JamesBrey

The “fertilizer shortage” was a sizeable speculative trend during the year’s first half as skyrocketing Eurasian natural gas prices led to widespread plant shut-offs across the area. US fertilizer producers, such as CVR Partners (NYSE:UAN), rose dramatically as sales prices increased. In March, I saw UAN as an excellent inflation hedge but was somewhat cautious about the firm due to its high debt and the potential for sales prices to reverse. The stock rose dramatically over the following month along with its peers but reversed as fertilizer prices leveled off. However, it has delivered a 22% total return since the article was written.

The fertilizer market’s situation has changed dramatically over the past ten months. Europe’s core natural gas shortage appears more permanent following Gasprom’s shut-down of the critical Nord Stream 1 pipeline and the mysterious attack on the pipeline that followed. Though no material repair efforts are underway, it would likely take some years before they could be made once begun. With that in mind, Europe will likely continue to face a natural gas shortage for a prolonged period, meaning fertilizer prices may remain elevated even if peace is found. Europe has continued to slash its fertilizer production level, a significant indirect benefit for CVR Partners since the EU produces 21% of global UAN (urea and ammonium nitrate).

Fertilizer production and even pricing are seasonally impacted as prices are usually highest in late spring, often when inventories are lowest following peak demand from farmers. Fertilizer buying activity is usually lowest in late Fall (today) as that is when much of the world (northern hemisphere) is harvesting. Accordingly, low fertilizer production levels in Europe (and likely most of Eurasia) today will probably have a more considerable price impact come spring of 2023. Given UAN’s value, fertilizer prices, global natural gas prices, and agricultural commodity prices have been in a tight trading range since spring, and fundamentals show signs of growing strain, UAN may be a strong bet today on a more significant shortage over the coming months.

The Fertilizer Shortage is Likely to Grow

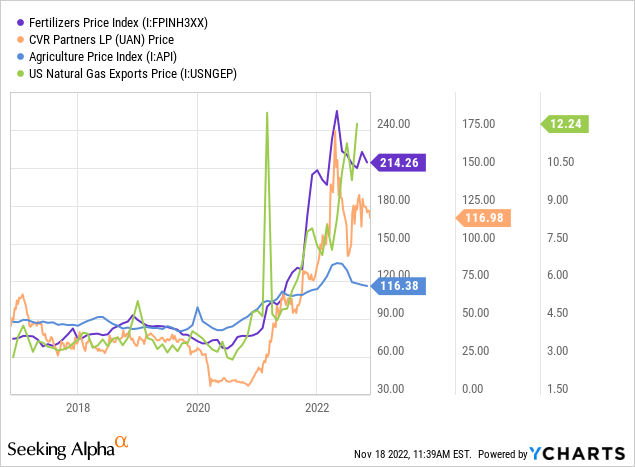

Fertilizer prices have been closely correlated to the overseas cost of natural gas and food prices. UAN has generally traded in line with changes to the fertilizers price index. See below:

As global natural gas prices rise (seen in the US export price index), global fertilizer production has tended to decline as it generally requires immense natural gas to make fertilizer. Around 70% of the cost of fertilizer production is solely based on the price of natural gas, creating a risk of food price hikes as (coincidently) 70% of Europe’s fertilizer output is shut down.

The current projection of the “caloric impact” of high fertilizer prices suggests a 2-3% decline in food-energy production, given recent fertilizer use estimates. Such a decline does not mean immediate food shortages outside a few countries, such as Ukraine and parts of the Middle East/Africa (around 20-40% est. calorie decline) that have disproportionately high exposure. However, fertilizer use and dependence levels are growing, so the impact could be higher than estimated come 2023. Global drought conditions may exacerbate the effects on food prices but may moderate fertilizer demand if acres planted decline accordingly.

I believe the fertilizer and agricultural markets will likely follow the same seasonal pattern from 2021. Prices and shortages were high in the spring of 2021 and moderated until the end of the year. As demand returned this year amid an even more significant shortage, prices rose even higher, again moderating as the planting season ended. Given global fertilizer production has declined further since the last peak demand season amid more extensive natural gas shortages in Eurasia, it is possible that the 2023 season will see an even more significant global fertilizer shortage and higher prices.

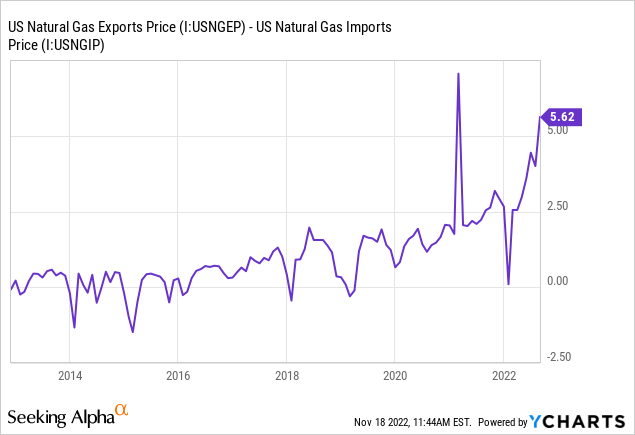

CVR Partner’s Q3 earnings were weak due to plant shut-offs, one-off operating cost increases, and sharply higher US natural gas prices. UAN benefits from its domestic competitors by having a slightly diversified feedstock cost, with Nat Gas alternatives making up around a third of its energy feed. Still, its profitability is highly dependent on US natural gas prices, which have fortunately fallen in recent months. That said, foreign natural gas prices have remained high, with the spread between US export and import prices rising to the highest level in years (excluding the one-off spike from 2020). See below:

This spread is critical for CVR Partners and other US fertilizer producers because it drives core profitability. The higher foreign natural gas prices are, the more expensive fertilizers tend to be. The lower domestic natural gas prices are, the lower manufacturing costs will tend to be. The spread has risen consistently since 2016, signaling a long-term benefit for US fertilizer producers, which has accelerated dramatically in recent years due to the “double-whammy” of COVID lockdown’s impact on production and the war’s direct and indirect effects on Eurasian fertilizer and natural gas production.

With this trend in mind, I believe CVR Partners will continue to see an ideal operating environment over an extended period. Further, the significant declines in EU fertilizer production during the Fall, and the long-term lack of natural gas supplies, imply even lower fertilizer supplies coming next spring. In the past, I was not as bullish on UAN since it appeared conditions might normalize after the Russia-Ukraine conflict ends. Still, now that the critical source of EU natural gas is impaired, the Eurasian natural gas shortage seems likely to persist for years. Accordingly, there is reason to believe UAN will sustain high EPS levels for a prolonged period.

What is UAN Worth?

CVR Partners has had an EPS of $23.80 over the past year, giving it an extremely low “P/E” of ~5X. The firm’s Q3 EPS was weak, but now that it has completed turnarounds at its nitrogen and fertilizer production facilities, its operating potential will likely strengthen over the coming quarters. The company’s total dividend was $19.30 per share over the past year (16% yield) – a level I expect will be sustained if UAN commodity prices remain as high as they are. With US natural gas prices down dramatically since September, the company’s forward profitability may be even higher than it has been over the past year.

In light of CVR Partner’s strong fundamental position, I believe the stock would be closer to its fair value at a TTM “P/E” of ~8X or a share price of $190 (or 60% above its current level). Of course, a high price range is not unlikely, given the many uncertainties facing the company that could hamper or boost its earnings. CVR Partners has a relatively high debt level, particularly compared to its lower historical earnings. Further, in the long run, CVR Partners may not sustain its high profits over the past year. That said, it appears more likely that CVR can maintain high profits for a prolonged period, given the recent changes in Europe’s natural gas supply and China’s extensive (but opaque) energy crisis, as well as the decline in US natural gas prices.

The Bottom Line

UAN is a risky bet as the stock is highly volatile and sensitive to small changes in the macroeconomic landscape. Fortunately, it does not have as sizeable economic exposure as most manufacturing stocks since the demand for fertilizer is highly inelastic. A risk to the firm is an end to the Russia-Ukraine conflict that shores the European natural gas supply (and Asia’s since US LNG is being redirected to Europe from Asia). However, the attack on the NS1 pipeline mitigates that risk as gas flows will likely be restrained even if peace is found, given it will take a long time to fix that pipeline. Other dangers to UAN include a rise in US natural gas prices. While that is certainly possible, I believe it is unlikely given the US has reached maximum LNG exports to capacity while domestic natural gas production is generally strong. Lastly, UAN could be impaired by a decline in food prices, which also appears unlikely given weak world agricultural stocks.

I am bullish on UAN and believe it will likely rise over the coming months. UAN and other US fertilizer producer stocks, maybe catalyzed in a bullish manner by a rise in nitrogen and urea prices over the coming two quarters. I expect fertilizer prices to rise further due to the increase in production cuts and the potential for increased demand.

Be the first to comment