RicAguiar/E+ via Getty Images

CRH plc (NYSE:CRH), a leading building materials player in the UK and the US, continues its strategic repositioning with the acquisition of Barrette, a residential fencing and railing solutions provider, from TorQuest Partners and Caisse de dépôt et placement du Québec (CDPQ) for $1.9bn. The deal fits well within its plans to move away from distribution toward the US (~55% of sales) and European (~35% of sales) infrastructure and residential end markets. More broadly, it also highlights CRH’s ability to recycle capital in an accretive manner, given the acquisition comes on the heels of the ~$3.8bn disposal of its Building Envelope business and comes with an attractive post-synergies valuation multiple. As CRH unlocks further value from its capital allocation strategy and delivers on its growth targets over time, the stock should re-rate toward peers such as Kingspan (OTCPK:KGSPY) and Geberit AG (OTCPK:GBERY).

Details of the Barrette Acquisition

M&A has historically been a core part of CRH’s growth model, but its prominence has increased in recent years as the company drives a strategic repositioning of its business. In this vein, CRH has announced an agreement to acquire Barrette Outdoor Living from TorQuest Partners and CDPQ for an enterprise value of $1.9bn. For context, Barrette is North America’s leading provider of residential fencing and railing solutions sold through specialty retailers, home centers, and lumberyards. In particular, the company is focused on residential Renovation Maintenance Improvement (RMI) with more durable and sustainable products such as PVC and aluminum, both of which are seeing increased penetration. The deal price represents a transaction multiple of ~10x EV/EBITDA pre-synergies and will be financed through CRH’s well-capitalized balance sheet. Subject to regulatory approval, the deal is set to close in the second half of 2022.

Accretively Recycling Capital

The Barrette deal follows CRH’s divestment of its Building Envelope business for an enterprise value of $3.8bn (comprising $3.5bn cash and $0.35bn from the transfer of lease liabilities) implying an ~11x trailing EV/EBITDA multiple. By comparison, Barrette sustains ~20% margins on EBITDA of $190m, with the pre-synergies multiple of ~10x EV/EBITDA implying accretive recycling of capital by CRH. That said, I suspect there remains ample room for the multiple to move even lower to <8x EV/EBITDA as the company drives value creation through the realization of synergies post-deal.

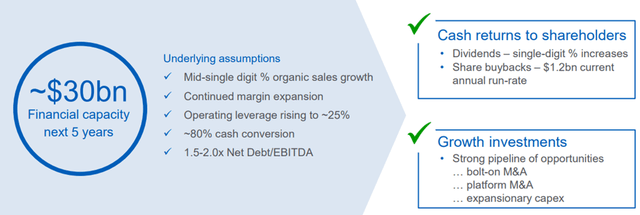

Recall from CRH’s last investor update that on the capital allocation front, much of the long-term value creation optionality will be driven by growth investments such as bolt-on acquisitions and platform M&A, as well as expansionary capex. Excess cash will then be earmarked for shareholder returns, presenting upside to the current single-digit % annual growth in dividends and share buybacks (currently at a $1.2bn/year run-rate). Relative to the company’s guidance for ~$30bn of capital deployment over the next five years, an increase in net debt/EBITDA to ~1x in 2022 (from ~0.6x prior) still leaves >$20bn of financial capacity post-deal. Thus, I see ample room for incremental upside from more deals and buybacks through 2025.

Positive Strategic Implications

Strategically, the Barrette product set fits well within CRH’s Architectural Products business (APG), comprising residential fencing and railing solutions in North America. Of note, Barrette has strong market positions in patio, decking, lawn, and garden products, which added to CRH’s APG segment, should extend the growth and margin improvement runway ahead. Its primary sales channels (retail and professional) are also similar, while the extended range should enhance CRH’s share of customer wallets over time. Though the skeptics might push back on adding Barrette’s RMI exposure at this point in the cycle, I would contend that the product suite also allows CRH to capitalize on the structural trend towards PVC/vinyl usage/conversion in the fencing and decking categories (mainly for durability reasons). Overall, the series of transactions are consistent with CRH’s focus on horizontal construction (i.e., infrastructure and residential) and should drive a less cyclical earnings base over the long run.

Unlocking More M&A-Led Growth with Barrette Acquisition

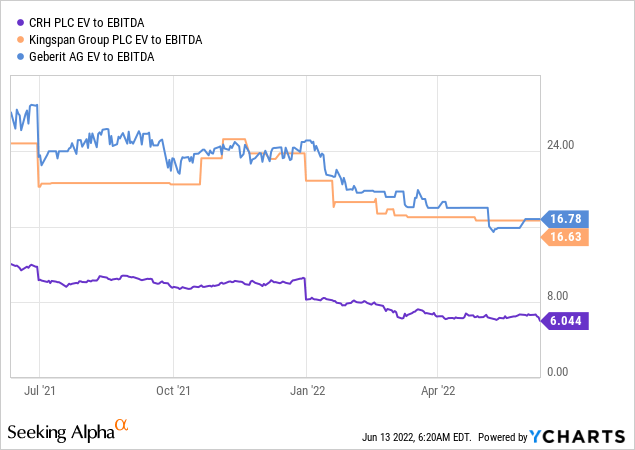

On balance, I view the $1.9bn Barrette acquisition as another positive step for CRH, adding clear strategic benefits by enhancing the Architectural Products business at a reasonable ~10x pre-synergies EV/EBITDA multiple. This could move below ~8x, though, depending on synergies, which in my view, demonstrates management’s discipline and ability to recycle capital in an accretive manner. That said, the acquisition is not too material in the group context as it represents a mid-single-digit % of the group’s EV and thus, there remains ample balance sheet flexibility for further reinvestment or shareholder returns down the line. At the current ~6x EV/EBITDA valuation, CRH stock trades well below its peers (e.g., Kingspan and Geberit) despite a promising M&A-driven growth trajectory and a less cyclical earnings profile.

Be the first to comment