Jennifer Mason/iStock via Getty Images

This is my first look at CTI BioPharma (NASDAQ:CTIC). It provides an interesting opportunity for those interested in betting on a newly approved therapy that could be a blockbuster.

In this article, I evaluate the opportunity.

CTI Biopharma has been slogging away with cancer therapies in clinical trials since 2003

Formed in 1991, as Cell Therapeutics, Inc., CTI BioPharma went public in 03/1997. It changed its name to CTI BioPharma Corp. in 05/2014.

It leaves a venerable trace of 62 diverse clinical trials on clinicaltrials.gov. going back to an initial 2003 study. This initial trial was conducted in patients with indolent (or low-grade) non-Hodgkin’s lymphoma, who had either relapsed or been refractory to previous treatment; it was designed to determine whether combining pixantrone (BBR 2778) with the monoclonal antibody rituximab, would lead to an increase in the period of patients’ remission, compared to rituximab alone.

Despite all this effort it did not hit paydirt with any therapy until the FDA approved pacritinib in 03/2022. CTI first acquired pacritinib, an oral, once-daily JAK2 inhibitor in 05/2012 from S*BIO Pte Ltd to burnish its late stage pipeline (2012 10-K, p. 2). Pacritinib had demonstrated meaningful clinical benefits and good tolerability in myelofibrosis [MF] patients in Phase 2 clinical trial.

At the time of the acquisition, CTIC was looking strong. CEO Bianco enthused:

With Pixuvri™ approaching approval and launch in the EU, and tosedostat and pacritinib entering phase 3 our late stage portfolio addresses a full complement of blood related cancers ranging from MPN to MDS, leukemia and lymphoma.

That was then. In the interim Pixuvri and tosedostat both hit the skids. Pixuvri failed a phase 3 in 07/2018. Tosedostat was removed (p. 5) from its pipeline in 11/2017. Pacritinib survived; but it took its own brickbats.

In 02/2016 it got hit with a clinical hold. The FDA was concerned about study deaths from intracranial hemorrhage, cardiac failure and cardiac arrest. It made detailed recommendations for a new study and reporting. CTI responded quickly and effectively securing a lifting of the hold the following January.

It still took more than five years to for CTI to snag its coveted FDA approval. In 02/2022:

Pacritinib (VONJO™) received accelerated approval in February 2022 for the treatment of adults with intermediate or high-risk primary or secondary (post-polycythemia vera or post-essential thrombocythemia) myelofibrosis with a platelet count below 50 x 109/L.

If CTI plays its cards just right, VONJO could become a blockbuster drug

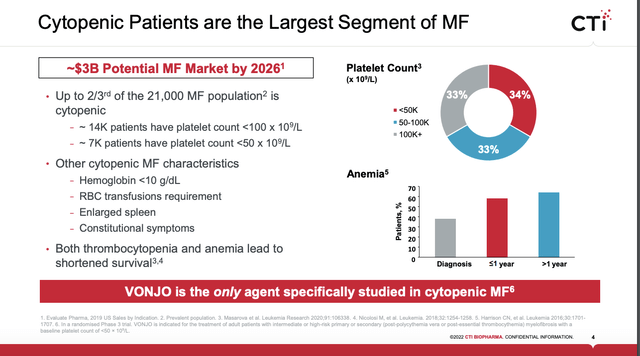

CTI has been through the ringer with VONJO as described above. For sure its approval was no small feat. CTI promptly slapped a wholesale acquisition cost of $19,500 per month on its important newly approved therapy. It soon issued a slide presentation announcing the enormous potential it visualized for VONJO including the following slide:

CTI 07/2022 presentation (investors.ctibiopharma.com)

It is exciting to see this kind of potential for VONJO. However, CTI investors dare not assume that VONJO’s blockbuster destiny is a certainty. FDA approval for VONJO is a major hurdle, it is not CTI’s only VONJO challenge.

Remember first and foremost, company presentations have a strong tendency towards optimism. VONJO has secured a nice label for treatment of cytopenic MF patients. Given its torturous path in arriving at this point as stated above one cannot disregard that its label includes the following:

This indication is approved under accelerated approval based on spleen volume reduction. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial(s).

CTI is conducting its PACIFICA trial with 2025 expected results towards fulfillment of this requirement.

Of more concern, competition in MF must be considered. Geron (GERN), a pharma I have covered extensively, has long been conducting trials in pursuit of an MF indication for its telomerase inhibitor imetelstat. Its phase 3 trial has a study completion date of 05/2024.

In 06/2022 Sierra Oncology, recently acquired by GSK plc (GSK) filed an NDA for its momelotinib in treatment of MF with the FDA. It should be announcing a PDUFA date shortly if the FDA accepts its application. Considering its competitive landscape, one analyst pegs VONJO sales at $235 million by 2027, a far cry from CTI’s goals.

CTI is all about risk with uncertain upside.

CTI’s market cap of $681.01 million, as I write midday on 07/19/2022 anticipates healthy revenue potential. If one selects a target of 3.5 X peak sales for one’s comfort zone then its current market cap would support peak sales of ~$200.

By this standard it would have a nice upside for those who peg VONJO as a potential blockbuster; not so much for those who assess its prospects at $235 million. Unfortunately, we have very little hard data to pull from. CTI’s Q1, 2022 earnings call (the “Call“) reported its early launch sales as follows:

On approval, our VONJO sale team were fully trained on the plant label, and we’re able to commercially launch VONJO within 10 days of FDA approval. The market has responded very well to launch primarily due to the fact that VONJO is highly differentiated when compared to other therapies. We are extremely proud of our progress thus far, having exceeded our internal projections with $2.5 million in net product sales in just a few weeks.

This does not tell us too terribly much. Analysts quizzed management about every little bit of color they could on this, including:

- Q. …were early patient prescriptions for VONJO, largely newly diagnosed patients or switches from those patients previously on JAK inhibitor? A. we’ve seen both in our launch;

- Q. are there any trends that you’re seeing in the breakdown between patients that have platelets below 50,000 compared to patients with platelets above 50,000; A. the newly issued National Comprehensive Cancer Network or NCCN Clinical Practice Guidelines recommend VONJO for both groups but it is too early to know how patients are breaking between the two;

- Q. is initial demand coming just from community practices versus academic institutions? A. surprisingly there is a nice balance between the two, rather than just the larger institutions;

- Q. what is the time frame from prescription to fill? A. expect 5-7 days;

- Q. elaborate on physician preference for VONJO compared to adjusting doses of ruxolitinib? A. physicians don’t like to dose modify, they are quite pleased that VONJO is just one dose for everybody.

The bottom line is that everything is peaches and cream as far as anecdotal feedback is concerned. It will take a number of quarters to generate real data as to how VONJO is faring.

From a financial perspective CTI should be OK during the initial launch. In the Call, CFO Kirske reported:

…cash and cash equivalents totaled $96.9 million as compared to $65.4 million as of December 31, 2021. The increase in cash and cash equivalents was primarily attributed to the proceeds of $60 million received from DRI Healthcare Trust under the terms of the royalty agreement.

Its royalty deal, coupled with ATM financing as needed, should give it necessary elbow room to build VONJO revenues over time. This 08/2021 deal provided potential for $135 million in financing, with $50 million in secured debt payable at closing and $60 million on FDA approval of pacritinib. The $25 million is payable based on sales milestones.

The deal’s one financial covenant requires CTI to maintain minimum liquidity during the loan term of $10 million.

Conclusion

CTI has passed one very difficult test by securing FDA approval of its MF therapy VONJO. Investors now face the long tedious process that one ought expect as its VONJO launch matures into a reliable revenue source.

I often refer to this period between approval and effective commercialization as the danger zone. Now is the time for those who feel lucky to place their bets. Investors who prefer not to rely on luck will be better served by steering clear or if they particularly like the opportunity, they should size their investment so that likely downdrafts will not be too painful.

Be the first to comment