JuSun

Picking growth stocks with a good margin of safety and attractive starting yield is one of the biggest contributors to long-term gains. That, combined with analyzing a company’s financials and its competitive landscape, can provide insight into not only the current state of the business, but also its potential for future growth. With careful analysis, income investors can pick top stocks that have strong fundamentals and yield decent returns over time.

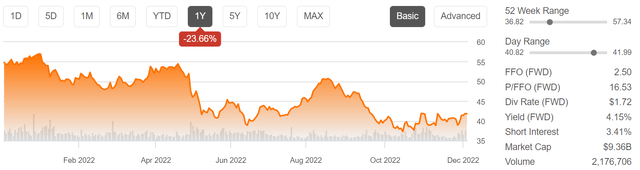

This brings me to CubeSmart (NYSE:CUBE), which now trades far closer to its 52-week low than its high of $57 achieved earlier this year. This article highlights some of the reasons why I believe CubeSmart is an excellent growth stock for investors.

Why CUBE?

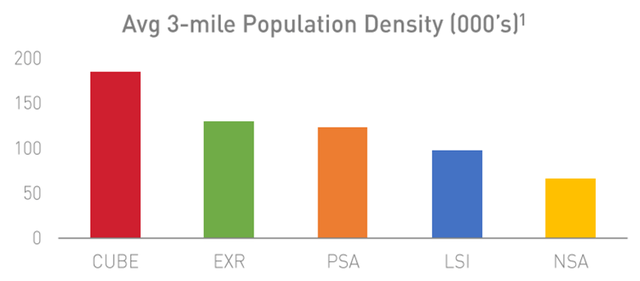

CubeSmart is one of the 3 largest publicly-traded self-storage REITs. It owns 1,274 properties across the United States. It’s broadly diversified across the U.S. with 89% of its owned store net operating income coming from top 40 metropolitan statistical areas. CUBE’s properties are generally located in population dense areas, with an average 3-mile population density near 200K. As shown below, this compares favorably to its peers, namely juggernauts Extra Space Storage (EXR) and Public Storage (PSA).

CUBE 3-Mile Density (Investor Presentation)

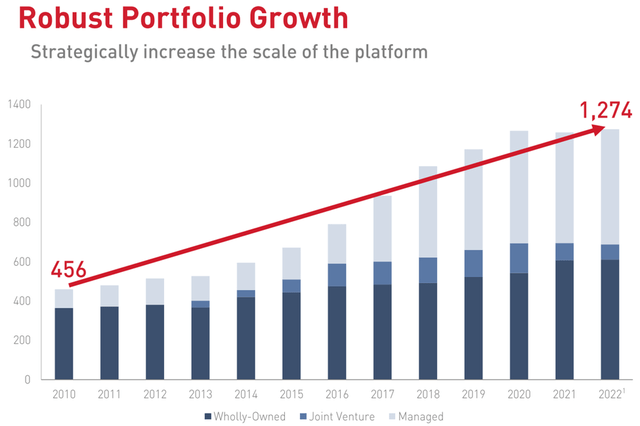

Beyond owned properties, CUBE also enjoys benefits from doing joint ventures and leveraging its third party management platform. JVs enable CUBE to participate in deals outside of its core geographies, thereby diversifying its cash flow. They also generate fees for the company and give it the opportunity to purchase the asset at the end of a holding period should it be a strategic fit.

Moreover, third party management gives CUBE a steady stream of management fees with little to no initial capital outlays. It also gives CUBE a source of acquisition pipeline through insights it generates from management of the properties. As shown below, CUBE has successfully leveraged all three strategies to substantially grow its platform over the past dozen years.

CUBE Portfolio Growth (Investor Presentation)

Meanwhile, CUBE has demonstrated robust growth, with FFO per share rising by an impressive 18% YoY to $0.66 in the third quarter. This was driven by strong occupancy of 94% and strong same-store revenue growth of 12%. At the same, CUBE is demonstrating improved operating leverage, as same-store operating expenses increased at a slower pace, at 4% YoY growth. Also encouraging, CUBE added a significant amount of third party managed stores to its platform with 39 more stores, bringing the total 3rd party managed store count to 663.

Importantly, CUBE now yields a respectable 4.1%, and the dividend is well covered by a 65% payout ratio (based on Q3 FFO per share of $0.66). This gives CUBE plenty of leeway to continue raising its dividend at a robust clip. This includes CUBE’s 11-year track record of annual raises with a 5-year dividend CAGR of 9.8%.

Notably, CUBE has both an internal source of funding through its low payout ratio and external borrowing capacity, as it has a strong BBB rated balance sheet with a low debt to EBITDA ratio of 4.4x. CUBE’s debt to gross assets stands at just 38%, and it has a very strong interest coverage ratio of 7.0x.

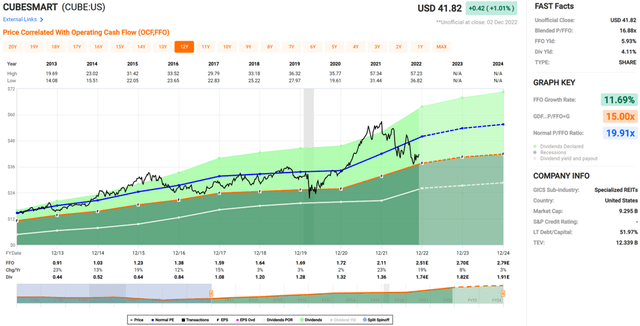

Turning to valuation, I find CUBE to be attractively priced at $41.82 with a forward P/FFO of 16.5. This is considering its strong balance sheet and strong growth profile. It also sits well below CUBE’s normal P/FFO of 19.9 over the past decade. Analysts have a consensus Buy rating on CUBE with an average price target of $49.70, equating to a potential 23% total return including dividends.

Investor Takeaway

In conclusion, I believe CubeSmart is an excellent growth stock for investors who are looking for a reliable dividend yield and potential upside. CUBE is well diversified across the U.S., has strong fundamentals, and offers a respectable dividend that is well covered by its cash flows and comes with a high growth rate. With a forward P/FFO well below historical valuations and an attractive yield, CUBE is a great choice for dividend growth investors.

Be the first to comment