NicoElNino

The Quarter

California Resources (NYSE:CRC) reported an excellent operating quarter. Adjusted EBITDAX and free cash flow came in at $204mm and $83 million, respectively. Cash flow could have been higher were it not for drilling activity that was pulled forward into the quarter. Price realizations after hedges were excellent, although still far below the spot market rates seen during the quarter. Oil realized $63.17/BBL, NGLs realized $68.29 and nat gas realized $6.73/mcf. The NGL performance was truly excellent coming out of winter months, and I was encouraged by the strength of natural gas despite the Freeport LNG shutdown.

The company is seeing the same cost inflation other operators are seeing (labor, materials, fuel, etc.) with the average BOE costing $37.76 all in versus $30.72 in Q2 2021. Fortunately, the higher realized prices offset these costs and allow for extremely healthy margins.

This overall operating strength and pull forward of development is allowing to increase its production guidance by 1 mmboe/day and raise cash flow and EBITDAX guidance by 10% and 2% respectively to $365-$450 million (which includes over $50 million of spending on carbon capture) and $895-$960 million. Ex the carbon capture spend, cash flow midpoint goes to about $450 million.

For valuation context, the company has net debt of only $276 million ($600 million in bonds versus $324 million of cash) and only $3.36 billion market cap. At the midpoint of free cash, this company is a ~12% yield (~14% ex carbon capture) and less than 4x EBITDA.

The Buybacks

The company is aggressively buying back its stock at these attractive valuations. It bought back $96 million of stock in Q2 making $360 million at an average price of $39.34 per share since the inception of the program last year. The company added $300 million to this buyback commitment to be completed before the end of Q2 2023.

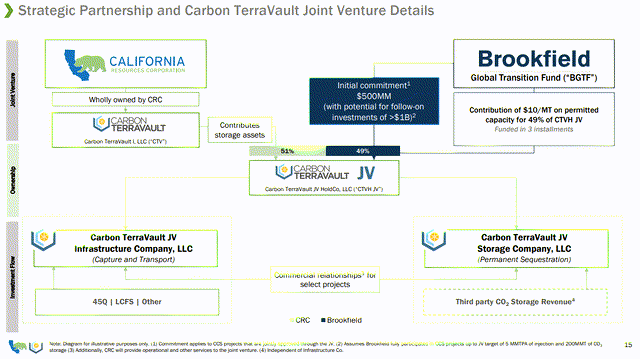

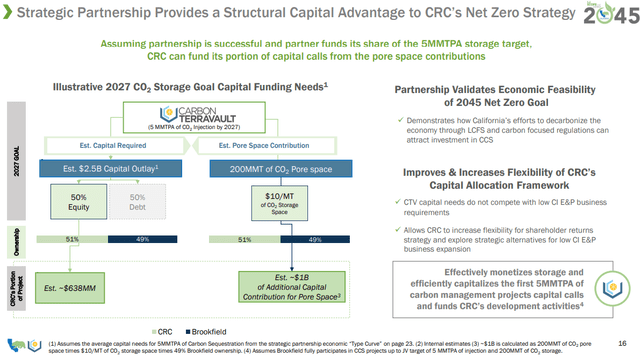

The Brookfield Carbon Capture Commitment

Perhaps the biggest announcement of the day was a deal with Brookfield Global Transition Fund, whereby Brookfield committed $500 for 49% of a JV to develop CCS (carbon capture and sequestration). Upon receiving full permits for operation, the company will contribute the assets of CTV1 (Carbon TerraVault1) and Brookfield will invest $500 million with potential incremental investments of >$1 billion. This investment dramatically derisks and provides the bulk of equity funding for the development of the CTV business. In my mind, it legitimizes how real this business can be once the permits are secured and highlights the hidden value within CRC.

Terms of the Brookfield Investment (Q2 CRC presentation) Economics of the Brookfield Investment (Q2 CRC presentation)

For those who don’t know Brookfield (BAM), they are among the most respected private equity investors in the world and perhaps the most respected with renewable/clean energy investing as the managers of Brookfield Renewable (BEP).

Risks

As with any energy company, CRC is vulnerable to the swings in commodity prices. It is also exposed to cost pressures to keep its rigs running. I believe the low valuation more than offsets those risks. In addition, while I believe the potential of the CCS business is not priced into the stock at all, anything can happen with government permits. If the EPA or California decide to deny the permits, there will be no CCS business. There is also execution risk and risk of snaring customers who will pay enough for carbon sequestration to make the enterprise viable.

Conclusion

Ever since I first covered CRC, I have been touting the quality of its E&P assets and the potential of the carbon capture business. The E&P story has improved markedly thanks to excellent execution and accommodative energy prices. The CCS business just took a big leap forward as well. The stock has not responded as yet, but I continue to believe this is one of the most interesting names in the energy space. I believe the valuation and buybacks provide support in the high 30s with a catalyst to double the stock over the coming year.

Be the first to comment