Tramino

I rated Cummins (NYSE:CMI) a long-term buy in my article published on June 6, 2022. The stock was trading at $210.83 at that time. Since then, the stock has returned 20.5%, while the S&P 500 Index (VOO) has dropped 1.7%. Any investor should be happy with a 20% return in less than six months. A 20% annual return would double your money in approximately 3.6 years. But the stock’s current run came as a surprise. Investors must understand the reasons behind Cummins’ stellar outperformance compared to the S&P 500 Index. The stock’s performance is due to short-term cyclical trends and not due to any structural change in the business. But the company is overvalued at current prices, and when demand for trucks fades and this cycle turns, the stock will pull back. Until then, the stock is a hold.

Good Revenue Growth

The company has seen good revenue growth since the beginning of 2021. Demand for heavy-duty and medium-duty trucks has been high. The company also sees good demand trends in its on-highway and off-highway markets. Geographically North America and India have seen good demand recovery since the pandemic’s beginning. The continuing COVID-19 lockdowns have caused weakness in China.

Exhibit 1: Cummins Quarterly Revenue by Segment [Q1 2021 – Q3 2022]

Cummins Quarterly Revenue by Segment [Q1 2021 – Q3 2022] (Cummins Investor Presentations, Author Compilation)![Cummins Quarterly Revenue by Segment [Q1 2021 - Q3 2022]](https://static.seekingalpha.com/uploads/2022/11/26/saupload__NUoFxtHUoB9WUtH_zPdR1SvVdfr5KBSyquLyPfXPXBJ9CO-bZdqA3snO0_u8WvuEwYUREYGq5nnMPPZwYJmS_I78Nu0ftC4oqYw6U0S8NlcjWbdJE4evh_7K2KJZ9JWyVxFqrychhR7hnM9uUiALZ26Py24-E_qeeHsFhPyrU2zZ8gKMrZPxi45dRnE7Q_thumb1.png)

From a segment perspective, its Engines, Distribution, and Power Systems have generated excellent, mostly double-digit sales growth [Exhibit 1] compared to the same quarter in the previous years. The company has forecasted 8% year-over-year revenue growth for 2022. The company should be finishing 2022 on a solid note. But, as inflation takes its toll on consumer savings and spending and interest rates continue to increase, Cummins should see a slowdown in demand in 2023.

New Power Division Continues Expansion

One of the things that attracted me to Cummins was their investment in hydrogen products. The company groups its hydrogen generation products and electrified power solutions that range from full-electric to hybrid in its New Power segment. It is essential to follow the progress of this segment to follow the progress of hydrogen and electrification efforts globally. Currently, governments across the globe are subsidizing both hydrogen production and electric vehicles.

In 2022, the New Power division should have sales of $180 million. Cummins will expand its PEM electrolyzer capacity in Belgium to 1 Gigawatt. The company announced that it would produce electrolyzers in Minnesota. This plant will have a 500 megawatts manufacturing capacity annually, which can be expanded to 1 gigawatt. The subsidies provided by the U.S. Federal Government to support the hydrogen economy as part of the Inflation Reduction Act have enabled this manufacturing facility. The company has partnered with Werner Enterprises to deliver a 15-liter hydrogen internal combustion engine when available.

Drop in Profit Margins

The company continued to see pressure on gross and EBITDA margins due to higher manufacturing costs and lower joint venture revenue from China. Gross margins came in at 22.3%, about 130 basis points lower than in the same quarter in 2021. The operating income margin was 8.13%, about 186 basis points lower than in the same quarter of 2021. The Engines segment EBITDA margins were particularly weak at 13.1%, about 210 basis points lower than in Q3 2021.

The company’s operating income margin was below 10% for 2020 and 2021, coming in at 9.6%. The company has seen further margin erosion, with its operating margin at 8.13% for the quarter ending September 2022. The average operating income margin for the company was 10.2% between 2012 and 2021. Net income margin was a meager 5.4% for the quarter ending September 2022 compared to an average of 8.33% between 2012 and 2021.

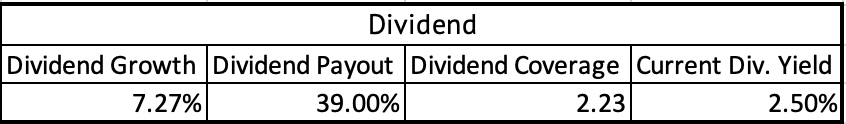

Dividends and Buybacks

Cummins offers a 2.5% dividend yield, safe with a payout ratio of 39% [Exhibit 2]. The company’s dividend has grown by 7.2% annually over the past five years and has been paid for 17 years. The dividend is also well covered by operating cash flows. For the trailing twelve months, the company paid $841 million in total dividends and had operating cash flows of $1.87 billion in operating cash flows.

Exhibit 2: Cummins Five-year Average Dividend Growth, Payout Ratio, Dividend Coverage, and Yield

Cummins Five-year Average Dividend Growth, Payout Ratio, Dividend Coverage, and Yield (Seeking Alpha, Author Calculation)

Between 2012 and 2021, the company spent $7.8 billion on share repurchases and reduced its share count by 43.8 million or 23%. That leads to an effective buyback price of approximately $178 per share. The company had 145.9 million diluted shares outstanding at the end of 2021.

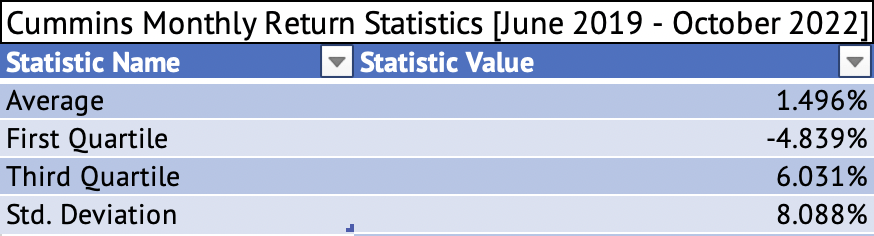

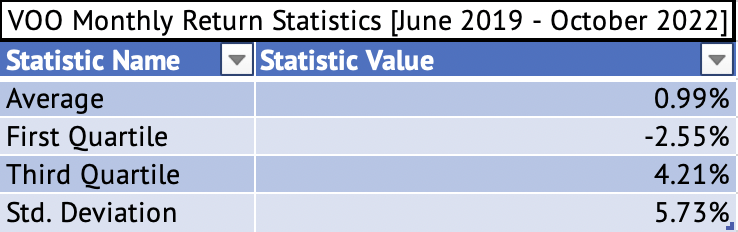

Monthly Return Analysis

Since June 2019, Cummins has had an average monthly return of 1.49% [Exhibit 3] compared to the Vanguard S&P 500 Index’s average monthly return of 0.99% [Exhibit 4]. Cummins’s first quartile monthly return [25% of the data points between June 2019 and October 2022] was negative 4.8%, while the Vanguard S&P 500 Index ETF’s first quartile return was a negative 2.5%.

Exhibit 3: Cummins Monthly Returns – Average, First Quartile, Third Quartile, and Standard Deviation

Cummins Monthly Returns – Average, First Quartile, Third Quartile, and Standard Deviation (Data Provided by IEX Cloud, Author Calculations)

Exhibit 4: Vanguard S&P 500 Index ETF (VOO) Monthly Returns – Average, First Quartile, Third Quartile, and Standard Deviation

Vanguard S&P 500 Index ETF (VOO) Monthly Returns – Average, First Quartile, Third Quartile, and Standard Deviation (Data Provided by IEX Cloud, Author Calculations)

Cummins’ third quartile [75% of the months] return was a much better 6.03% compared to the Vanguard S&P 500 Index ETF’s third quartile return of 4.2%. As investors might expect, Cummins has a higher standard deviation in returns than the well-diversified Vanguard S&P 500 Index ETF.

Cummins’ monthly returns have a very high positive correlation with the Vanguard S&P 500 Index ETF. Although in the past year, that correlation may have broken down, with Cummins returning 13.9% while the S&P 500 has lost 12.4%. If the S&P 500 has a bull run in December and into 2023, this positive correlation between the two may help Cummins generate further gains.

A linear regression analysis produced a beta of 0.99 for Cummins. Yahoo Finance has calculated a beta of 1.05. This beta value means Cummins’ monthly returns, on average, should align with the S&P 500 Index. Given this beta, Cummins may not protect a portfolio against the market’s volatility. But 2022 is an exception, with Cummins outperforming the S&P 500 Index by a wide margin. Cummins’ outperformance is due to the surprising strength in the global truck market, even in the face of high inflation, interest rates, and faltering global consumer demand and spending trends.

Cummins is Overvalued

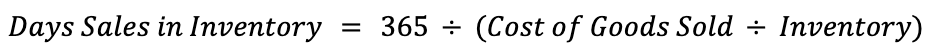

The company is overvalued, with its poor profitability showing. The company is trading at a trailing PE [GAAP] of 18.7x compared to its five-year average of 16.8x. Its forward GAAP PE is 16x compared to its five-year average of 14x. The company has high inventory levels, with 100 days of sales in inventory [Exhibit 5]. This is the highest inventory level the company has had since 2012 [Exhibit 6]. In previous years, the highest number of inventory sales in inventory was 86 days in 2021, and the lowest was 62 days in 2012. In absolute terms, inventory has increased by 27% as of Q3 FY 2022 from the end of 2021. China sees weak demand as the COVID shutdown chaos continues there. India may continue to see strong growth in 2023, but the small size of its economy’s manufacturing base may limit Cummins’s long-term growth. If the global economy slows down in 2023, Cummins might see a further impact on margins due to its high inventory levels.

Exhibit 5: The Formula for Days Sales in Inventory

The Formula for Days Sales in Inventory (Refinitiv)

Exhibit 6: Cummins Days Sales in Inventory [FY 2012-Q3 FY 2022]

Cummins Days Sales in Inventory [FY 2012-Q3 FY 2022] (Seeking Alpha, Author Calculations)![Cummins Days Sales in Inventory [FY 2012-Q3 FY 2022]](https://static.seekingalpha.com/uploads/2022/11/26/saupload_zQNag0sEkoTGc6aAW-orem6RPtITqd0c5FmKFjNENh6HV7kOEn28QCP76KhUINq28XXsbkt6Fp3ZBt4HcqW681HEEq6WmFZ6XTxvBFmKOx4ApfofR-RbnyYafdB_i_Bc_rgoUNa3qIz7eRpUl0UDO5qfovBxOp4VTShVLPlr-_I-BtMvRK3nEZneBP_BAg.png)

Conclusion

Cummins’ stock has had a good run, but there may not be much upside left. With high-interest rates and inflation slowing global growth, the company may face headwinds to revenue growth and profitability in 2023. Its high inventory levels may negatively impact the profit margins in Q4 2022 and the first half of 2023. It may be best to wait for a better entry point to buy Cummins.

Be the first to comment