onurdongel/E+ via Getty Images

Crestwood Equity Partners LP (NYSE:CEQP) is a midsized master limited partnership that has long been one of our favorite companies in the sector. There are some very good reasons for this, as the company essentially embodies most of the characteristics that are desirable in an energy partnership. Prior to the COVID-19 pandemic, the company had one of the strongest balance sheets in the sector, which it has managed to strengthen further over the past two years. The company also had significant growth potential that it continues to possess, unlike many of its peers. Indeed, Crestwood Equity Partners is positioned to grow its cash flow over the remainder of 2022. When we combine this with the partnership’s current 8.13% yield and the fact that Crestwood did not have to cut its distribution in 2020, we have the makings of a wonderful investment for any income-focused investor.

About Crestwood Equity Partners

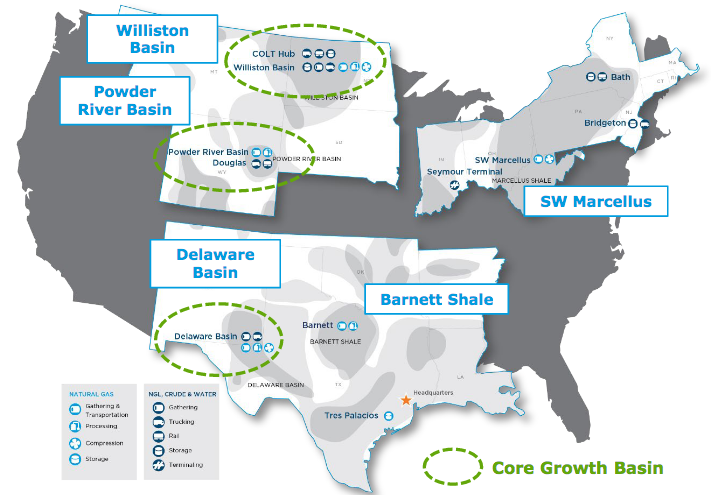

As stated above, Crestwood Equity Partners is a midsized midstream partnership that primarily operates gathering and processing assets in the Williston, Powder River, and Delaware Basins.

CEQP Investor Presentation

Crestwood Equity Partners’ assets differ from what many people picture when they think of a midstream company. Crestwood Equity Partners does not operate any long-haul pipelines that carry large quantities of resources over large geographic distances, for example. Rather, the company’s pipeline network grabs the natural gas and crude oil from the well in the ground and then transports them to the first stop on their journey to the end-user, which is typically a much larger long-haul pipeline or a processing plant of some kind.

Crestwood Equity Partners also operates 1.4 billion cubic feet per day of natural gas processing capacity, which gives it the ability to provide both natural gas gathering and processing services for its customers. The processing of natural gas is a necessary part of bringing natural gas from the producer to the consumer. This is because natural gas contains a number of impurities, notably water and sulfur, when it is first pulled out of the ground. The processing of the gas is necessary in order to remove these impurities before the gas can be used. The company spent the past few years building up its processing capacity to its current size, which was responsible for much of the company’s cash flow growth over that time.

Crestwood Equity Partners’ fourth quarter 2021 showed some signs of the company’s growth trajectory resuming, after the coronavirus-driven price collapse in the energy markets temporarily stalled it. The company’s full-year 2021 adjusted EBITDA and distributable cash flow were both above their full-year 2020 values, for example.

|

FY 2021 |

FY 2020 |

|

|

Adjusted EBITDA |

600.1 |

580.3 |

|

DCF |

371.1 |

361.2 |

(all figures in millions of U.S. dollars)

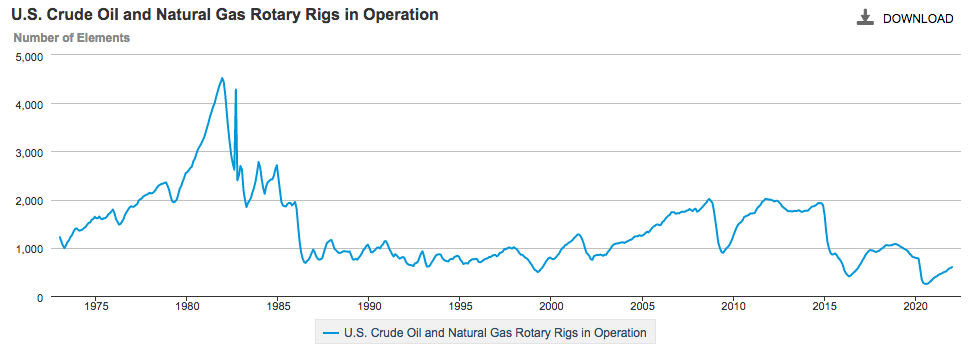

This growth looks likely to continue throughout 2022. As might be expected, this is being driven at least partially by the high oil and gas prices that seem likely to be with us for quite some time. We can see some evidence by looking at the rig count data, which tells us the number of rotary rigs that are currently in operation drilling wells. According to the United States Energy Information Administration, there were 601 of these rigs in operation during January 2022 (the most recent month for which data is currently available). This is a figure that has been increasing since the middle of 2020, when it bottomed out at 250 rigs, although it is still at a much lower level than prior to the pandemic.

U.S. Energy Information Administration

This indicates that upstream producers are still being fairly cautious about their production activity despite energy prices being at the highest levels that we have seen in several years. I pointed this out in a previous article by stating that several major producers are content to simply hold their crude oil and natural gas production steady in order to maximize their free cash flow. However, the rising rig counts are very much a sign that drilling activity is increasing, pointing to potentially growing production going forward. As Crestwood’s gathering pipeline operation is compensated based on the resource volumes that are pulled from the wells, higher drilling activity should point to growing cash flows. Indeed, the company itself has predicted this, with management guiding to adjusted EBITDA growth in every quarter of this year.

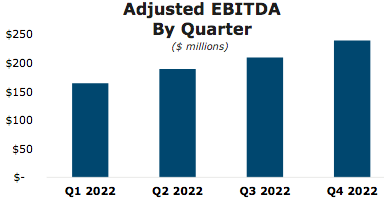

CEQP Investor Presentation

This would give the company a full-year adjusted EBITDA of $740 million to $840 million. This would represent a 23.31% to 39.98% increase over the $600.1 million that the company reported for full-year 2021.

Crestwood Equity Partners is positioned to continue this growth trajectory going forward beyond 2022. The company has allocated between $160 million and $180 million to capital spending on various growth projects for the full-year 2022. The majority of this spending is being dedicated to building out its gathering systems in the Williston Basin, which is by far the company’s largest area of operations.

It is expanding its gathering systems so that they can be connected to newly drilled wells. Indeed, the company’s flagship Arrow system needs to add 120 well connections in the near future. The nice thing about this expansion program is that Crestwood’s customers have already entered into long-term contracts with the partnership that states that they need and will utilize this new infrastructure.

The fact that the company already has these contracts in place is nice for two reasons. The first of these is that Crestwood Equity Partners is not spending a large sum of money to construct infrastructure that nobody wants to use. The second attractive thing is that the partnership knows in advance exactly how profitable these projects will be so it knows in advance that it will be generating an appropriate return on its investment. In this case, the partnership’s growth projects will pay for themselves in four to six years, which is very reasonable for a midstream partnership and is in line with what the company’s peers typically achieve on their growth projects.

One of the very nice things here is that Crestwood Equity Partners will be able to fund its growth projects without having to take on any debt. This is part of the company’s self-funding strategy that it uses to insulate itself from market fluctuations. The traditional model for a master limited partnership is that the company pays out all of its cash flow as distributions to investors and then finances its growth projects through the issuance of debt and equity. This does not work though when the market turns against the sector as it did in 2015 and 2020. This prompted Crestwood to adopt a more sustainable model that allows it to not have to particularly care what the market thinks of its partnership units.

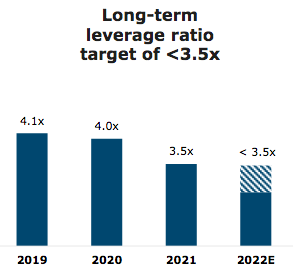

Basically, the company only pays out a proportion of its distributable cash flow to its investors and it keeps the rest to fund its projects. The company is on track to generate a distributable cash flow of $500 million to $560 million in 2022. It will pay out only about $255 million in distributions so it can still fund its just discussed growth projects with $75 million to $135 million left over for other tasks such as debt reduction. This is actually what it is planning to do, which should allow it to exit 2022 with a leverage ratio below 3.5x. This would be a continuation of the company’s history of debt reduction over the past few years:

CEQP Investor Presentation

This gives Crestwood Equity Partners one of the most conservative leverage ratios in the midstream sector. As I have pointed out in several past articles, the leverage ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. Analysts generally consider a ratio of less than 5.0x to be reasonable. I personally prefer to see this ratio under 4.0x in order to add a margin of safety to the position, which very few midstream firms actually possess. Thus, Crestwood Equity Partners should have a much easier time carrying its debt than most of its peers, which will likely endear it to more risk-averse investors such as retirees.

Another reason that this low leverage ratio is important is that it brings the company’s debt load below its long-term target of 3.5 times adjusted EBITDA. This means that Crestwood Equity Partners will likely stop attempting to reduce its debt post-2022. This frees up capital that can be used for other purposes. The company has not publicly stated its plans for 2023 or beyond but it is not inconceivable that the company will use this freed-up cash flow to reward its common unitholders in some way, such as a distribution increase. This potential for a higher distribution next year is yet another reason to like this already fantastic company.

Long-Term Macroeconomic Fundamentals

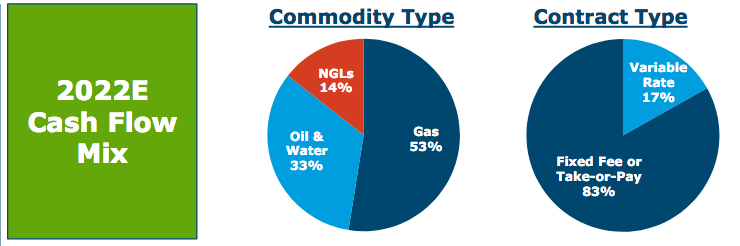

Although Crestwood Equity Partners is somewhat diversified across the various fossil fuels, the majority of its cash flow comes from the gathering and processing of natural gas:

CEQP Investor Presentation

As we showed earlier, the company’s upstream customers appear to be willing to cautiously increase their production of both crude oil and natural gas during periods when resource prices are high. This thus has a positive impact on Crestwood Equity Partners’ cash flow because of the higher resource volumes. There may be a reason to believe that resource prices will remain high or even increase from today’s levels. This is due to economic law and is particularly true in the case of natural gas.

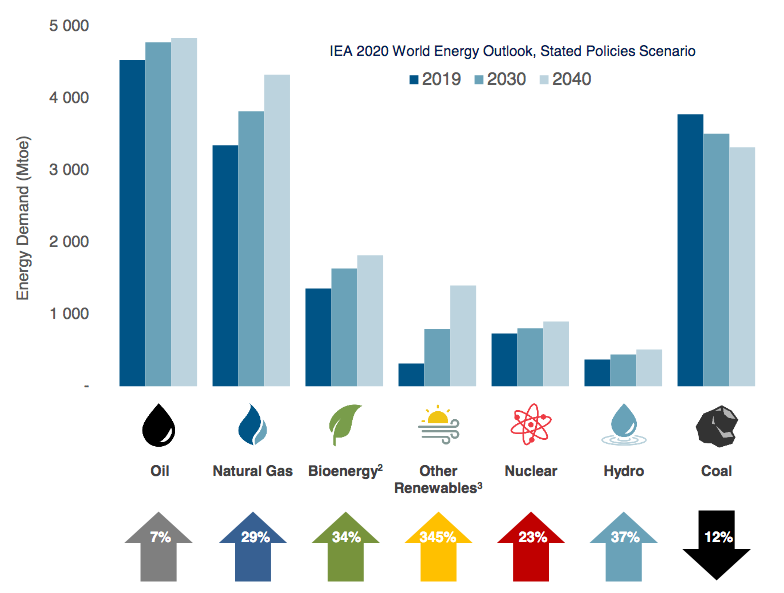

The primary reason for this prediction is that the demand for natural gas is likely to grow much more rapidly than the production of it. As I have pointed out in many previous articles, the International Energy Agency expects the global demand for natural gas to increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

There is little reason to believe that the supply of natural gas will increase to the same degree. As I pointed out in a recent article, we are seeing major American gas producers like Antero Resources (AR) being willing to hold production steady in order to maximize their free cash flow. There is little reason to believe that energy companies could increase production sufficiently to satisfy the projected demand growth even if they wanted to, however. This is because the industry in aggregate has been underinvesting in production and infrastructure since the oil bear market of 2015. In fact, Moody’s states that global upstream spending needs to increase by 54% in order to avert a global supply shock. It seems highly unlikely that the industry will do this, particularly considering the pressure that politicians and activists have been exerting to improve sustainability. Thus, we have a situation in which demand will rise much more rapidly than supply, which results in higher prices. Although we will probably see the volumes and cash flows of a company like Crestwood Equity Partners continue to rise in such an environment, upstream producers will probably not increase production as rapidly as demand. Thus, we should not expect Crestwood Equity Partners to see the volume growth that this demand projection suggests.

Distribution Analysis

It is important for us to determine how easily a midstream company can carry its distribution. After all, we have seen plenty of cases over the past two years where the company was stretching itself too thin and had to cut, even before the COVID-19 pandemic induced a few midstream titans to cut their distributions. As a distribution cut almost always causes the unit price to fall, such a scenario both reduces our assets and cuts our income.

The usual way that we analyze a midstream company’s ability to carry its distribution is by looking at its distributable cash flow. The distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by a company’s ordinary operations that is available to be distributed to the limited partners. Crestwood Equity Partners reported a distributable cash flow of $371.1 million for the full-year 2021 period but only paid out $157.6 million in distributions. This gives the company a distribution coverage ratio of 2.35x, which is a very respectable ratio that gives us confidence that the company will have no difficulty maintaining its distribution going forward. After all, analysts generally consider anything over 1.20x to be reasonable and sustainable. As my regular readers know, though, I like to be somewhat more conservative and see this ratio above 1.30x in order to add a margin of safety to the distribution. Crestwood Equity Partners meets both of these requirements handily. In short, there is very little reason to worry about a distribution cut here. Indeed, as has already been discussed, a distribution increase over the next year or two is much more likely.

Conclusion

In conclusion, Crestwood Equity Partners has long been one of the best companies in the midstream space, although it is not as well known as the larger players. The company already has a very commanding presence in the Williston Basin, which is slowly beginning to see a revival of activity following the 2020 collapse. This positions Crestwood Equity Partners well to deliver some near-term growth.

As the company has largely met its debt reduction goals, it may be willing to reward unitholders in the form of a distribution increase over the next year or two. The company’s yield is still a respectable 8.13% at the current level though and the fact that it can easily sustain this level makes this company a very attractive opportunity for an income-focused investor.

Be the first to comment