naphtalina/iStock via Getty Images

Cummins’ Cyclicality

Cummins Inc. (NYSE:CMI) had a reputation as a cyclical business that varied with the sales of trucks. It no longer has that reputation because the last two declines in 2008 and 2019 were general recessions covering most businesses. However, now trucking appears likely to continue to decline and Cummins likely will decline as trucks do.

Cummins’ Business

Cummins has been a well-managed business that aims for long-term results. Its original market is the sale of diesel engines used in trucks that are manufactured by other companies that make their own diesel engines. Customers are opting to buy Cummins products because of fuel efficiency, reliability, and low maintenance costs.

To succeed, Cummins must continue to have a better-performing engine and have a manufacturing organization that can produce that product at a low price. They have been successful in doing this by making large-scale investments to achieve manufacturing efficiency and have come out of downturn cycles stronger than they went in. Truck sales are very cyclical. To get around that, Cummins has expanded into the distribution, components, and power generation system business. They have succeeded in reducing cyclicality. It is a highly efficient and very profitable cyclical business. They have large operations and joint ventures in India, China, and Brazil, and worldwide parts supplies.

The Heavy U.S. Truck Market

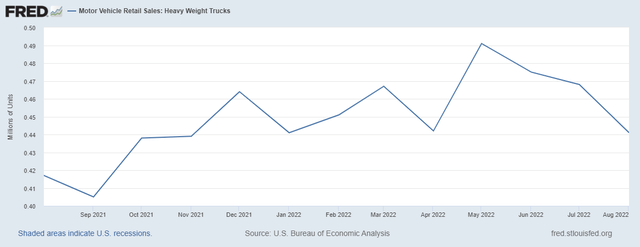

May Sales of heavy trucks were 491,000 units. By August, the volume declined by 50,000 units to 414,000 This is an 11% decline in three months. This data is seasonally adjusted.

Management made its presentation of second quarter results before the last two months of decline in heavy trucks were available. The decline in June was modest. Cummins might have lowered its guidance if they had seen more data on truck sales. Truck sales for September will be available on the fourth of October. A fourth consecutive decline will further confirm the decline in the Cummins market.

Second Quarter Results

Quarterly results are summarized by the author in the table below.

Cummins Q2 2022

$ Million

| 2022 | 2021 | % Growth | |

| Revenue | 6,586 | 6,111 | 7.8% |

| Net Income | 678 | 600 | 13.0% |

| EPS $/Share | 4.77 | 4.10 | 16.3% |

Revenue increased by 7.8%, but net income increased by 13% because incremental volume did not increase fixed costs in manufacturing. Cummins buys back shares, so the earnings per share increased more than net income.

Project Zero

The new CEO, Janet Rumsey, has been responsible for the development of “Project Zero,” an effort to build truck powertrains with no carbon emissions. This “New Power” includes fuel cells and other electrical power generation. In 2022, this business is projected to have $200 million of revenue, but $220 million in negative EBITDA because of the heavy development and marketing cost.

The new CEO has just completed the acquisition of Meritor. This is a company with annual sales of approximately $4.4 billion, with a net income of $0.3 billion. The purchase price is $3.7 billion. They expect that the acquisition will be accretive for earnings-per-share. The business makes axles, brakes, and other powertrain components. It also makes equipment for electric powertrains which mesh with project zero. Cummins previously had only made small bolt-on deals that were nothing like the size of Meritor.

The new CEO is putting most of her effort into the new power business to make it succeed. They have made acquisitions before the current large one to gain technology that they intend to develop into zero-emission vehicles. They have a lot of research to build the infrastructure for zero-emission vehicles, which is why the new power business is running a negative EBITDA of greater than revenue. The task of integrating their new $4.4 billion acquisition is going to take a lot of effort. So, management’s focus is on this area of the business when it is likely that the core trucking business will experience lower growth and, possibly, next year negative growth.

The new power business is counting heavily on federal incentives built into the infrastructure bill and the new anti-inflation bill passed by Congress. There is considerable effort in packaging the new technology to meet the incentives based on this legislation. For example, Cummins has reached a deal with Walmart (WMT) to power heavy-duty trucks with natural gas as fuel. Efforts like that, while creative, will take some time to manage. They are heavily into research on hydrogen using fuel cells, so there is a lot of effort underway that can create a great new business. However, this will require significant effort to make them viable in the medium term.

Full Year Revenue Growth and EBITDA

The following table lists Cummins’ projections for the growth of the individual market segments before consideration of the acquisition. The average growth assumed for the second half of 2022 is 8%. Trucks are assumed to be growing at 10% a year. Cummins and its supply chain have been stretched to meet that demand. They are still working with customers to meet the demand for new trucks. The market for trucks will be impacted by the economy. The economy is no longer growing rapidly as it recovers from the pandemic. You don’t have to believe that the economy will go into recession to question whether customers will continue to buy products after the Fed’s interest rate increases, at a rate that is growing by 8%.

Full Year Cummins Guidance Projection Before Impact of Meritor

|

|||||||||||||||||||||||

| This Data is from Cummins Q2 Presentation. | |||||||||||||||||||||||

Guidance for the second half of 2022 projects growth revenue of $1.1 billion and EBITDA of $0.5 billion from more volume from existing assets. Declines in the engine business affect distribution and components. If the decline in truck sales continues, the revenue and EBITDA in the second half may decline.

Impact of Lower Growth

A prudent investor would assume no growth in the base business in the second half. That would lower full-year EBITDA and profit by 12%, which would lower the stock price by $25 per share if the P/E ratio remained the same. But an unexpected decline in profits could drive the stock down by 35 dollars.

Risks and Opportunities

The risk to the U.S. business in engines, components, and distribution is the reason to sell Cummins. This risk is described above. This section describes the other risks and opportunities.

A mammoth part of the truck market potential is in China. Currently, Chinese sales are down 50%. So that is partially a risk and partially a long-term opportunity for growth. A large part of the Chinese market is served by joint ventures, which do not provide much profitability to Cummins.

Cummins has had poor results with diesel-powered light trucks and SUVs. They expect that recent deals will lead to higher sales in that market, but that opportunity might be limited.

The biggest risk is a downturn in the trucking market as interest rates rise. Trucking firms may become more cautious in modernizing their fleet. The negative volume would lower not just trucking but also distribution and components.

Conclusions

Cummins will likely be affected by downturns in the trucking market and by the costs of making zero emissions a viable business. The company’s performance and a relatively low P/E ratio of 18 times offer some protection. However, once the downturn starts, investors will be cautious. Cummins stock will probably fall. In the future, Cummins could be a good buy again but, at this juncture, it is a sell.

Be the first to comment