yuelan

Here at the Mare Evidence Lab’s tower, we anticipated what was going to happen. We initiated to cover Credit Suisse (NYSE:CS) with a publication called Valuation Is Less Important Than Earnings and after that we follow-up with two analyses commenting on the company’s profit warming. Here below the link to our previous publications so our readers are well informed of the story up to now:

- 20/04/2022 – A Never-Ending Story

- 08/06/2022 – Third Profit Warning

As a recap, Credit Suisse stock price has declined by more than 60% since Gottstein’s arrival in February 2020, this is one of the worst performance among major global banks in the period. Following the spy story with the previous CEO, the Swiss bank collapsed with the Greensill Capital financial scandal and later on the hit related to the implosion of Archegos Capital fund. Last November, the Swiss bank was also fined $475 million for the “tuna bonds” scandal in Mozambique.

What is going on?

Once again, Credit Suisse has decided to replace the CEO Thomas Gottstein with Ulrich Koerner, previously CEO of the bank’s asset management division, and started a strategic review to rebound its banking activities. Although Gottstein inherited a number of problems, the way the company reacted and the subsequent strategy adopted left the bank in a weaker position, in particular if we are looking at the investment banking performance. The new CEO will start on August the 1st.

Q2 Results and the new plan analysis

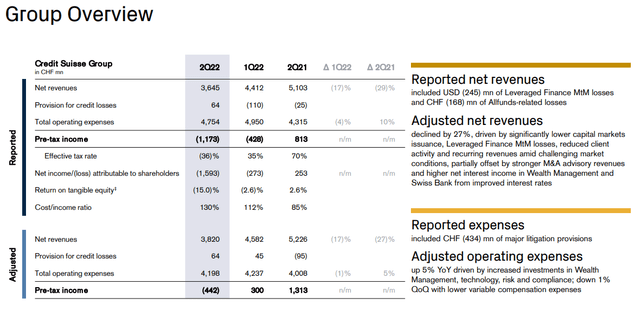

Revenues fell to CHF 3.645 billion, driven by a 43% decline in the investment bank, from CHF 5.103 billion in the second quarter of 2021. CET1 ratio decreased to 13.5% at the end of June from 13.7% in the same period of 2021 and the asset management division recorded large outflows (5.3% annualized) driven by the EMEA and Switzerland area.

In the press release, the CEO said that the second quarter results were “disappointing” and that the bank’s performance was “significantly affected by a number of external, geopolitical, macroeconomic and market factors”.

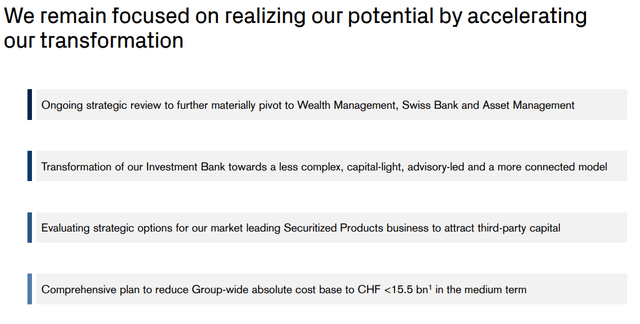

Aside from the current results, the new CEO appointment suggests a further move away from the investment banking division. From what we understood, the plan is to transform the IB arm into a low-capital-consumption division, and this appears to be similar to the strategy adopted by UBS in 2012. Not many details were provided. In the meantime, Credit Suisse is seeking to attract third-party capital for this business, presumably to reduce the size of the exit and the underline restructuring costs, but we wonder who will intervene and how this relationship would work. The cost base should be reduced to less than CHF 15.5 billion over the medium term from the CHF 16.5-17.0 previously, but it is unclear how this will be done.

Conclusion and Valuation

The bank appears very cheap, but there is a reason behind it. Downside risks are equally important to consider. Wall Street analysts might welcome the new CEO, but execution risk and restructuring losses will remain. We continue to reiterate our holding rating and our previous valuation.

Be the first to comment