NIKILAY GLUHOV/iStock via Getty Images

While Cresco Labs (OTCQX:CRLBF) built a business focused on branded products, the market has suddenly shifted away from the wholesale market. The deal to acquire Columbia Care (OTCQX:CCHWF) will solve a lot of those problems in the short term. My investment thesis remains ultra Bullish on Cresco Labs headed into the deal closure in the next few months.

Wholesale Struggles

As the US cannabis market has tightened up causing dispensary owners to focus on selling more of their own branded market, Cresco Labs has struggled more than other large multi-state operators (MSOs). The wholesale market has become a tough market with most dispensary owners outside of a state like California being vertically integrated with their own branded product supply taking priority shelf space.

For this reason, Cresco Labs reported Q3’22 revenues dipped 2% YoY to $210 million. The large MSO reached $218 million in quarterly revenue in the prior quarter and has faced a tough wholesale market and a hit to revenues by exiting some distribution revenues in California causing a 400 basis point impact to sales growth.

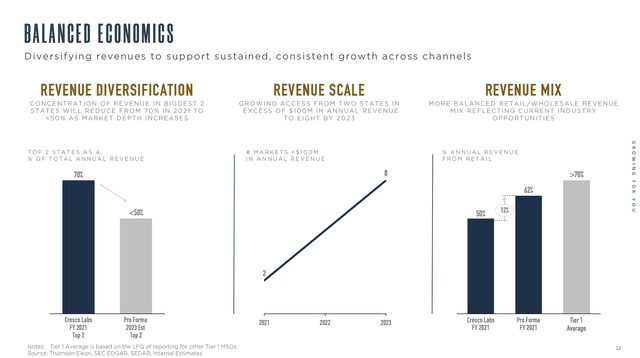

Retail revenue actually grew 11% in the quarter to reach $118 million. Cresco Labs saw wholesale revenues fell 7% to only $93 million, yet the MSO is still the leader in US branded cannabis sales in a sign of how tough the wholesale market has become this year.

The Columbia Care deal solves a lot of this problem with a shift to retail sales of 62% at the time the deal was announced. Though, the Q3’22 results saw Columbia Care generate 14% growth in wholesale revenues due to the New Jersey market.

Source: Cresco Labs Aug. ’22 presentation

As state markets normalize over time with a shift away from vertically integrated MSOs, Cresco Labs shareholders might prefer the company had stayed focused on more branded sales. Going forward though, the MSO will look like the rest of the group and take advantage of the recreational cannabis sales opportunities in New Jersey, New York and Virginia in the years ahead.

Confusing Story Provides Opportunity

The investment story is confusing with Cresco Labs set to divest a ton of assets in the process of closing the Columbia Care deal. The company already has a $185 million deal (only $110 million in upfront cash) with Sean ‘Diddy’ Combs to divest assets in New York, Illinois and Massachusetts.

- New York: Brooklyn (CC), Manhattan (CC), New Hartford (CL), and Rochester (CC) retail assets and Rochester (CC) production asset.

- Massachusetts: Greenfield (CC), Worcester (CL), and Leicester (CL) retail assets and Leicester (CL) production asset.

- Illinois: Chicago – Jefferson Park (CC) and Villa Park (CC) retail assets and Aurora (CC) production asset.

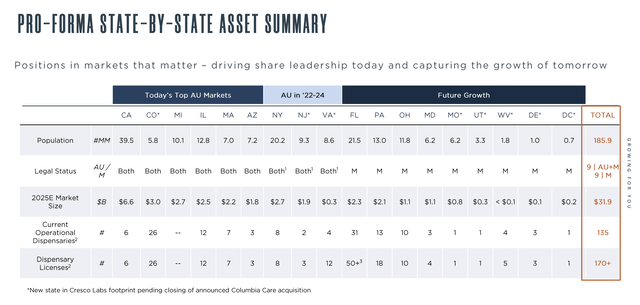

The new Cresco Labs has the following footprint by state before the divestitures mentioned above and further plans in Florida, Ohio and Maryland. Columbia Care provides key assets in New Jersey and Virginia currently missing in the Cresco Labs asset base.

Source: Cresco Labs Aug. ’22 presentation

The combined company will have New York opening up as well to provide a strong growth path through 2024 with these East coast recreational markets opening up. In addition, Cresco Labs will have future opportunities in Florida, Pennsylvania, Ohio and Maryland with the expansion into recreational cannabis sales.

Of course, the major problem in valuing the combined stock is isolating the revenues leaving the business for the divestments. The New York stores aren’t big revenue generators, but the rest of the lost stores should generally offer solid revenues to strip from the system. Cresco Labs still forecasts offsetting the lost assets with $300 million in cash.

In addition, Columbia Care is struggling to cross the finish line with Q3 revenues not even growing 1%. The MSO reported revenues of $133 million with an adjusted gross margin of 43% leading to an adjusted EBITDA margin of 16%, though the margin is up over 6 percentage points from last year.

The combined company had Q3’22 revenues in the $343 million range before the divestitures. The adjusted EBITDA isn’t very impressive at only $63 million, but the deal should offer plenty of opportunity to consolidate costs and boost margins as the company inches closer to exiting the growth phase. In essence, the purchase of Columbia Care served as a capex purchase to acquire key cultivation and production assets reducing what Cresco Labs needs to build on the East Coast going forward.

The combined stock valuation is only $2 billion after the stock weakness in the cannabis sector. The analysts forecast combined 2023 revenue in the $1.5 billion range, but the divestiture of assets in key states will lower those revenue estimates.

The combined company has over 135 operations dispensaries with over 100 outside of Florida. The original divestiture strips out 9 stores with only 5 of those stores having material revenues.

Takeaway

The key investor takeaway is that Cresco Labs is cheap and poised for growth in the years ahead. The closing of the Columbia Care deal will make for volatile trading in the next few quarters with the divestitures stripping out revenues from the business in exchange for up to $300 million.

The stock is likely to trade in the range of 1.5x sales with plenty of opportunity to boost adjusted EBITDA margins after the deal closes. Due to the volatility, interested investors should use weakness to load up on Cresco Labs.

Be the first to comment