OZANKUTSAL/iStock via Getty Images

Despite some major successes, Leveraged ETFs (LETFs) have had some notable failures. These failures are the result of a phenomenon known as volatility drag (also known as volatility decay), the fact that LETFs tend to underperform in the presence of volatility. Investors should be careful with newly introduced single-stock LETFs because individual stocks tend to be much more volatile than stock indexes, resulting in the potential for excessive volatility decay. I explain the phenomenon and then apply math to separate what I believe are viable single-stock LETFs from those with structural flaws.

Background

Leveraged exchanged traded funds (LETFs) provide investors a leveraged exposure of k typically ranging from -3 to 3. For example, k =2 corresponds to a 2x LETF: On a day when the index increases by 1%, the 2x LETF rises by 2%. The case k = -1 corresponds to an inverse fund that benefits as the index declines: On a day when the index decreases by 1%, the inverse LETF increases by 1%.

A well-known drawback of LETFs is volatility drag or volatility decay, the tendency of volatility to impair investment returns over extended periods. Most LETFs rebalance leverage daily and have to “buy high” and “sell low” each day to keep their leverage ratios fixed, which leads to poor performance in choppy markets. Another explanation is that a large loss requires a much larger return to get back to even. For example, a loss of 75% requires a return of 300% to get back to even; a loss of 90% requires a return of 900% to get back to even.

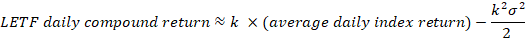

Mathematically, volatility decay can be approximated by the following formula:

Source: Author

Volatility (the Greek letter sigma) is the standard deviation of daily price returns, not the annualized number quoted by options traders. For those interested in the exact formula for compound return, see the appendix of my Journal of Beta Strategies article (message me for a copy).

Some investors question the existence of volatility drag in that some LETFs outperform their stated leverage on a cumulative basis. For example, some S&P 500 and Nasdaq-100 LETFs have had excellent performance (at least prior to 2022!), better than k-times the index return.

There is no inconsistency once you understand the difference between compound and cumulative returns. For example, suppose an underlying investment has an average annual return of 6%, and its 2x LETF has an average annual return of 8%. This implies an annualized volatility drag in compound return of -4%, since 8% – 2×6% = -4%. However, an investment compounding at 8% will eventually more than double the cumulative return of the investment compounding at 6%. Thus, there can be still volatility drag even as the LETF outperforms its stated leverage on a cumulative basis.

Regardless of this intellectual debate, we know that successful long LETFs combine high underlying index returns with low underlying index volatility. Failed LETFs combine low index returns with high volatility. For example, the gold miners bull and bear LETFs NUGT and DUST in tandem have ten-year average annual returns of roughly -50% per year through October 31, 2022. This results from the fact that the gold miner’s index is highly volatile with low underlying returns.

Why Single-Stock LETFs Can Be Problematic And My Proposed Solution

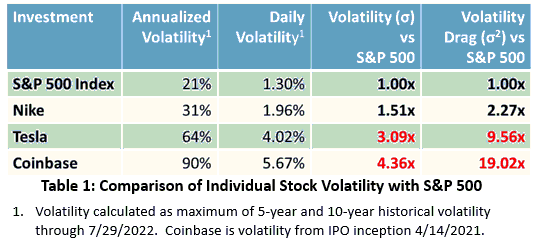

Volatility drag is why single-stock LETFs can be so problematic — individual stocks lack diversification and are often much more volatile than a stock index. As shown in Table 1, stocks such as Tesla and Coinbase can have 3x-4x the volatility of the S&P 500, translating into almost 10x-20x the volatility drag (proportional to volatility squared).

Source: Author Calculations

With 19x the volatility drag of the S&P 500, the price of a 2x Coinbase LETF is likely to decay over time even as 2x S&P 500 LETFs have been successful.

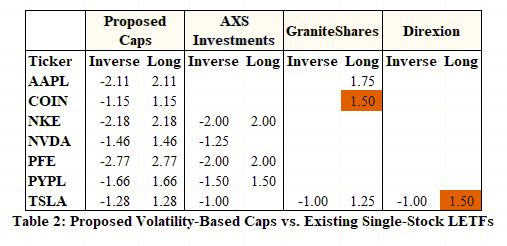

In my open-access paper Averting Disaster, I propose volatility-based leverage caps for single-stock LETFs to prevent compound returns from going negative. These caps offer imperfect, but I believe reasonable, guidelines for the viable amount of leverage for each single-stock LETF. Table 2 provides a comparison of these caps with single-stock LETFs currently trading in the US.

Source: Author’s “Averting Disaster” Open-Access Journal Article

In Table 2, notice that the single-stock LETFs of AXS Investments appear to be incorporating volatility into their leverage amounts, as their leverage caps correlate with my proposed cap levels. For example, AXS Investments’ inverse leverage levels have an r-squared of 0.856 with my proposed leverage caps and stay within my recommended limits. Thus, the AXS Investment LETFs appear to offer viable speculative vehicles. That doesn’t mean that I endorse them as good investments but rather suggest they avoid major structural design flaws.

As for the GraniteShares and Direxion LETFs, they too mostly fit within my guidelines with two exceptions. The GraniteShares Coinbase LETF (NASDAQ:CONL) has leverage of 1.5x versus my recommendation of a cap of 1.15x. This is a notable deviation and occurs because the underlying Coinbase stock is simply too volatile. Coinbase’s excessive volatility is likely to result in significant LETF price decay unless Coinbase’s business matures such that Coinbase’s stock volatility “settles down.”

Direxion’s Tesla 1.5x LETF (NASDAQ:TSLL) also deviates from my recommended cap of 1.28x. Although this is a lesser deviation, I expect that the price of the Tesla LETF to also decay over time barring some fundamental change to Tesla’s business and trading volatility.

Note that for both the Coinbase and Tesla LETFs, I am not making predictions regarding how the underlying stocks will perform in the near term. Both Coinbase and Tesla could rally significantly leading to short-term outperformance of the LETFs. And since many LETF investors only hold these products for a short time, one could argue that their long-term price performance is irrelevant. I disagree.

The father of value investing, Benjamin Graham, noted that a good investment is often a good speculation as well. I would argue the inverse — that a bad investment is likely a bad speculation. If an investment is likely to decline over the long term it is also more likely to decline over the near term. What’s more, I don’t have confidence in most investors’ ability to time short-term price moves. So, even though I don’t know when or whether Tesla or Coinbase will rebound, I would suggest another speculative vehicle, such as options, would be a more effective way to profit from such a rebound.

Additional Points And Caveats

My calculations use statistical estimates given that we don’t know ahead of time what future stock returns and volatilities will be. That being said, highly volatile stocks tend to remain highly volatile. Therefore, my calculations provide a reasonable, but imperfect, indicator of which LETFs are likely to be problematic.

The purpose of my Averting Disaster paper was to educate and suggest possible guidelines for regulators to consider when evaluating single-stock LETFs. For individuals wishing to evaluate volatility drag on their own, I suggest using a shorter time period for measuring volatility. My proposal of using a 5-10 year period for volatility measurement was to offer stable guidelines that don’t vary significantly from year to year. However, a shorter time period would be more accurate for forecasting near-term volatility.

Although I allowed for volatility-based leverage caps greater than 2 in Table 2, I suggest single-stock leverage be capped to at most 2 as a common-sense guideline. No model is perfect, and it is possible for what appear to be solid, low-volatility companies to experience degradation in their underlying business and stock performance.

Conclusion

Although I don’t claim them to be perfect, the concrete examples and guidelines provided here should help investors better understand the potential risks and drawbacks of single-stock LETFs. I believe this approach is much more effective than providing vague “the sky is falling” warnings.

In the end, I hope to educate investors, sponsors, and regulators on this topic in order for the U.S. financial markets to collectively arrive at LETF products that allow speculation with the maximum likelihood of a successful outcome.

Be the first to comment