phototechno/iStock via Getty Images

Introduction

Thanks to the booming oil and gas prices of 2022, Crescent Point Energy (NYSE:CPG) was able to see their net debt target achieved that, as my previous article discussed, marked an important milestone for higher shareholder returns. Following the subsequent release of their updated guidance, it sees the company on autopilot in 2023 but thankfully, further on the horizon, there are big things possibly coming in 2024 for their shareholder returns, as discussed within this follow-up analysis.

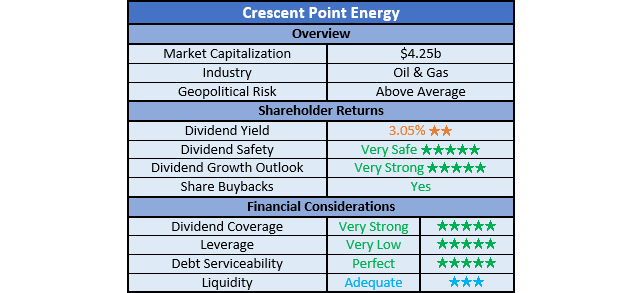

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

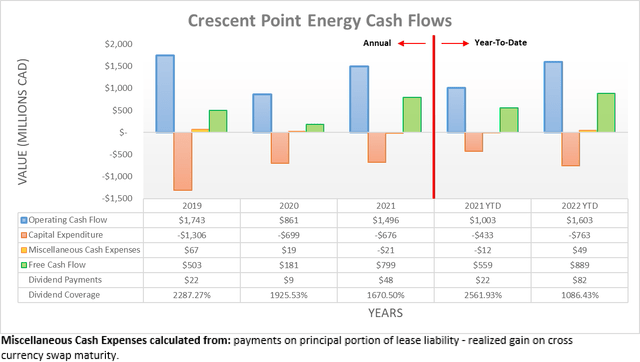

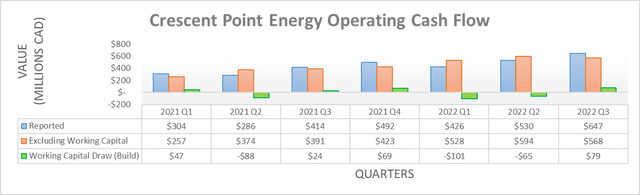

After enjoying very impressive cash flow performance during the first half of 2022, thankfully this continued into the third quarter despite the otherwise softer oil prices, as their operating cash flow climbed to C$1.603b across the first nine months. Similar to the first half, their operating cash flow once again is around two-thirds higher year-on-year versus their previous result of C$1.003b during the first nine months of 2021. Even though their capital expenditure was ramped up materially year-on-year, this still allowed their free cash flow during the first nine months of 2022 to climb significantly year-on-year to now reach C$889m versus their previous result of C$559m during the first nine months of 2021, thereby providing ample funds to achieve their net debt target, as subsequently discussed.

Upon zooming into their operating cash flow on a per-quarter basis, it shows the third quarter of 2022 saw the highest reported result since at least the start of 2021 at C$647m. Admittedly, this was aided by a C$79m working capital build, which if removed, still sees a very impressive result of C$568m that is not far below their equivalent previous result of C$594m for the second quarter, despite oil prices materially softening.

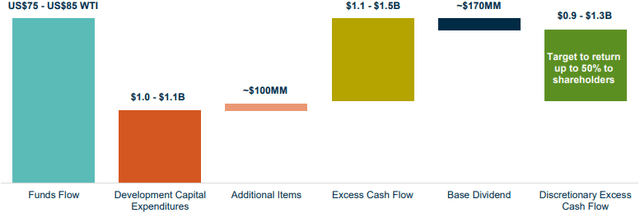

Whilst interesting, the more important topic is their outlook for 2023 and beyond as this carries far greater bearings for their shareholders. Thankfully, management already released their guidance for 2023 that includes a breakdown for each of the primary elements, along with a lower and upper end range, depending upon the prevailing oil price.

Crescent Point Energy October 2022 Corporate Presentation

In my eyes, the most important number for shareholders is their “excess cash flow”, which is effectively another word for free cash flow, similar to how their “funds flow” is essentially operating cash flow. If looking at this element of their guidance for 2023, they forecast a range of C$1.1b to C$1.5b, depending upon whether Western Texas Intermediate oil prices are either $75 to $85 per barrel. Seeing as oil prices have softened materially over economic fears, it seems more reasonable to utilize the lower end of their guidance range, thereby providing a margin of safety. Even though prices could trade below this level, the prospects of OPEC once again cutting production and only minor production growth forecast for the United States shale industry should limit downside risk past $75 per barrel, barring a black swan event.

Even if utilizing this lower range, their free cash flow of C$1.1b still represents a very high free cash flow yield of circa 19% given their current market capitalization of approximately $4.25b and CAD to USD exchange rate of $0.74. Obviously, this represents desirable value, especially as the basis stems from relatively modest oil prices that are well below those throughout the majority of 2022. Equally important, their free cash flow guidance for 2023 is not coming about due to unsustainably low capital expenditure. In fact, their guidance for this element is actually increasing to C$1.05b at the midpoint versus their updated guidance for 2022 of C$950m.

Elsewhere, their guidance for 2023 also points to C$170m for their base dividend payments, which is broadly in line with their quarterly rate during the third quarter of 2022. Finally, they are expecting to return 50% of their excess free cash flow after dividend payments via share buybacks and special dividends, as expected when conducting the previous analysis since they have reached their subsequently discussed net debt target. Once again, even if merely utilizing the lower end of their guidance, it sees C$450m for share buybacks and special dividends with an equal amount retained within the company. In the event the upper end of their guidance is reached, which is certainly not unrealistic, these numbers climb quickly to C$650m, thereby indicating desirable upside potential if oil prices perform better than expected during 2023.

Regardless of whether their results for 2023 are closer to the lower or upper end of their guidance, it nevertheless sees the year effectively on autopilot as their shareholder returns policy remains unchanged, along with only modestly higher capital expenditure versus 2022. Whilst sounding rather boring, thankfully there is still more to look forward to further on the horizon with big things possibly coming in 2024, whereby shareholders could start taking home a relatively higher percentage of their free cash flow.

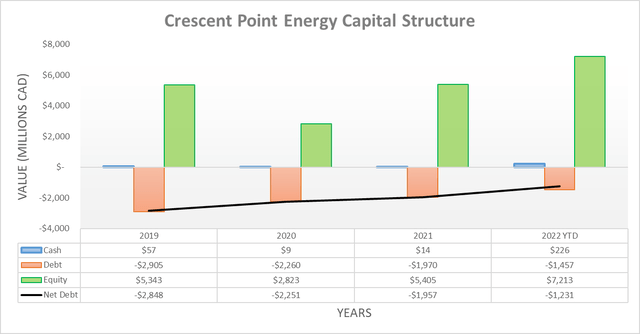

Since conducting the previous analysis following the second quarter of 2022, the third quarter once again saw their net debt drop lower, thereby now landing at C$1.231b versus its previous level of C$1.545b. As expected when conducting the previous analysis, this now formerly sees them achieving their net debt target of C$1.3b, which marked an important milestone for higher shareholder returns whereby they began returning their circa 50% of free cash flow.

When looking ahead into 2023 and beyond, their net debt will continue its downward march on the back of their retained free cash flow. If once again utilizing the lower end of their guidance, the C$450m of retained free cash flow stands to eliminate slightly more than a third of their current net debt, which even ignores the amount they are slicing away during the fourth quarter of 2022. This is already a very impressive change, although if they were to hit the upper end of their guidance, their C$650m of retained free cash flow would eliminate more than half of their net debt. Regardless of where their results land, either end of their guidance opens the door for big things in 2024 as their leverage decreases.

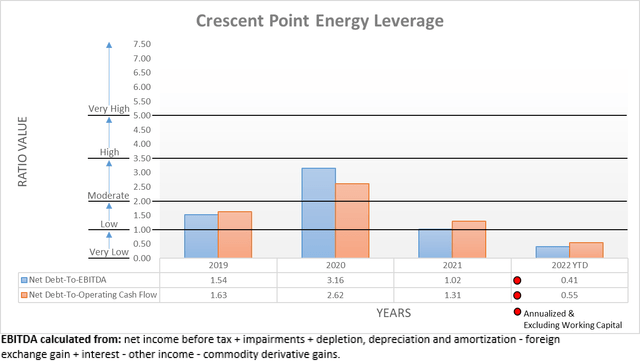

Quite unsurprisingly, their lower net debt following the third quarter of 2022 translated into lower leverage with their net debt-to-EBITDA and net debt-to-operating cash flow now landing at 0.41 and 0.55 respectively. Obviously, leaving their leverage well beneath the threshold of 1.00 for the very low territory, as was the case with their previous respective results of 0.49 and 0.69 following the second quarter.

Given the outlook to possibly halve their net debt during 2023, it seems reasonable to expect their very low leverage to persist, even if their financial performance softens on the back of lower oil prices versus the very strong levels during 2022. Apart from strengthening their ability to navigate any unforeseen shocks, it also helps ensure they reach their ideal leverage target, as per the commentary from management included below.

“So yes, we do have a bit of an ideal or target leverage that we’re shooting for. And I would say it’s kind of a 1x debt-to-cash flow in that $45 to $50 WTI range. And that’s really in the long run what we’re shooting for as far as the target.”

-Crescent Point Energy Q3 2022 Conference Call.

Whilst they did not directly state what net debt this ideal leverage target translates into, it is still possible to make a reasonable estimation based on other information available. If looking at their guidance for 2023 cash flows on slide seven of their October 2022 corporate presentation, they state their capital expenditure and base dividend payments are fully funded with Western Texas Intermediate oil prices of under $50 per barrel, which is effectively the basis for their ideal leverage target. These two respective cash outflows are forecast to be C$1.05b at the midpoint and circa C$170m, thereby totaling around C$1.2b and very interestingly, this is practically equal to their current net debt of C$1.231b.

Unless they change course, 2023 should see their net debt well beneath what is required for their ideal leverage target, which raises the probability that even higher shareholders returns will be coming in 2024 whereby their shareholders take home a relatively larger portion of their free cash flow than the current circa 50%. As they have no requirement to deleverage any further, this could easily be scaled to 75%, if not even closer to 100%, thereby representing big increases versus their current shareholder returns. Even though management did not commit to lifting their shareholder returns even higher during their third quarter of 2022 conference call, the pressure to take this path will only grow ever stronger the lower their net debt falls.

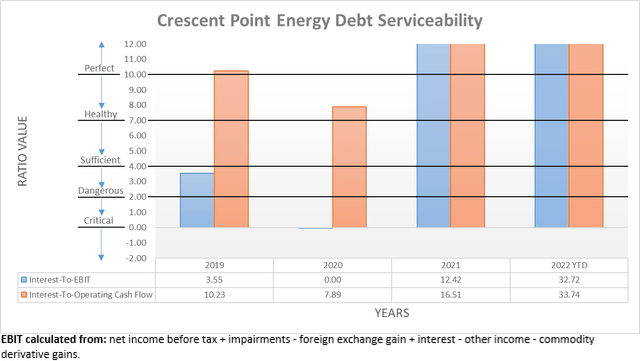

Apart from sending their leverage plunging, eliminating net debt also helps improve their debt serviceability regardless of the prevailing operating conditions, which is becoming increasingly important to consider as interest rates climb rapidly. It does not matter if their interest expense is compared against their accrual-based EBIT or cash-based operating cash flow, it now produces interest coverage north of 30, which is obviously perfect and encompasses a very large margin of safety. This further strengthens the outlook for even higher shareholder returns as their net debt continues falling, thereby relieving even more of the cost of debt.

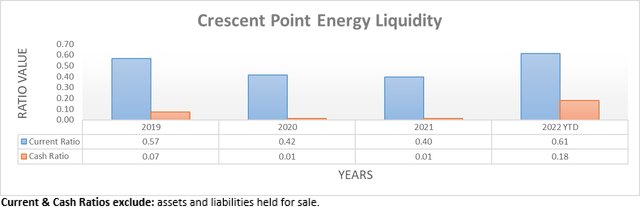

Throughout the third quarter of 2022, they also materially improved their liquidity with their current ratio climbing to 0.61 versus its previous result of only 0.44 following the second quarter. Whilst this is still on the low side, more importantly, they have significantly improved their cash ratio to 0.18 versus its previous result of only a mere 0.01 across these same two points in time, thereby better supporting their adequate liquidity via lowering dependence upon their credit facility.

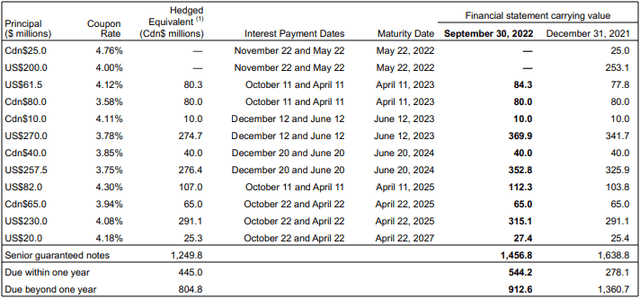

When looking ahead into 2023, they face C$544.2m of debt maturities split across four separate senior guaranteed notes. These should not be problematic to repay and refinance as necessary given their outlook for C$450m to C$650m of retained free cash flow, especially with help from their credit facility that still retains availability of C$2.297b and does not mature until November 2025. Obviously, the more debt maturities they cleanse, the easier and safer it becomes to return even more of their free cash flow to their shareholders.

Crescent Point Energy Third Quarter Of 2022 Results Announcement

Conclusion

Despite their guidance seemingly being set on autopilot in 2023, thankfully there should be big things coming in 2024. Admittedly, a lot can change within a year but if looking ahead, their net debt is still tracking lower at a brisk pace with 2023 likely to eliminate between one-third and half of their net debt. The lower their net debt falls, the higher the probability of even higher shareholder returns and thus given their net debt is already around what is required for their ideal leverage target, I expect to see shareholders enjoying even more cash heading into their pockets as 2024 approaches, as a percentage of their free cash flow. Notwithstanding the risks abound that have pushed oil prices materially lower than a few months ago, I nevertheless believe that maintaining my buy rating is appropriate given their forecast very high near 20% free cash flow yield during 2023 even in light of these lower oil prices.

Notes: Unless specified otherwise, all figures in this article were taken from Crescent Point Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment