grandriver

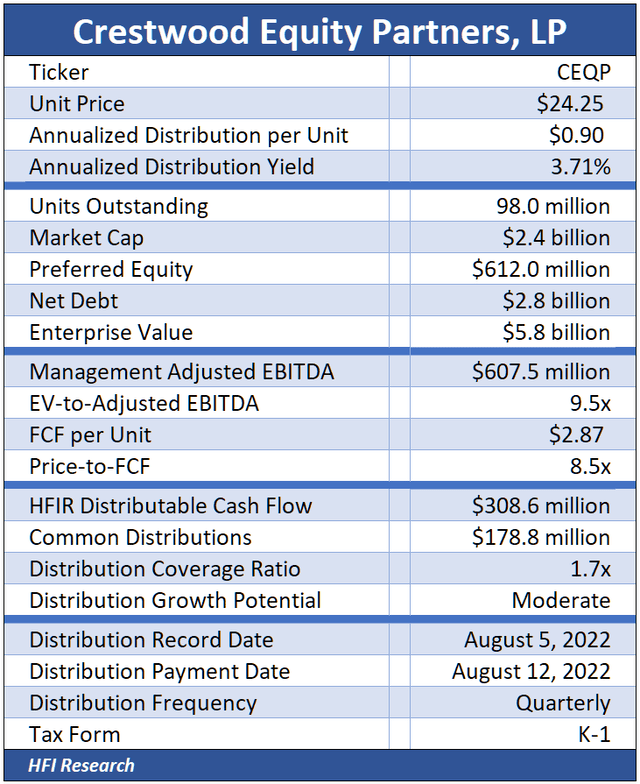

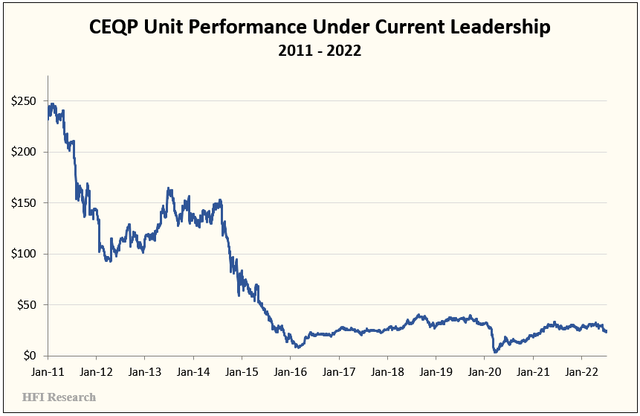

We’ve been critics of Crestwood Equity Partners (NYSE:CEQP) management for its history as a failed empire builder. During the previous oil upcycle, management overpaid for billions of dollars of assets, only to sell many of those assets at a loss during the subsequent downturn.

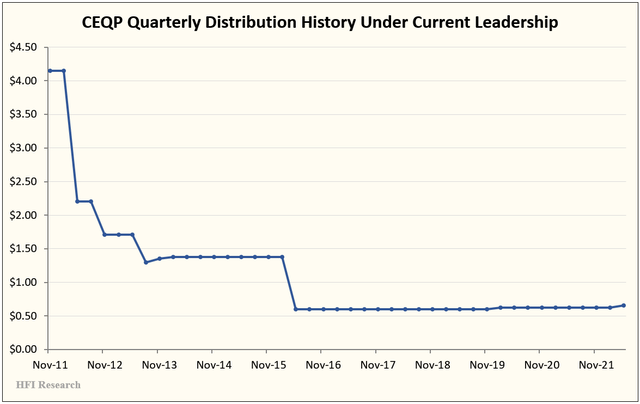

We profiled CEQP’s spending binge from 2011 to 2013, which was followed by its selling assets at a loss from 2015 to 2020. CEQP’s capital allocation was disastrous for its unitholders, who suffered under the company’s current leadership in terms of the unit price…

…as well as the common distribution:

Another knock against CEQP is its persistently low return on capital, which has been mired in the low-single-digits range for years. The low returns have translated into a low trading multiple for its units relative to peers.

Prior to 2022, the company also displayed a lack of a strategic focus, with a far-flung collection of primarily gathering and processing (G&P) assets spanning the Marcellus, Bakken, Powder River, Barnett, and Permian Basin.

CEQP’s Recent Improvements

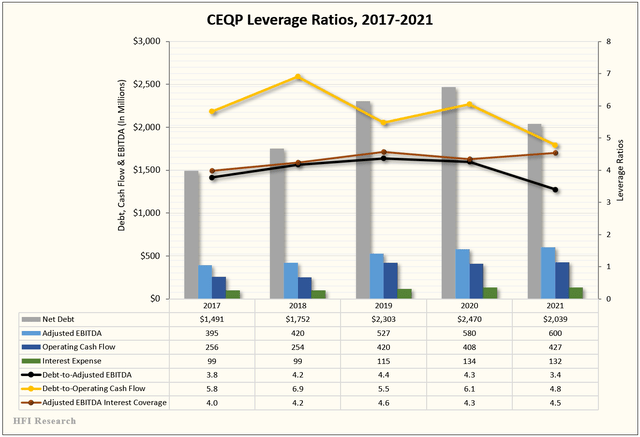

Things have changed for the better in 2022. For one, CEQP’s leverage has been reduced to normal levels. It ended the first quarter with its leverage ratio at 3.5-times.

Next, CEQP acquired Oasis Midstream in February at a reasonable price of 7.5-times our estimate of 2022 EBITDA, roughly the same multiple at which CEQP had traded before the acquisition was announced. While the deal wasn’t particularly accretive in terms of cash flow or leverage, we believe CEQP obtained valuable acreage dedications. The deal significantly increased CEQP’s scale and should also lead to operational synergies in the Bakken.

Then in May, CEQP sold its non-core Barnett assets for $275 million and at the same time acquired Sendero Midstream for $600 million and First Reserve’s 50% interest in the Crestwood Permian JV for $320 million. The Sendero acquisition allows CEQP to grow its Permian volumes without having to build another gas processing plant. The JV acquisition gave CEQP more flexibility in operating its Permian assets.

These acquisitions diversified CEQP’s Delaware Basin G&P customer roster and increased its Permian assets’ contribution to cash flow. CEQP’s Permian G&P assets now generate approximately 20% of total company cash flow. We expect that percentage to increase due to organic growth in gathered volumes.

Assuming CEQP sticks with its newly acquired assets, operates them well, and maintains a conservative balance sheet, we expect the assets to generate meaningful cash flow growth over the coming years.

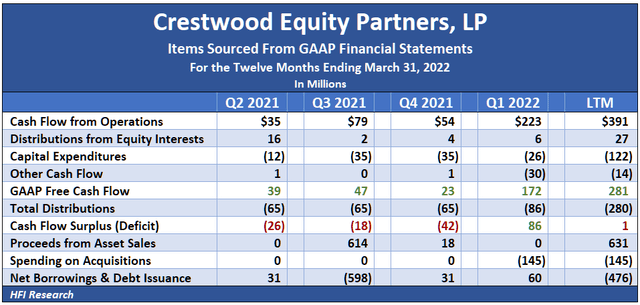

After the Permian asset acquisition closes, which is expected in the third quarter, CEQP’s future quarterly results are likely to improve over the past few quarters, during which the company’s free cash flow after total capex and distributions was essentially nil. The table below shows the performance over the past four quarters.

CEQP’s ability to generate a cash flow surplus begs the question of how management will allocate it. If CEQP can sustain its Adj. EBITDA, as we expect, we don’t see a pressing need for more debt reduction. However, additional debt reduction would signal to unitholders that management is serious about operating on a more conservative footing.

If CEQP generates a cash flow surplus, the risk to public unitholders is whether management can refrain from making high-priced acquisitions. We hope management instead focuses on increasing the company’s returns on capital and returning free cash flow to unitholders.

CEQP Units Are In Bargain Territory

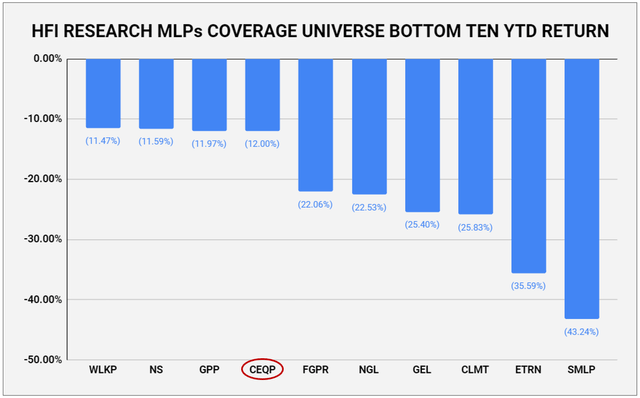

CEQP units have been clobbered in the recent selloff along with the rest of the midstream sector. The units have fallen by 26.4% from their April 2022 high. Aside from the beleaguered Equitrans (ETRN), CEQP is the worst-performing G&P in our coverage universe, which encompasses every one of its public peers, as well as the other midstream operators.

We believe CEQP’s poor equity performance is more attributable to the company’s low returns on capital and investor apathy in its story rather than to any serious problem with the company.

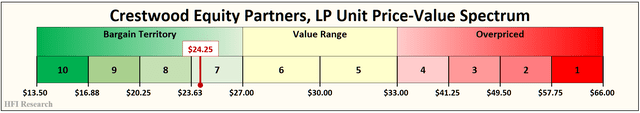

After the recent price decline, CEQP units have entered bargain territory. We value them in the range of $27 to $33. Our price target is the midpoint, or $30, which represents a 23.7% upside from CEQP’s current price of $24.25.

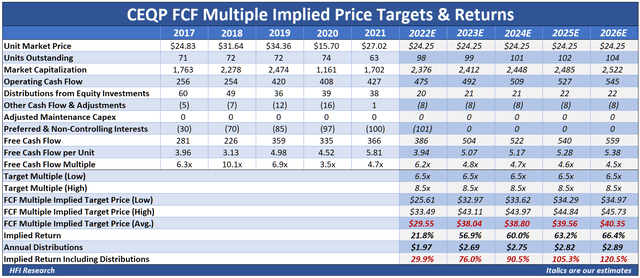

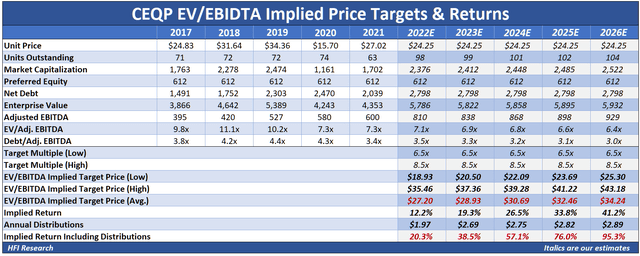

Our valuations assume that CEQP’s free cash flow and Adjusted EBITDA increase by 3.5% annually and that its common distributions increase by 2.5% annually through 2026. Importantly, we apply a discounted multiple range, from 6.5-times to 8.5-times, to reflect CEQP’s low return on capital. If management can increase the company’s returns on capital, the units have a significant upside to our valuations.

Our free cash flow multiple valuation implies the units are worth $29.55 in 2022 for a 29.9% total return when distributions are factored in. The implied total return increases to an impressive 120.5% over the next five years.

Our EV/EBITDA valuation values the units at $27.20 in 2022. Including distributions, the implied total return is 20.3%. That return increases to 95.3% by 2026.

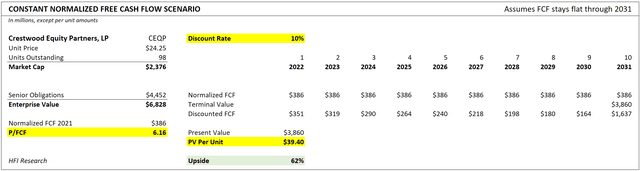

Lastly, our discounted cash flow valuation does not apply as severe of a discount on CEQP’s multiple. Using a 10% discount rate, it values the units at $39.50, which implies a 34% upside from current levels.

Conclusion

Aside from poor management decisions, the main risk we see for CEQP unitholders is a dramatic fall in oil prices that reduces drilling activity in the Bakken. We don’t believe this is as big an issue in the Permian, which we believe will maintain production at all but the most severe recessions.

Fortunately, with leverage now at a comfortable level – and assuming it stays that way – CEQP is likely to come through an oil-market downturn with its equity value and earning power intact.

Alternatively, if oil and gas prices remain elevated above $90 per barrel, as we expect, we believe CEQP will benefit from volume growth in both the Bakken and Permian.

We rate CEQP units a Buy. At their current price, the units have an unusually large 10.8% yield, limited fundamental downside, and potentially significant upside from volume growth and improved returns on capital. We believe income-seeking investors looking to diversify their midstream portfolios and/or increase their portfolio’s yield should buy CEQP units.

Be the first to comment