MoMo Productions/DigitalVision via Getty Images

December 12th of 2022 proved to be a rather significant day for shareholders of Coupa Software (NASDAQ:COUP). This is because the management team at the company announced, in addition to its third-quarter earnings release, that it had agreed to sell itself to software investment firm Thoma Bravo in a multi-billion-dollar transaction, representing a significant premium over where shares were trading prior to the deal being announced. Although some investors may be disappointed by this development because it removes the potential for additional upside from the drawing board, the terms of the transaction seem perfectly appropriate and, if anything, now might be a really good time to consider unloading shares in order to look for opportunities elsewhere. Because the company is a quality operator that continues to grow, and because of some additional upside being warranted if the deal is completed, I have decided to rate the enterprise a ‘hold’ though.

A big deal

As I mentioned already, the management team at Coupa Software announced, on December 12th, that it had agreed to sell the company, a firm that focuses on business spend management, to software investment firm Thoma Bravo. This transaction values Coupa Software at $81 per share, all of which will be completed in cash. Based on the number of shares of the company currently outstanding, this implies an equity purchase price of $7.05 billion. When you add on top of this net debt, you end up with an enterprise value of around $8 billion. For context, this price implies a 77% premium to the closing share price of the company on November 22nd of this year, which was the last full trading day prior to media reports coming out regarding a potential transaction for the firm.

Author – SEC EDGAR Data

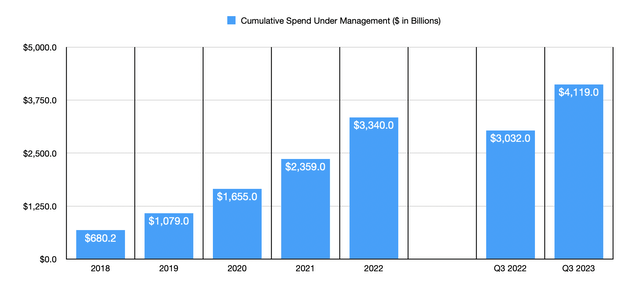

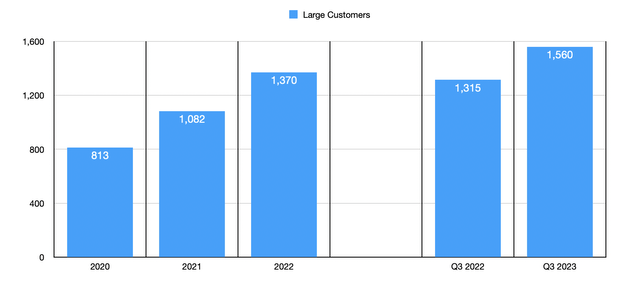

For myself and my readers, this works out quite nicely. You see, back in early September of this year, I wrote an article wherein I discussed the investment worthiness of Coupa Software. After coming to understand the company’s business model and how rapid its growth had been in prior years, I found myself bullish on the firm. As an example of how fast the company was growing, consider that from 2018 through 2022 the firm had grown its revenue from $186.8 million to $725.3 million. Although net profits were worsening year after year, operating cash flow and adjusted EBITDA were skyrocketing. Operating cash flow, as an example, expanded from $19.6 million in 2018 to $168.1 million in 2022. Meanwhile, adjusted EBITDA expanded from negative $3.2 million to positive $236.9 million over the same window of time. This came as the number of large customers for the company shot up, eventually hitting a high of 1.44 million as of the end of the first quarter of 2023. And over that same window of time, the cumulative spend under management for the firm spiked to nearly $3.60 trillion. That was up from the $680.2 billion estimated for 2018.

Because of how bullish I found myself on the company, I ended up rating the firm a ‘buy’. This was even at a time when profits were worsening year after year because of the company’s growth initiatives. On top of that, I felt as though shares, while perhaps appropriately priced for any company growing that fast, were not exactly on the cheap side of the equation. So far, that call has played out quite well thanks to this announcement. While the S&P 500 is up by 1.5%, shares of Coupa Software have generated upside of 37.9%.

Author – SEC EDGAR Data

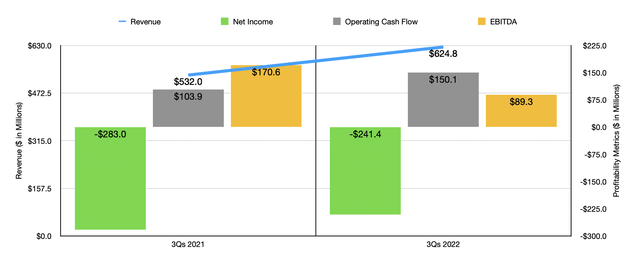

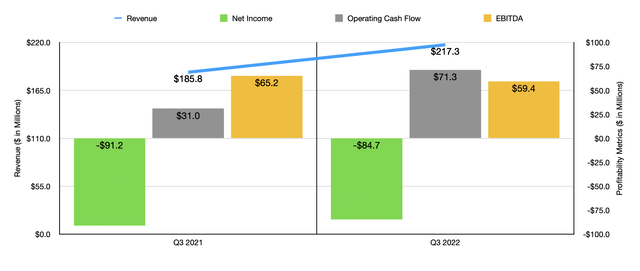

One reason why investors might be disappointed in this development is that the company has continued to post attractive performance. In the first nine months of its 2023 fiscal year, the company reported revenue of $624.8 million. That’s up nicely from the $532 million reported the same time last year. Net income actually improved slightly, going from a loss of $283 million to a more modest loss of $241.4 million. Operating cash flow surged from $103.9 million to $150.1 million. The only metric that really worsened was adjusted EBITDA. Based on my calculations, it nearly halved from $170.6 million to $89.3 million. As you can see in the chart below, results for the third quarter of 2023 alone were rather similar to what the results were for the first nine months of 2023 in their entirety.

Author – SEC EDGAR Data

There is no doubt that Coupa Software has some issues, namely related to profitability. On the other hand, the company’s growth is impressive in multiple ways. At the end of the day, profitability and cash flows are what matter most. But the company could not achieve that kind of upside if it were not for improved user data. The number of significant customers, those generating $100,000 per year or more in revenue for the enterprise, came in at 1,560 in the third quarter of this year. That was up from the 1,315 reported one year earlier and compared favorably to the 1,519 the company reported for the second quarter alone. Cumulative spend under management jumped from $3.03 billion last year to $4.12 billion this year. In the second quarter of this year, for context, that number was at $3.86 billion. Naturally, this also would mean that remaining performance obligations for the company have also been on the rise. In the third quarter, this metric hit an all-time high of $1.45 billion. up from the 1.42 billion dollars reported one quarter earlier and it compares to the $1.18 billion reported in the third quarter of 2022.

Author – SEC EDGAR Data

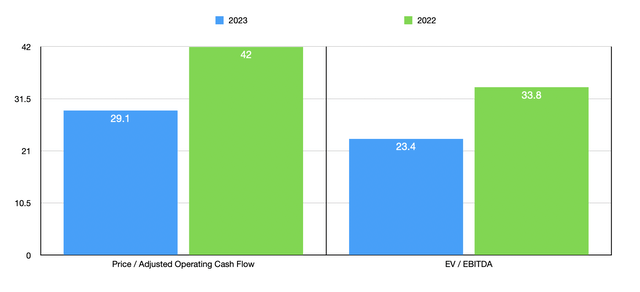

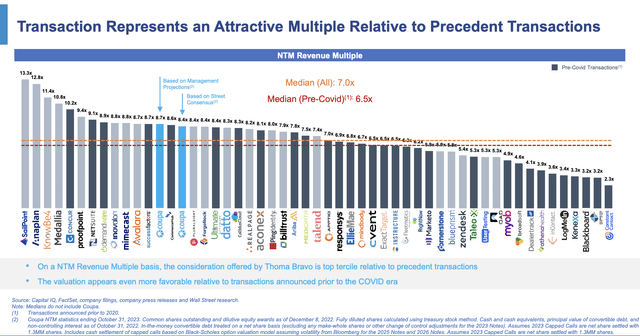

While it is true that investors will miss out on future growth, I believe the price being paid for the enterprise is wholly appropriate. If we take the year-over-year change in operating cash flow and annualize that for both it and EBITDA, investors should expect a reading of operating cash flow this year of $242.8 million and EBITDA of $342.2 million. Based on these figures, the company is being sold at a price to operating cash flow multiple of 29.1 and at an EV to EBITDA multiple of 23.4. By comparison, if we were to use the data from 2022, these multiples would be 42 and 33.8, respectively. Another way to value the company is through the lens of a revenue multiplier. On a forward basis, management is putting this multiple at 8.7. That’s actually above the 7 that the company calculated as a median for similar transactions in the past.

Author – SEC EDGAR Data

Coupa Software

Takeaway

based on all the data we have at our disposal, I do believe that the management team at Coupa Software has likely made a good decision. Given the company’s current share price of $78.65, there does seem to be nearly 3% of additional upside on the table. That 3% should be realized sometime between now and the time the deal gets completed in the first half of the 2023 calendar year. For investors who want a stable prospect and especially for those who want to utilize leverage, this could very well result in some additional upside. But given how volatile the stock was prior to the announcement, it’s not unthinkable that shares could plummet materially if the deal in question falls through. I don’t personally foresee any regulatory issues here. But for those who want a sure bet, it’s important to keep in mind that deals can fall through for other reasons. Depending on who would be to blame and what the overall circumstances would be, this could result in Coupa Software paying its suitor $200 million or its suitor paying it $435 million. Regardless of that though, given how small the additional upside is from here and the chance that the deal could always fall through, it may actually just make the most sense to divest of shares and look elsewhere for opportunities. But because the company does still offer some additional upside if all goes well, I’ve decided to keep a ‘hold’ rating on it, down from the ‘buy’ rating I had on it previously.

Be the first to comment