WHPics/iStock via Getty Images

Company Overview:

Crocs (NASDAQ:CROX) is a footwear business, manufacturing casual lifestyle shoes for the masses. The majority of its products are made using their proprietary Croslite technology, which allows for extreme comfort in use.

As per Crocs’ website, they sell the following products (as well as heels for women and Jibbitz).

Crocs style options (Crocs website)

Jibbitz are little accessories which are attached to the holes in the clogs. Several years ago, Crocs acquired the business and it has been a resounding success, especially with younger people.

The bulk of Crocs’ revenue and notoriety is derived from their “clogs”, which is pictured above. There are few people in the western world who have not seen the famous… or infamous clogs. As the renowned Marmite slogan states “You either love it or hate it”.

Recent Updates:

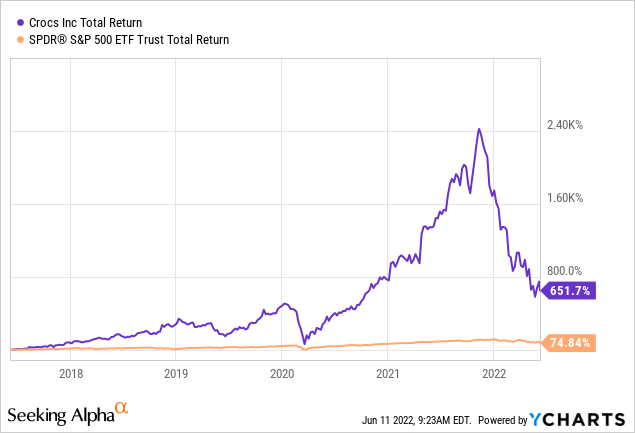

Crocs’ share price has been quite volatile recently, as the below shows.

The surge we see from 2018 onward was on the back of a spectacular turnaround under Andrew Rees, who joined Crocs in 2014 (and became CEO in 2017). At the time, Crocs was loss making and seemed to be on its way to a slow death. Several years later, with a focused strategy in full force, he returned profitability and strong growth.

What also catches the eye is the c.70% fall from the Dec-21 high. In December, Crocs announced the acquisition of privately-held footwear business HEYDUDE, financed with 80% cash (via debt issuance) and 20% share issue. Naturally, shareholders and markets were spooked. Heavy dilution and a crippled balance sheet to acquire a business no one has heard of seemed absurd. Alongside this, investors began to question the sustainability of Crocs’ brand and growth with inflation ahead, potentially believing a repeat of 2012-2015 was on the cards.

Investment Thesis:

Based on the limited facts so far: many people dislike the clogs, the share price has collapsed, the balance sheet is a mess, market sentiment is bearish, economic conditions will impede growth and Crocs have overpaid for an unknown brand. This would suggest a sell and yet I will attempt to convince you otherwise.

When we look beneath the surface, this looks to us like a fantastic business. Crocs is incredibly profitable and HEYDUDE is only going to improve that. When we look at Crocs’ KPIs against its peers, it’s almost as if Crocs is in a different industry. It outperforms to a level rarely seen between peers.

We believe economic conditions act as noise to distract investors from the underlying business. Yes, they will negatively impact the business, it is inevitable, but Crocs is well positioned to navigate what is ahead and is entering its own period of expansion and growth.

We think this is a spectacularly managed business, which has invested in itself aggressively. Although many investors have run for the hills, we have faith (backed by fundamentals) on the exciting future ahead. We thus rate this stock a buy.

Sector analysis:

Crocs is a small fish within the wider global footwear market, which is valued at over $384.2BN. The casual footwear segment specifically is forecast to grow at a respectable 2.3% CAGR, this will be led by the developing world, China, and the US.

This growth is nothing to be blown away by, but we must remember the bulk of footwear sales are replacement purchases. This is not Crocs’ primary sales, the business is still growing its customer base aggressively, alongside repeat customers. Our expectation would be for Crocs to outgrow the market as a whole into the medium term, given the total addressable market remaining.

Crocs’ management have done a good job of positioning themselves for this future growth, their marketing efforts in the Asian Pacific region seems to have paid off. Current Q1 2022 revenue breaks down as follows.

| Source: Q1 22 Investor Deck | 660.1 | 100% |

| Region: | Revenue ($M): | Percentage: |

| North America | 319.5 | 48.4% |

| Asia Pacific | 95.8 | 14.5% |

| Europe, ME, Africa, LatAm | 129.9 | 19.7% |

| HEYDUDE | 114.9 | 17.4% |

The fashion industry is not just about numbers. One of the biggest drivers of sales is trends and these can be quite unpredictable. The general consensus is that if you want to succeed in the fashion industry, you must either remain trendy (which for many involves copying designs of others) or serve a specific need. Research has shown that brand value within the fashion industry is actually very low, this goes against our instinct when we look at brands like Zara and Louis Vuitton, which have been around for decades.

Crocs has been on both sides of this. In 2010, TIME ranked Crocs as one of the worst inventions. This was a reflection of what many people, arguably the majority, thought. In Crocs Q3 investor presentation, management stated that they were still fighting against this negative perception. The surprising thing with Crocs is, this likely helped the brand. From 2009 to 2014. Crocs grew at a CAGR of 16.6%. Crocs did this by offering function, function which superseded any opinions regarding looks. Those who Crocs targeted did not care about what they looked like or the opinions of others.

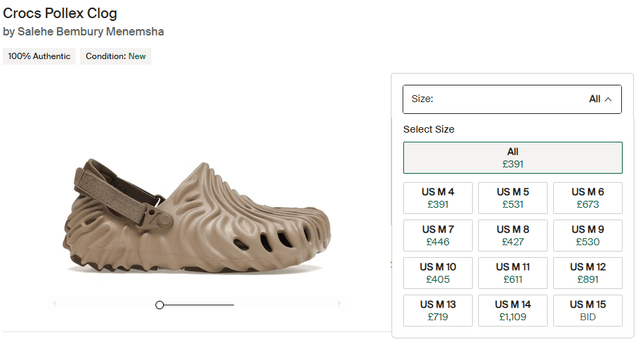

Over a decade later, Crocs is now cool. As an example, the following clog sold out immediately for $85 and is reselling for a pretty penny.

Crocs x Salehe Bembury resell price (StockX)

This is not me nitpicking either, a quick peruse around StockX will show many Crocs trading above their retail price.

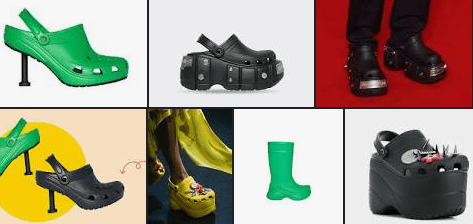

The Wall Street answer for how this has occurred will include phrases such as “targeted marketing”, “strong market research and understanding”. The reality however is cyclical trends. Ugly is the new hype. We only need to look at Balenciaga (OTCPK:PPRUF), which is currently the most popular fashion brand in the world. Balenciaga has spent the last few years selling (and selling out of) what is perceived to be ugly designs, headed by Demna Gvasalia, who was a big driver of the ‘ugly’ trend with his brand Vetements. The two brands acknowledged each other’s contribution to this trend with the following collaboration.

Balenciaga x Crocs collab (Google Images)

The key here, long-term, is that Crocs are actually functional. As people wear them, they will understand why a decade earlier people were so crazy for them. This is why hype is short lived, but I think Crocs can come out of it with a genuine global foothold in the footwear market. During the last 3 years, Crocs has grown its top-line revenue by 28.6%.

Therefore, Crocs represents an interesting outlier in the fashion industry. When it was ridiculed and ‘out-of-fashion’ it grew revenue well and had a loyal fan base. Now, when it is at the forefront of trends, it is growing at an even greater quantum. This suggests, at least to some extent, Crocs is insulted from changing trends.

Economic considerations:

Crocs’ performance is highly correlated to the economic condition of the countries it trades in.

Inflation:

High inflation across the western world persists. The Bank of England believes it could peak around 10% this year in the UK, before decelerating in 2023. Forecasts are similar for the US and Europe. This is problematic for Crocs as costs will increase, both personnel and production, which will reduce margins. To combat this, businesses can increase prices, based on the knowledge they will net benefit from pricing out some customers. Crocs went down this route. The initial impact is as follows.

| Margin: | Q1 2022: | Q1 2021: | % change: |

|

Adj. Gross Profit |

53.9% | 55.2% | (1.3%) |

| Adj. Operating Profit | 26.6% | 27.3% | (0.7%) |

Source: Investor deck

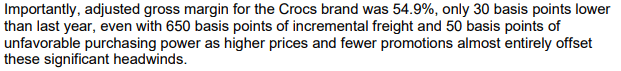

Q1 22 numbers include HEYDUDE and so is not entirely like-for-like. That said, we can clearly see the impact on Crocs has not been material. As management explains, the price increase has allowed them to offset the majority of the impact on gross profit margins.

Investor Transcript (Q1 22) (Crocs)

Thus, inflation has had a minimal impact on Crocs’ financials. Of course, in a low inflation environment, Crocs could experience margin expansion, but given the situation, performance has been good.

Interest rates:

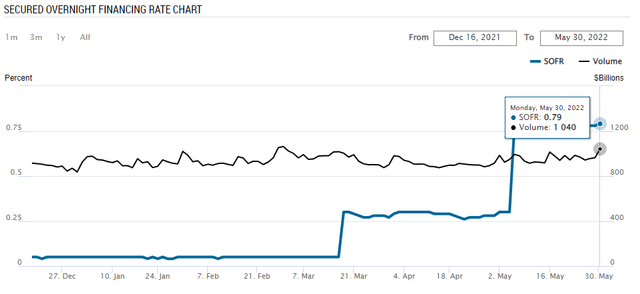

As mentioned previously, Crocs took on a sizable amount of debt to finance the HEYDUDE transaction. The terms of the loan is 3.5% + SOFR (0.5% floor). The change in SOFR since the investment can be found below.

Secured Overnight Financing Rate – Dec21 to date (New York Fed)

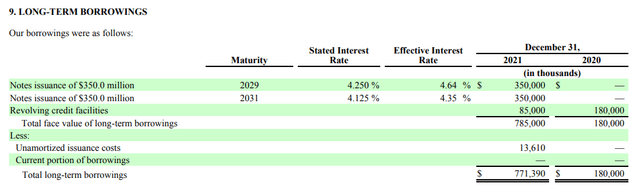

With further rate hikes expected during the year, it is likely Crocs will be paying at least 4.25% for the rest of the financial year. With the loan officially drawn on the 17th of February, this would suggest c.$73M in interest payment by year end. Further, Crocs already has c. 770M of long-term debt on its balance sheet.

Crocs 2021 Financial Statement Excerpt (Crocs)

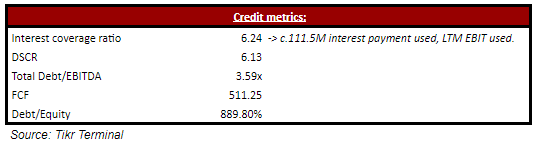

Once we include this also, our expected interest payments increase to c.$111.5M.

Credit analysis (Tikr Terminal)

This interest expense is an expected figure based on today’s SOFR. It will certainly change but we are using it for the sake of a debt analysis now.

This gives us an interest coverage ratio of 6.24x. As a risk-averse investor, I would be looking for 2.5-4x at least, with comfort over forecast EBIT. In the case of Crocs, forecast EBIT is 26.6% higher than LTM, meaning coverage of c.8x. Q1 2022 numbers suggest this is possible, meaning 2022 downside EBIT will likely still be greater than 2021.

In the private debt space, a debt/EBITDA ratio of 3.59x is very good. Assuming a healthy FCF-generative business, there would be no concern.

The debt/equity percentage is clearly too high currently as the business is highly levered. Management have paused share buybacks and will now pursue an aggressive strategy of deleveraging, benefiting from the free-cash flow generation. Given the low credit risk, we are comfortable watching this play out.

Therefore, we believe the market’s fear around leveraging is overblown. Crocs can comfortably service its debts at current levels, with no growth required.

GDP:

Negative GDP growth in Q1 2022 has spooked capital markets. Many believe inflation is partially contributing to slowing economic growth, as consumers have less discretionary income to spend. Further, with capital markets stagnating since Q3 2021, wealth driven investment and consumption is believed to have slowed. When we look beyond the top-line numbers, things are less clear.

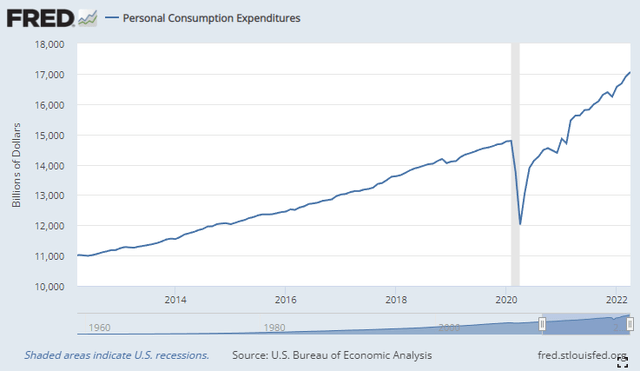

Personal consumption remains strong and has shown no evidence of slowing. The post-COVID binge is long gone, we cannot apply that lazy categorization. The reality is, if we are headed for a recession, someone forgot to tell consumers.

Personal Consumption Expenditure (FRED)

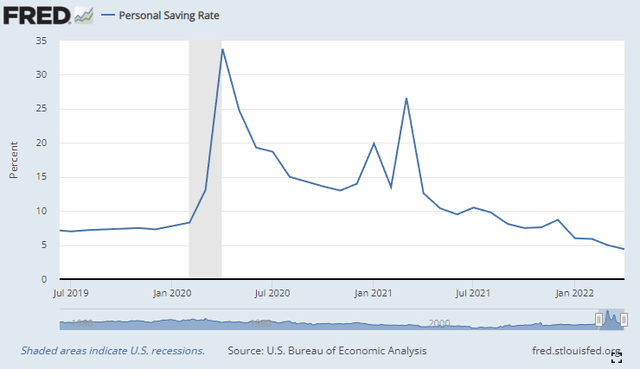

Personal savings supports this, with a very clear trend. At this rate, we will see strong consumer spending growth for the year. GDP is not just made up of consumption, but it is the majority contributor.

Personal Saving Rate (FRED)

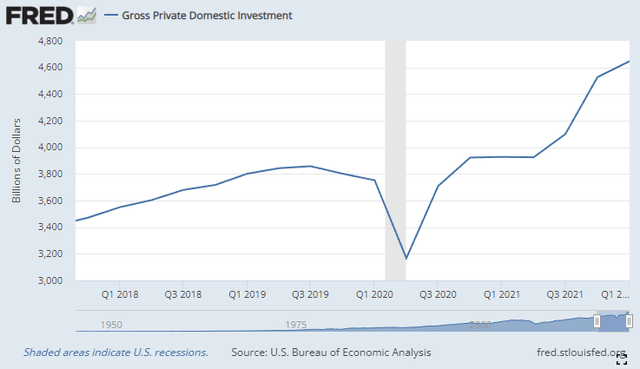

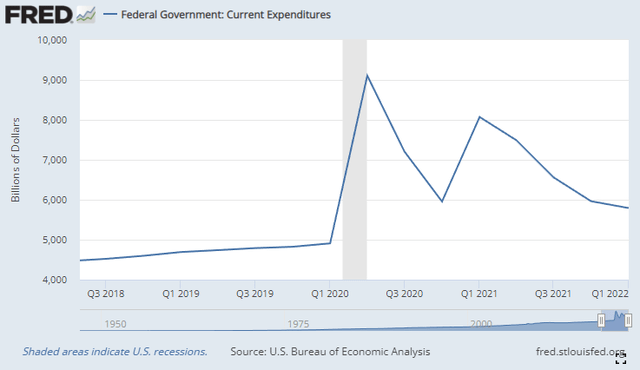

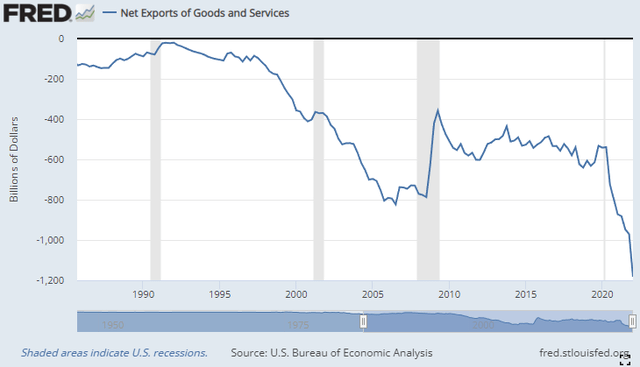

I will not break down every component of GDP individually when graphs can do the talking for me. As the following shows, this dip in GDP may be as a result of a sharp increase in imports, which align with the over-consumption that we are seeing domestically.

Gross Private Domestic Investment (FRED)

Government Expenditure (FRED)

Net Export (FRED)

I do not write this to say that a recession is impossible but rather that consumption specifically is strong and is not the reason for the dip in GDP. With savings continuing to trend down, the likelihood is that consumption will continue.

Financials:

As the following shows, Crocs is a beat machine.

Crocs – EPS estimate v. actual (Seeking Alpha)

Q2 2022 was no different. Revenue was up 47% against PY and adjusted diluted EPS was up 38%. What is extremely positive to see is the growth across the board, every product line is growing strongly. Even HEYDUDE, which is likely still in the integration phase, has beat.

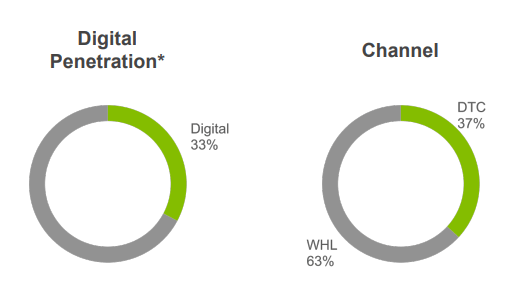

DTC Digital sales have grown 23% v. PY. I have highlighted this metric specifically as it is one of the best ways for businesses to grow organically. DTC means greater margins, as there are no third-parties, and also reduces their reliance on any one retailer. Historically, this has been incredibly difficult for fashion brands to execute, as their retailers control consumer traffic. In recent years, only Nike and LV have successfully pursued this strategy. The fact Crocs is growing at such a rate suggests they too can control the production-to-sale process.

Digital penetration and sales channel (Crocs)

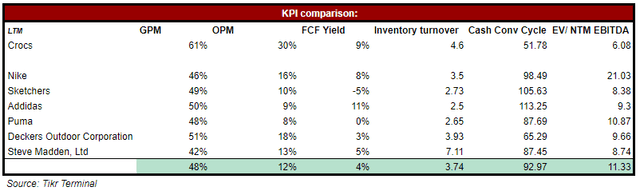

Finally, I want to highlight Crocs’ margins. The business is incredibly profitable and blows its peers out the water.

KPI comparison to peers (Tikr Terminal)

This shows the unique nature of Crocs’ products and the lack of penetration from its competitors into its niche. Crocs can demand a premium to standard sandals, due to the superiority of its products. Equally, the manufacturing of its footwear is simpler given its nature.

HEYDUDE:

Markets are not convinced with the HEYDUDE acquisition. I will be honest; I have not heard of the business either. That does not mean it is a bad investment, however. If we agree that most of us do not understand this business, let’s focus on what we can understand, numbers.

During Q1 2022, HEYDUDE achieved an Adj. gross profit margin of 49.9% and adj. operating margin of 37.9%. This is quite fantastic for what is seemingly a growing business. Importantly, this is accretive on the bottom line of the group.

Furthermore, HEYDUDE ranks 9th in Piper Sandler’s Spring 2022 and generates 95% of its revenues from the US. The brand’s key demographic is young people in the US, with specific strengths in the Midwest and southern US. This explains the lack of awareness by many investors. The research suggests the brand has fairly good credibility, which will allow it to generate comfortable organic growth. This said, Crocs’ management have acknowledged the brand has a long way to go and intend to increase its brand awareness, leveraging the Crocs model. The real potential of HEYDUDE is here, the margins will allow for aggressive marketing, but the marketing must be effective. Crocs has an impressive track record.

An additional revenue stream also reduces the reliance on clogs to generate revenue, although we are comfortable with its long-term prospects, this provides protection against any unexpected negative events related to the clogs line.

Therefore, on paper this acquisition looks great. Many businesses have paid more just for HEYDUDE’s growth, the fact that the margins are so impressive is a bonus. With Crocs support in marketing, production, and overseas expansion, I can see HEYDUDE continuing its aggressive growth and reflecting in positive EPS for the group.

Valuation:

With the shares so depressed and sentiment low, we believe the valuation will inevitably be significantly higher than it is currently trading. We have valued the business on a NTM EV/EBITDA model, to reflect the full-year impact of HEYDUDE. As well as a DCF valuation.

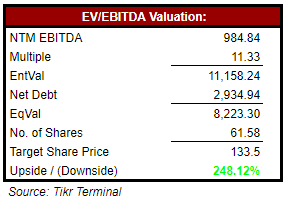

NTM EV/EBITDA:

Market-based valuation (Tikr Terminal)

We have applied a 11.33x multiple, representing the average of Crocs’ peers. Given Crocs’ superior margins, this is certainly a prudent approach. Based on this valuation, we find an upside of 248%.

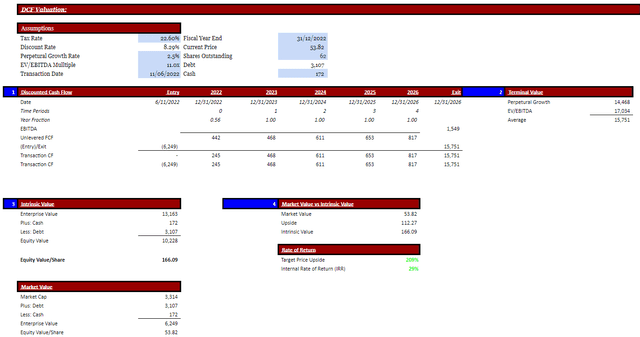

DCF valuation:

DCF Valuation (Author’s own calculation)

I have assumed aggressive investment into marketing in 2022 and 2023 so as to accelerate HEYDUDE and Crocs further, with the pay-off in free cash flow coming from 2024 onward.

This suggests a valuation of $166.09, based on a blend between perpetual growth and market-based exit.

Regardless of method used, the upside potential of Crocs is impressive and is a reflection of the astronomical fall in share price we have witnessed.

Key investment risks:

Through this paper, I have made the bad seem not so bad and the good look great. There are genuine risks with this investment. Those include:

- Deleveraging – Crocs rightfully intends to aggressively deleverage. Should demand dip, it is possible that this is slowed. Should this occur, the businesses’ ability to invest in growth will be hamstrung.

- HEYDUDE failing – There is the possibility that the combination of the two businesses and instilling of Crocs’ management causes a destabilizing effect on HEYDUDE.

- Hype comes to an end – The counter argument is that once Crocs’ hype dies down, so will its growth. This is certainly possible, and a re-rating of demand could see several years of negative growth.

- China – China represented both a great opportunity and now a risk. Much of the recent growth in the fashion industry has come from China and Crocs has not fully capitalized on this. With structural issues beginning to show in China, the ship may have sailed for Crocs.

Final Thoughts:

At the start of this paper, I listed several reasons why Crocs’ share price has fallen by the magnitude it has. I have looked to explain why each of those points are overblown and mean this quality business is oversold.

The key takeaway is that $ for $, Crocs is a fantastic investment in the fashion industry. HEYDUDE looks to be an accretive addition and if management can improve its brand awareness, the group could become a cash flow king.

Crocs has been on both sides of public perception, being hated and loved for selling “ugly” footwear. The business grew its revenue during both periods. The reason is because it transcends “fashion”, their footwear has a genuine use case, being extremely comfortable and more versatile than sandals/casual shoes.

For these reasons, we consider Crocs one of our highest conviction plays. We rate this stock a buy.

Be the first to comment