Spencer Platt

CSX Stock Overview

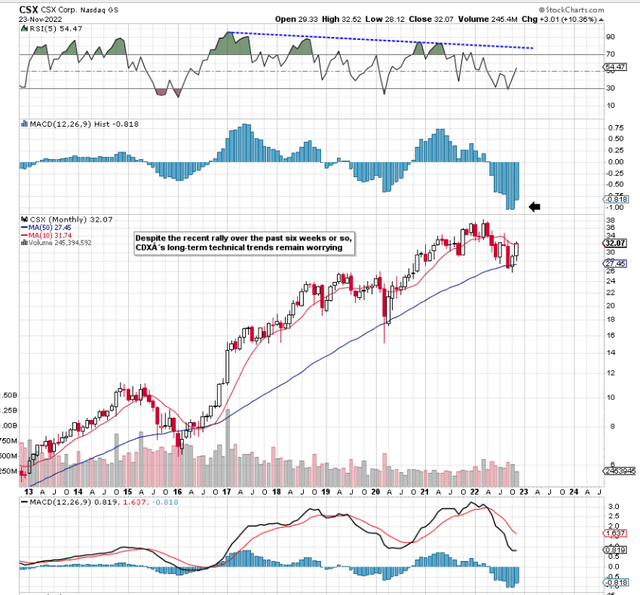

If we pull up a long-term chart of CSX Corporation (NASDAQ:CSX), we can see that the stock’s 50-month moving average successfully put a halt to selling in October of this year. We are still giving CSX the benefit of the doubt here with respect to its bull market being intact (As we would need to see the 10-month moving average break below the 50 to be long-term bearish) but there are some ominous signs that the company’s long-term bullish trend may have come to an end.

Why do we say this? Well, apart from the fact that the stock’s RSI momentum indicator has been registering a bearish divergence for many years, the aggressive down move in the share price in 2022 has been the worse for many years. We see this by means of how oversold the MACD histogram continues to be and how little the histogram has moved over the past 6 weeks or so despite the upmove in the share price.

CSX Long-Term Chart (Stockcharts.com)

Strike Negotiations

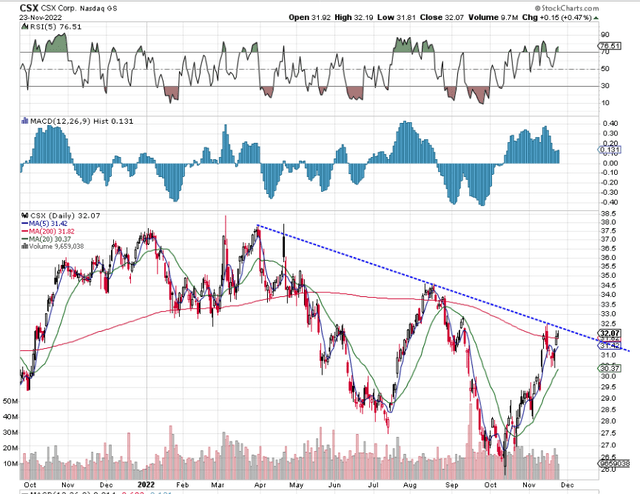

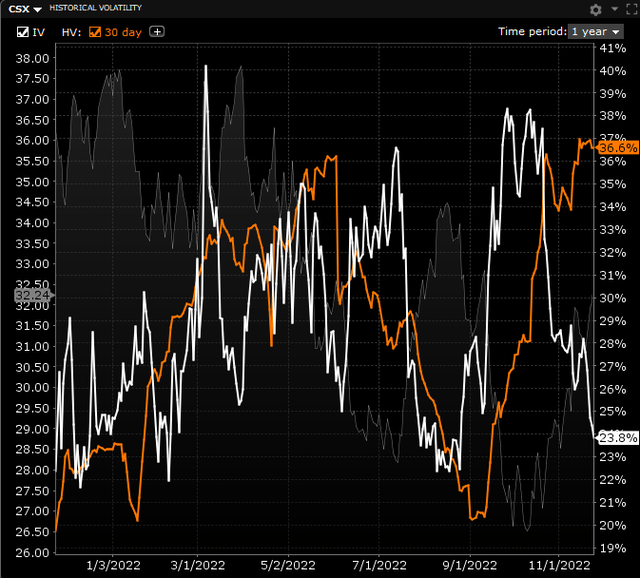

Moving on to the daily chart, we see that shares of CSX are coming up against strong resistance of both the stock’s 200-day moving average and as well as the depicted multi-month downcycle trendline. Therefore, we should know soon enough the direction of at least the short-term trend. Furthermore, implied volatility (compared to historic which creates an opportunity for option buyers) is on the low side which is surprising given the strike negotiations which are taking place in this space at the moment. The market seems to be oblivious to the risk of a rail strike this winter, a situation which has resulted in the president seemingly taking a leading role in the negotiations.

The reason for this is undoubtedly the congress “Put option” which basically means congress will ultimately intervene if the unions and railroads cannot come to an agreement. Instead of looking at the ramifications of avoiding a multiple union strike on December 9th next, the crux of the matter is that costs are going up, period. This means unless CSX can find the growth to meet these extra costs, shares will find it difficult to appreciate meaningfully in value any time soon.

Suffice it to say, these negotiations not only affect CSX but stretches to companies such as Union Pacific Corporation (UNP), Canadian Pacific Railway Limited (CP), Canadian National Railway Company (CNI) & Norfolk Southern Corporation (NSC). Rail transportation would come to a standstill in the event of a mass strike but, in my opinion, it is not going to happen. Therefore, given that IV tends to expand back towards its mean over time, we would be eyeing up something like a debit put spread if indeed shares deliver a convincing swing high to the downside (sell signal).

CSX Daily Chart (Stockcharts.com) CSX Implied Volatility V Historic (Interactive Brokers)

Growth Worries

How long we would potentially keep this position on would be determined by the company’s technicals plus the relationship between CSX’s profitability and its valuation. In the company’s recent third quarter, we saw a top-line gain of close $600 million which resulted in operating earnings rising to $1.55 billion for the quarter. Although interest expense jumped by approximately $16 million in the quarter, net profit of $1.11 billion came in almost 15% higher over the same period of 12 months prior. Q4 estimates however show an expected sequential quarterly drop in both earnings and sales for Q4 (EPS of $0.48 on sales of $3.77 billion). Obviously, fears remain regarding the higher labor costs which really ties into the inflation argument in general and how these rising costs will affect the income statement. In fact, if we span out estimates to fiscal 2023, analysts who cover CSX expect virtually no growth in either earnings or sales for the upcoming fiscal year.

Growth for us is not a huge issue if as mentioned, the relationship between the company’s valuation and cash flow stands up to scrutiny. For example, CSX’s present profitability (Confirmed by the encouraging bottom-line growth in Q3) looks in solid shape boasting the generation of over $5.5 billion in operating cash flow over the past 4 quarters and a return of equity percentage of 31.34% over the same period. However, ROE percentages can be misleading due to falling equity and that is what has been happening of late in CSX. Shareholder equity is down over $600 million since the end of fiscal 2021 with debt increasing by $1.7+ billion over the same time period.

For this very reason, CSX’s forward book multiple now comes in at 5.63 which is higher than the company’s 5-year average despite the volatility in recent months. Therefore, when we take into account that higher book multiple, CSX’s profitability and the no growth projections next year, the risk/reward play from a long-term bullish standpoint remains questionable at this present moment in time.

Conclusion

Therefore to sum up, when sizing up the ramifications of potential workers’ strike on December 9th next, investors should instead keep focused on the big picture in the railroad space. Costs are going up and unless growth is there on the other side to meet these rising costs, transportation stocks will remain under pressure for the time being. We look forward to continued coverage.

Be the first to comment