Gumpanat/iStock via Getty Images

Investment thesis

Crown Holdings (NYSE:CCK) is facing two main headwinds that are having a negative impact on the company’s operations. On the one hand, a stronger dollar, whose impact is significant considering that only 36.70% of the total net sales in 2021 took place within the United States, is decreasing the dollar value of operations abroad. On the other hand, increasing energy costs in Europe are starting to be felt in the company’s operations and is a headwind that is expected to intensify in the second half of 2022. This is jeopardizing management’s plan to continue expanding through high CapEX at a time when debt costs more than $200 million in annual interests and the newly initiated dividend costs $100 million each year.

Still, it is very important not to lose the long-term vision despite recent headwinds. We are in front of a company with more than 100 years of existence, which operates in a critical industry for the day-to-day of billions of consumers around the world, which is widely diversified geographically, and whose sales are expected to grow significantly in 2022, 2023 and beyond as the industry is expected to grow at a CAGR of ~5% in the coming years. And yet, shares are trading at prices below 34.5% from all-time highs reached in March of this year due to the expected impact these headwinds, which I strongly believe are temporary as they are directly linked to the current macroeconomic landscape, will have on the balance sheet.

A brief overview of Crown Holdings

Crown Holdings is a global designer, manufacturer, and seller of packaging products for consumer goods and industrial products. It supplies the beverage and food industries by manufacturing aluminum and steel cans and supplies the metals, food and beverage, construction, agricultural, corrugated and general industries by manufacturing steel and plastic consumables and equipment, paper-based protective packaging, and plastic film consumables and equipment. Nevertheless, most of the company’s revenue comes from steel and aluminum cans for the beverage industry (and, to a lesser extent, the food industry).

The company was founded in 1892 and its market cap currently stands at $9.71 billion, employing around 26,000 workers worldwide. It operates 200 plants in 40 different countries, supplying major players in the beverage industry including Anheuser-Busch InBev (BUD), Coca-Cola (KO), Heineken (OTCQX:HEINY), Keurig Dr Pepper (KDP), Molson Coors (TAP), PepsiCo (PEP) and Refresco, among others.

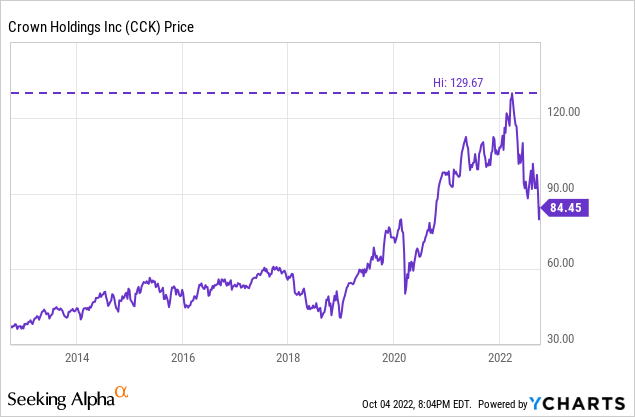

Currently, shares are trading at $84.45, which represents a 34.59% decline from all-time highs of $129.10 on March 25, 2022. The recent decline can be largely attributable to expectations of tighter profit margins in the short to medium term as a result of rising energy costs in Europe, as well as a negative impact of foreign exchange rates due to a stronger-than-usual dollar. But for long-term investors, this represents an opportunity to buy shares at a lower price and thus start averaging down from an acceptable point. In this sense, the approach that should be taken when buying Crown Holdings shares should be through a dollar-cost averaging strategy. That is because the stock price could continue to fall as the full impact that inflationary pressures will have on the balance sheet and for how long they will remain in the macroeconomic landscape is still unknown as the war between Russia and Ukraine still shows no signs of ending.

First of all, it is important to understand that the company is currently carrying a sizeable debt pile as a result of the different acquisitions that have taken place in the last decade and the continuous sizable investments that took place over the years to expand operations by building new manufacturing plants worldwide, which has allowed for increasing revenue and prepared the company to absorb part of the growing demand expected in the coming years.

Acquisitions and divestitures

In April 2014, the company acquired Mivisa Envases, a Spanish manufacturer of two- and three-piece food cans and ends generating net sales of €555 million and EBITDA of €133 million in fiscal 2013, for €1.2 billion, and almost a year later, in February 2015, it acquired Empaque, a leading Mexican manufacturer of aluminum cans and ends, bottle caps, and glass bottles for the beverage industry, employing around 1,500 workers, from Heineken for ~$1.23 billion.

In April 2018, the company acquired Signode Industrial Group Holdings, a leading global provider of transit packaging systems and solutions which operates in 40 countries and provides customers in around 60 countries, from The Carlyle Group (CG) for $3.91 billion. The newly acquired business reported $2.3 billion in net sales and $384 million of EBITDA for the trailing twelve months ended November 30, 2017.

Finally, in August 2021, the company sold its European tinplate business, which included 44 manufacturing plants in 17 European, Middle East, and African countries, although Crown Holdings still retains a 20% ownership. The business manufactures food cans and ends, aerosol cans, metal closures, and promotional packaging for various consumer brands, generating €1.9 million in annual sales and €220 million in EBITDA, and Crown Holdings used the cash to reduce its debt pile, increase capital expenditures, and buying back shares.

Net sales should keep growing in the coming years

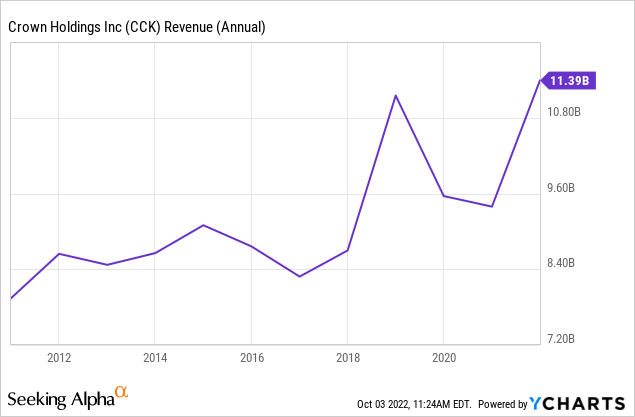

During the last decade, the company has managed to grow revenue thanks to all the acquisitions performed, as well as high investments to build new manufacturing plants and expand existing ones. Currently, a stronger US dollar is having a direct impact on the company’s net sales, limiting the growth in the last quarter. Nevertheless, net sales keep growing thanks to volume growth and increasing prices.

During the second quarter of 2022, net sales increased by 23% year over year due to increased volumes of 4% in the beverage can business and increased prices in order to pass on increased raw material and production costs to customers, raising the current trailing twelve months’ net sales to $12.65 billion, which represents a ~11% increase compared to the results of 2021. Furthermore, net sales estimates for the full 2022 stand at $13.4 billion, and $14.02 billion for 2023, which means revenue should grow by about ~11% by the end of 2023.

The global beverage cans market size is expected to grow at a CAGR of 5.1% from 2022 to 2028, and the company keeps expanding its production capacity in order to meet growing demand. In March 2022, it announced a new beverage plant in the United Kingdom, which is expected to start operating during the second quarter of 2023 and, since then, it announced it would add new high-speed lines in Italy and Spain. This news comes after announcing new plants in Brazil, Kentucky, and Virginia in 2020 and 2021.

Using 2021 as a reference, 36.70% of net sales are provided by operations within the United States, 8.19% in Brazil, 7.86% in Mexico, 6.86% in Canada, 3.62% in the United Kingdom, and 36.76% in other countries. Of these sales, it is important to point out that the beverage industry is the most significant as the America’s Beverage segment provided 38.98% of total net sales, whereas the Europe’s Beverage segment provided 16.17%, and the Asia Pacific another 11.60%. Transit Packaging provided 22.20% of total revenue, and 11.04% was provided by other operations, which include food can, aerosol can and closures businesses in North America, and beverage tooling and equipment operations in the U.S. and U.K.

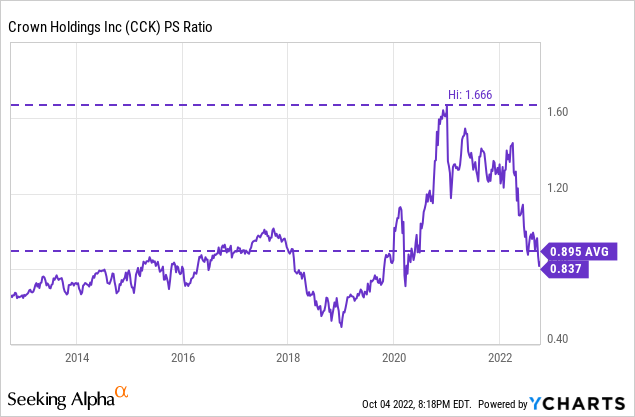

The recent decline in the share price along with increasing sales caused a steep decline in the price-to-sales ratio, which currently stands at 0.837. This means the company generates $1.19 for each dollar held in shares by investors annually. In this sense, investors are less willing to pay for the company’s sales compared to the 2020-2021 period and the first half of 2022 as the PS ratio is 49.76% below the high of 1.666 reached in January 2021 and 6.48% below the average of the last 10 years. But this decline is not due to investors expecting lower sales as the expectation is that these will actually increase at a fairly rapid rate in 2022 and 2023, but rather due to a declining ability of the company to convert these sales into actual cash as margins are declining due to inflationary pressures and are expected to keep declining in the second half of 2022.

Margins are expected to keep declining in the second half of 2022

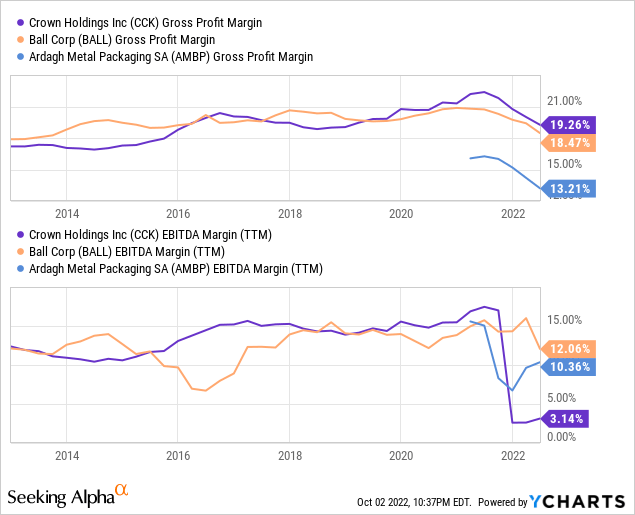

The company has managed to increase its profit margins during the last decade and managed to stabilize them at a level of over 20% in 2020 and 2021, but higher energy prices in Europe are currently limiting the company’s capacity to convert sales into actual cash. In this sense, the trailing twelve months’ gross profit margin currently stands at 19.26%, although it dropped to 18.49% during the last quarter, which is still significantly higher than the 16.67% posted by its direct competitor Ball Corporation (BALL), and much higher than the 12.59% posted by Ardagh Metal Packaging (AMBP), another beverage cans supplier. The management expects the second half of 2022 to be tougher than the first half in terms of energy prices and, therefore, profit margins are expected to continue declining, although current margins are more than enough to keep generating positive cash from operations, so the company is prepared to absorb a significant impact on margins without its long-term viability being called into question.

When it comes to the EBITDA margin, it is very important to point out that the company recorded $1.5 billion in settlement charges for its pension expenses in the fourth quarter of 2021, which caused an unusual drop in the EBITDA margin in that quarter to almost -40%, causing a significant drop in the current trailing twelve months’ EBITDA margin. In this sense, the EBITDA margin stood at 16.58% during the past quarter, which is significantly higher than the EBITDA margin of 1.43% reported by Ball Corporation and slightly lower than the 17.42% reported by Ardagh. Actually, both the EBITDA and gross profit margins are unusually high taking into account a PS ratio below 1 and expectations of growing sales, and this suggests that at least a significant part of the expected drop in margins is priced in the share price.

The downside is that the current cash on hand is very low, so a significant drop in profit margins could force the management to decrease capital expenditures and/or borrow cash in the coming quarters to overcome current inflationary and forex headwinds. Nevertheless, during the last quarter’s earnings call, CEO Tim Donahue stated that the company began a cost reduction program in the Transit focused on administrative overheads, which should help mitigate some of the impacts.

The deleveraging phase could be paused if margins decline too much

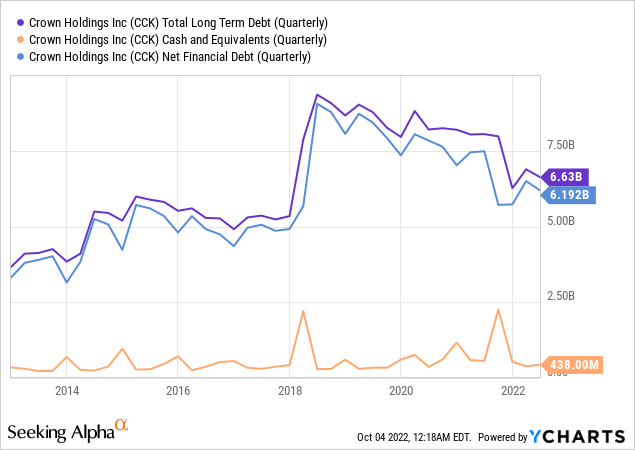

As a consequence of acquisitions, high capital expenditures for operations expansion, and share repurchases, the company’s debt pile has been accumulating during the 2010-2020 period but started to decline since then thanks to positive cash from operations and the divestiture of the European tinplate business to $6.63 billion.

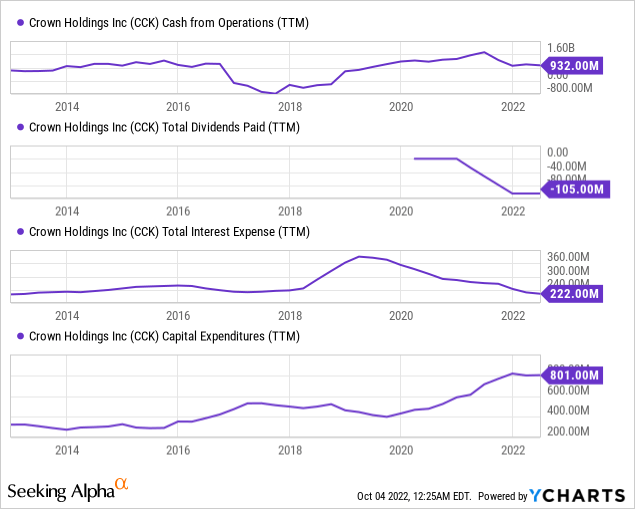

Still, this deleveraging phase, which has proved successful to date, could be paused due to the current headwinds as cash on hand currently stands at only $438 million. The company’s capital expenditures doubled since 2016 to $800 million, so the management still has a very valuable bullet in that it has where to cut in order to overcome the next quarters marked by lower margins before being forced to use debt. It is very important to note that cash from operations is currently enough to cover all the company’s expenses, so the starting point for enduring the headwinds awaiting in the coming quarters is very good.

The dividend payout ratio is very low as the company is in expansion mode

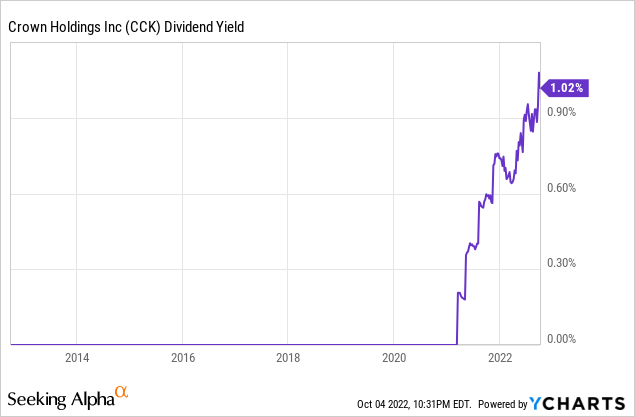

The company initiated a quarterly dividend of $0.20 per share in the first quarter of 2021 and announced a 10% raise to $0.22 per quarter in February 2022. Currently, the trailing twelve months’ total dividends paid of $105 million represents only 11% of the company’s cash from operations despite the recent decline, but interest expenses of $222 million are limiting the company’s capacity to grow them while capital expenditures of $801 million are eating up a significant portion of the rest of the cash generated as the management is strongly focused on growth.

In this sense, the dividend does not represent a significant expense and thus I believe the potential increases in the long term are enormous as such a low payout ratio is allowing for expansion through this high CAPEX. CEO Tim Donahue stated during the second quarter’s earnings call that one possibility is that capital expenditures will remain at $1 billion as a general rule (at least in 2022 and 2023) while the increased capacities would help reduce the percentage of cash from operations that this capital expense represents as revenue growth should follow, and such high capital expenditure is causing the dividend yield to be currently limited at 1.02%.

But first of all, I would like to mention that said strategy is actually very feasible with current operations’ performance as trailing twelve months’ cash from operations of $801 million does not show the increase in inventories of $705 million during the same period, although accounts payable increased by $643 million while accounts receivables only grew by $229 million. As margins decline in the coming quarters, it is possible that the management will soon be forced to temporarily lower the intensity with which new investments are being made, although it can still cut the rate at which it is buying back shares before doing so.

Share buybacks increase the size of the company that each share represents over the years

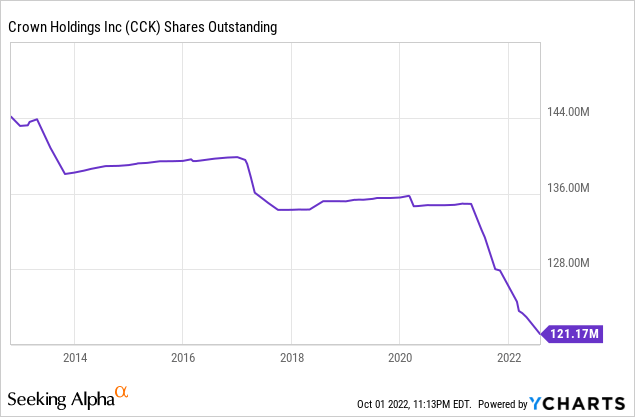

The management has a relatively aggressive buyback policy and successfully decreased the number of shares outstanding by 12.53% from 151.09 million in July 2011 to 132.16 million in July 2021, and although the decline has not been as sharp in the last 10 years as a whole, it has accelerated in the last few quarters.

In this sense, in December 2021, the management authorized a share repurchase program of up to $3 billion until 2024, for which each share of the company should represent an increasing size of the company over the years as $3 billion is almost a third of the company’s value considering the current market cap of $9.71.

Even so, share buybacks is the expense that is most in danger if the management is finally forced to cut expenses as a result of rising inflationary pressures coming from Europe in the coming quarters.

Risks worth mentioning

The current inflationary pressures are moving from raw materials to energy prices. In this sense, both aluminum and steel experienced a sharp decline in their prices in recent months, but energy prices are starting to be a new problem, especially (but not only) in Europe, where the company has operations. These pressures are expected to have a direct impact on the company’s margins, and therefore, the profitability of Crown Holdings will be limited in the coming quarters.

The increase in long-term debt during the last decade has created an interest expense that, despite having decreased to $222 million per year thanks to the deleveraging phase, continues to limit the company’s capacity to increase the dividend. If profit margins fall too low and the management doesn’t cut back where it should, debt could rise again in the coming quarters, and thus interest expenses.

Also, the current share repurchase program of up to $3 billion by 2024 represents an expense that the management could be forced to eliminate (at least temporarily) in the coming quarters if the impact of declining margins significantly reduces the cash generated through operations as a result of inflationary pressures.

And finally, as investors, it is very important to reduce risk through a dollar-cost averaging strategy as the full impact of inflationary pressures in operations is still unknown. In this sense, the price could continue to fall if the impact of rising energy prices is stronger than expected and/or the war between Ukraine and Russia lasts longer than expected.

Conclusion

Currently, the management’s plan is to stabilize CAPEX at $1 billion while continuing to pay almost $350 million in dividends and interest expenses, but rising energy prices, especially in Europe, as well as a stronger than usual dollar, could force them to lower their expectations regarding all these initiatives, and that is the reason the share price declined by 34.59% in six months. Cash from operations is enough to cover the current dividend and interest expenses very loosely, and the company still has enough surpluses to invest $800 million in CAPEX while buying back shares, but that’s all that the cash can be stretched. Once rising energy prices start to be felt in the second half of 2022, I believe the management will need to lower its expectations as investors already did.

Still, the company is a true cash cow as it generates vast amounts of cash over the years while revenue growth is high thanks to that profitability, which allows it to invest large amounts of CAPEX while reducing its debt pile. The company has been operating for over 100 years and current headwinds are temporary as they are directly linked to the current macroeconomic landscape. But still, I think that investors should invest cautiously, that is, through relatively small positions, because the price of the shares could continue to fall and the future could offer us even better prices than the current ones.

Be the first to comment