Marilyn Nieves/E+ via Getty Images

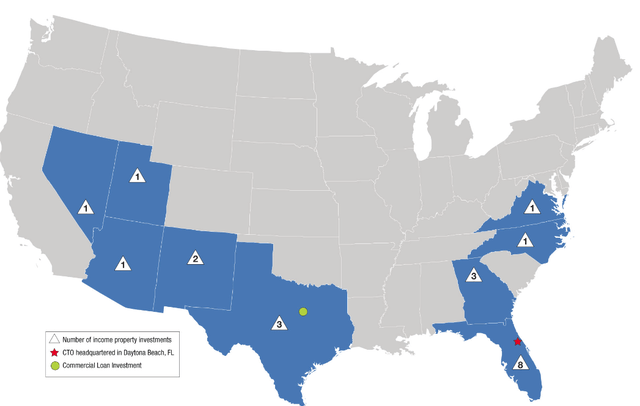

CTO Realty Growth, Inc. (NYSE:CTO) was founded in 1910 and is headquartered in Daytona Beach, Florida. While they have a long operating history, they are a newly formed real estate investment trust (“REIT”), with conversion approved in 2020 and completion in 2021. Additionally, its Board of Directors recently approved a 3 for 1 stock split, which went into effect on July 1, 2022.

Presently, the stock is trading at a post-split price of approximately $22/share, which represents a multiple of forward adjusted funds from operations (“AFFO”) of 12.50x. With just 22 retail-based properties in their portfolio, the company is smaller than most of the competition. While that may be enough for some to justify the lower multiple relative to peers, who are trading at approximately 15x, there are clear upside opportunities in CTO.

Attractive spreads between their in-place and leased occupancy levels in their larger properties provide additional runway for continued growth in net operating income (“NOI”). In addition, contributions from their largest acquisition to date, the Madison Yards, in Atlanta, GA, should begin to provide immediate benefits to rental revenues. As these gains are realized, ongoing share price repurchasing activities should preserve earnings that would have otherwise been diluted from future equity raises or common conversions.

With a dividend yield of nearly 7%, CTO offers investors the right combination of an above-average payout and share-price upside potential.

A Small Portfolio Of Properties But In All The Right Locations

CTO owns 22 retail-based properties, 14 of which are in some of the fastest growing submarkets in Florida, Texas, and Atlanta. These properties are primarily focused on both grocery-anchored and traditional/mixed-use properties.

CTO Company Website – Map of Geographic Concentration

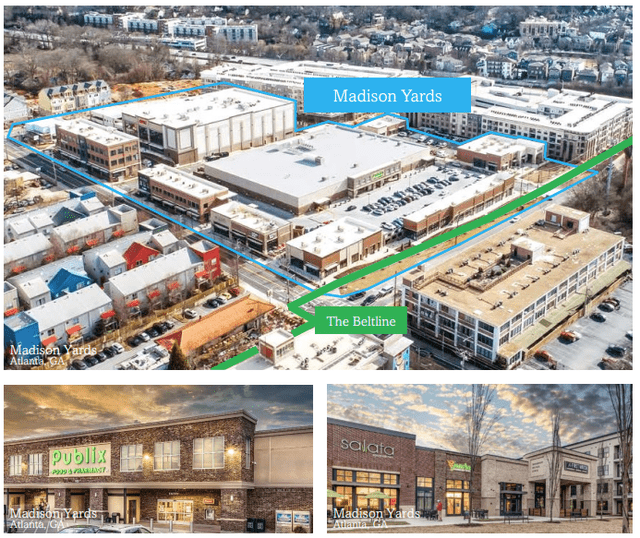

In July 2022, the company completed its largest acquisition to date, the Madison Yards in Atlanta, GA for +$80M. The Publix-anchored property is newly built, with a leased occupancy of 98%. Following the acquisition, Atlanta became the top market in the company’s portfolio, representing approximately 23% of the company’s annualized base rents (“ABR”).

With an in-place occupancy of 96%, Madison Yards is expected to immediately contribute to revenue growth. Additionally, there is 200 basis points (“bps”) of opportunity in further commencements later in the year. This should add attractive incremental benefits in later periods.

July 2022 Investor Presentation – Overview of The Newly Acquired Madison Yards Property

Aside from their core real estate properties, CTO also has a 16% stake in Alpine Income Property Trust, Inc (PINE), a publicly traded pure play net lease REIT. CTO’s earnings benefit from both the dividend payout, which brings in about +$2.5M/year, and any resulting share price appreciation. In addition, CTO receives management fees for serving as their external manager.

Furthermore, CTO also has a book of commercial loans and investments, in addition to subsurface mineral interests in the State of Florida.

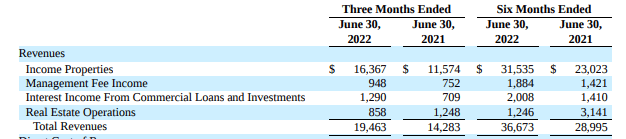

While the activity in these non-core investments is notable for reporting purposes, they still represent just a small portion of the company’s overall business. Through the first half of the year, for example, management fees and interest income represented just over 10% of total revenues. Future growth, thus, will hinge upon the expansion of their core properties and not necessarily through these other interests, which primarily serve as supplemental sources of revenue.

Q2FY22 Form 10-Q – Summary of Total Revenues

Solid Occupancy Levels With Abundant Leasing Opportunities

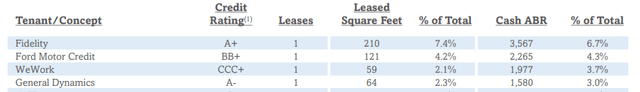

Top tenants of CTO include Fidelity, who is their single largest by ABR at 6.7% of the total, and Ford Motor Credit (F), WeWork (WE), and General Dynamics (GD). Collectively, these four tenants accounted for just over 17.5% of total ABR as of the most recent filing period. Of the four, WE is one to be the most concerned about, given their past history. But they are also one that could be readily replaced in the future, if necessary.

Q2FY22 Investor Supplement – Partial Summary of Top Tenants

Overall, the portfolio was 93.5% leased at the end of the second quarter. While most properties were over 90% leased, a few were in the 80% range. In addition, though leased occupancy was 93.5%, economic occupancy, signifying leased but not yet commenced leases, stood at 91.3%. The over 200bps gap between the two presents a favorable indication of growth in cash rents as these leases gradually come online.

In the coming periods, CTO will experience rising physical occupancy levels, especially in select properties, such as Ashford Lane in Atlanta, GA, where there is a 900bps gap between their leased rate and the actual commencement rate. Gains in this property is expected to drive NOI growth over the next 18 months.

These future gains will build on current period strength that included YOY double-digit growth in NOI, FFO, and AFFO. NOI was up 13%, excluding one-time items, while both FFO and AFFO were up an impressive 60% and 38%, respectively.

Partly driving these gains were a combination of contractual rental increases and the effects of new leases coming online during the period. CTO also benefitted from a favorable leasing environment that included the signing of over 40k square feet of new and renewal leases at spreads that were modestly higher than prior period rates.

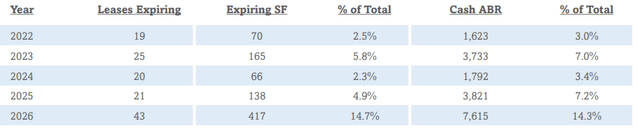

A healthy rollover schedule also provides an attractive opportunity to reset rates closer to their current weighted average rate of $31.82/square foot. In 2023, for example, 25 leases are expiring at an average price/square foot of $22.62. Even at their current average renewal rate of $29.28, this still presents an attractive mark-to-market opportunity.

Q2FY22 Investor Supplement – Lease Expiration Schedule

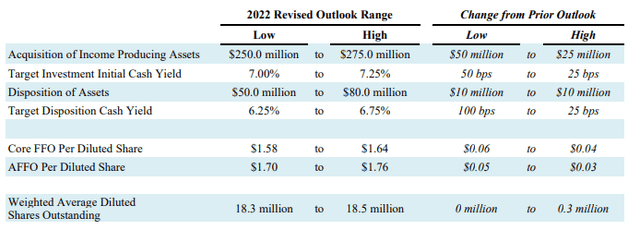

In addition to the abundant opportunities for internal growth, management still expects to opportunistically acquire additional properties to their portfolio. This is reflected in their full-year guidance, which was revised higher across the board due to their current YTD performance. Total acquisitions for the year are now expected to be +$250M at the low point, which would be +$50M higher than their prior outlook.

Q2FY22 Earnings Release – 2022 Revised Guidance

A Flexible Balance Sheet With Limited Debt-Related Risks

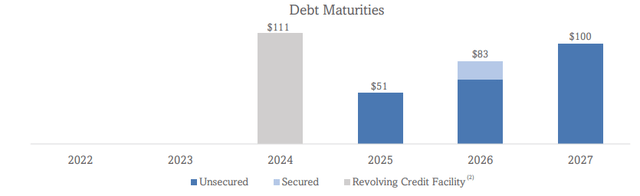

For a smaller REIT, CTO does have adequate flexibility on their balance sheet to support additional expansion activities. Their net debt multiple is on the higher side, at 6.6x, but there are no significant near-term maturities, and their exposure to variable-rate debt is minimal. Additionally, at period end, CTO had over +$100M in liquidity, which is more than enough to cover their near-medium term obligations.

Q2FY22 Investor Supplement – Debt Maturity Schedule

For income investors, an investment in CTO comes with a quarterly payout that is currently yielding nearly 7%. At an annual rate of $1.49/share, the payout is approximately 88% of the low end of forward AFFO. While that is on the high side, it is still fully covered. Additionally, the ratio is likely to improve in later periods through growth in AFFO. Though investors are unlikely to see a hike in the payout anytime soon, the current yield is still more attractive than what one could get in many other equity-based alternatives.

The Current Dividend And Share Price Upside Potential Present An Attractive Value Proposition

CTO is a newly formed REIT that is smaller in scale than most of the peer set. Their core portfolio includes just 22 properties, and their current market cap is less than +$500M. A low degree of trading volume further constrains the stock to a tight trading range. While this can be frustrating to those seeking upside, some comfort can be found in the quarterly dividend payout, which is currently yielding nearly 7% at current pricing. Though shares have yet to experience significant appreciation, that doesn’t mean they are bound to remain in their current holding pattern.

The recent large-scale acquisition of the Madison Yards property in Atlanta, GA is likely to provide accretive benefits in later periods. Attractive spreads between their in-place and leased occupancy levels in several of their top properties also provides an extended runway for NOI growth, which is already up double-digits. A healthy rollover schedule provides even more opportunities for rental growth.

These are but a few drivers that are likely to contribute to meaningful earnings growth in future periods. For those concerned about earnings dilution through equity raises or common conversions, ongoing repurchasing activity should provide the necessary preventative backstop.

At an assumed future dividend yield of 6%, shares would be worth approximately $25, which would represent a forward multiple of AFFO of 14.6x. For a smaller REIT operating in some of the fastest growing submarkets in the country with ample opportunities for internal growth, this is a reasonable multiple. With over 10% share price upside potential, in addition to an above-average dividend yield, there is an attractive value proposition in CTO for those seeking another REIT for their long-term portfolios.

Be the first to comment