ablokhin

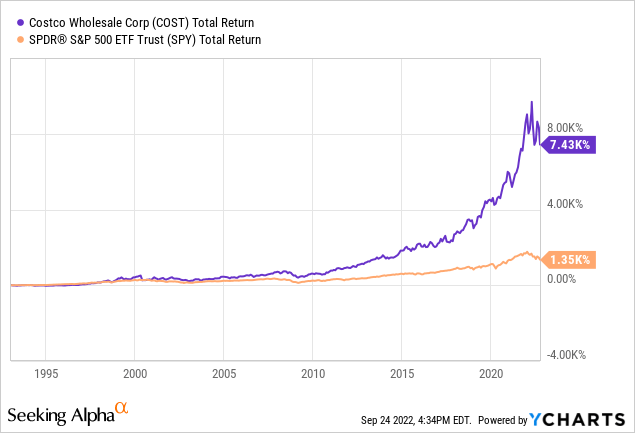

Costco (NASDAQ:COST) is without a doubt one of the best listed companies of today. Over the last few years, the company has widely outperformed the American indices, generating average annual returns of over 14% over the last 17 years.

The company’s profits have grown accordingly, and the company has managed to have a net cash position that gives them a lot of flexibility in case difficult times may come. Despite all these positive traits, the stock is at a very dangerous point of overvaluation which, in my opinion, poses a lot of risk and little benefit in the short to medium term.

Business Model

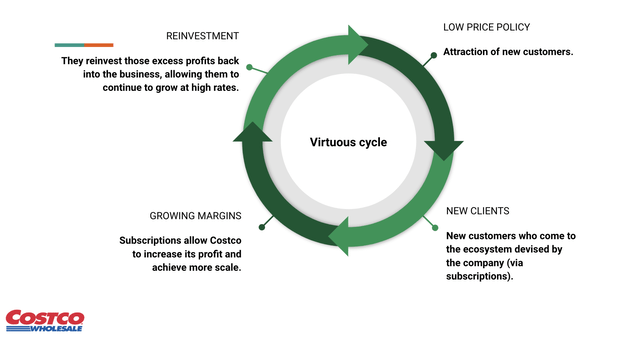

Costco’s business model, unlike other traditional supermarkets, is based on membership subscription, something that has allowed them to flourish in a highly competitive market. It could be said that Costco, unlike other traditional supermarkets, is a deal finder for customers who pay subscriptions. Thanks to the bargaining power of its scale, the company can buy large batches of products and offer them at low prices to its customers. At the same time, the extra benefits provided by subscriptions allow them to invest and develop their own brands (Kirkland) to produce at low cost and continue to offer a good value proposition to their subscribers.

Regarding memberships, there are two types: on the one hand, the one for individual clients (sold for $60 per year) and the business membership ($120 per year), aimed at small businesses, restaurants… that may need to buy food and other products in their stores.

Costco’s Virtuous Cycle (Own Models)

The image above outlines the virtuous cycle of Costco’s business model. On the one hand, the policy of low prices and quality products makes it possible to attract new customers to the business ecosystem. Encouraged by these competitive prices, customers pay the annual subscription, which expands margins and leaves room for reinvestment and further growth. At the same time, scale allows prices to be kept low since costs do not increase too much. The process repeats itself every year, and some investors (Nick Sleep) have referred to Costco as a perpetual growth machine.

Another of the key elements of Costco’s thesis is that the company has a much more robust cost structure than its main competitors, as can be seen in the evolution of profits in times of contraction of consumption for large retailers for Walmart (WMT) or Target (TGT).

Although the company has the capacity to maintain its growth, I think that investors are having very high expectations that may not materialize if there is a recession that may lead the US economy to a prolonged suffering.

Financials

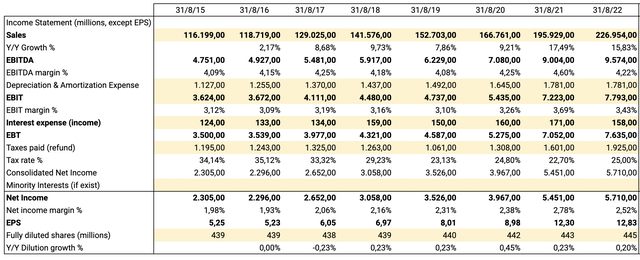

Over the past few years, Costco’s fundamentals have been positive across the board. On the one hand, the company has grown its revenues at 8-9% per year, while the increase in its margins, derived from the increase in profits from memberships, has pushed the company’s profits above 10% per annum. The table below allows direct verification of the evolution of the most important financial metrics that measure the performance of the business. Since 2017, Costco’s earnings have grown at an impressive 15% rate, well below share price growth.

Costco’s Financial Performance (Own Models)

Although in the long term, stock performance is highly correlated with earnings growth rates, this short-term negative correlation can translate into a fall in the multiple that may cause the company’s price to collapse. Investors are very bullish on the company, and I believe that in the coming quarters the slowdown in consumption and the strong base compared to previous years may cause stagnation or decline in sales and profits of the company.

Regarding the latest results presented by the company, it can be seen how there has not yet been a slowdown in consumption in the first months of the year. Sales have grown by 16% compared to the same quarter of the previous year, while profits have grown by 11%, well below the growth in sales. The profit margin has fallen from 2.7% last year to 2.6% this year. In addition, there has been a slowdown in membership growth, which has only grown at 9% per year.

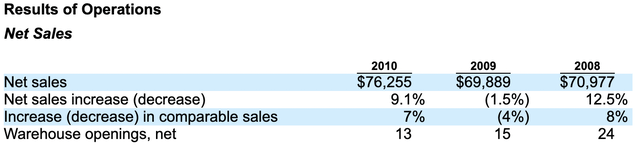

As the purchasing power of American citizens is eroded by rising inflation, I believe that Costco will deliver results that will disappoint the market, allowing the stock to return to reasonable price levels where the risk/reward situation improves significantly. In case anyone doubts the difficulties that Costco may have in a recessionary scenario, the evolution of sales and comparable sales in times of crisis is shown below.

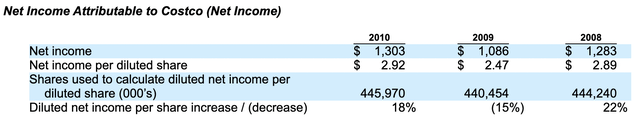

Costco’s sales evolution during the Great Financial Crisis (sec.gov)

Costco’s net profit in 2008 sank 20% due to the weakness of the Canadian dollar against the US dollar, as well as the drop in sales and the maintenance of fixed costs such as personnel and its low price policy.

Costco’s Net Profit during the Great Financial Crisis (sec.gov)

Even if investors aren’t thinking about these potential earnings declines, I think Costco may disappoint if consumer spending suffers if the Fed keeps raising interest rates. In general, drops in the stock market usually take place in two phases: first, a multiple drop due to a change in expectations and, second, due to a change in fundamentals. With Costco we may still be halfway there.

Valuation

Without a doubt, the stickiest question about Costco. Despite being an excellent company, I fully believe that the pace of future earnings growth in no way justifies Costco’s current valuation.

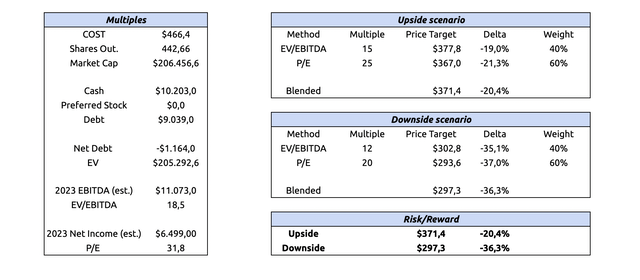

It is excessively worrying when several valuation scenarios are taken into account, both in the short term and in a medium term period.

Risk/Reward for Costco in 2023 (Own Models)

First of all, the short-term analysis allows us to verify that if the valuation multiples move to a level in line with interest rates around 4%, both in a normal scenario and in a negative one, I only contemplate losses in the short term. In this case I have assumed that revenues would increase only an 8% for the next year, whilst the margin would stay around 2.5%, due to the increase in the costs of the goods sold by the company.

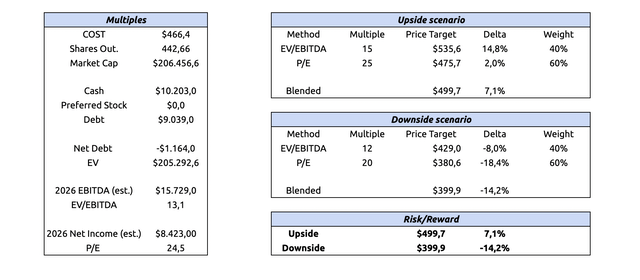

Risk/Reward analysis of Costco (Own Models)

In a 5-year scenario, I think it is reasonable to consider sales growth close to 8-9% per year along with maintaining profit margins in the 2.5% range. Even in that scenario, applying valuation multiples of 25 earnings, the target price would be roughly equal to the price at which the company is currently trading.

Conclusions And Risks

I think it’s important to note that Costco is a company I admire and would like to add to my long-term stock portfolio. However, the excessive valuation of the company means that, at these price levels, it is, in my opinion, an excessively risky investment. Paraphrasing Warren Buffett:

For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.

- First, the company’s valuation is too high for the earnings growth resulting from my estimates. In a severe multiple contraction scenario, the stock could drop as low as $300, about 36% from current levels. In another less aggressive scenario, the company could fall to $370. In any case, there is not enough upside a year ahead.

- Although I am convinced that Costco will continue to grow its earnings per share over time, I think that the next few quarters may be a bit disappointing, mainly due to the slowdown in consumption and the strong comparable base compared to previous quarters and years.

All in all, I think that Costco, despite being a company of exceptional quality with extraordinary fundamentals, is trading at a very high premium compared to the market because investors have very high growth expectations for the business. I’m sure Costco will be an index-beating company in the long run, but the risk/reward situation is currently not optimal for my investing profile.

I would reconsider my position and be willing to add Costco to my long-term stock portfolio if the company were to drop below $350 a share. In the meantime, I think there are more exciting opportunities on the market today.

Be the first to comment