DNY59

Thesis

Crown Castle Inc. (NYSE:CCI) operates a “shared communications infrastructure,” providing critical infrastructure to wireless service providers mainly focused on the US market. It helps to build out highly costly cell towers, which its customers can lease, adding capacity without building out costly upgrades on their own. Crown Castle has also penetrated the small cell nodes space, leveraging its market leadership into a faster growth area to sustain future distribution visibility for its investors.

However, CCI has been pummeled by the bears, losing more than 40% of its value (on a price-performance basis) from its December highs at its recent October lows. We believe the market has gotten the battering spot on, as it needed to de-risk higher execution risks on a much lower site rental growth cadence through FY25. In addition, the company has been beset by non-renewals related to the T-Mobile (TMUS) and Sprint network, lowering its estimated adjusted EBITDA growth and, consequently, its AFFO per share accretion.

Given the relatively low dividend yield contribution to its 10Y total return CAGR, CCI’s price performance is critical to its total return. As such, we believe investors need to pay attention to CCI’s price action to discern whether the current entry levels are appropriate to add exposure relative to its forward growth prospects.

Our analysis suggests that CCI has recovered remarkably from its October lows, up nearly 20% at its recent highs. While we observed some near-term selling pressure from sellers taking exposure off, we believe CCI’s valuation remains reasonable relative to its 10Y average. However, we caution investors expecting CCI to be elevated back to its 2021 overvalued highs anytime soon, given more languid growth prospects through FY25.

Hence, investors should continue to expect an extended consolidation zone and assess the robustness of the subsequent pullback before adding more positions.

For now, we rate CCI as a Hold as a pullback looks increasingly likely to digest its recent strong recovery.

CCI: The Market Got The Battering Spot On

Relative to its overvalued 2021 NTM AFFO per share multiples of nearly 30x, CCI’s valuation collapsed to a low of about 16x at its October bottom. Compared to its 5Y average of 23x, the de-rating has been massive for CCI investors, as its YTD total return fell to -32%.

With a relatively low 10Y NTM average dividend yield of just 3.5%, it wasn’t sufficient to mitigate the price-performance hammering by the market. However, we believe substantial pessimism has been reflected, as the market has likely priced in tepid growth prospects for Crown Castle over the next few years.

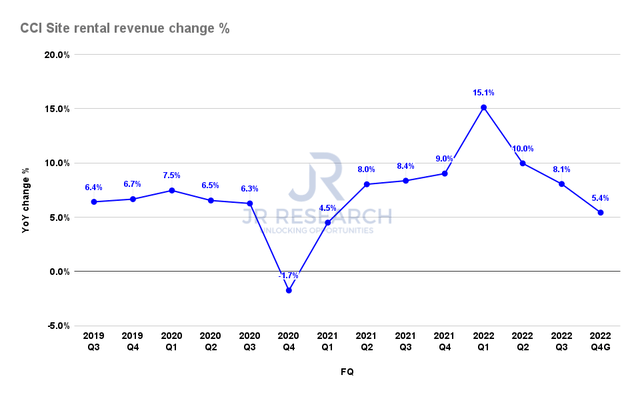

CCI Site rental revenue change % (Company filings)

Accordingly, Crown Castle’s site rental revenue growth has collapsed from its Q1’22 highs of 15.1%. As such, the market’s anticipation of a marked slowdown was spot on as it set up CCI’s December 2021 highs, with sellers reminding CCI bulls that its growth wasn’t sustainable.

Based on the company’s updated Q4’22 guidance, its site rental revenue could fall to just 5.4%.

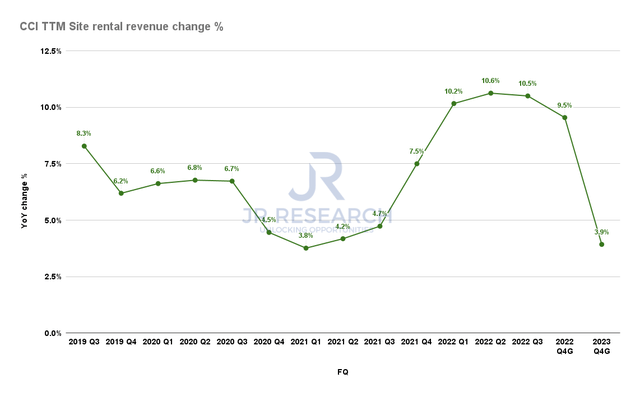

CCI TTM Site rental revenue % (Company filings)

Moreover, the company expects its non-renewal headwinds to continue further into FY25, as it highlighted in its recent filings. As such, Crown Castle’s FY23 site rental revenue growth is projected to increase by just 3.9%, as seen above.

Despite that, the company expects to recover its dividend growth momentum over the medium term, as management articulated in a recent conference:

I wanted to be clear that for ’24 and ’25, we’d expect that to take us below [our average targeted dividend] growth trend of 7% to 8%. But importantly, as we look out and think about the long-term demand trends in the business and how well we’re positioned, we don’t see those near-term headwinds in any way impairing that long-term growth opportunity and would expect the business to return to 7% to 8% growth at the dividend per share line beyond ’25. (Morgan Stanley European Technology, Media & Telecom Conference 2022)

As such, it’s clear why the market had de-rated CCI significantly from its 2021 highs. The company clearly couldn’t sustain its rental revenue growth cadence, impacting its distribution.

However, the critical question that investors need to ask is whether they expect a further de-rating or are confident that the valuation at its October lows has reflected significant pessimism.

Is CCI Stock A Buy, Sell, Or Hold?

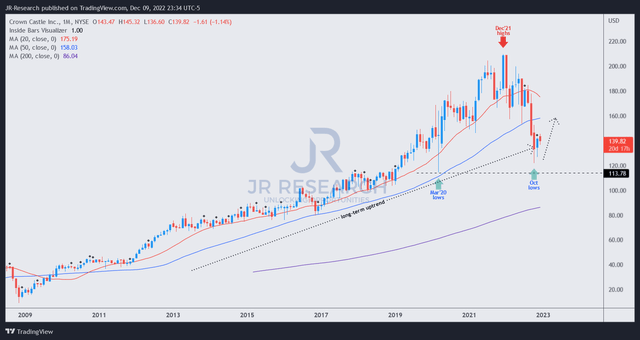

CCI price chart (monthly) (TradingView)

CCI’s long-term uptrend came under significant pressure at its October lows, as reflected by the hammering from its December 2021 highs. As such, it’s critical to note that CCI’s price performance is vital to sustaining its long-term total return relative to its dividend yields.

The support seen at its October lows is constructive, suggesting that CCI long-term buyers were ready to stanch further selling downside. However, it’s also essential to understand that buyers still need to retake its 50-month moving average (blue line) for CCI to resume its bullish bias decisively.

Moreover, its near- and medium-term bias remain in the downtrend, and therefore, investors should continue to expect near-term downside volatility, proffering investors solid opportunities to add.

With the recent sharp recovery from its October lows, we assess that a near-term pullback is likely, which should improve buyers’ reward/risk. Therefore, investors should remain patient.

Rating CCI as a Hold for now.

Be the first to comment