As a result, UAN carried inventory into 3Q due to reduced sales volume in 2Q. Management also held back $15 million in distributable cash flow “DCF” to provide for future working capital needs.

For 3Q, my estimation for distribution is between $2 and $6. This wide range is caused by many moving parts: volume that UAN may sell in the summer fill, the release of the reserved $15 million and any potential release of the 45Q cash payment from the partner, should the cash be received in 3Q.

I believe that the fundamentals of both the nitrogen fertilizer market and the partnership are in excellent shape and I expect that the next twelve months will provide better cash distribution compared to that in the last 12 months, which was $20.48 per unit.

Nitrogen fertilizer market fundamental is excellent

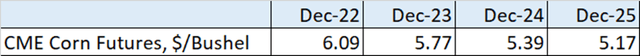

The fortune of the nitrogen fertilizer market is joined at the hip with the fortune of the corn and, to a lesser extent, the wheat growers. With two back-to-back years of strong prices, the growers are generally very profitable. The corn futures prices, shown in Figure 2, are strong. With a tight worldwide market for coarse grain, the war in Ukraine and the disruption of grain growing and shipment out of Ukraine, and with a low stock to use ratio in the US, it is likely that these prices will hold. With $5 or above per bushel for corn, the growers are incentivized to apply the full level of nitrogen for the potential yield of their acres to maximize their profits. Hence, I expect the demand for nitrogen to remain strong.

Figure 2: CME corn futures (CME)

I expect the supply side will continue to remain tight for the next twelve months for several reasons. While the late spring planting resulted in carry-over inventory into the summer, the largest US nitrogen manufacturer, CF Industries (CF) is exporting a large portion of its 3Q production to take advantage of higher prices outside of the US. Another large supplier Nutrient (NTR) is doing the same to a lesser extent. This has resulted in a lower volume summer fill offer from CF and will help to clear up the excess domestic supply going into the fall application season.

Natural gas is used to produce nitrogen fertilizers. Gas prices are very high outside of the US. High input cost steepens the nitrogen cost curve. With European gas at TTF trading at around $60 per MMBtu, the cost of input energy alone to produce nitrogen is higher than its sales price. Many European nitrogen fertilizer plants have been shut down. Similarly, the cost of input cost is high in Asia. The benchmark cost of LNG is around $47 per MMBtu at LNG JKM. Some plants in India and Pakistan have been shut down as a result. The net result of all the shut downs is that supply is curtailed and will be curtailed as long as input cost stays high. With the Russians curtailing natural gas shipments to the EU, it is expected that gas prices will stay high.

With high nitrogen prices in the world, China has restricted export of urea to ensure that there is ample supply domestically. The industry expects the Chinese export of urea to be less than 30% of the typical 5 to 6 million metric tons each year. It is expected that this export restriction will stay in place as long as the nitrogen prices stay high. This restriction will further constrain worldwide supply.

Russia continues to export nitrogen. Even though the ITC made a negative final injury determination concerning its investigation of import of urea ammonium nitrate “uan”, it is expected that Russian uan will be shipped mostly to Europe and Brazil, where prices are higher and where shipping cost is lower. Some Russian products will reach US shores, but will probably be much less compared to the past.

All of the foregoing supply constraints point to a tight supply demand balance in the US market, which still rely on imports to satisfy part of its demand. As a result, prices have already risen since the low in late July. I expect that prices will continue to increase into the fall application season when the carry-over inventory overhang will have been absorbed. With a favorable farm economy, I expect that we will have a strong fall application season and a strong spring run. This will further cause US prices to rise to reach parity with international prices. The price weakness in the US that was caused by a higher inventory exiting the spring is just a temporary setback that will pass in a few months. Overall, I expect nitrogen prices in the next twelve months to be comparable to those in the last twelve months.

The partnership has cleaned up its operation, and is poised to deliver strong results

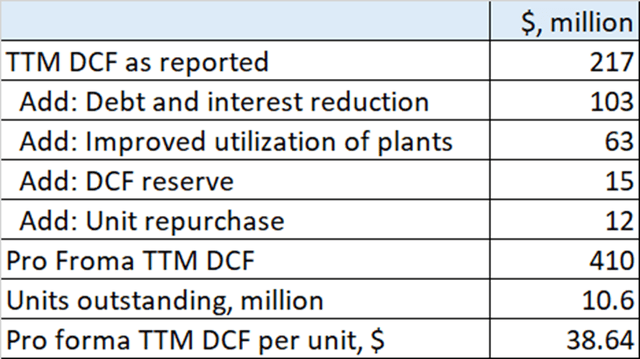

The DCF for the past twelve months did not reflect the full potential of UAN. With all the work that has been done by the partnership, I expect that we will see the full potential of the earning power of business reflected in the DCF in the next twelve months. I will expand my thoughts on the improvement below.

The partnership’s balance sheet has been strengthened. Debt has been reduced from $650 million to $550 million. The partnership repaid $100 million of this debt out of DCF. Going forward, DCF will no longer be burdened by debt repayment. In addition, cash interest has now gone down to about $8.5 million a quarter compared to $15 million in the past. Debt repayment related burden on the DCF was $102 million in the last twelve months. This item will not recur going forward.

UAN suffered from low utilization rate of the plants due to reliability issues. These issues should be fixed in the turnaround that both plants will complete in 3Q. Once the fixes are in, I expect the plants to operate in the high 90% range of plant utilization, rather than an average of 90% in the last four quarters. I estimate that DCF could have been higher by as much as $63 million had the plants been running in its normal utilization in the high 90% range. Going forward, a high utilization should provide a nice boast to DCF.

In the last twelve months, the partnership spent about $12 million of DCF on unit repurchase. The partnership has exhausted its repurchase authorization. Unless more authorization is granted, this will no longer be a drag on DCF going forward. Furthermore, the partnership withheld $15 million from 2Q DCF for working capital needs. Hopefully, this will be released shortly.

Higher distribution in the next twelve months is likely if nitrogen prices hold up

By making the adjustments to DCF as discussed above, I estimate the pro forma DCF for the last twelve months to be around $38 per unit, compared to the actual $20.48. What is more important is that the $18 per unit drag should no longer be there going forward. This is shown in Figure 3.

Figure 3: Pro forma TTM DCF. (Author’s model)

In addition, there will be an uplift of $15 million from the cash payment from the 45Q tax credit partner upon closing of the agreement, followed by an annual payment to the partnership. The $15 million reserved in 2Q will be released, hopefully in 3Q. Hence, there is at least another $30 million uplift to DCF in the next twelve months.

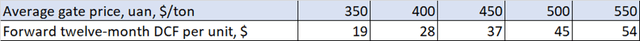

With all these issues cleaned up, I believe that UAN can realize its full DCF potential which I have estimated as shown in Figure 4 below. Just as a point of reference, the pro forma DCF of $38.64 per unit for the last twelve months is calculated based on a volume adjusted actual uan gate price of $425.

Figure 4: DCF as a function of average selling price. (Author’s model)

UAN’s unit price traded recently around $119. I believe that once UAN has established a history of more consistent distribution, investors may be willing to value its unit with a yield consistent with the 2012-2015 period, which was 9.1%. Currently, investors are valuing UAN units at approximately 17% TTM yield. I believe that this valuation gap will close over time as investors become more comfortable with the durability of the nitrogen market fundamental and the consistency of partnership execution.

Risks

To some extent, the geopolitical issues caused grain and energy prices to skyrocket. Resolution of the same issues may cause grain and energy prices to go down, thereby reducing demand as well as improving supply of nitrogen. More bountiful harvest worldwide will replenish stock, thereby lowering prices of corn and wheat, thereby reducing demand for nitrogen. Domestic energy prices have gone up, causing UAN’s input prices to go up. Average pet coke prices over the TTM have gone up over 40% compared to the previous TTM. Average natural gas prices over the TTM have gone up over 100% compared to the previous TTM. I expect domestic natural gas prices to continue to go up in the next twelve months, impacting the cost of the partnership. The plants have had operational issues and there will be unforeseen operational issues, which will impact production volume and hence DCF. The weather is always a big factor affecting the outcome of the farm and hence the fertilizer business. It is always a factor beyond anyone’s control.

Takeaway

UAN’s cash distribution is $20.48 for the TTM. I estimated an $18 hit to the distribution due to one-time factors and low utilization of the plants due to reliability issues. With the reliability issues fixed in the 3Q turnaround and with the one-time factors out of the way, UAN is in a strong position to realize its full DCF potential. The supply demand dynamics favor a tight nitrogen market in the next twelve months. If market conditions continue to hold up, I expect nitrogen prices in the next twelve months to be comparable to those of the last twelve months. Hence, a distribution in the high $30 range is possible for the next twelve months.

Be the first to comment