JHVEPhoto

A more in-depth version of this report, including metric definitions and targets, plus additional investor resources, was first shared with members of my Quality Value Investing subscription service in the Seeking Alpha Marketplace on November 30, 2022.

Typical of the Wall Street way, Cognizant Technology Solutions Corporation (NASDAQ:CTSH) Class A shares were downgraded by analysts in early November after the global IT services company reported 2022 third-quarter results that missed expectations, plus management had the gall to offer lowered guidance.

Since Quality Value Investing forever seeks high-quality business models represented by stocks temporarily trading at reasonable or bargain prices, the foolish short-sighted activity gets our far-sighted attention.

The resulting investment thesis:

Cognizant is a low-leveraged, high-functioning global IT services player with a contemporary business model, solid fundamentals, and a discounted stock price supported by below-average downside risks.

QVI’s current overall rating: Buy, based on a bullish view of the company and a bullish view of the stock.

Unless noted, all data presented is sourced from Seeking Alpha Premium as of the intraday market on December 12, 2022; and intended for illustration only.

An Enduring Business Model

CTSH is a dividend-paying mid-cap stock in the information technology sector’s IT consulting and other services industry.

Cognizant Technology Solutions Corporation, a professional services company, provides consulting, technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services; Healthcare; Products and Resources; and Communications, Media, and Technology. The company was founded in 1994 and is headquartered in Teaneck, New Jersey, USA.

QVI’s value proposition elevator pitch for Cognizant Technology Solutions:

By helping clients from a representative majority of global healthcare, financial services, media, and internet companies become data-enabled and data-driven in the digital era, Cognizant has produced a timely, profitable, and enduring business model.

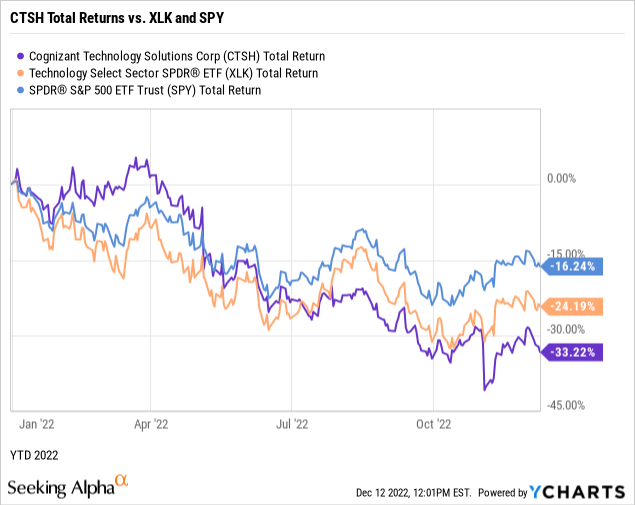

The chart below illustrates the stock’s performance against the Technology Select Sector SPDR Fund ETF (NYSE:XLK) and the SPDR S&P 500 ETF Trust (NYSE:SPY) during the 2022 endemic bear market. For example, after outperforming in the first half of 2022, CTSH has underperformed in the total returns of its sector and the broader market during the YTD timeframe. However, is there a potential upside to reversing this latest trend?

QVI’s value proposition rating for Cognizant Technology Solutions: Bullish.

Yields Suggest a Cheap, Safe Stock

Let’s uncover the equity bond rate of Cognizant Technology Solutions’ common shares.

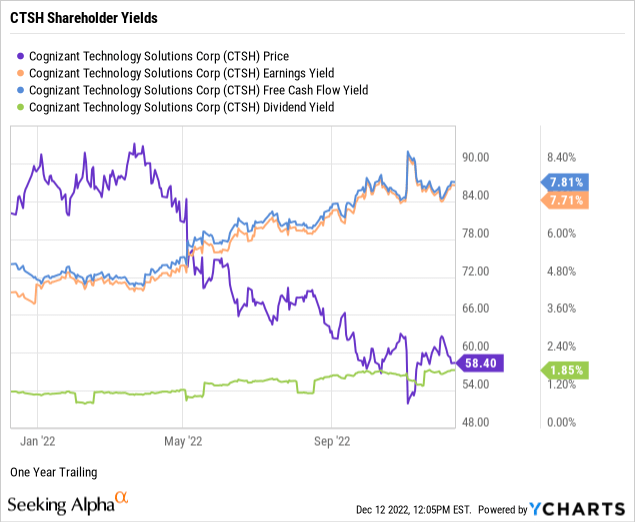

CTSH’s earnings yield was trading at 7.71%, as demonstrated in the below chart. In addition, its free cash flow yield was 7.81%. As inverse valuation multiples, the earnings and free cash flow yields suggest that CTSH trades at a discount. QVI will further explore valuation later in this primary ticker article.

Cognizant offers a modest forward dividend yield of 1.85%, supported by a conservative 24.05% payout ratio, thus indicating a safe, well-covered dividend with room for annual raises.

CTSH yielded 12.84% from an annual payout of $1.08 on a split- and dividend-adjusted cost basis of $8.41 per share on March 9, 2009, the last major market bottom. Thus, its market cycle yield-on-cost basis was 1,099 basis points above the forward yield. Now that’s safe high-yield investing.

Quality Value Investing takes the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 3.58% on the 10-Year Treasury benchmark note. For example, the average shareholder yield for CTSH was 5.79% or +221 bps and 9.45% or +587 bps when using the 2009 yield-on-cost basis.

QVI’s shareholder yields rating for CTSH: Bullish.

Share Buybacks are Quality at Value

Next, we’ll explore the fundamentals of Cognizant Technology Solutions, uncovering the performance strength of the company’s senior management.

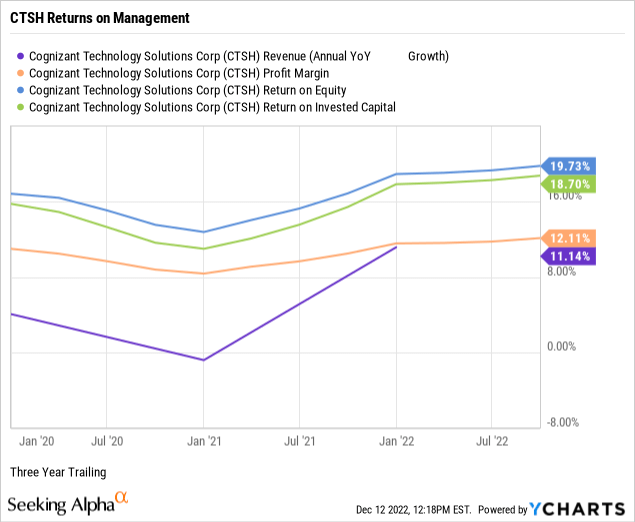

Per the below chart, Cognizant had positive three-year annualized double-digit revenue growth of 11.14%, outperforming the 5.33% median growth for the information technology sector.

Cognizant had a trailing three-year pre-tax double-digit net profit margin of 12.11%, topping the sector’s median net margin of 3.22%.

Management was producing a trailing three-year return on equity or ROE of 19.73%, nearly quadrupling the sector’s median ROE of 4.99%. Often a positive contributor to ROE, Cognizant’s board of directors announced, as part of its Q3 2022 earnings release, an increase of $2 billion to its ongoing share repurchase authorization program. Whether intentional or self-serving, the board appears to be buying back shares of its quality company at value prices.

At 18.70%, Cognizant’s return on invested capital or ROIC more than quintuples the sector’s median ROIC of 3.34%, indicating that its senior executives are outstanding capital allocators. In addition, Cognizant’s ROIC nearly doubled its trailing weighted average cost of capital or WACC of 9.38%. (Source of WACC: GuruFocus).

The double-digit revenue growth, sector-beating net profit margin, and attractive returns on equity and capital indicate quality management performance in Teaneck.

QVI’s fundamentals rating for Cognizant Technology Solutions: Bullish.

Mr. Market has Oversold/Underbought CTSH

Quality Value Investing relies on four valuation multiples to estimate the intrinsic value or margin of safety of a targeted quality enterprise’s stock price.

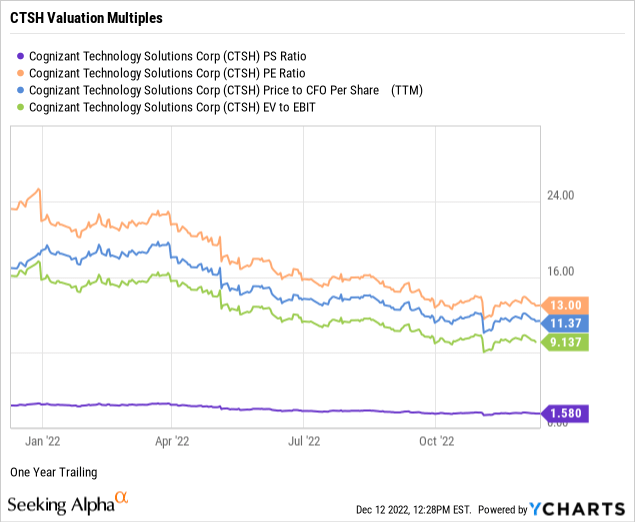

At 1.58 times, the price-to-sales ratio or P/S for CTSH was trading below the trailing P/S ratio of 2.44 for the information technology sector and 2.28 times for the S&P 500. (Source of S&P 500 P/S: Charles Schwab & Co.) Thus, the weighted industry plus market sentiment suggests a discounted stock price relative to Cognizant’s topline.

CTSH had a price-to-trailing earnings multiple or P/E of 13.00 times against a sector median P/E of 23.27, indicating investor sentiment discounts the stock price relative to earnings per share. Further, CTSH traded at a discount to the S&P 500’s overall P/E of 19.18. (Source of S&P 500 P/E: Barron’s).

At 11.37 times, CTSH traded with a price-to-operating cash flow multiple or P/CF at a steep discount to the sector’s median P/CF of 18.75 times, indicating that the market prices the stock below fair value relative to current cash flows.

Against the broader sector median of 18.40, CTSH traded at 9.14 times enterprise value to operating earnings or EV/EBIT, signaling the stock was oversold or underbought by the market.

Weighting the preferred valuation multiples suggests the market assigns a discount to Cognizant Technology Solution’s stock price relative to sales, earnings, cash flows, and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this article, risks and potential catalysts notwithstanding, Quality Value Investing would call CTSH a value-priced stock of an enduring, A-rated, global IT services enterprise.

QVI’s valuation rating for CTSH: Bullish.

Phenomenal Debt Coverage

Next, we’ll uncover and rate the downside risks of Cognizant Technology Solutions and its Class A common shares.

Morningstar assigns CTSH a narrow moat rating due to its customers’ high switching costs in an otherwise competitive IT services landscape.

As reported on its September 2022 quarterly financial statements, at 107.60, Cognizant’s long-term debt coverage could pay off its obligations more than 100 times in a crisis using its liquid assets, such as cash and equivalents, short-term investments, and accounts receivables. Cognizant’s long-term debt to equity was a conservative 11.26% in a further test of its paydown capacity.

Cognizant’s short-term debt coverage or current ratio was 2.27 times. Thus, its balance sheet provides double the liquid assets necessary to pay down its current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes.

CTSH’s 60-month trailing beta was 1.06, while its shorter-term 24-month beta was less volatile at 0.93. Thus, with price volatility trading near the S&P 500 standard of 1.00, CTSH presents as a market-average volatility mid-cap portfolio holding.

The short interest percentage of the float for CTSH was a bear paws-off of 1.72%. So perhaps the near-sighted traders view the stock as a market-leading, narrow-moat IT services provider with a loyal and sustainable client base.

Cognizant Technology Solutions is a fundamentally superior company with an enduring value proposition and an attractive risk profile, particularly its outstanding low-leveraged debt, against a broader bear market.

QVI’s downside risk rating for CTSH: Below Average.

Catalysts and Final Thoughts

Catalysts confirming or contradicting Quality Value Investing’s overall buy investment thesis on Cognizant Technology Solutions and its Class A common shares include, but are not limited to:

- Confirmations: IT spending with Cognizant should increase its competitiveness as the enterprise technology landscape gets more difficult to navigate. Analysts expect more reliance from Cognizant on automation to handle its business process outsourcing, thus contributing to margin expansion. In addition, CTSH’s traditional consulting business should increase its overall revenue share by strengthening its client companies’ digital IT.

- Contradictions: Cognizant’s growth could become increasingly limited, given its vertical specialization and ongoing consolidation. Cognizant’s switching costs could erode as new development ops methods make clients more inclined to bring application testing and maintenance in-house. As cloud-native software improves its capabilities, Cognizant’s custom application layers for even the most complex enterprises could become less necessary.

(Additional source of catalysts: Morningstar).

By helping global clients become data-enabled and data-driven in the digital era, Cognizant has become a low-leveraged, high-functioning global IT services provider with a contemporary and profitable business model, solid fundamentals, and below-average downside risks.

Nonetheless, in typical Wall Street fashion, the company’s shares were downgraded by analysts in November after management missed expectations and lowered guidance, depressing the stock price to bargain bin status.

Hence, since Quality Value Investing forever screens for high-quality business models represented by stocks temporarily trading at reasonable or bargain prices, such foolish short-sighted activity has attracted our far-sighted attention.

Be the first to comment