Stanislaw Pytel

What Is Candyverse Brands?

Kelowna, Canada-based Candyverse Brands (CNDY:CA) was founded to develop, manufacture and sell plant-based, low sugar snacks for consumers in Canada and the United States.

Management is headed by founder and Chief Executive Officer Garrett Downes, who has been with the firm since inception in 2019 and was previously co-founder and Director of Angel Brands.

The company’s primary offerings include its Better Bears Flavors:

-

Mixed Berry

-

Tropical Citrus

-

Variety Packs

As of March 31, 2022, Candyverse has booked fair market value investment of $6.2 million as of March 31, 2022 from investors.

Candyverse’s Market & Competition

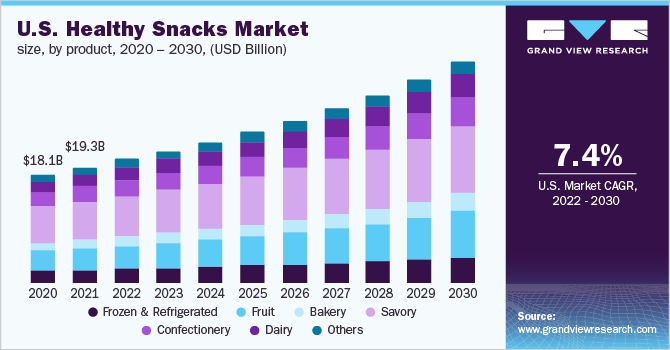

According to a 2022 market research report by Grand View Research, the global market for healthy snacks was an estimated $85.6 billion in 2021 and is forecast to reach $152 billion by 2030.

This represents a forecast CAGR of 6.6% from 2022 to 2030.

The main drivers for this expected growth are increased convenience-seeking behavior by consumers, growing availability of products and new product options developed by manufacturers.

Also, below is a chart showing the historical and projected future growth trajectory of the U.S. healthy snack market:

U.S. Healthy Snacks Market (Grand View Research)

Major competitive or other industry participants include:

-

LILY’S SWEETS

-

The Hershey Company

-

Mondelez (Cadbury)

-

Dare

-

Haribo

-

GoBio Vegan Organic Gummi Bears

-

Yumy Bear

-

Smart Sweets

-

Healthy Hippo

-

YumEarth Organic

-

Project 7

-

Lily’s

-

Kiss My Keto

Candyverse’s IPO Date and Details

The initial public offering date, or IPO, for Candyverse has not been indicated by the company or its agent.

(Warning: Compared to stocks with more history, IPOs typically have less information for investors to review and analyze. For this reason, investors should use caution when thinking about investing in an IPO, or immediately post IPO. Also, investors should keep in mind that many IPOs are heavily marketed, past company performance is not a guarantee of future results and potential risks may be understated.)

Candyverse intends to raise $730,000 in gross proceeds from a Canadian IPO of its common shares, offering 2.5 million shares at a proposed price of USD$0.29.

The IPO is not being marketed to investors outside of Canada. No U.S. SEC filings have been made.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $12.6 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 4.82%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

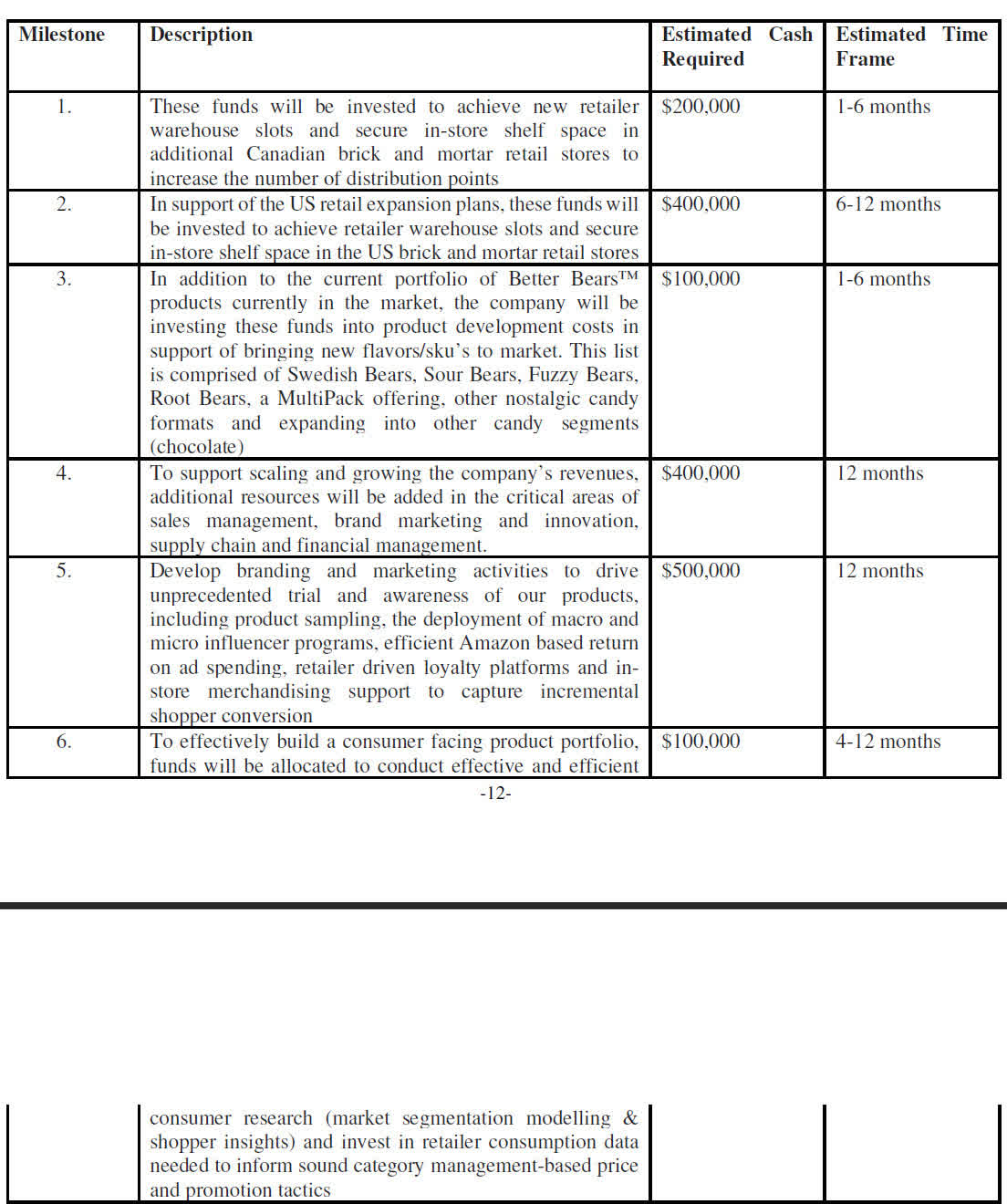

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of Proceeds (SEDAR)

(Source – SEDAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management is aware of no legal proceedings in process or contemplated against the company.

The listed agent of the IPO is Leede Jones Gable.

How To Invest In The Company’s Stock: 7 Steps

Investors can buy shares of the stock in the same way they may buy stocks of other publicly traded companies, or as part of the pre-IPO allocation.

Note: This report is not a recommendation to purchase stock or any other security. For investors who are interested in pursuing a potential investment after the IPO is complete, the following steps for buying stocks will be helpful.

Step 1: Understand The Company’s Financial History

Although there is not much public financial information available about the company, investors can look at the company’s financial history in their SEDAR filings. (Source)

Step 2: Assess The Company’s Financial Reports

The primary financial statements available for publicly-traded companies include the income statement, balance sheet, and statement of cash flows. These financial statements can help investors learn about a company’s cash capitalization structure, cash flow trends and financial position.

My summary of the firm’s recent financial results is below:

The company’s financials have produced increasing topline revenue from a tiny base, no gross profit and gross margin, growing operating loss and higher cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($2.8 million).

Advertising & Promotion expenses as a percentage of total revenue have risen sharply as revenue has increased; its Advertising & Promotion efficiency multiple was 1.1x in the most recent reporting period.

The firm currently plans to pay no dividends for the foreseeable future and does not have a policy with respect to dividends.

Step 3: Evaluate The Company’s Potential Compared To Your Investment Horizon

When investors evaluate potential stocks to buy, it’s important to consider their time horizon and risk tolerance before buying shares. For example, a swing trader may be interested in short-term growth potential, whereas a long-term investor may prioritize strong financials ahead of short-term price movements.

Step 4: Select A Brokerage

Investors who do not already have a trading account will begin with the selection of a brokerage firm. The account types commonly used for trading stocks include a standard brokerage account or a retirement account.

Investors who prefer advice for a fee can open a trading account with a full-service broker or an independent investment advisor and those who want to manage their portfolio for a reduced cost may choose a discount brokerage company.

Step 5: Choose An Investment Size And Strategy

Investors who have decided to buy shares of company stock should consider how many shares to purchase and what investment strategy to adopt for their new position. The investment strategy will guide an investors’ holding period and exit strategy.

Many investors choose to buy and hold stocks for lengthy periods. Examples of basic investing strategies include swing trading, short-term trading or investing over a long-term holding period.

For investors wishing to gain a pre-IPO allocation of shares at the IPO price, they would “indicate interest” with their broker in advance of the IPO. Indicating an interest is not a guarantee that the investor will receive an allocation of pre-IPO shares.

Step 6: Choose An Order Type

Investors have many choices for placing orders to purchase stocks, including market orders, limit orders and stop orders.

-

Market order: This is the most common type of order made by retail traders. A market order executes a trade immediately at the best available transaction price.

-

Limit order: When an investor places a buy limit order, they specify a maximum price to be paid for the shares.

-

Stop order: A buy-stop order is an order to buy at a specified price, known as the stop price, which will be higher than the current market price. In the case of buy-stop, the stop price will be lower than the current market price.

Step 7: Submit The Trade

After investors have funded their account with cash, they may decide an investment size and order type, then submit the trade to place an order. If the trade is a market order, it will be filled immediately at the best available market price.

However, if investors submit a limit order or stop order, the investor may have to wait until the stock reaches their target price or stop-loss price for the trade to be completed.

The Bottom Line

CNDY:CA is seeking public market investment for its growth objectives in Canada and U.S. markets.

The market opportunity for selling healthy snacks is large and expected to grow in the U.S. market at a CAGR of 7.4% through 2030.

The primary risk to the company’s outlook is its tiny size and need to ramp up production and sales of its products in order to gain cost efficiencies.

As for valuation, management is asking investors to pay an EV/Revenue multiple of almost 22x.

As a reference, a basket of U.S. publicly held food processing companies had an EV/Revenue multiple of 2.2x in January 2022, according to an index by noted valuation expert Dr. Aswath Damodaran.

The IPO appears priced for perfection and assumes a very strong ramp of sales growth. It is likely management will need significantly more capital to achieve even limited objectives, so I’m on Hold for the IPO.

Be the first to comment