© Reuters.

By Liz Moyer

Investing.com — Stocks fell on Thursday in another good news is bad news scenario for investors.

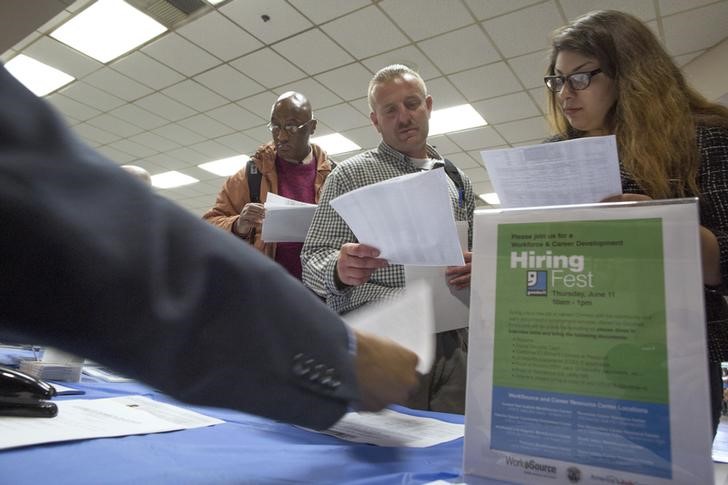

ADP’s data was stronger than expected, and were lower than expected. That is good for workers, but investors interpreted the trend as encouraging the Federal Reserve to keep interest rates higher for longer. The Fed wants to tame interest rates, and it needs to cool the labor market in the process.

The data sets up Friday’s report on jobs from the government, which is a broader reading than just private payrolls. The Fed will be looking at the numbers to judge whether the tight labor market is showing signs of softening. It already expects the unemployment rate, which has hovered around 3.7% recently, to rise this year as economic conditions weaken.

The Fed meets again in February and is another quarter of a percentage point, which is a slower pace than at its previous meetings. But Fed officials have been talking this week about targeting a higher than initially forecast terminal rate this year as interest rates remain elevated. Investors have been hoping for signs that the Fed would pause or pivot sooner rather than later.

Friday data also includes readings on the services sector and factory orders. Next week, the latest slug of inflation data is due out.

Here are three things that could affect markets tomorrow:

1. Jobs report

December’s report is expected to show the economy added 200,000 jobs last month, which would be slower than the 263,000 added in November. The is expected to remain at 3.7%, and analysts will be watching for the labor participation rate. The data are due out at 8:30 ET (13:30 GMT).

2. Services data

The is due out at 10:00 ET, and analysts expect December’s reading to be 55 versus the 56.5 reported for the prior month.

3. Factory orders

for November are due out at 10:00 ET, as well. Analysts expect a decline of 0.8% compared with the 1% gain in the prior reading. That would be the first negative reading since July.

Be the first to comment