Boarding1Now/iStock Editorial via Getty Images

Investment Thesis: While revenue growth has been encouraging, investors will want to see further evidence that the company can return to profitability and sustainably reduce its long-term debt.

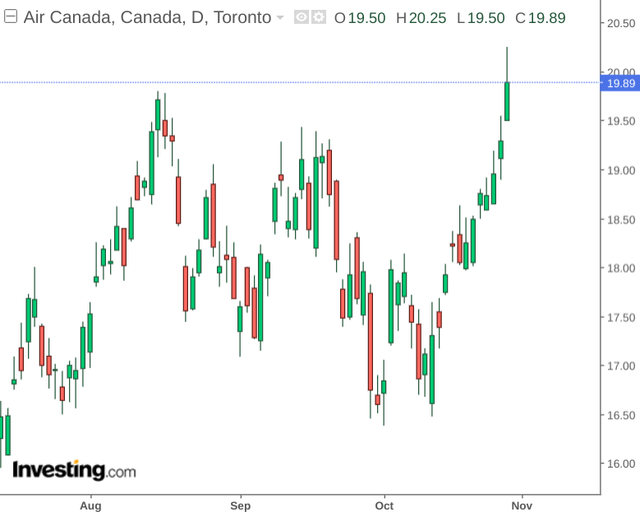

In a previous article back in August, I made the argument that Air Canada (OTCQX:ACDVF) (TSX:AC:CA) holds potential for longer-term growth, but growth in the short-term could be modest.

The market disagreed, with the stock up by nearly 10% since my last article:

The purpose of this article is to assess whether Air Canada could have scope to see further upside from here, taking recent earnings performance into account.

Performance

The most recent earnings quarter saw Air Canada achieve an operating margin of 12.1 percent – which marked the first positive quarterly operating margin since the start of the pandemic.

Operating revenues came in at $5.322 billion, which is over double that of the third quarter of 2021, along with an EBITDA margin of 19.9 percent. While the company still saw a net loss of $508 million this quarter, this was down from a net loss of $640 million in the third quarter of 2021.

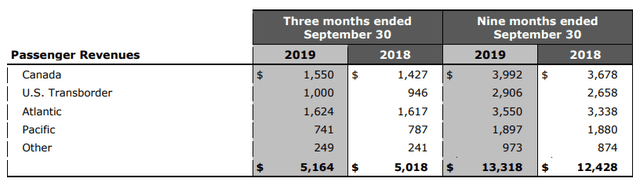

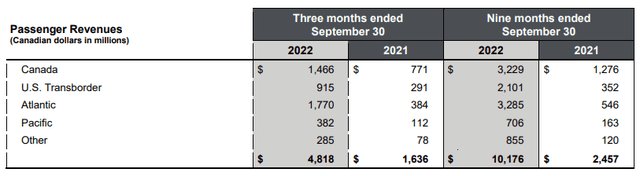

Moreover, when comparing passenger revenues across geographies – we can see that the company is starting to see revenue levels approach that of Q3 2019 once again:

Q3 2019 Passenger Revenues

Air Canada Condensed Consolidated Financial Statements and Notes Quarter 3 2019

Q3 2022 Passenger Revenues

Air Canada Condensed Consolidated Financial Statements and Notes Quarter 3 2022

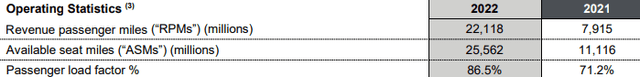

Additionally, revenue passenger miles and available seat miles are up sharply on that of last year. For Q3 2019, revenue passenger miles and available seat miles came in at CAD 27.954 billion and 32.457 billion respectively.

News Release: Air Canada Reports Third Quarter 2022 Financial Results

As such, we can also see that these metrics are making their way back towards 2019 levels.

From a balance sheet standpoint, we can see that the quick ratio (calculated as current assets less inventories all over current liabilities) has risen to above 1 – indicating that Air Canada has sufficient liquid assets to cover its current liabilities:

| September 2019 | September 2022 | |

| Total current assets | 7415 | 10195 |

| Aircraft fuel inventory | 104 | 238 |

| Spare parts and supplies inventory | 107 | 108 |

| Total current liabilities | 7838 | 9005 |

| Quick Ratio | 0.92 | 1.09 |

Source: Figures sourced from Air Canada Q3 2019 and Q3 2022 Condensed Consolidated Financial Statements and Notes. Figures provided in Canadian dollars in millions (except quick ratio). Quick ratio calculated by author.

With that being said, while Air Canada’s quick ratio has seen an improvement, the company has also seen an increase in its long-term debt to total assets:

| September 2019 | September 2022 | |

| Long-term debt and lease liabilities | 8116 | 15799 |

| Total assets | 27497 | 29754 |

| Long-term debt and lease liabilities to total assets ratio | 0.30 | 0.53 |

Source: Figures sourced from Air Canada Q3 2019 and Q3 2022 Condensed Consolidated Financial Statements and Notes. Figures provided in Canadian dollars in millions (except long-term debt and lease liabilities to total assets ratio). Long-term debt and lease liabilities to total assets ratio calculated by author.

In this regard, while the growth in revenue and short-term liquidity is encouraging, I take the view that investors will start to focus more on long-term debt metrics going forward, and look for evidence that the company can pay down long-term debt loads that were incurred during the pandemic.

Looking Forward

To date, Air Canada has clearly shown signs of recovery after travel has started to approach pre-pandemic levels once again.

While there have been concerns that inflationary pressures could keep demand lower – there has not been any particular evidence of this to date. While there could be a seasonal slowdown in revenue growth as we approach the winter months – I take the view that revenue growth still has room to run over the medium and longer-term.

As mentioned, there will come a point whereby revenue growth is no longer sufficient to appease investors, who are likely to pay more attention to whether the company can reduce its long-term debt load, which still remains elevated compared to 2019. In addition, as the company still is operating at a net loss – revenue growth will need to continue to rise significantly to return the company to profitability.

Going forward, one would like to see a reduction in long-term debt, or at least a reduction in long-term debt relative to total assets. Should we see evidence of this going forward, then I take the view that this could serve as a catalyst for upside.

Conclusion

To conclude, Air Canada has seen strong revenue growth as compared to last year. With that being said, investors will want to see further evidence that the company can return to profitability and sustainably reduce its long-term debt. As such, I take a “wait and see” approach on Air Canada at this point in time.

Be the first to comment