Leestat

Introduction

The last few years have been far from wonderful for the unitholders of CSI Compressco (NASDAQ:CCLP), whose unit price is barely above $1.00 and thus trading at levels that are normally associated with distressed companies or, in this case, partnerships. Even though they are far from a perfect picture of financial strength, green shoots are emerging that could see them possibly leaving the dark days behind.

Coverage Summary & Ratings

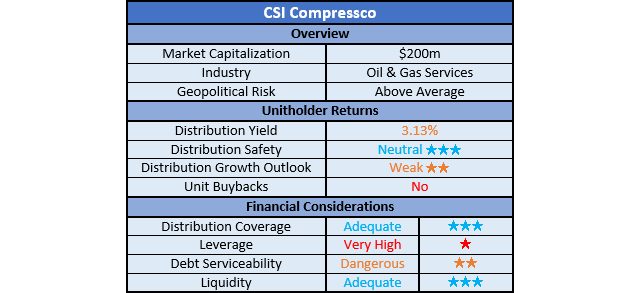

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

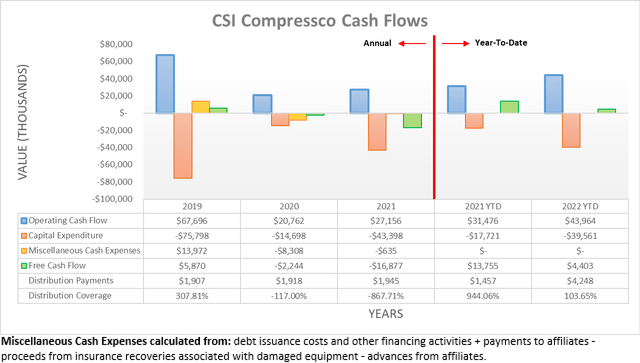

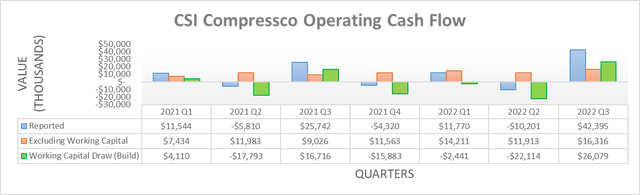

Following the severe economic downturn of 2020 and sluggish recovery during 2021 on the back of the Covid-19 pandemic, naturally their cash flow performance suffered as oil and gas companies pulled back on drilling. As a result, their operating cash flow crashed to only $20.8m during 2020 with their result of $27.2m during 2021 still far below its previous level of $67.7m during 2019. Even though the first half of 2022 was still soft at best, thankfully this appears to have improved during the third quarter, which hopefully will mark the beginning of a recovery.

When viewed on a quarterly basis, their operating cash flow of $42.4m for the third quarter of 2022 shows a large improvement versus the first half that only saw results of $11.8m and negative $10.2m during the first and second quarters respectively. In fact, the third quarter saw their best results since at least the start of 2021, not only at this reported level but also at the underlying level that excludes working capital movements, which saw a result of $16.3m. Whether this is a blimp on the radar or the beginning of a recovery can only be proven by time, although the outlook is positive following the otherwise tragic Russia-Ukraine war.

Since the implications of this pivotal geopolitical shock have already been widely discussed throughout the past half year, it would be no value to simply rehash these facts, but suffice to say, Europe now sees itself decoupling its vast natural gas supply from Russia, regardless of how the war ends. Even though this is proving painful, it creates additional medium to long-term demand for natural gas in the United States via LNG exports, which in turn creates a positive outlook for those who supply gas companies with equipment. Nevertheless, it should still be remembered there is an inherent lag between natural gas prices increasing and producers increasing drilling and thus, as a result, increasing demand for their compression equipment.

Even without any further boost, thanks to their improved operating cash flow during the first half of 2022, they finally saw adequate distribution coverage for the first time since 2019 with their payments of $4.2m funded by $4.4m of free cash flow. Whilst only a very narrow difference, hopefully this improved outlook for natural gas production will translate into higher free cash flow and thus mark an inflection point whereby they can not only cover their distributions but more importantly, begin deleveraging.

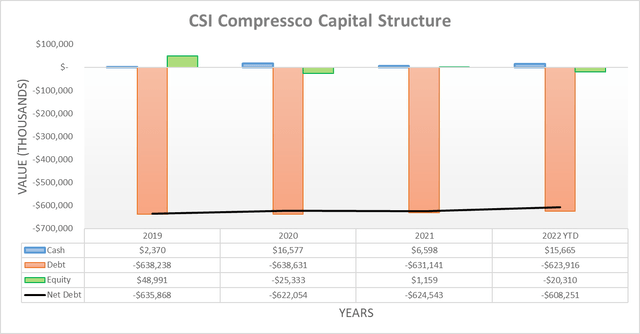

On one hand, their capital structure was remarkably stable during the past three years, despite the turbulent operating conditions. Whereas on the other hand, the extent of their overleverage starts becoming visible with their net debt at $608.3m far outstripping everything else, especially their equity that is actually a negative $20.3m. Whilst it sounds very alarming to have higher liabilities than assets, in reality, there is far more to consider when assessing leverage.

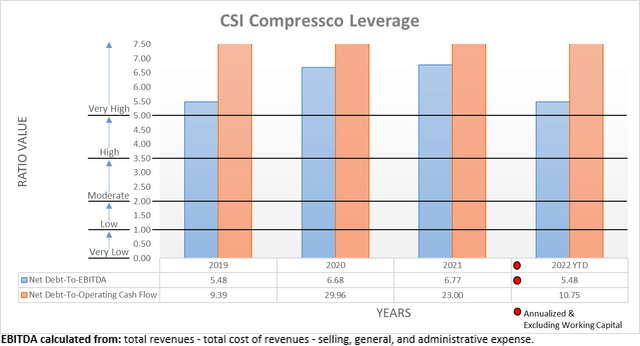

Quite unsurprisingly, their leverage when compared to their financial performance is also very high, with their net debt-to-EBITDA of 5.48 above the applicable threshold of 5.01. More worryingly, their net debt-to-operating cash flow is literally off the charts at 10.75, despite already slightly more than halving since their previous result of 23.00 at the end of 2021 on the back of their improved cash flow performance during the first nine months of 2022. In my eyes, cash is king and thus such a result is more important to watch than their accrual-based net-debt-EBITDA, although if the strong outlook for natural gas production in the United States comes to fruition, this should continue dropping rapidly as their financial performance continues improving. Furthermore, their very high leverage is anything but ideal and chokes unitholder returns, although it does not necessarily determine whether they can survive, rather it displays the amount of work ahead.

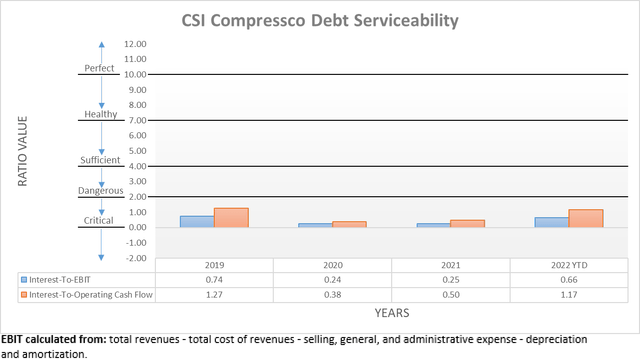

After seeing their very high leverage, it was obviously not surprising to see they are also struggling with debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. Despite the first nine months of 2022 seeing improved financial performance, their interest coverage is still dangerous regardless of whether taking an accrual or cash-based approach with results of 0.66 and 1.17 when compared against their EBIT and operating cash flow, respectively.

Herein lies the biggest problem of their overleverage because during the first nine months of 2022 their interest expense was $37.6m on an accrual basis or $23.6m if utilizing a cash-basis given the timing of payments. Even if opting for the lower of these two, it still means their accompanying operating cash flow of $44m would have been slightly more than 50% higher if not for the burden of servicing their debt, despite their cash flow performance already improving. Whilst there is not a quick solution, this stands to unlock immense potential for their unitholders because as their cash flow performance continues improving as hoped, they can repay more debt, thereby lessening this burden and generating even more free cash flow, which should create a positive feedback loop.

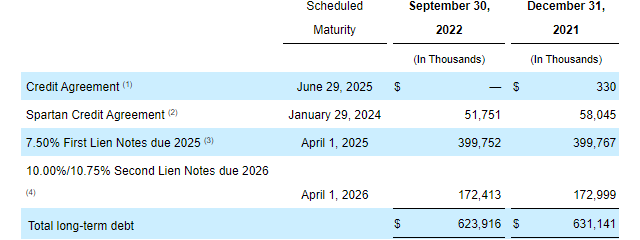

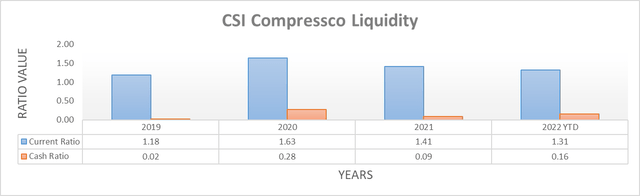

As alluded to earlier, their liquidity ultimately underscores whether they are about to crash and burn or continue fighting towards a recovery, as it assesses their ability to continue meeting liabilities and the other obligations necessary to remain a going concern. Thankfully in this regard, they are looking much better than would have otherwise been portrayed by their leverage with their current ratio and cash ratios sitting at 1.31 and 0.16 respectively. In addition, they do not face any debt maturities until January 2024 at the earliest with the bulk of their debt not maturing until April 2025 or later and thus if wrapped together, their liquidity appears adequate with years to wait for the hopefully forthcoming recovery.

CSI Compressco Q3 2022 10-Q

Conclusion

Thankfully, they do not appear to be circling the drain, despite what could otherwise be assumed if looking at their unit price. That said, they have a long road ahead to shake the burden of their overleverage and because this recovery is still just beginning, it remains too early to assess a possible timeline, but thankfully, the outlook is positive, and they appear to have a number of years. Even though I am normally hesitant about overleverage, in this situation I nevertheless believe that a buy rating is appropriate due to the positive outlook for natural gas production in the United States following the Russia-Ukraine war.

Notes: Unless specified otherwise, all figures in this article were taken from CSI Compressco’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment