Ryan Fletcher/iStock Editorial via Getty Images

I came across Curtiss-Wright Corporation (NYSE:CW) while screening for companies trading near their 52-week highs.

I believe Curtiss-Wright has the ‘right’ business mix for the current environment. More than 50% of CW’s revenues are levered to secular growth in defense spending while another ~20% is set to benefit from the coming nuclear energy renaissance. Although the stock trades at a premium to industrial sector peers, I believe this premium is well-deserved due to the defensive nature of CW’s business.

Company Overview

Curtiss-Wright Corporation is a global aerospace & defense manufacturer, as well as a components and service provider to the nuclear power industry. The company’s aerospace DNA dates back to aviation pioneers Glenn Curtiss and the Wright brothers.

Curtiss-Wright was the leading aircraft engine manufacturer in the U.S. pre-World War 2. However, it failed to make the transition to jet engines in the post-war period and ceded the market to upstarts like Lockheed (LMT), Northrop (NOC), and other aircraft manufacturers.

In the 1960s, CW diversified into the nuclear industry through the purchase of Target Rock Corporation. Target Rock manufactured safety and release valves for naval nuclear propulsion systems that was later used in civilian nuclear power plants.

Finally, in the early 2000s, CW further diversified away from aerospace markets by branching out into defense electronics such as sensors and embedded computing.

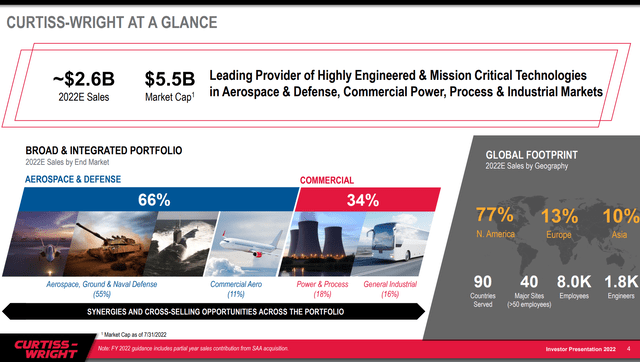

Today, the company operates in 4 business segments: Aerospace, Ground & Naval Defense, Commercial Aero, Power & Process, and General Industrial (Figure 1). About 2/3 of revenues come from the aerospace and defense markets, and 1/3 from power and industrial markets.

Figure 1 – CW Overview (CW Investor Presentation)

Technicals Show Strong Relative Momentum

Readers of my articles will note that I often start my analysis of companies and funds from a macro and/or technical angle. This is part of my MacroTIPs investment framework – I look for Macro Trends, and Inflection Points. I believe investing is just like sailing, it is much easier to have macro tailwinds behind your back.

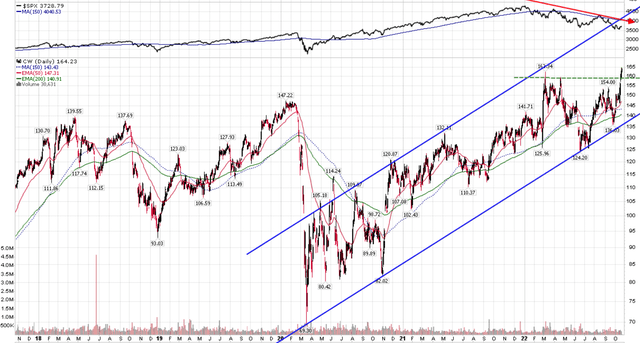

In Curtiss-Wright’s case, we can see from Figure 2 below that the company is breaking to new all-time highs despite a multi-quarter bear market, with the S&P 500 Index down 25% YTD.

Figure 2 – CW showing relative strength (Author created with price charts from stockcharts.com)

What is going on at Curtiss-Wright and is this a trend we should consider participating in?

Defense Could An Investment Theme For The Next Decade

It is clearly an understatement to say that the world is becoming a more hostile place. 2022 started with a full-scale European land war as Russia invaded Ukraine. Now as we close out the year, we are looking at a potential conflict between China and the US regarding Taiwan. As the world becomes more dangerous, the obvious beneficiaries are defense manufacturers who provide arms and munitions to western governments.

Defense Spending Set To Ratchet Higher Following Russian Invasion

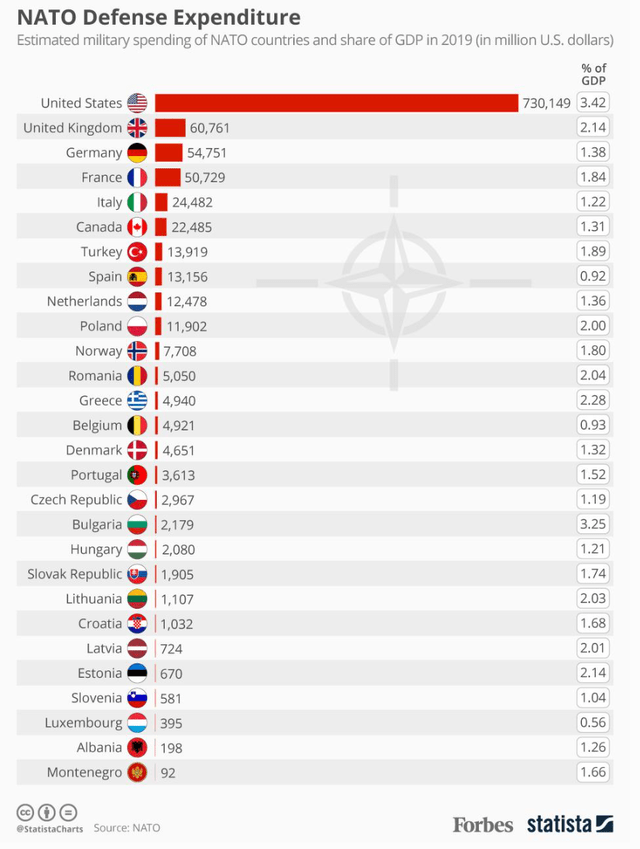

In 2014, as a response to Russia’s annexation of Crimea, the countries within the North Atlantic Treaty Organization (“NATO”) agreed to reverse years of defense spending declines and increase their defense budgets to 2% of GDP by 2024. However, with pressing domestic priorities, many countries put defense spending on the back burner, with only 9 of NATO’s 30 members meeting the 2% of GDP target as of 2019 (Figure 3).

Figure 3 – NATO defense spending, 2019 (statista via a forbes article)

However, the perennial defense spending shortfall may be about to change. Following the Russian invasion of Ukraine, NATO reiterated in recent meetings its goal of spending at least 2% of GDP on defense. Now, we are seeing many countries take action towards that goal. Spain recently announced it is increasing its 2023 defense spending by 26% YoY and is on target to surpass the 2% goal. Germany is pledging to increase its defense spending by €100 billion euros. Britain also pledged to double defense spending to £100 billion by 2030 (note: British PM Liz Truss’ resignation on October 20 may impact the defense budget). In short, the western world is seeing a secular increase in defense spending that should last many years.

Right Business Mix For Dangerous Times

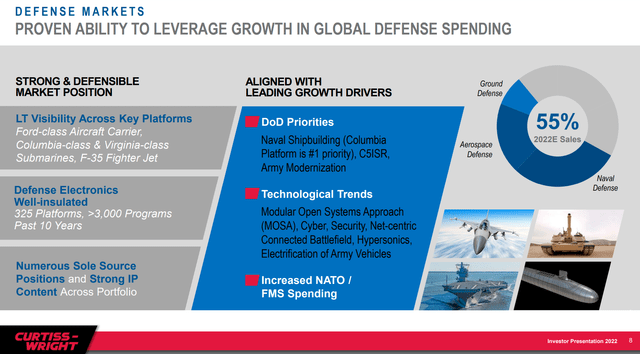

Curtiss-Wright is well positioned to benefit from this secular tailwind in defense spending as more than 50% of its revenues are in aerospace, naval and ground defense segments. CW manufactures defense electronics that goes into dozens of different platforms and programs, as well as components for naval nuclear propulsion systems.

Figure 4 – CW defense markets (CW Investor Presentation)

Nuclear Energy Renaissance A Tailwind

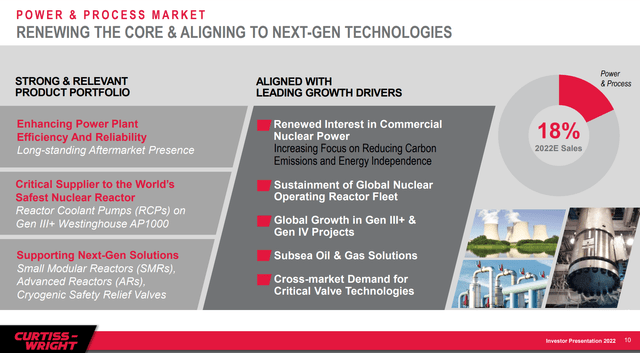

In addition to defense, Curtiss-Wright is also aligned with another key secular driver, nuclear energy. The power segment represents 18% of the company’s sales. CW is a global supplier of nuclear power technologies including reactor coolant pumps, controllers, valves, and other engineered products. Curtiss-Wright also provides aftermarket servicing to nuclear reactors and has content in every operating reactor in the U.S (Figure 5).

Figure 5 – CW nuclear power markets (CW Investor Presentation)

As I have written previously in articles on the Global X Uranium ETF (URA) and Centrus Energy Corp. (LEU), governments around the world are coming to the realization that nuclear power is one of the key solutions to our current energy crisis. Nuclear power has zero carbon emissions and reduces our reliance on hostile fossil fuel exporters like Russia and Iran.

With close to 75% of revenues tied to secular tailwinds like defense spending and nuclear energy, is it any wonder Curtiss-Wright is acting like a safe haven amidst the market turmoil?

Impressive Financial Performance Through A Cycle

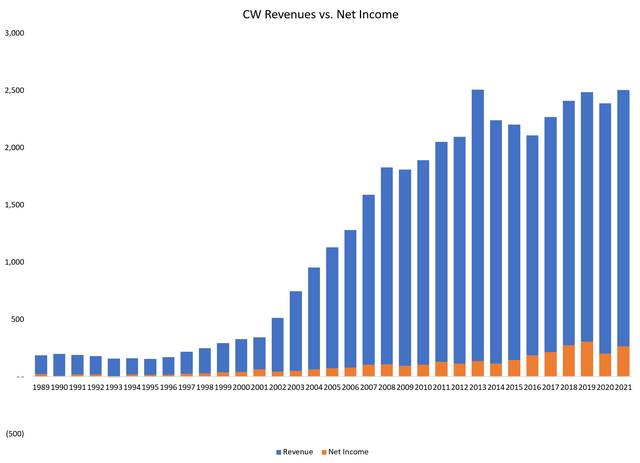

Due to the critical nature of Curtiss-Wright’s products and services, the company has been able to consistently grow revenues (5Yr CAGR of 3.5%; 10Yr CAGR of 2.0%) and maintain net profitability through a cycle, including through the 2008 recession (Figure 6). The last time CW recorded a net loss was in 1993.

Figure 6 – CW Revenues vs. Net Income (Author created with data from roic.ai)

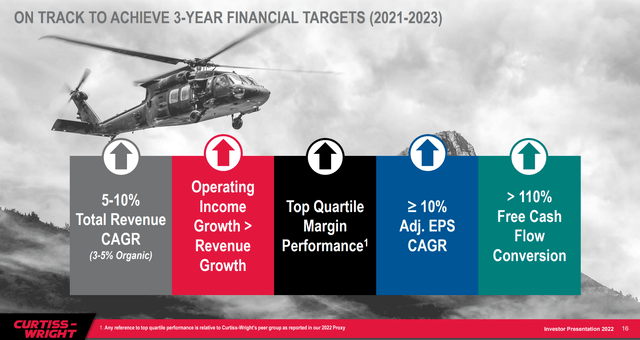

In recent years, Curtiss-Wright’s financial goals have been even more aggressive, with 3-Yr financial targets of 5-10% CAGR revenue growth, operating income growth faster than revenue growth, greater than 10% EPS CAGR, and over 110% free cashflow conversion (Figure 7).

Figure 7 – CW financial goals (CW Investor Presentation)

Q2 Was A Beat And Raise Quarter

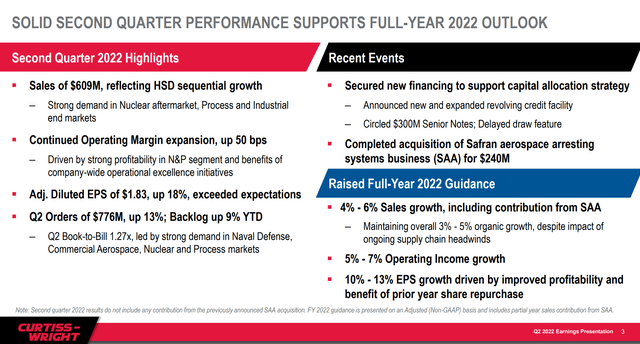

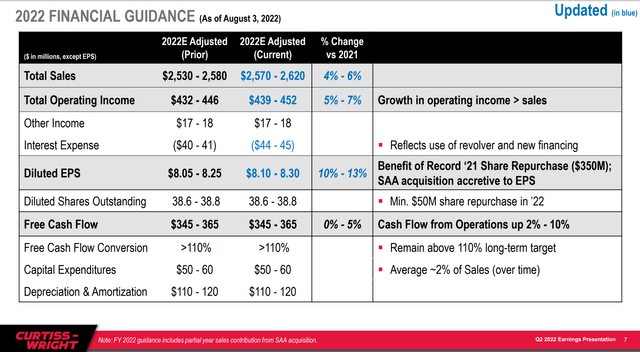

To date, CW has been able to achieve its lofty goals, with Q2/2022 adj. EPS of $1.83 vs. analyst estimates of $1.69, up 18% YoY despite flat YoY organic revenue growth. Along with Q2/2022 results, the company raised its full-year 2022 guidance to include the recently acquired Safran Aerosystems Arresting Company (‘SAA’) (Figure 8).

Figure 8 – CW Q2/2022 was a beat and raise quarter (CW Investor Presentation)

Valuations At A Premium

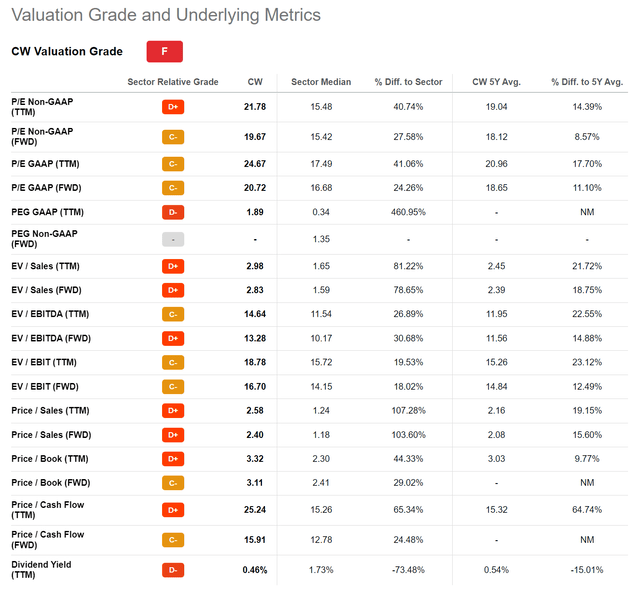

In terms of valuation, it appears Curtiss-Wright’s defensive business fundamentals (pun intended) are well reflected in it’s premium multiple of 19.7x non-GAAP Fwd P/E vs. Industrial peers at 15.4x (Figure 9).

Figure 9 – CW valuation at a premium (Seeking Alpha)

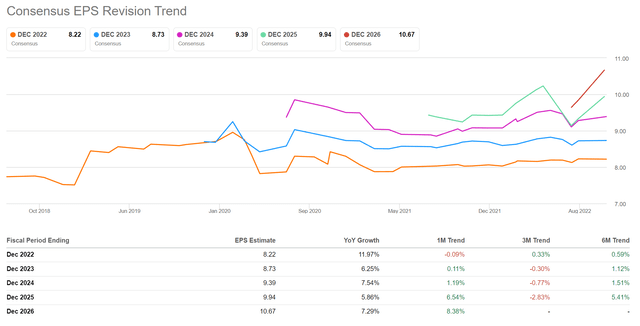

However, I believe Curtiss-Wright deserves this premium valuation as it is experiencing positive earnings revisions, particularly in 2025 and 2026 estimates (Figure 10).

Figure 10 – CW earnings revisions (Seeking Alpha)

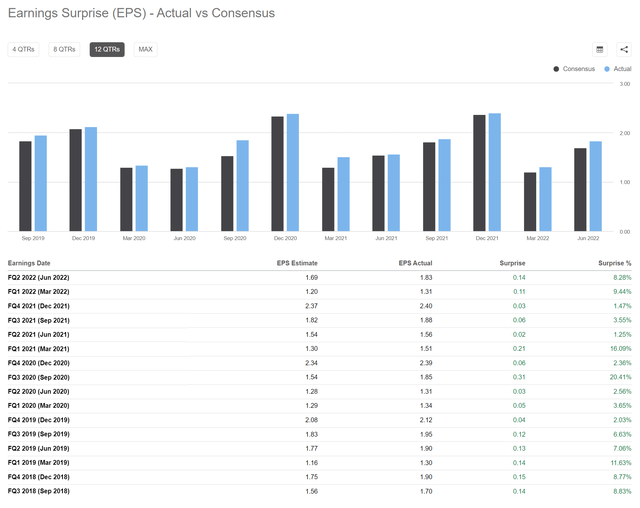

Furthermore, CW has a history of meeting and exceeding analyst estimates due to the strong visibility of its government-based contracts and management execution (Figure 11).

Figure 11 – CW mostly meet and beat estimates (Seeking Alpha)

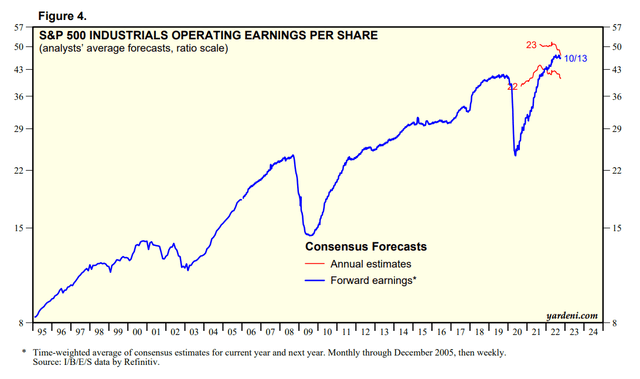

On the other hand, the Industrial sector is seeing earnings estimates roll over, as analysts price in a potential 2023 global recession (Figure 12).

Figure 12 – Industrial earning estimates revised lower (yardeni.com)

Risks

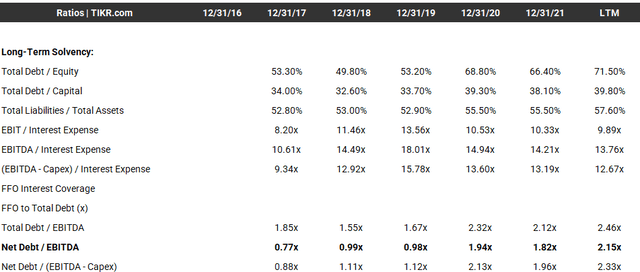

One investment risk with Curtiss-Wright is its moderately high debt levels. CW has $1.2 billion in debt, or 2.2x Net Debt / LTM EBITDA. This is the highest level of leverage the company has had since an acquisition binge in 2011/2012 left the company at 2.7x Net Debt / EBITDA (Figure 13).

Figure 13 – CW solvency ratios (tikr.com)

The high debt levels are mitigated somewhat by the company’s strong free cash flow generation. CW is expected to generate $355 million in free cash flows in 2022, which would go towards reducing leverage.

Figure 14 – CW is expected to generate over $350 million in FCF (CW Investor Presentation)

Conclusion

In conclusion, I believe Curtiss-Wright has the ‘right’ business mix for the current environment. More than 50% of CW’s revenues are aligned to secular growth in defense spending while another ~20% is set to benefit from a potential nuclear energy renaissance. Although the stock trades at a premium to sector peers, I believe this premium is well-deserved due to the defensive nature of CW’s business.

Be the first to comment