megaflopp/iStock via Getty Images

Introduction

After CrossAmerica Partners (NYSE:CAPL) rolled the dice on their large 7-Eleven acquisition, they saw 2022 shaping up to be make or break for their very high distribution yield of 10.81%, as my previous article explained. Despite 2022 beginning with booming operating conditions as both wholesale fuel margins and volumes trended at near-record levels, sadly, a distribution reduction is still likely despite the extraordinary times.

Executive Summary & Ratings

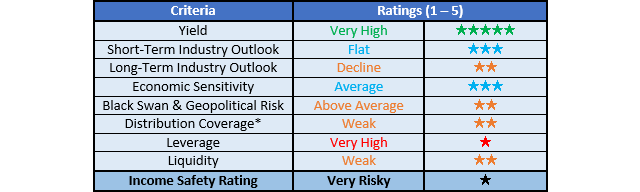

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

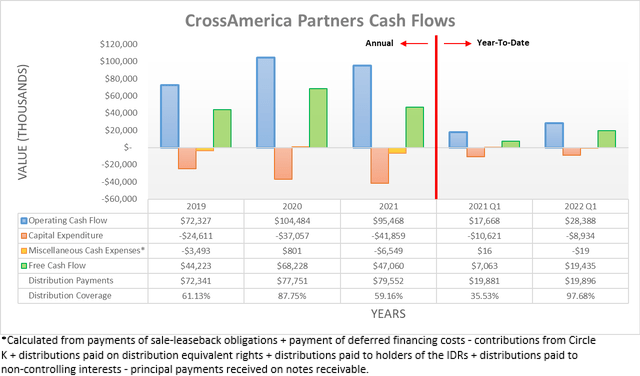

Despite seeing 2021 end with a rather murky outlook due to uncertainty surrounding the contributions from their 7-Eleven acquisition, thankfully their results for the first quarter of 2022 have been released and thus with this acquisition now largely integrated, they help provide a clearer picture. When viewing their cash flow performance, it shows that their operating cash flow increased by a very significant 60.67% year-on-year to $28.4m versus its previous result of $17.7m during the first quarter of 2021 but alas, this remains insufficient to reduce the burden of their distribution payments.

Apart from only providing weak distribution coverage of 97.68% once removing their $8.9m of capital expenditure during the first quarter of 2022, these results were materially helped by a working capital draw of $3.4m. If this were removed, it would see their underlying operating cash flow at only $25m and thus leave their distribution coverage weaker at 80.65% and thus even more reliant upon debt-funding to fill the cash burn. Since their capital expenditure is actually down 15.88% year-on-year versus its previous level of $10.6m during the first quarter of 2021 despite acquiring a vast array of new assets from 7-Eleven, their weak distribution coverage cannot simply be blamed upon growth investments.

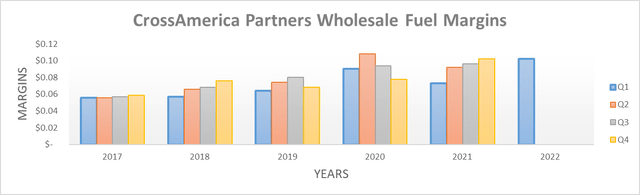

When conducting the previous analysis, it was hoped that their 7-Eleven acquisition would finally put an end to this cash burn but sadly, this has not been the case, which is especially disappointing because it coincides with booming operating conditions within the refined product market. This resulted in the near-record wholesale fuel margins from the fourth quarter of 2021 continuing into the first quarter of 2022, as the graph included below displays.

It can be seen that their wholesale fuel margin of $0.102 during the first quarter of 2022 is a near-record during the past five years with only their result of $0.108 during the second quarter of 2020 coming in higher. Obviously, higher wholesale fuel margins help their financial performance, although normally they are offset by lower volumes due to demand destruction, thereby broadly netting out but interestingly, this dynamic appears not to have been forthcoming during the first quarter of 2022 to any significant extent, thereby making for extraordinary times. Unfortunately, their 7-Eleven acquisition skews the comparison of their results year-on-year but thankfully those of their closest peer, Sunoco (SUN), can still be utilized to estimate a relative change given the commodity nature of their industry. These show that during the first quarter of 2022, their volumes were effectively unchanged year-on-year with 1,769 million gallons versus 1,756 million gallons during the first quarter of 2021, as per Sunoco Q1 2022 8-K.

Whilst the lack of demand destruction during the first quarter of 2022 may sound positive, it actually makes their inability to provide adequate distribution coverage even more disappointing since these results likely represent some of the best that investors can realistically hope to see, let alone be sustained well into the future. Given the prospects of a recession looming as the Federal Reserve pushes interest rates higher at the fastest pace in decades that should dent demand, thereby lowering either volumes or wholesale fuel margins, these booming operating conditions are likely to end quite soon.

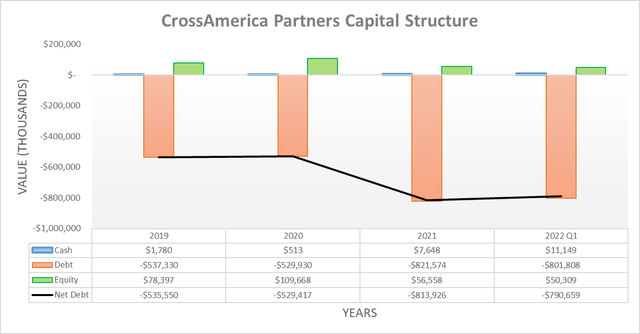

Despite their continued cash burn to fund their oversized distribution payments throughout the first quarter of 2022, their net debt still declined from $813.9m at the end of 2021 to now land slightly lower at $790.7m. Rather unsurprisingly, this stemmed from $1.5m of divestitures and even more importantly, a further $25m preferred equity issuance of which they received $24.5m net of related expenses. Whilst not a massive difference, these new units are entitled to a 9% distribution yield that will consume a further $2.25m per annum of their cash inflows going forwards. Thereby making them a particularly expensive way to reduce their net debt but as subsequently discussed, the impact has only been marginal.

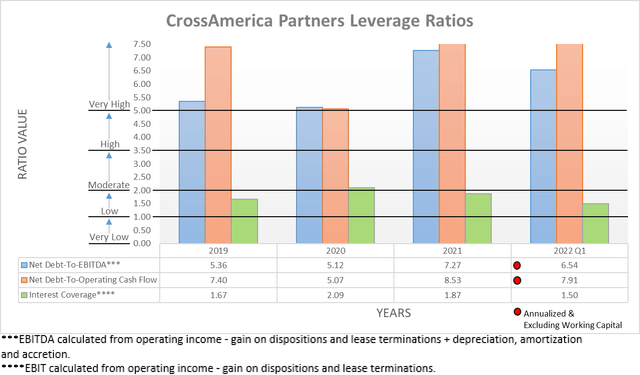

Thanks to their stronger financial performance during the first quarter of 2022 and slightly lower net debt, their leverage declined in tandem. Despite the positive direction, it still remains well into the very high territory given both of their results are still well above the applicable threshold of 5.01 with their respective net debt-to-EBITDA and net debt-to-operating cash flow decreasing to 6.54 and 7.91 versus their previous respective results of 7.27 and 8.53 at the end of 2021. This follows the same trend seen during the fourth quarter of 2021 that was driven by the integration of their 7-Eleven acquisition, as my previous analysis discussed.

When looking ahead, this positive trend is unlikely to continue now that their 7-Eleven acquisition is largely integrated and as previously discussed, their booming wholesale fuel margins are unlikely to continue well into the future. This means that unless they keep issuing more preferred equity, their deleveraging will cease in the best scenario, if not actually reverse given the continued cash burn to fund their oversized distribution payments.

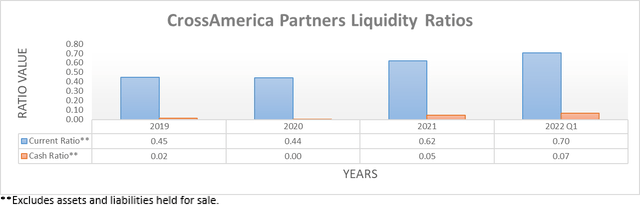

Whilst their liquidity once again appears to have improved on the surface, this only tells a fraction of the story. Despite their respective current and cash ratios improving to 0.70 and 0.07 versus their previous respective results of 0.62 and 0.05 at the end of 2021, their liquidity remains weak given the only minimal improvements to the leverage ratio limit for their credit facility covenant, as per the commentary from management included below.

“Our blended aggregate leverage ratio would be around 4.9 times, compared to approximately 5.1 times at the end of the fourth quarter of 2021.”

– CrossAmerica Partners Q1 2022 Conference Call.

Whilst this nevertheless represents an improvement, it remains only small and was also helped along by their preferred equity issuance and thus not necessarily fundamental improvements that can be steadily replicated without imposing further costs upon their already strained cash inflows. There are several moving parts to this situation with the most important being that following the 30th of September 2022, the leverage ratio limit for their credit facility covenant reverts down to only 4.75 and thus below their current result of 4.90. Following the previously discussed outlook for their broader leverage, it seems highly questionable this is achievable so quickly even if achieved, whether it can be sustained once their net debt starts climbing higher on the back of the cash burn to fund their oversized distribution payments.

Since they would have to see their leverage ratio not just meet this limit but at least fall slightly below to sustain their distributions, it makes a reduction likely within the coming months. If interested in further details regarding their liquidity and credit facility covenant please refer to my previously linked article because little appears to have changed since publication.

Conclusion

Even if these booming operating conditions were sustained forever, their distributions would still be oversized, thereby leaving them very risky with the end of the third quarter of 2022 sitting on the horizon as a deadline given their credit facility covenant that will likely see a reduction. Following this analysis, it should not be surprising that I continue believing my hold rating to be appropriate once again.

Notes: Unless specified otherwise, all figures in this article were taken from CrossAmerica Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment