Fototocam/iStock via Getty Images

In the face of rising interest rates and stagflation, luxury retail might be one of the last places investors would generally look. Yet that is exactly what I am going to propose as I lay out my investing thesis for Crocs, Inc. (NASDAQ:CROX). Crocs, Inc. manufactures and markets a unique brand of clogs and sandals, and in the lines that follow I will lay out why I believe that the stock is bargain-priced even if the footwear is not.

Recent Market Dynamics

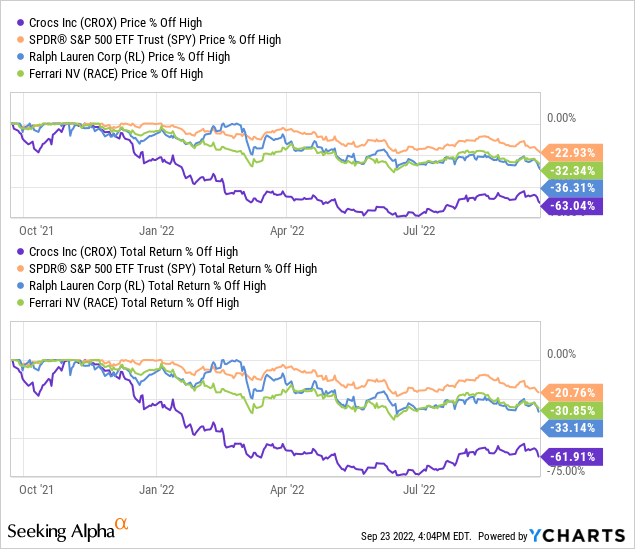

It is no secret that the market has not been kind to investors in the last 12 months. As the graph below shows, the overall market is down 23% in the last year. High-end brands in all industries have suffered a steeper decline. Crocs stock has been hammered disproportionately, suffering a decline three times as severe as the overall market.

Market Performance of Selected Luxury Brands in Multiple Industries

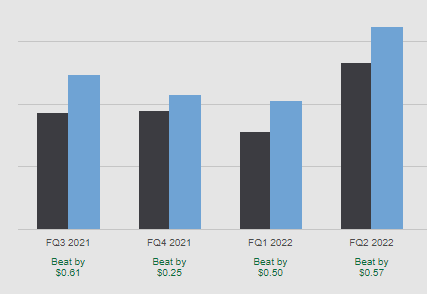

The interesting part is that this dramatic price drop has come at a time of stellar operating performance. In fact, the company has exceeded earnings expectations in each of the last four quarters. While one might comment that the overall market has declined, I’ll reiterate that Crocs, Inc. has dropped three times as much.

And, not only has the legacy company consistently exceeded expectations, the acquisition of HEYDUDE has done so as well. When the HEYDUDE acquisition closed, the management estimated the acquisition would add $645,000 to revenue this year. Just six months later, CEO Andrew Rees adjusted that estimate to almost $1 billion.

CROCS Recent Earnings History (Seeking Alpha)

A Stable Market

There will always be twice as many shoes as people (if you don’t count what’s in closets) so you can be sure that the overall market for footwear will remain relatively stable. You can look at that as a positive or negative, but what it really means is Job 1 for the company is to maintain market share. With the increasing brand awareness, innovative marketing, and the acquisition of HEYDUDE, I don’t think that will be a problem in the foreseeable future.

HEYDUDE provides an interesting dynamic in the current economic environment. The target market for HEYDUDE is teens and maybe college-age kids and while we, as adults, may not be terribly familiar with the company, the target demographic certainly is. According to a recent Piper Sandler survey, HEYDUDE has risen from a ranking of 54 to a current spot in the “top ten” when teens were asked to name their favorite shoe brand.

In addition, it is worth noting that the teen demographic does not participate much in economic slowdowns. I’ve worked in schools for 31 years, and it is extremely common to see teens come to school with better cars than their teachers and to see economically challenged teens wearing $150 Nikes and buying $6 caffeinated beverages.

Profitability and Valuation

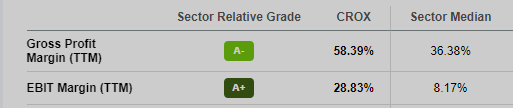

The Seeking Alpha Quant Ratings show very impressive profitability metrics and while freight costs and currency rates are providing some headwinds, Crocs, Inc. is still kicking out profitability numbers comfortably above the sector median.

Profitability Metrics for Crocs, Inc. (Seeking Alpha)

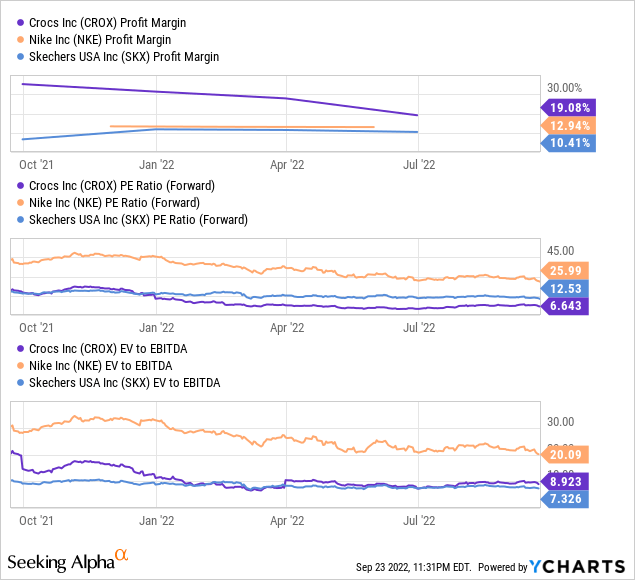

The chart below backs up those numbers and shows Crocs’ profitability metrics to be almost twice that of other footwear companies shown. Obviously, a lot of that has to do with pricing power. Crocs has a unique niche in the footwear industry and has developed a very loyal and growing following. A high emphasis on digital sales continues to keep costs under control, and endorsements from celebrities like Post Malone and Ruby Rose continue to grow the brand. By embracing its unique style, even when being chided for it, Crocs has not only remained relevant but become a household name.

Profit and Valuation Metrics from Well-Known Footwear Companies

From a valuation perspective, the stock looks even better. The company’s Forward PE ratio comes in well less than half the ratio of other footwear stocks and if you consider Price/Cash Flow as a more telling metrics, the story remains the same. Crocs, Inc. sports a Price/Free Cash Flow ratio of 12 compared to 23 for Steve Madden (SHOO) and numbers in the mid-30s for Nike (NKE) and Skechers (SKX). The only metric where Crocs, Inc. does not come out on top is EV/EBITDA, where Skechers shows more value. That is understandable with the recent debt taken on in the HEYDUDE acquisition.

Skin in the Game

Personally, I am more interested in insider buying than insider selling numbers with a publicly traded company. Insider selling often is simply a function of liquidating personal money as stock options mature. Insider buying, especially open market buys, does get my attention. To that end, Crocs, Inc. insiders have purchased over $4 million of their own stock over the past year. The most interesting buyer is Chairman Thomas Smach who bought over a million dollars’ worth of Crox stock at a price of $86/share. That means he likely believes the stock is at least 30% undervalued at its current price. I personally have skin in the game as well. I was lucky enough to initiate a position at $55.10/share and CROX currently represents 13% of my personal portfolio.

Price Point Variety

While the price of Crocs sandals or clogs can be as high as $100, which seems high for casual footwear, you can also get a pair for under $25 if you so desire. This variety of price points allows almost anyone to have access. This is an anecdotal truth. As I was writing this, I saw two 12-year-old kids playing football in clogs in the street right in front of my window. The image and marketing efforts are paying off for Crocs as middle school, high school and college students are making up a big part of the loyal following and will likely be repeat customers for years to come.

Catalysts and Risks

In my mind, there are two obvious catalysts for price appreciation. The first one is the compressed valuation. If Crocs, Inc. would move toward a valuation more in line with the sector median, that alone would account for about a 30% increase in the stock price. The second catalyst is continued growth. This company is still in high growth mode and the acquisition of HEYDUDE, which grew revenues by 96% YOY, is certainly an important part of that growth story.

And there are risks. Right now, Crocs has a compressed valuation. The pessimism is likely due to investor sentiment that the loyal following will be somewhat of a flash in the pan and will soon wane. There is also concern about margin compression going forward, as the company currently has above-average pricing power and brand loyalty that has led to industry-leading margins.

Final Thoughts

As you can tell by now, I am a CROX bull. I do expect modest margin compression over the next few years, but that is more than offset by the unusually low valuation. The company has consistently beat expectations and has ambitious plans going forward. The 11 analysts recognized by Seeking Alpha are expecting a 3-5 year earnings growth rate of 21%, which is about double the sector average. Strong growth combined with a compressed valuation is a great recipe for a winning investment.

While I don’t expect the stock to return to its 52-week high of $183 anytime soon, I would be surprised if this ambitious overachiever did not touch $95 sometime in the next two years. A price target of $95 implies a very modest PE of 9.4 while still providing investors a return of 42.4%. The price at the time of this writing is $66.71, and I wholeheartedly recommend this stock as a buy anywhere under $75.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition, which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment