KanawatTH/iStock via Getty Images

Investment Thesis

Cybersecurity threats have increased throughout the past decade, and as the world becomes even more digital, the threat of cyberattacks is only going to keep increasing. Businesses know the risks posed if their cybersecurity provider is not up to scratch, and so cybersecurity is an industry where you want to be the very best – enter, CrowdStrike Holdings, Inc. (NASDAQ:NASDAQ:CRWD).

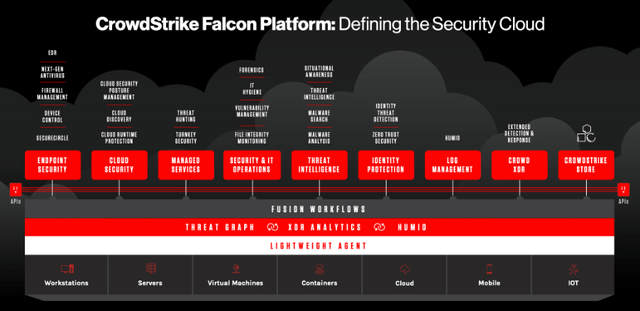

Founded in 2011, CrowdStrike is a cloud-native cybersecurity company operating a software-as-a-service business model. Due to this cloud-native approach, CrowdStrike’s core offering, the Falcon platform, has been able to scale rapidly whilst delivering impressive results that legacy players struggle to compete with.

This platform specializes in endpoint and cloud workload protection, meaning that it can protect endpoint devices (laptops, desktops, mobile phones, IoT devices, etc.) operating in both on-premise and cloud-based environments. CrowdStrike is consistently adding new solutions to the Falcon platform, giving customers an excuse to spend more and more money with this business.

CrowdStrike Q2’23 Investor Presentation

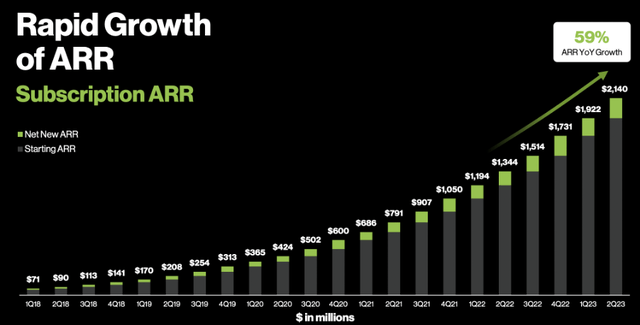

I outlined in a previous article exactly why CrowdStrike was (and still is) the highest conviction investment in my portfolio: it has powerful economic moats that will only get stronger, it is founder-led with plenty of skin-in-the-game, it has an enticing margin profile, and it is a leader in an industry that is only going to get bigger and more important. This goes some way to explaining why CrowdStrike has experienced tremendous revenue growth over the last 5 years.

CrowdStrike Q2’23 Investor Presentation

Unfortunately, when it comes to a company such as CrowdStrike, people like to talk about one thing – valuation. It is an undeniably brilliant business, but how much should you be willing to pay for a company like this?

Well, let’s just say there are many ways to judge valuation, and there are a few methods that get thrown around which, ironically, do not provide much value to investors. This often leads to the (in my view, incorrect) conclusion that CrowdStrike is ‘wildly overvalued’.

How Not To Value A ‘Growth’ Stock

I have a real pet peeve when it comes to valuations. As someone who invests primarily in ‘growth’ companies, it can often be difficult to ascertain exactly what is and what isn’t a reasonable price to pay for these businesses. It’s not like I’m buying a stable dividend paying blue-chip for which I can use my Investing 101 textbook to decide whether or not shares are intrinsically valued.

Specifically, my pet peeve is this: I’ll write a detailed article about a company, analyzing all aspects, demonstrating its quality, and offering up my valuation model, just for someone to comment on its current price-to-earnings ratio, or price-to-sales ratio & imply that it is heavily overvalued – ignoring all other aspects of the amazing company, and also often ignoring the valuation model that I include.

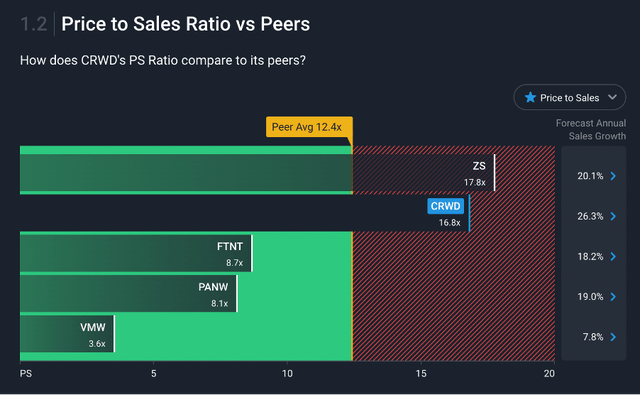

Firstly, I hate the notion of price-to-sales (or P/S) in general, because its only useful in a very limited number of situations & doesn’t take into account the margins of each individual company. I especially dislike it when I see comments like the following on a recent CrowdStrike article:

Trading at 25x forward REVENUES.

Bubble still alive and well, folks.

The main issue here is that valuing CrowdStrike on a forward P/S multiple effectively ignores any potential growth that the company will have beyond 2023. Quite frankly, the statement ‘trading at 25x forward REVENUES’ says extremely little about whether or not a company is ‘overvalued’.

The only merit I can give this statement is that CrowdStrike’s P/S is significantly higher than its industry peers, but it’s probably worth considering why. Is it because the business itself is the best in class? Is it because the growth outlook for CrowdStrike is more promising than its peers? Is it because CrowdStrike consistently beats and raises guidance? Unsurprisingly, I think ‘yes’ is an appropriate answer to all these questions.

Hopefully I’ve done enough to convince you that a simple forward P/S ratio is not an appropriate way to value a long-term investment in a business like CrowdStrike – and if I haven’t, then I hope that my own valuation model at the end of this article will.

But before that, I’ll head to the most recent CrowdStrike article on Seeking Alpha by the brilliant App Economy Insights, who stated within the article that CrowdStrike shares could at least double by the end of 2025, assuming they would trade north of 50x FCF. Let’s just say that one comment strongly disagreed:

Wow, what are you smoking?

“Simply put, I have a hard time not seeing CRWD at least double by the end of 2025, assuming it would trade north of 50 times free cash flow by then.”

50x fcf!? Even under 0% interest rates its insane, much less what we have now or in 2025

Once again, another comment seeing a large multiple & freaking out because of it – and once again, it’s worth remembering that these are only multiples at a certain point in time & as a business continues to grow (and the forward growth rates and margin expansion potential fall), these multiples naturally contract.

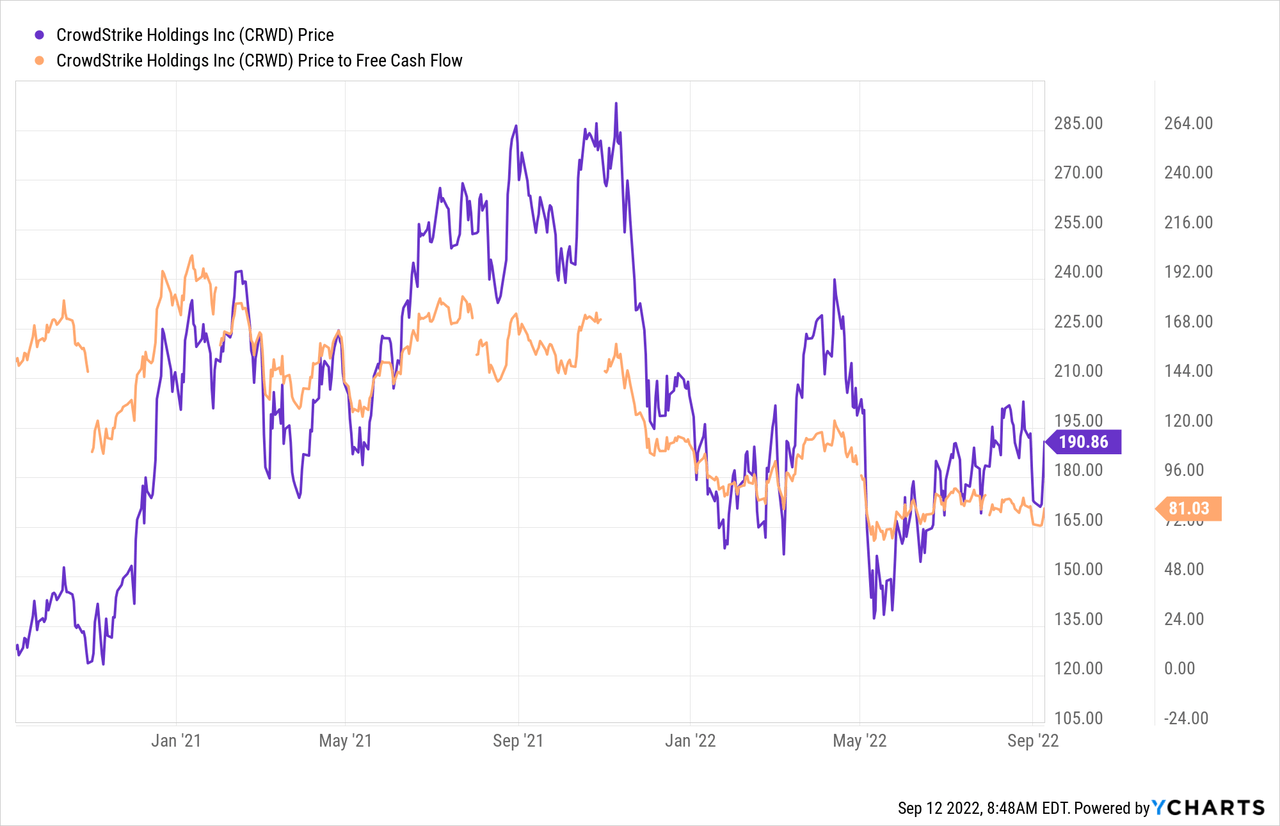

Here’s a fun fact; CrowdStrike traded for a price-to-FCF multiple of ~150x two years ago. Now I know what some of you may be thinking:

‘150x FCF?! Who on earth would pay those kind of crazy multiples?! SELL SELL SELL!!!’

Well, if you had sold (or avoided buying) because of this ‘crazy’ multiple, you would’ve missed out on a 50% gain in two years, despite the stock pulling back substantially from its recent highs.

The company now trades for a price-to-FCF of ~81x, which I’m sure is more than enough to scare some ‘value’ investors away. But understanding the basic principles of these valuations is key; CrowdStrike trades at this multiple because it is growing FCF at a rapid pace & is expected to do so for a long time, and this has to be reflected in its current share price.

CrowdStrike could not realistically trade at anything much lower. According to TIKR, analysts are expecting CrowdStrike to deliver free cash flow of $683m in FY23, a 54% YoY increase from 2022. If CrowdStrike currently traded at a ‘reasonable’ P/FCF multiple of, say, 20x right now, then that leaves two scenarios for 2023: either it continues trading at 20x, and investors see an easy 54% gain on their shares, or its P/FCF multiple falls below 20x, at which point someone with deep pockets would say “thank you very much” and acquire it.

I’ve spoken a lot about my pet peeves with some valuation methods, but it would be rich of me to criticize without demonstrating what I believe to be an appropriate way to value CrowdStrike – so, time to do just that.

CrowdStrike Valuation Model

As with all high growth, disruptive companies, valuation is tough, and this is undeniable. I believe that my approach gives me an idea about whether CrowdStrike is insanely overvalued or undervalued, but valuation is always the final thing I look at – the quality of the business itself is far more important in the long run. I hope, however, that this model should help demonstrate why a company such as CrowdStrike merits the ‘insanely high’ valuation multiples that we just saw.

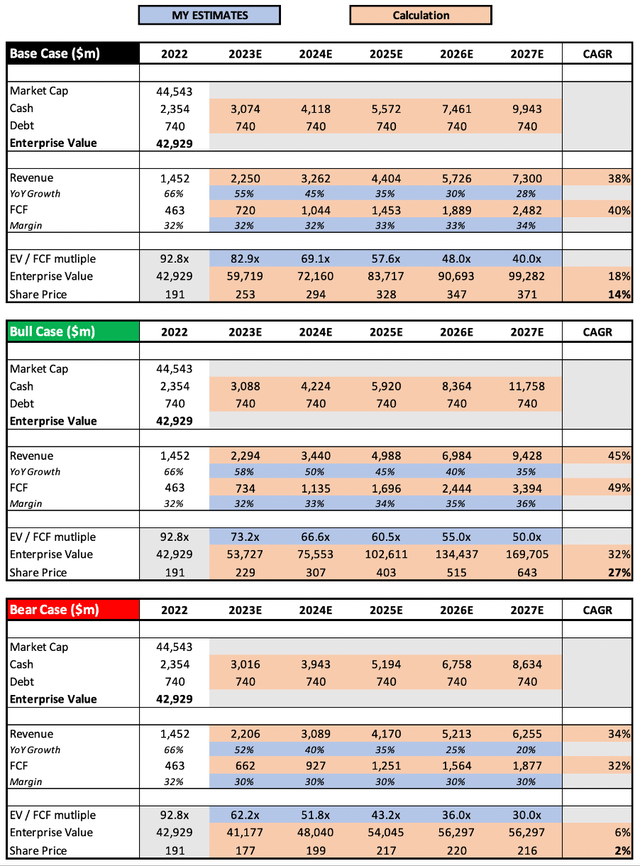

I’ll briefly outline my assumptions before giving a broader comment on valuations of companies. It’s also worth highlighting that I am more cautious with my valuation assumptions, since I’d rather see a positive future surprise than a negative one.

In my base case scenario, I assume that CrowdStrike will continue beating & raising its full year guidance (which currently sits at $2,223-$2,232m) and achieve YoY revenue growth in FY23 of ~50%. I have assumed that this growth gradually eases up to reach 28% YoY in 2027, giving a revenue CAGR over the period of 38%. I have also assumed that FCF margins will expand slightly, although they are already ahead of management’s long-term 30% target. I also assumed that shares outstanding will increase by 25% over the period, given CrowdStrike’s history of shareholder dilution, and I believe that an appropriate EV / FCF multiple in 2027 is 40x, given the continued potential for revenue growth & margin expansion from 2027 onwards.

Without going into too much detail, my bull case scenario assumes that CrowdStrike’s revenue growth does not slow down as quickly, and my bear case scenario assumes that revenue slows down at a quicker rate. This is currently a top-line growth story, so revenue growth will be the biggest driver of future shareholders returns right now. As a CrowdStrike shareholder, I would personally be expecting results to be closer to my bull case scenario.

Given all this, I can see CrowdStrike shares achieving a CAGR through to 2027 of 2%, 14%, and 27% in my respective bear, base, and bull case scenarios.

Whilst it’s nice to see these numbers, CrowdStrike’s potential share price appreciation should not be the only takeaway from this article. If you look at the base case scenario, it clearly demonstrates how multiples can contract (from 92.8x in 2022 to 40.0x in 2027) whilst the business itself grows & delivers good shareholder returns.

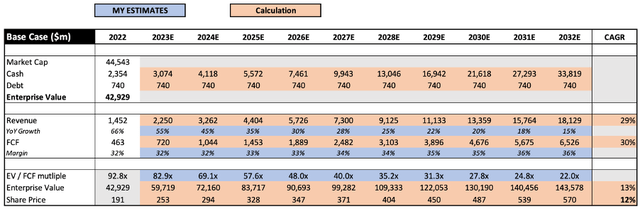

I generally don’t do a 10-year forecast, because honestly I expect companies like CrowdStrike to deliver additional revenue streams in 10 years that I couldn’t even think of right now. I will include it, however, more to demonstrate how valuation contractions work over time, which should go some way to explaining why CrowdStrike has very high multiples right now.

As you can see, the base case scenario has CrowdStrike going from an EV/FCF multiple of ~93x in FY22 to ~22x by FY32, whilst still delivering a share price CAGR of 12%.

The share price CAGR isn’t as important in this scenario (like I said, I expect that CrowdStrike will grow revenue at a faster rate by opening up more revenue opportunities over the next decade), but what is important for the purpose of this example is the trend of CrowdStrike’s EV / FCF multiple. It goes from ‘crazy’ to ‘normal’, whilst delivering a decent return to investors.

Remember, the current multiple is the market’s best estimate of a company’s future earnings & growth potential.

Bottom Line

This was a bit of a cathartic article for me to write – I’ve managed to get a lot off my chest! Hopefully, all the while I’ve also managed to demonstrate why any short-term multiple should be taken into broader context, and why simply declaring ‘25x forward revenue is too high’ or ‘50x FCF is too high’ is not an appropriate way to value ‘growth companies’, and investors could end up missing out on some of the best companies of our generation by taking this approach.

CrowdStrike was the perfect company for me to demonstrate this phenomena on, because it ticked all the boxes of being seemingly ‘overvalued’, but in reality being potentially undervalued – particularly if it delivers future results that are aligned with my bull case scenario.

Yet the most important thing to remember is that without a quality business, valuation might mean nothing. It doesn’t matter if I’m only paying 8x earnings for a company that’s about to be destroyed by the competition – 8x zero would still be zero.

Instead, investors should make sure to focus as much time as possible analyzing the company itself & ensuring that is a durable, growing, high-quality business such as CrowdStrike.

That is the key to successful long-term investing in my opinion.

Be the first to comment