mihailomilovanovic/E+ via Getty Images

Company Overview

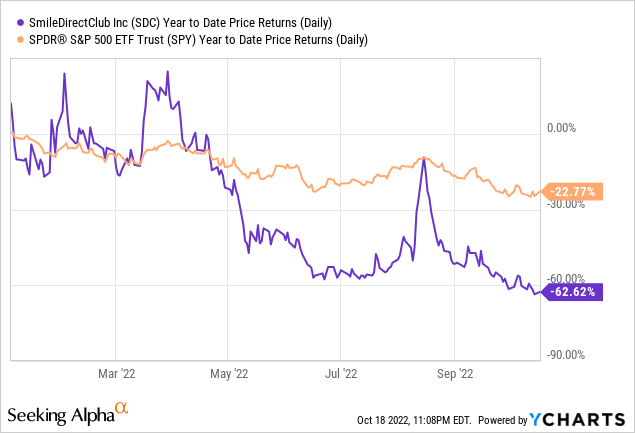

SmileDirectClub (NASDAQ:SDC) is an oral care company that offers clear aligner therapy treatment along with other dental products, such as teeth whitening and impression kits. The company was founded in 2014 and is based in Nashville, Tennessee. Since founding the company has served more than 1.5 million customers and has more than 1,000 partners around the globe to provide SmileDirectClub products. In 2019, SmileDirectClub completed its initial public offering at $23 per share at an $8.9 billion valuation. Since then, the company has seen its value disappear dramatically, and is now priced at less than $1 per share. Year-to-date, the company has lost 62% of its value since in the beginning of the year, which is around ~3x larger than the broader index. Currently, the company’s valuation stands at $335.74 million.

Poor Financial Results

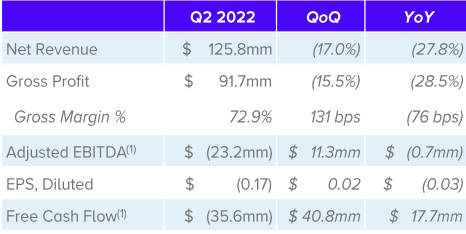

The most recent earnings in Q2 2022 has been disappointing for investors, and has shown that the company is not able to turnaround its business despite management’s claims that there is a lot of growth opportunities ahead. For a new company, top line metrics are the most important, and we’ve seen a dramatic decrease in quarterly revenue on a year-over-year basis, as the company saw a decline of 27.8% in net revenue. Bottom line metrics performed a bit better, but still deteriorated since the same quarter in 2021. For example, EPS loss widened by $0.03 and Adjusted EBITDA declined slightly by $0.7 million. We believe these negative results under the backdrop of a better macroeconomic environment than what we see today should be extremely concerning for investors.

Q2 2022 Earnings Presentation

Economic Headwinds

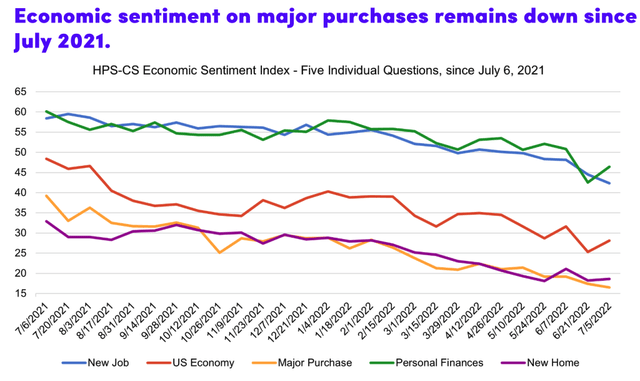

SmileDirectClub provides orthodontic services that are more discretionary than other orthodontic services as its technology and product focuses on aesthetic improvements for most part. For a product that costs over $2,000, it is reasonable to assume that the demand for the company’s product is sensitive to economic conditions, especially related to consumer spend. SmileDirectClub recognizes this and has largely attributed its poor Q2 earnings to the economic difficulties.

We don’t disagree with the company’s assessment that the economy is affecting the company’s business prospects. However, it is safe to say that economic conditions are far worse right now than it has been in Q2, which should raise the likelihood of even worse performance as the company gears up for its Q3 earnings. Since Q2 earnings were announced, the Federal Reserve has hiked rates even more, monetary conditions are tighter, and inflation is persisting higher than expected. Overall, we don’t expect any good quarters to come out of SmileDirectClub anytime soon.

Troubling Cash Burn

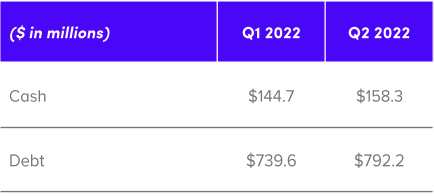

The company’s net loss of $65 million in Q2 should be a troubling trend of high cash burn and deteriorating balance sheet. On a quarter-over-quarter basis, net debt has increased from $594.9 million to $633.9 million, which presents a 7% increase in net debt at a time when interest rate expenses are rising due to the higher interest rate environment. The company proposed some strategic actions to reduce costs, such as exiting international market and reducing capex, but we believe these moves are not significant enough to stop the bleeding, and will come at the expense of its future growth potential. Management has not had a clear strategy toward sustainable growth and healthy profitability, and we believe that liquidity risk remains high as the company tries to navigate through deteriorating market conditions.

Q2 2022 Earnings Presentation

Upside Risks

High Short Float

The company has an extremely high short float of 23.30%, which raises the risk of a “short squeeze” akin to the meme stock rallies of the past. As a result, we do not recommend investors to take short positions for short-term profits as the company has an abnormally high short float ratio (usually ~10% is considered high).

Acquisition Target

There may be upside risks associated with moves by private equity firms or competitors to acquire this company for industry consolidation. Though the risk has some probability, we believe the chance is low given the poor economic conditions for M&A activity and because we believe that the company is burning too much cash and struggling on too many fronts to make the company an attractive target. The company also has $640 million in net debt, which should make the company a difficult acquisition target.

Takeaway

Based on current financial results and the worsening macroeconomic environment, we recommend a “Strong Sell” rating on the stock. The company’s stock will continue to get punished by the market as monetary conditions tighten and we don’t see any immediate catalysts to change the narrative on the company’s stock and its financial prospects. In addition, liquidity risk remains extremely high as debt mounts and access to funding becomes more limited due to the company’s fundamentals and the high interest rate environment.

Be the first to comment