Kwarkot

Investment Thesis

CTO Realty Growth, Inc. (NYSE:CTO) is a real estate investment trust (“REIT”) that deals in owning and managing a portfolio of retail-based properties mainly located in high-growth markets of the U.S. The company has recently announced the acquisition of West Broad Village, which can act as a primary catalyst to accelerate the company’s growth in the long term. It also pays a high dividend yield, making it an attractive investment opportunity for retired and risk-averse investors.

About CTO

CTO is a retail-oriented real estate investment trust. The company owns and manages 22 commercial real estate properties in 10 states across the country with the assistance of third-party property management companies. CTO mainly focuses on investing in income-producing real estate with a primary focus on multi-tenant, retail-oriented properties. The company aims to acquire income properties, primarily focusing on multi-tenants which can help it to broaden the credit base of lease tenants and facilitate its diversification geographically, mainly in the U.S. growth markets.

In addition to the income property business, the company’s business includes Management services, Commercial Loan & Master Lease Investments, and Real Estate Operations. Its management services business generates revenue by managing Alpine Income Property Trust, Inc. (PINE). As per the agreement with PINE, it earns a base management fee equal to 1.5% of PINE’s total equity. Commercial loans and Master Lease Investments mainly originate loans specifically for commercial real estate across the U.S and its territories. These loans include commercial first mortgage loans and commercial mezzanine loans. Mortgage loans are generally secured by a lien on the property, whereas mezzanine loans are secured by pledging equity ownership of the borrower in the underlying real estate property.

As of December 2021, this portfolio consisted of two commercial properties and two commercial loan investments valued at $39.1 million. The Real Estate Operations include operations such as developing Daytona beach and owning mitigation credits and subsurface interests. A significant portion of a whole city block near the International Speedway Boulevard, one of the city’s main thoroughfares, was acquired by the company for $4.1 million as part of the Daytona Beach Development, which is currently part of its portfolio. It also deals in owning mitigation credits valued at $24.7 million.

Acquisition of Virginia

According to Forbes, for the third consecutive year, grocery-anchored retail property sales in the U.S. held the second-highest share of all retail property types in 2021. This reflects the constant growth of demand for grocery-anchored retail property. Focusing on investing in such properties can be very beneficial to the companies operating in this industry.

Identifying the current market trends, the company recently announced the acquisition of West Broad Village property, a 392,000-square-foot mixed-use, grocery-anchored lifestyle property located in the submarket of Richmond, Virginia. This property acquisition deal was finalized at a purchase price of $93.9 million. The company’s current guidance for initial cash yields shows that the purchase price represents a going-in cap rate above that range. This is the company’s first investment in Virginia and Whole Foods & REI-anchored lifestyle property, which I think shows the diversification of the portfolio and strong demographics. I believe this acquisition can act as a primary catalyst to accelerate the company’s growth as this region has experienced constant population growth, which I think is one of the essential elements to look at before investing in grocery-anchored properties. This investment can generate higher incomes due to strong demographics and high quality of life in Richmond. The business policies in this area are also friendly, enabling the company to execute its future leasing plans. This high-income growth and diversified portfolio can further help CTO increase its profit margins and drive attractive stabilized cash flows.

Higher cash flows to CTO Realty Growth can help it to sustain its attractive dividend yield for a longer period. After considering all these factors, I believe this is an excellent opportunity for the company to generate higher returns from the property and maintain its long-term upside.

15.10% Dividend Yield

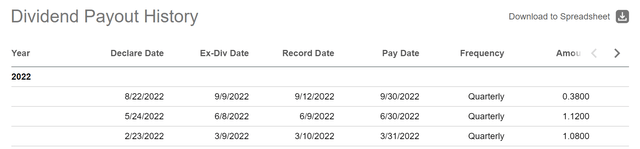

The company’s conversion to the REIT financial structure and high increase in cash flow generation have increased the company’s dividend payout since 2020. Now, it has become one of the highest dividend payers among its peers. I think the recent acquisition of West Broad Village made by the company and many other such acquisitions made during the current year can help the company to sustain this high payout. The company declared a $2.58 per share as a total dividend for common shareholders for the first three-quarters of FY2022. I am estimating the full-year dividend can be $3.00 per share, representing a dividend yield of 15.10% at the current share price levels. Looking at the dividend yield, I believe this is an attractive investment opportunity for retired and risk-averse investors seeking fixed, regular income.

Dividend Payout History of CTO (Seeking Alpha)

What is the Main Risk Faced CTO?

Dependency on the Retail Sector

The risk that influences the retail sector generally and the demand for retail space is there since a sizeable number of the buildings in CTO’s rental property portfolio are commercial assets constructed to be used by retail tenants. The weakening of the national, regional, and local economies, the level of consumer spending, the level of consumer confidence, the unfavorable financial situation of some large retailers, the periodic consolidation of operators in the retail sector, any excess of retail space in several locations, and increasing competition can affect the CTO’s portfolio. The ability of CTO’s retail tenants to produce sales in their shops and the manner prospective tenants lease space may both be dramatically impacted by the rise in consumer expenditure through e-commerce platforms. The company cannot anticipate with certainty what prospective tenants will need to run their businesses, what requirements will be made for the construction of future retail spaces, or how much money will be generated at traditional “brick and mortar” locations.

CTO invests a lot of time and money into analyzing tenant trends, preferences, and consumer spending patterns. Occupancy and rental rates may decrease if CTO fails to foresee and quickly react to market trends. The financial standing of CTO’s retail tenants and the desire of retail operators to rent space at income properties could be negatively impacted by any of the abovementioned variables. These circumstances could, in turn, have a negative impact on market rentals for retail outlets and have a material and negative impact on the company’s financial situation, operating results, cash flow, and capacity to meet debt servicing commitments and distribute profits to investors.

Valuation

The company has recently announced the acquisition of West Broad Village, which I believe can accelerate the company’s growth as a result of potential leasing opportunities in the strong demographics. After considering all these factors, I am estimating an FFO (funds from operations) per share of $1.95 for FY2023, which projects the forward P/FFO ratio at 10.18x. After comparing the forward P/FFO ratio of 10.18x with the sector median of 14.11x, I think the company is undervalued. I believe the company might gain significant momentum as a result of the recent acquisition of West Broad Village and strong demand in the retail sector.

After considering all these factors, I think CTO Realty Growth might trade above the sector median. Hence, I estimate the company might trade at a P/FFO ratio of 15.20x, giving the target price of $29.64, which is a 49.24% upside compared to the current share price of $19.86.

Conclusion

CTO Realty Growth, Inc. is a real estate investment trust which focuses on owning and managing high-quality portfolios in the U.S markets. The company’s investment portfolio is dependent on the retail sector, as a sizeable number of the buildings in CTO’s rental property portfolio are commercial assets that were constructed to be used by retail tenants. It has recently announced the acquisition of West Broad Village, which I believe can significantly help the company grow, considering the property’s strong demographics and future leasing opportunities.

After comparing the forward P/FFO ratio of 10.18x with the sector median of 14.11x, I think CTO Realty Growth is undervalued. The company pays a high dividend yield which makes it an attractive investment opportunity for retired and risk-averse investors. After considering all the above factors, I assign a buy rating for CTO Realty Growth, Inc.

Be the first to comment